-

Stocks slip on strong US growth data

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

-

Kele, Inc. Appoints Mark Sciortino as Chief Growth Officer

-

Primary Endpoint Successfully Achieved in Lexaria's Phase 1b Study GLP-1-H24-4

Primary Endpoint Successfully Achieved in Lexaria's Phase 1b Study GLP-1-H24-4

-

SMX Expands Precious Metals Strategy Through New Identity Infrastructure Partnerships

-

NuRAN Announces Closing of the Restructuring Transaction and Initial Tranche of Additional Debt Settlements

NuRAN Announces Closing of the Restructuring Transaction and Initial Tranche of Additional Debt Settlements

-

Dolphin Subsidiary Shore Fire Media's Podcast Clients Recognized as 2025's Best

-

Who Is the Best Plastic Surgery Marketing Company?

Who Is the Best Plastic Surgery Marketing Company?

-

Snaplii Simplifies Holiday Gifting with Smart Cash Gift Cards, Built-In Savings

-

QS Energy Positions AOT 3.0 for Full‑Pipeline, Global Deployment

QS Energy Positions AOT 3.0 for Full‑Pipeline, Global Deployment

-

Flushing Bank Expands Presence in Chinatown with Opening of New Branch

-

Starring Georgia Announces Plans to Carry Out a Comprehensive Rehabilitation of the Tbilisi State Concert Hall

Starring Georgia Announces Plans to Carry Out a Comprehensive Rehabilitation of the Tbilisi State Concert Hall

-

Universal EV Chargers Scales Driver-First DC Fast Charging in 2025, Commissioning 320 Live Ports Across Key U.S. Markets

-

Nextech3D.ai Provides Shareholder Update on Krafty Labs Acquisition and Announces New CEO Investment

Nextech3D.ai Provides Shareholder Update on Krafty Labs Acquisition and Announces New CEO Investment

-

The Alkaline Water Company Announces Capital Structure Reset and Strategic Alignment Ahead of Regulation A Offering

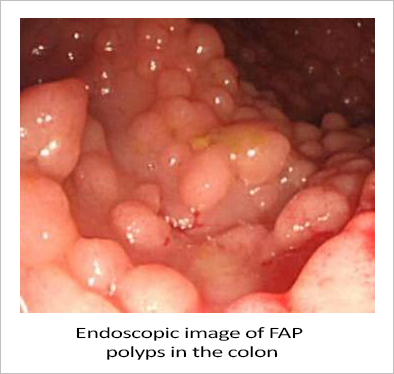

How Biodexa Is Racing To Get Its Phase 3 Program in FAP Under Way And Gain First-Mover Advantage in a $7Bn Addressable Market

CARDIFF, UK / ACCESS Newswire / July 28, 2025 / Familial Adenomatous Polyposis (FAP) is an inherited condition that puts people at a much greater risk of developing colon cancer. If left untreated, there is a near 100% likelihood that the person will develop colon or rectum cancer. Despite the seriousness, there is no approved therapeutic option for treating FAP patients, and surgical resection of the colon and/or rectum remains the standard of care.

That could change if one company has its way.

Biodexa Pharmaceuticals PLC. (NASDAQ:BDRX), a clinical-stage biopharmaceutical company, reports making significant progress in developing eRapa, an oral tablet formulation of rapamycin, to treat FAP non-surgically. eRapa inhibits the mTOR (mammalian Target Of Rapamycin) protein. Too much mTOR has been linked to cancer and has been shown to be over-expressed in FAP polyps, thereby underscoring the rationale for using an mTOR inhibitor like eRapa to treat FAP.

Key Milestones Met

Since the start of the year, Biodexa has hit several milestones with eRapa as it works to bring its treatment to the market in the U.S. and Europe. The company says it already has key opinion leaders engaged, vendors contracted, 30 sites in the U.S. and Europe identified for its Phase 3 study and funding in place, putting it ahead of its potential rivals including Recursion Pharmaceuticals Inc. (RXRX), which is currently in a Phase 1b/2 study of its treatment for FAP and Tempest Therapeutics Inc. (TPST), which in May received the go-ahead from the FDA for a Phase 2 trial of its FAP drug.

If Biodexa's eRapa treatment is shown to be successful in its Phase 3 study and the treatment gets approved, the company believes it would have first-mover advantage in what it estimates is a $7 billion addressable market opportunity.

Solid Regulatory Footing

In February, Biodexa received Fast Track status from the U.S. Food and Drug Administration (FDA) for eRapa. Fast Track status is designed to facilitate the development and expedite the review of drugs to treat serious conditions where there is an unmet medical need. The FDA awarded Biodexa Fast Track status after Phase 2 data showed patients experienced an 89% non-progression rate and a 29% median reduction in polyp burden at 12 months compared with baseline.

In conjunction with its Fast Track Status in the U.S., eRapa received Orphan Drug status in Europe, adding to the Orphan Drug designation in the U.S. that had been awarded some time ago. Both are designed to speed up the development of drugs that could provide significant benefits to patients who are suffering from rare, life-threatening diseases. The European Orphan Drug status also gives the drug company 10 years of marketing exclusivity and provides special incentives, including eligibility for protocol assistance and possible exemptions or reductions in certain regulatory fees, reports Biodexa.

Those designations were quickly followed by Biodexa holding a Type C meeting with the FDA that included a discussion of the statistical plan, the safety database and most importantly, a composite endpoint for a Phase 3 study. FDA representatives from both the gastroenterology and oncology divisions provided valuable input into the proposed program, which is important for the success of the Phase 3 study. In Europe, Biodexa has already named Precision for Medicine LLC as the clinical research organization to conduct the European component of the Phase 3 study of eRapa.

Trials Getting Underway

The trials are now getting underway. In June, Biodexa initiated its first clinical site in the U.S. with its collaboration partner, Rapamycin Holdings Inc., which does business as Emtora Biosciences. Emtora Biosciences was awarded an additional $3 million grant (bringing the total to $20 million) by the Cancer Prevention & Research Institute of Texas to support the Phase 3 FAP trial. Biodexa has branded its Phase 3 program the 'Serenta' trial. The Serenta trial (NCT06950385) is a randomized, double-blind, placebo-controlled study designed to evaluate the safety and efficacy of eRapa in individuals diagnosed with FAP. The first site is actively screening eligible participants.

In Europe, Biodexa just filed a Clinical Trial Application (CTA) with the European Medicines Agency (EMA) for its Serenta trial. A CTA is the formal regulatory submission required to obtain approval to begin a clinical trial in Europe and is similar to the Investigational New Drug (IND) application process in the United States. If approved, it would permit the Serenta trial to proceed in Europe, initially covering clinical sites in Denmark, Germany, the Netherlands and Spain, with Italy expected to be added in due course. Investors should expect more announcements from Biodexa as the Phase 3 trial hits more milestones in the weeks and months to come.

Biodexa is optimistic about its future prospects and aims to replicate the success of Palvella Therapeutics Inc. (PVLA), a biotechnology company also developing a rapamycin product for patients with rare dermatological diseases that sports a $425 million market cap (enterprise value of around $350 million excluding $75 million cash at March 31, 2025). Following a similar strategy, Biodexa is also going after rare diseases that don't have proven therapies and have big addressable markets, with ambitious plans to improve the quality of life for suffering patients around the world.

Featured image from Biodexa

This post contains sponsored content. This content is for informational purposes only and is not intended to be investing advice.

Click here for more information on Biodexa Pharmaceuticals.

Contact:

Stephen Stamp, CEO, CFO

[email protected]

Important notice, please read: The information and statistical data contained herein may contain forward-looking statements that reflect the company's intentions, expectations, assumptions, or beliefs concerning future events, including, but not limited to, expectations with respect to FDA and other regulatory bodies approval of new products, technology, and product development milestones, the ability of the company to leverage its product development and negotiate favorable collaborative agreements, the commencement of sales, the size of market opportunities with respect to the company's product candidates and sufficiency of the company's cash flow for future liquidity and capital resource needs and other risks identified in the Risk Factor Section of the company's Annual Report and any subsequent reports filed with the SEC. We do not undertake to advise you as to any change in this information. The forward-looking statements are qualified by important factors that could cause actual results to differ materially from those in the forward-looking statements. In addition, significant fluctuations in quarterly results may occur as a result of varying milestone payments and the timing of costs and expenses related to the company's research and development programs. This is not a solicitation of any offer to buy or sell. Redington, Inc. is paid by Biodexa Pharmaceuticals PLC to provide investor relations services, and its employees or members of their families may from time to time own an equity interest in companies mentioned herein.

SOURCE: Biodexa Pharmaceuticals

View the original press release on ACCESS Newswire

P.Costa--AMWN