-

Spurs sign Kudus but Gibbs-White move stalls

Spurs sign Kudus but Gibbs-White move stalls

-

Trump flies to flood-ravaged Texas as scrutiny of response mounts

-

IEA sees anaemic global oil demand growth amid tariff turmoil

IEA sees anaemic global oil demand growth amid tariff turmoil

-

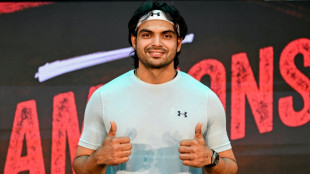

India's Chopra wants coach Zelezny's big-stage mindset

-

Trump threatens Canada with higher tariff, mulls further global levies

Trump threatens Canada with higher tariff, mulls further global levies

-

Five-star Bumrah strikes for India as England post 387

-

Minister's death spooks Russian elite amid corruption clampdown

Minister's death spooks Russian elite amid corruption clampdown

-

UNESCO adds Cameroon, Malawi sites to heritage list

-

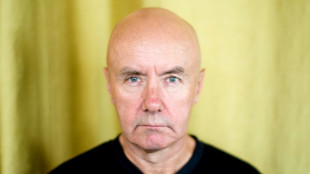

Irvine Welsh takes aim at 'brain atrophying' tech ahead of new Trainspotting sequel

Irvine Welsh takes aim at 'brain atrophying' tech ahead of new Trainspotting sequel

-

Bumrah's treble strike rocks England before Smith hits back

-

Swiatek and Anisimova battle to be new queen of Wimbledon

Swiatek and Anisimova battle to be new queen of Wimbledon

-

German backpacker found after 12 days missing in Australian bush

-

The main moments of Paris Couture Week

The main moments of Paris Couture Week

-

US and China have 'positive' meeting at ASEAN foreign minister talks

-

Defence, joint debt and farmers: EU draws budget battle lines

Defence, joint debt and farmers: EU draws budget battle lines

-

US singer Chris Brown denies more charges in UK assault case

-

Bumrah's treble strike rocks England in third Test

Bumrah's treble strike rocks England in third Test

-

Liverpool to honour Diogo Jota in return to action at Preston

-

Hemp guards against England complacency in Euros showdown with Wales

Hemp guards against England complacency in Euros showdown with Wales

-

Stocks mostly fall as Trump ramps up tariff threats

-

Rubio has 'positive' meeting with China's Wang at ASEAN talks

Rubio has 'positive' meeting with China's Wang at ASEAN talks

-

Australia's Aboriginals ask UNESCO to protect ancient carvings site

-

Raudenski: from Homeland Security to Tour de France engine hunter

Raudenski: from Homeland Security to Tour de France engine hunter

-

London's Heathrow eyes higher fees for £10bn upgrade

-

Oasis return reminds world of when Manchester captured cultural zeitgeist

Oasis return reminds world of when Manchester captured cultural zeitgeist

-

EU blasts Russia's latest Ukraine attacks, threatens new sanctions

-

Nobel laureate Mohammadi says Iran issuing death threats

Nobel laureate Mohammadi says Iran issuing death threats

-

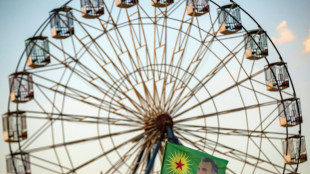

Kurdish PKK fighters destroy weapons at key ceremony

-

Springbok scrum-half speedster Williams gets chance to impress

Springbok scrum-half speedster Williams gets chance to impress

-

Cambodia to pass laws allowing for citizenship to be stripped

-

Spurs sign Kudus with Gibbs-White set to follow

Spurs sign Kudus with Gibbs-White set to follow

-

Kiss's combined Aus-NZ side out to 'light up' Lions tour

-

Markets mixed as traders cautiously eye trade developments

Markets mixed as traders cautiously eye trade developments

-

Djokovic faces Sinner in Wimbledon blockbuster, Alcaraz takes on Fritz

-

Rubio meets China's Wang on sidelines of ASEAN talks

Rubio meets China's Wang on sidelines of ASEAN talks

-

Son of Mexico's 'El Chapo' set to plead guilty in US drugs case

-

Honduran teen deported by US feels like foreigner in native country

Honduran teen deported by US feels like foreigner in native country

-

Lithuania bids to save Baltic seals as ice sheets recede

-

'Impossible to sleep': noise disputes rile fun-loving Spain

'Impossible to sleep': noise disputes rile fun-loving Spain

-

Danes reluctant to embrace retirement at 70

-

China crackdown on gay erotica stifles rare outlet for LGBTQ expression

China crackdown on gay erotica stifles rare outlet for LGBTQ expression

-

Veteran O'Connor called up for Wallabies against Lions

-

Trump to visit flood-ravaged Texas amid scrutiny

Trump to visit flood-ravaged Texas amid scrutiny

-

Clarke out for All Blacks against France as Narawa called up

-

Veteran James O'Connor called up for Wallabies against Lions

Veteran James O'Connor called up for Wallabies against Lions

-

Kurdish PKK fighters to begin disarming at key ceremony

-

China's economy likely grew 5.2% in Q2 despite trade war: AFP poll

China's economy likely grew 5.2% in Q2 despite trade war: AFP poll

-

Traders brush off new Trump threats to extend stocks rally

-

Venezuelans deported from US demand return of their children

Venezuelans deported from US demand return of their children

-

Rubio to meet China's Wang on sidelines of ASEAN talks

Encision Reports Fourth Quarter Fiscal Year 2025 Results

BOULDER, CO / ACCESS Newswire / July 11, 2025 / Encision Inc. (OTC PINK:ECIA), a medical device company that owns the patented Active Electrode Monitoring (AEM®) Technology that prevents dangerous radiant energy burns in minimally invasive surgery, today announced financial results for its fiscal year ended March 31, 2025.

The Company posted quarterly net revenue of $1.52 million for a quarterly net loss of $47 thousand, or $(0.00) per diluted share. These results compare to net revenue of $1.53 million for a quarterly net loss of $337 thousand, or $(0.03) per diluted share, in the year-ago quarter. Gross margin on net revenue was 56% in the fiscal 2025 fourth quarter and 45% in the fiscal 2024 fourth quarter. Gross margin increased in the current year's fourth quarter compared to last year's fourth quarter due principally to lower material costs.

The Company posted annual product net revenue of $6.22 million and service net revenue of $0.34 million, or total net revenue of $6.56 million for a net loss of $0.22 million, or $(0.02) per diluted share. These results compare to product net revenue of $6.43 million and service net revenue of $0.15 million, or total net revenue of $6.59 million for a net loss of $0.69 million, or $(0.06) per diluted share, in the prior fiscal year. Gross margin on product revenue was 53.8% in fiscal 2025, compared to 47.6% in fiscal 2024.

"We made progress in improving our gross margins and managing expenses in fiscal 2025," said Gregory Trudel, President & CEO of Encision. "While top-line revenue was relatively flat, we saw improvements in service revenue and operational efficiency. We remain committed to advancing our technology and bringing innovative surgical safety solutions to market."

Encision Inc. designs and markets a portfolio of high-performance surgical instrumentation that delivers advances in patient safety with AEM technology, surgical performance, and value to hospitals across a broad range of minimally invasive surgical procedures. Based in Boulder, Colorado, the company pioneered the development and deployment of Active Electrode Monitoring, AEM technology, to eliminate dangerous stray energy burns during minimally invasive procedures. For additional information about all our products, please visit www.encision.com .

In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the Company notes that statements in this press release and elsewhere that look forward in time, which include everything other than historical information, involve risks and uncertainties that may cause actual results to differ materially from those indicated by the forward-looking statements. Factors that could cause the Company's actual results to differ materially include, among others, its ability to develop new or enhanced products and have such products accepted in the market, its ability to increase net sales through the Company's distribution channels, its ability to compete successfully against other manufacturers of surgical instruments, insufficient quantity of new account conversions, insufficient cash to fund operations, delays in developing new products and receiving FDA approval for such new products and other factors discussed in the Company's filings with the Securities and Exchange Commission. Readers are encouraged to review the risk factors and other disclosures appearing in the Company's Annual Report on Form 10-K for the year ended March 31, 2025, and subsequent filings with the Securities and Exchange Commission. We do not undertake any obligation to update publicly any forward-looking statements, whether as a result of the receipt of new information, future events, or otherwise.

CONTACT:

Brandon Shepard

Encision Inc.

303-444-2600

Encision Inc.

Balance Sheets

March 31, 2025 | March 31, 2024 | |||

ASSETS | ||||

Current assets: | ||||

Cash | $ | 257,433 | $ | 42,509 |

Accounts receivable | 786,471 | 891,129 | ||

Inventories | 1,483,182 | 1,402,338 | ||

Prepaid expenses | 85,679 | 90,298 | ||

Total current assets | 2,612,765 | 2,426,274 | ||

Equipment: | ||||

Furniture, fixtures and equipment, at cost | 2,585,446 | 2,627,726 | ||

Accumulated depreciation | (2,340,689 | ) | (2,373,722 | ) |

Equipment, net | 244,757 | 254,004 | ||

Right of use asset, net | 568,395 | 900,787 | ||

Patents, net | 171,890 | 164,010 | ||

Other assets | 72,892 | 65,641 | ||

TOTAL ASSETS | $ | 3,670,699 | $ | 3,810,716 |

LIABILITIES AND SHAREHOLDERS' EQUITY | ||||

Current liabilities: | ||||

Accounts payable | $ | 346,900 | $ | 346,049 |

Line of credit | 395,964 | -- | ||

Secured notes | 44,128 | 47,194 | ||

Accrued compensation | 180,850 | 184,913 | ||

Deferred Revenue | 17,401 | -- | ||

Other accrued liabilities | 160,274 | 119,804 | ||

Accrued lease liability | 430,398 | 370,377 | ||

Total current liabilities | 1,575,915 | 1,068,337 | ||

Long-term liability: | ||||

Secured notes | 177,470 | 219,021 | ||

Accrued lease liability | 266,212 | 696,610 | ||

Total liabilities | 2,019,597 | 1,983,968 | ||

Commitments and contingencies (Note 4) | ||||

Shareholders' equity: | ||||

Preferred stock, no par value: 10,000,000 shares authorized; none issued and outstanding | -- | -- | ||

Common stock and additional paid-in capital, no par value: 100,000,000 shares authorized; 11,879,645 issued and outstanding at March 31, 2025 and 11,858,627 at March 31, 2024 | 24,416,347 | 24,371,795 | ||

Accumulated (deficit) | (22,765,245 | ) | (22,545,047 | ) |

Total shareholders' equity | 1,651,102 | 1,826,748 | ||

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 3,670,699 | $ | 3,810,716 |

Encision Inc.

Statements of Operations

Years Ended | March 31, 2025 | March 31, 2024 | ||||

NET REVENUE: | ||||||

Product | $ | 6,217,687 | $ | 6,431,969 | ||

Service | 337,628 | 153,913 | ||||

Total revenue | 6,555,315 | 6,585,882 | ||||

COST OF REVENUE: | ||||||

Product | 2,873,588 | 3,370,855 | ||||

Service | 170,441 | 79,065 | ||||

Total cost of revenue | 3,044,029 | 3,449,920 | ||||

GROSS PROFIT | 3,511,286 | 3,135,962 | ||||

OPERATING EXPENSES: | ||||||

Sales and marketing | 1,689,503 | 1,634,124 | ||||

General and administrative | 1,400,611 | 1,520,727 | ||||

Research and development | 593,152 | 621,894 | ||||

Total operating expenses | 3,683,266 | 3,776,745 | ||||

OPERATING (LOSS) | (171,980 | ) | (640,783 | ) | ||

OTHER (EXPENSE): | ||||||

Interest expense, net | (43,723 | ) | (62,373 | ) | ||

Other income, (expense) net | (4,495 | ) | 11,373 | |||

Interest expense and other income, expense, net | (48,218 | ) | (51,000 | ) | ||

(LOSS) BEFORE PROVISION FOR INCOME TAXES | (220,198 | ) | (691,783 | ) | ||

Provision for income taxes | -- | -- | ||||

NET (LOSS) | $ | (220,198 | ) | $ | (691,783 | ) |

Net (loss) per share-basic and diluted | $ | (0.02 | ) | $ | (0.06 | ) |

Weighted average shares-basic and diluted | 11,879,645 | 11,770,391 | ||||

Encision Inc.

Statements of Cash Flows

Years Ended | March 31, 2025 | March 31, 2024 | |||

Cash flows provided by (used in) operating activities: | |||||

Net (loss) | (220,198 | ) | $ | (691,783 | ) |

Adjustments to reconcile net (loss) income to net cash (used in) operating activities: | |||||

Depreciation and amortization | 81,393 | 85,218 | |||

Stock-based compensation expense related to stock options | 46,001 | 53,552 | |||

Provision for inventory obsolescence | 4,920 | 12,000 | |||

Change in operating assets and liabilities: | |||||

Right of use asset, net | (37,985 | ) | 68,710 | ||

Accounts receivable | 104,658 | 29,592 | |||

Inventories | (85,764 | ) | 484,866 | ||

Prepaid expenses and other assets | (2,632 | ) | 6,728 | ||

Accounts payable | 18,252 | 93,092 | |||

Accrued compensation and other accrued liabilities | 36,407 | 2,414 | |||

Net cash provided by (used in) operating activities | (54,948 | ) | 144,389 | ||

Cash flows (used in) investing activities: | |||||

Acquisition of property and equipment | (54,415 | ) | (12,050 | ) | |

Patent costs | (25,610 | ) | (24,773 | ) | |

Net cash (used in) investing activities | (80,025 | ) | (36,823 | ) | |

Cash flows provided by (used in) financing activities: | |||||

Borrowings from (paydown of) credit facility, net change | 395,964 | (177,402 | ) | ||

Borrowings from (paydown of) secured notes | (44,618 | ) | (46,788) | ||

Net proceeds (payments) from exercise of stock options | (1,449 | ) | (29,833 | ) | |

Net cash provided by (used in) financing activities | 349,897 | (254,023 | ) | ||

Net (decrease) in cash | 214,924 | (146,457 | ) | ||

Cash, beginning of fiscal year | 42,509 | 188,966 | |||

Cash, end of fiscal year | $ | 257,433 | $ | 42,509 | |

Supplemental disclosure of non-cash investing activity information: | |||||

Supplemental disclosures of cash flow information: | |||||

Cash paid during the year for interest | $ | 43,723 | $ | 62,373 | |

SOURCE: Encision, Inc.

View the original press release on ACCESS Newswire

F.Bennett--AMWN