-

'Job done': Sundowns coach proud despite Club World Cup exit

'Job done': Sundowns coach proud despite Club World Cup exit

-

RFK Jr vaccine panel targets childhood vaccinations in first meeting

-

Tech giants' net zero goals verging on fantasy: researchers

Tech giants' net zero goals verging on fantasy: researchers

-

Australia quicks hit back after strong West Indies bowling effort

-

Dortmund through to Club World Cup last 16, Fluminense deny Sundowns

Dortmund through to Club World Cup last 16, Fluminense deny Sundowns

-

Judge orders Trump admin to release billions in EV charging funds

-

Sale of NBA's $10 bn Lakers expected to close this year

Sale of NBA's $10 bn Lakers expected to close this year

-

US Fed proposes easing key banking rule

-

Nvidia hits fresh record while global stocks are mixed

Nvidia hits fresh record while global stocks are mixed

-

Elliott-inspired England to play Germany in Under-21 Euros final

-

Gunmen kill 11 in crime-hit Mexican city

Gunmen kill 11 in crime-hit Mexican city

-

Mbappe absent from Real Madrid squad for Salzburg Club World Cup clash

-

Sainz opts out of race for FIA presidency

Sainz opts out of race for FIA presidency

-

Shamar Joseph rips through Australia top order in first Test

-

Court rejects EDF complaint over Czech nuclear tender

Court rejects EDF complaint over Czech nuclear tender

-

Mbappe returns to Real Madrid training at Club World Cup

-

Kenya anniversary protests turn violent, 8 dead

Kenya anniversary protests turn violent, 8 dead

-

Elliott double fires England into Under-21 Euros final

-

Trans campaigners descend on UK parliament to protest 'bathroom ban'

Trans campaigners descend on UK parliament to protest 'bathroom ban'

-

New York mayoral vote floors Democratic establishment

-

Trump claims 'win' as NATO agrees massive spending hike

Trump claims 'win' as NATO agrees massive spending hike

-

EU probes Mars takeover of Pringles maker Kellanova

-

Sidelined Zelensky still gets Trump face time at NATO summit

Sidelined Zelensky still gets Trump face time at NATO summit

-

Mexico president threatens to sue over SpaceX rocket debris

-

Amazon tycoon Bezos arrives in Venice for lavish wedding

Amazon tycoon Bezos arrives in Venice for lavish wedding

-

Shamar Joseph gives West Indies strong start against Australia

-

Raducanu's Wimbledon build-up hit by Eastbourne exit

Raducanu's Wimbledon build-up hit by Eastbourne exit

-

RFK Jr.'s vaccine panel opens amid backlash over fabricated study

-

'You try not to bump into things:' blind sailing in Rio

'You try not to bump into things:' blind sailing in Rio

-

Trump says 'three or four' candidates in mind for Fed chief

-

Trump teases Iran talks next week, says nuclear programme set back 'decades'

Trump teases Iran talks next week, says nuclear programme set back 'decades'

-

Turkey tussles with Australia to host 2026 UN climate talks

-

Bielle-Biarrey 'fit' for Top 14 final after suffering concussion

Bielle-Biarrey 'fit' for Top 14 final after suffering concussion

-

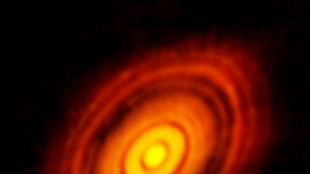

James Webb telescope discovers its first exoplanet

-

Kenya's Kipyegon seeks history with four minute mile attempt

Kenya's Kipyegon seeks history with four minute mile attempt

-

Gunmen kill 10 in crime-hit Mexican city

-

Olympic surfing venue battling erosion threat

Olympic surfing venue battling erosion threat

-

Relief, joy as Israel reopens after Iran war ceasefire

-

Spain upholds fine against Rubiales for Hermoso forced kiss

Spain upholds fine against Rubiales for Hermoso forced kiss

-

Iran hangs three more accused of spying as fears grow for Swede

-

Australia choose to bat first in first Test against West Indies

Australia choose to bat first in first Test against West Indies

-

Gambhir backs India bowlers to 'deliver' despite first Test misery

-

Trump reassures allies as NATO agrees 'historic' spending hike

Trump reassures allies as NATO agrees 'historic' spending hike

-

England's Duckett says mindset change behind Test success

-

Trump sees 'progress' on Gaza, raising hopes for ceasefire

Trump sees 'progress' on Gaza, raising hopes for ceasefire

-

UK's Glastonbury Festival opens gates amid Kneecap controversy

-

Oil rebounds as markets track Iran-Israel ceasefire

Oil rebounds as markets track Iran-Israel ceasefire

-

Cable theft in north France disrupts Eurostar traffic

-

Cambodians at quiet Thai border plead for peace

Cambodians at quiet Thai border plead for peace

-

Trump plays nice as NATO eyes 'historic' spending hike

The Dixie Group Reports Results for First Quarter of 2025 and New $75 Million Senior Credit Facility

DALTON, GA / ACCESS Newswire / May 9, 2025 / The Dixie Group, Inc. (OTCQB:DXYN) today reported financial results for the quarter ended March 29, 2025.

The Company had favorable year over year gross margins despite lower year over year net sales volume

The Company had an operating income of $11 thousand in the first quarter of 2025 compared to an operating loss of $857 thousand in the same period of 2024

During the first quarter of 2025 the Company closed on a new $75 million credit facility

For the first quarter of 2025, the Company had net sales of $62,990,000 as compared to $65,254,000 in the same quarter of 2024. The Company had an operating income of $11,000 in the first quarter of 2025 compared to an operating loss of $857,000 in the first quarter of 2024. The net loss from continuing operations in the first quarter of 2025 was $1,582,000 or $0.11 per diluted share. In 2024, the net loss from continuing operations for the first quarter was $2,410,000 or $0.16 per diluted share.

Commenting on the results, Daniel K. Frierson, Chairman and Chief Executive Officer, said, "The industry continues to experience weak market conditions driven by low existing home sales and lower consumer confidence. Our first quarter net sales were down 3.5% from the same period a year ago. Sales of our soft floorcovering products again outperformed our hard surface products and we continued to gain market share in the soft surface category. Just as in the previous quarter, premium products performed better than the market in all categories.

Despite the lower sales volume, our gross margins in the first quarter were favorable to prior year at $16,902,000 or 26.8% of net sales compared to $15,809,000 or 24.2% of net sales in the prior year. We also had favorable year over year operating income in the first quarter at $11,000 compared to an operating loss of $857,000 in the prior year. The improvements are primarily the result of our continued focus on cost reductions and operating efficiencies throughout the Company.

Low consumer confidence was further impacted by the uncertainty around the announcement of tariffs during the quarter. We had previously minimized the amount of our products being imported from China and we have worked with all of the suppliers of our imported products to reduce the impact of tariffs on the cost of our products. The situation is very volatile at this time, and it is difficult to predict what the impact of increased tariffs will be on imported products. At this time, several industry players have already announced price increases. Certainly, the impact will be greater on some hard surface categories.

We were pleased by the success of the first quarter trade shows, including Surfaces where we showcased 25 new styles of carpet across our nylon, polyester and decorative collections. Our focus continues to be on creating differentiated styles for the residential market, with an emphasis on color, pattern, and textural visuals. This includes our Step Into Color campaign where we offer the best and broadest color lines in the industry including custom color offerings in our white dyeable nylon carpet collections produced through our nylon extrusion operation that began successful production last year.

We also showcased eight hard surface collections with new visuals and innovations and ten new colors in our Fabrica wood program which were all very well received and will continue to fuel growth in this program. In our TRUCOR brand, we are focused on simplification of our product line and consumer friendly messaging. We featured new visuals and constructions in several of our SPC, WPC, and laminate programs. Notably, our PRIME X collection, with a half inch thick WPC construction and 7x72 inch plank in ten colors. Also our Boardwalk collection, with rolled edge and beautiful visuals in a high end SPC platform, will get 10 new colors in 2025. And we are expanding our market leading visuals in the SPC tile/stone segment with 6 new "built in grout" options. Our hard surface introductions began rolling out late in the 1st quarter and will continue through mid year.

During the quarter we were pleased to announce closure on a new, three year, $75 million revolving senior credit facility with MidCap Financial. The new credit facility replaces our former senior credit facility with Fifth Third Bank and provides the Company with secured future financing." The Frierson concluded.

The year over year gross margin improved by 2.6% of gross sales as the result of cost reductions and operating efficiencies. Selling and administrative expenses were slightly above the prior year at $16.9 million compared to $16.4 million, partially due to higher employee benefit costs and professional fees.

On our balance sheet, receivables increased $4.6 million from the balance at fiscal year end 2024 due to higher sales in the last month of the first quarter 2025 as compared to the seasonally lower sales volume in the last month of the fiscal year 2024. Net inventory value at the end of the first quarter of 2025 was $66.7 million, slightly below the fiscal year end 2024 balance of $66.9 million. Combined accounts payable and accrued expenses were $11.0 million higher at the end of the first quarter of 2025 as compared to the December 2024 balance. This increase was primarily driven by higher payables and accruals for raw materials to replenish inventory and meet higher production needs in preparation for an expected increase in demand in the second quarter. In the first quarter of 2025, capital expenditures were $74 thousand. Capital expenditures for the full fiscal year 2025 are planned at $2.5 million. Interest expense was $1.5 million in the first quarter of 2025 compared to $1.5 million in the first quarter of 2024. Our debt increased by $2.3 million in the first quarter of 2025 driven by operating needs.

On February 25, 2025, the Company entered into a new $75 million senior revolving credit facility. The credit agreement is for a three year term and proceeds from the credit facility were used to retire the Company's previous revolving credit facility with Fifth Third Bank. At the end of the first quarter of 2025, our unused borrowing availability under our line of credit with our new senior lending facility was $12.0 million which was subject to a $6.0 million minimum excess availability requirement.

This press release contains forward-looking statements. Forward-looking statements are based on estimates, projections, beliefs and assumptions of management and the Company at the time of such statements and are not guarantees of performance. Forward-looking statements are subject to risk factors and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements. Such factors include the levels of demand for the products produced by the Company. Other factors that could affect the Company's results include, but are not limited to, availability of raw material and transportation costs related to petroleum prices, the cost and availability of capital, integration of acquisitions, ability to attract, develop and retain qualified personnel and general economic and competitive conditions related to the Company's business. Issues related to the availability and price of energy may adversely affect the Company's operations. Additional information regarding these and other risk factors and uncertainties may be found in the Company's filings with the Securities and Exchange Commission. The Company disclaims any obligation to update or revise any forward-looking statements based on the occurrence of future events, the receipt of new information, or otherwise.

THE DIXIE GROUP, INC.

Consolidated Condensed Statements of Operations

(unaudited; in thousands, except earnings (loss) per share)

Three Months Ended | ||||||

March 29, | March 30, | |||||

NET SALES | $ | 62,990 | $ | 65,254 | ||

Cost of sales | 46,088 | 49,445 | ||||

GROSS PROFIT | 16,902 | 15,809 | ||||

Selling and administrative expenses | 16,874 | 16,372 | ||||

Other operating (income) expense, net | (98 | ) | 52 | |||

Facility consolidation and severance expenses, net | 115 | 242 | ||||

OPERATING INCOME (LOSS) | 11 | (857 | ) | |||

Interest expense | 1,493 | 1,532 | ||||

Other expense, net | 88 | 5 | ||||

LOSS OF CONTINUING OPERATIONS BEFORE TAXES | (1,570 | ) | (2,394 | ) | ||

Income tax provision | 12 | 16 | ||||

LOSS FROM CONTINUING OPERATIONS | (1,582 | ) | (2,410 | ) | ||

Loss from discontinued operations, net of tax | (115 | ) | (84 | ) | ||

NET LOSS | $ | (1,697 | ) | $ | (2,494 | ) |

BASIC EARNINGS (LOSS) PER SHARE: | ||||||

Continuing operations | $ | (0.11 | ) | $ | (0.16 | ) |

Discontinued operations | (0.01 | ) | (0.01 | ) | ||

Net loss | $ | (0.12 | ) | $ | (0.17 | ) |

BASIC SHARES OUTSTANDING | 14,366 | 14,850 | ||||

DILUTED EARNINGS (LOSS) PER SHARE: | ||||||

Continuing operations | $ | (0.11 | ) | $ | (0.16 | ) |

Discontinued operations | (0.01 | ) | (0.01 | ) | ||

Net loss | $ | (0.12 | ) | $ | (0.17 | ) |

DILUTED SHARES OUTSTANDING | 14,366 | 14,850 | ||||

DIVIDENDS PER SHARE: | ||||||

Common Stock | $ | - | $ | - | ||

Class B Common Stock | $ | - | $ | - | ||

THE DIXIE GROUP, INC.

Consolidated Condensed Balance Sheets

(in thousands)

March 29, | December 28, | |||

ASSETS | (Unaudited) | |||

CURRENT ASSETS | ||||

Cash and cash equivalents | $ | 4,795 | $ | 19 |

Receivables, net of allowances for expected credit losses of $503 and $454 | 27,940 | 23,325 | ||

Inventories, net | 66,741 | 66,852 | ||

Prepaid and other current assets | 6,160 | 5,643 | ||

TOTAL CURRENT ASSETS | 105,636 | 95,839 | ||

PROPERTY, PLANT AND EQUIPMENT, NET | 32,527 | 33,747 | ||

OPERATING LEASES RIGHT-OF-USE ASSETS | 24,501 | 25,368 | ||

RESTRICTED CASH | 4,309 | - | ||

OTHER ASSETS | 17,426 | 19,854 | ||

LONG TERM ASSETS OF DISCONTINUED OPERATIONS | 1,047 | 1,064 | ||

TOTAL ASSETS | $ | 185,446 | $ | 175,872 |

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||

Current Liabilities | ||||

Accounts payable | $ | 26,036 | $ | 14,884 |

Accrued expenses | 14,945 | 15,057 | ||

Current portion of long-term debt | 57,912 | 53,818 | ||

Current portion of operating lease liabilities | 3,746 | 3,804 | ||

Current liabilities of discontinued operations | 1,121 | 1,156 | ||

TOTAL CURRENT LIABILITIES | 103,760 | 88,719 | ||

LONG-TERM DEBT, NET | 26,742 | 28,530 | ||

OPERATING LEASE LIABILITIES | 21,476 | 22,295 | ||

OTHER LONG-TERM LIABILITIES | 15,467 | 16,712 | ||

LONG-TERM LIABILITIES OF DISCONTINUED OPERATIONS | 3,384 | 3,398 | ||

STOCKHOLDERS' EQUITY | 14,617 | 16,218 | ||

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 185,446 | $ | 175,872 |

CONTACT:

Allen Danzey

Chief Financial Officer

706-876-5865

[email protected]

SOURCE: The Dixie Group

View the original press release on ACCESS Newswire

Y.Kobayashi--AMWN