-

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

-

Swiss court to hear landmark climate case against cement giant

-

Knicks' Brunson scores 47, Bulls edge Hawks epic

Knicks' Brunson scores 47, Bulls edge Hawks epic

-

Global nuclear arms control under pressure in 2026

-

Asian markets rally with Wall St as rate hopes rise, AI fears ease

Asian markets rally with Wall St as rate hopes rise, AI fears ease

-

Jailed Malaysian ex-PM Najib loses bid for house arrest

-

Banned film exposes Hong Kong's censorship trend, director says

Banned film exposes Hong Kong's censorship trend, director says

-

Duffy, Patel force West Indies collapse as NZ close in on Test series win

-

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

-

A night out on the town during Nigeria's 'Detty December'

-

US in 'pursuit' of third oil tanker in Caribbean: official

US in 'pursuit' of third oil tanker in Caribbean: official

-

CO2 soon to be buried under North Sea oil platform

-

Steelers edge Lions as Bears, 49ers reach playoffs

Steelers edge Lions as Bears, 49ers reach playoffs

-

India's Bollywood counts costs as star fees squeeze profits

-

McCullum admits errors in Ashes preparations as England look to salvage pride

McCullum admits errors in Ashes preparations as England look to salvage pride

-

Pets, pedis and peppermints: When the diva is a donkey

-

'A den of bandits': Rwanda closes thousands of evangelical churches

'A den of bandits': Rwanda closes thousands of evangelical churches

-

Southeast Asia bloc meets to press Thailand, Cambodia on truce

-

As US battles China on AI, some companies choose Chinese

As US battles China on AI, some companies choose Chinese

-

AI resurrections of dead celebrities amuse and rankle

-

Steelers receiver Metcalf strikes Lions fan

Steelers receiver Metcalf strikes Lions fan

-

Morocco coach 'taking no risks' with Hakimi fitness

-

Gang members given hundreds-years-long sentences in El Salvador

Gang members given hundreds-years-long sentences in El Salvador

-

Chargers, Bills edge closer to playoff berths

-

Gang members given hundred-years-long sentences in El Salvador

Gang members given hundred-years-long sentences in El Salvador

-

Hosts Morocco off to winning start at Africa Cup of Nations

-

No jacket required for Emery as Villa dream of title glory

No jacket required for Emery as Villa dream of title glory

-

Amorim fears United captain Fernandes will be out 'a while'

-

Nigerian government frees 130 kidnapped Catholic schoolchildren

Nigerian government frees 130 kidnapped Catholic schoolchildren

-

Captain Kane helps undermanned Bayern go nine clear in Bundesliga

-

Captain Kane helps undermanned Bayern go nine clear

Captain Kane helps undermanned Bayern go nine clear

-

Rogers stars as Villa beat Man Utd to boost title bid

-

Barca strengthen Liga lead at Villarreal, Atletico go third

Barca strengthen Liga lead at Villarreal, Atletico go third

-

Third 'Avatar' film soars to top in N. American box office debut

-

Third day of Ukraine settlement talks to begin in Miami

Third day of Ukraine settlement talks to begin in Miami

-

Barcelona's Raphinha, Yamal strike in Villarreal win

-

Macron, on UAE visit, announces new French aircraft carrier

Macron, on UAE visit, announces new French aircraft carrier

-

Barca's Raphinha, Yamal strike in Villarreal win

-

Gunmen kill 9, wound 10 in South Africa bar attack

Gunmen kill 9, wound 10 in South Africa bar attack

-

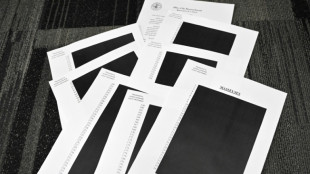

Allegations of new cover-up over Epstein files

-

Atletico go third with comfortable win at Girona

Atletico go third with comfortable win at Girona

-

Schwarz breaks World Cup duck with Alta Badia giant slalom victory

-

Salah unaffected by Liverpool turmoil ahead of AFCON opener - Egypt coach

Salah unaffected by Liverpool turmoil ahead of AFCON opener - Egypt coach

-

Goggia eases her pain with World Cup super-G win as Vonn takes third

-

Goggia wins World Cup super-G as Vonn takes third

Goggia wins World Cup super-G as Vonn takes third

-

Cambodia says Thai border clashes displace over half a million

-

Kremlin denies three-way US-Ukraine-Russia talks in preparation

Kremlin denies three-way US-Ukraine-Russia talks in preparation

-

Williamson says 'series by series' call on New Zealand Test future

-

Taiwan police rule out 'terrorism' in metro stabbing

Taiwan police rule out 'terrorism' in metro stabbing

-

Australia falls silent, lights candles for Bondi Beach shooting victims

Bausch Health Announces Extension of DURECT Corporation Tender Offer to September 10, 2025

LAVAL, QC AND CUPERTINO, CA / ACCESS Newswire / August 26, 2025 / Bausch Health Companies Inc. (NYSE:BHC)(TSX:BHC), a global, diversified pharmaceutical company, and DURECT Corporation (NASDAQ:DRRX) today announced that BHC Lyon Merger Sub, Inc. ("Purchaser"), a wholly owned subsidiary of Bausch Health Americas, Inc. ("BHA"), and an indirect subsidiary of Bausch Health Companies Inc. ("BHC"), has extended the expiration date of its tender offer (the "Offer") to acquire all of the outstanding shares of common stock of DURECT Corporation for $1.75 per share in an all-cash transaction for an upfront consideration of approximately $63 million at closing, with the potential for two additional net sales milestone payments of up to $350 million in the aggregate (subject to certain adjustments in respect of a retention plan) if the milestones are achieved before the earlier of the 10 year anniversary of the first commercial sale of larsucosterol (5-cholesten-3ß, 25-diol 3-sulfate sodium salt) in the United States and December 31, 2045.

The Offer, which was previously scheduled to expire at 5:00 p.m., New York City time, on September 9, 2025, has been extended until 5:00 p.m., New York City time, on September 10, 2025. Holders that have previously tendered their shares do not need to re-tender their shares or take any other action in response to this extension.

The Offer is being made pursuant to the terms and conditions described in the Offer to Purchase, dated August 12, 2025 (as it may be amended or supplemented from time to time, the "Offer to Purchase"), the related letter of transmittal and certain other offer documents, copies of which are attached to the tender offer statement on Schedule TO filed by BHC, BHA and Purchaser with the U.S. Securities and Exchange Commission (the "SEC") on August 12, 2025. The Offer is conditioned upon the fulfilment of certain conditions described in "The Tender Offer-Section 15-Conditions to the Offer" of the Offer to Purchase, including but not limited to, a majority of the outstanding shares of DURECT Corporation's common stock being tendered into the Offer and not withdrawn, as well as other customary closing conditions.

About Bausch Health

Bausch Health Companies Inc. (NYSE: BHC) (TSX: BHC), is a global, diversified pharmaceutical company enriching lives through our relentless drive to deliver better health care outcomes. We develop, manufacture and market a range of products primarily in gastroenterology, hepatology, neurology, dermatology, dentistry, aesthetics, international pharmaceuticals and eye health, through our controlling interest in Bausch + Lomb Corporation. Our ambition is to be a globally integrated healthcare company, trusted and valued by patients, HCPs, employees and investors. Our gastroenterology business, Salix Pharmaceuticals, is one of the largest specialty pharmaceutical businesses in the world and has licensed, developed and marketed innovative products for the treatment of gastrointestinal diseases for more than 30 years. For more information about Salix, visit www.Salix.com and connect with us on Twitter and LinkedIn. For more information about Bausch Health, visit www.bauschhealth.com and connect with us on LinkedIn.

About DURECT Corporation

DURECT Corporation (Nasdaq: DRRX) is a late-stage biopharmaceutical company pioneering the development of epigenetic therapies that target dysregulated DNA methylation to transform the treatment of serious and life-threatening conditions, including acute organ injury. Larsucosterol, DURECT's lead drug candidate, binds to and inhibits the activity of DNA methyltransferases, epigenetic enzymes that are elevated and associated with hypermethylation found in AH patients. Larsucosterol is in clinical development for the potential treatment of AH, for which the FDA has granted a Fast Track and a Breakthrough Therapy designation; MASH is also being explored. For more information about DURECT, please visit www.durect.com and follow us on X (formerly Twitter) at https://x.com/DURECTCorp.

Forward Looking Statements

This news release may contain forward-looking statements about the proposed transaction with DURECT (the "Transaction") and the future performance of Bausch Health (Bausch Health and DURECT, collectively, "the Parties"), which may generally be identified by the use of the words "anticipates," "hopes," "expects," "intends," "plans," "should," "could," "would," "may," "believes," "subject to" and variations or similar expressions. These statements are based upon the current expectations and beliefs of management and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Actual results are subject to other risks and uncertainties that relate more broadly to the Parties' overall businesses, including those more fully described in the Parties' most recent annual reports on Form 10-K and detailed from time to time in the Parties' other filings with the U.S. Securities and Exchange Commission and, in the case of Bausch Health, the Canadian Securities Administrators, which factors are incorporated herein by reference. In addition, such risks and uncertainties include, but are not limited to, the following: uncertainties relating to the timing of the consummation of the proposed Transaction; the possibility that any or all of the conditions to the consummation of the Transaction may not be satisfied or waived; the failure to obtain requisite stockholder approval of DURECT, the effect of the announcement or pendency of the Transaction on Parties' ability to maintain relationships with customers, suppliers, and other business partners; the impact of the Transaction if consummated on Bausch's business, financial position and results of operations, including with respect to expectations regarding margin expansion, accretion and deleveraging; and risks relating to potential diversion of management attention away from the Parties' ongoing business operations. There can be no assurance that the conditions to closing the Transaction will be satisfied or that the tender offer and the Transaction will be consummated. Additional information regarding certain of these material factors and assumptions may be found in the Parties' filings described above as well as the filings made in connection with the Transaction described below. These forward-looking statements speak only as of the date hereof. The Parties undertake no obligation to update any of these forward-looking statements to reflect events or circumstances after the date of this news release or to reflect actual outcomes, unless required by law.

Additional Information

On August 12, 2025, the Purchaser filed with the SEC a tender offer statement on Schedule TO and DURECT Corporation filed with the SEC a solicitation/recommendation statement on Schedule 14D-9 regarding the Offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND OTHER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS THEY MAY BE AMENDED FROM TIME TO TIME, CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BEFORE ANY DECISION IS MADE WITH RESPECT TO THE OFFER. The tender offer materials are available at no charge on the SEC's website at www.sec.gov. The tender offer materials and related materials also may be obtained for free under the "Corporate Governance-SEC Filings" section of our investor website at https://ir.bauschhealth.com/, and the Solicitation/Recommendation Statement and such other documents also may be obtained for free from DURECT under the "SEC Filings" section of DURECT's investor website at https://www.durect.com/investors/.

Investor Contact: | Media Contact: |

Investor Relations (DURECT Corporation) | Media Contact (DURECT Corporation) |

SOURCE: Bausch Health Companies Inc.

View the original press release on ACCESS Newswire

P.Mathewson--AMWN