-

Swiss Von Allmen pips Odermatt to Val Gardena downhill

Swiss Von Allmen pips Odermatt to Val Gardena downhill

-

Vonn claims third podium of the season at Val d'Isere

-

India drops Shubman Gill from T20 World Cup squad

India drops Shubman Gill from T20 World Cup squad

-

Tens of thousands attend funeral of killed Bangladesh student leader

-

England 'flat' as Crawley admits Australia a better side

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

-

Awake Breast Augmentation: Gruber Plastic Surgery Highlights Live Implant Sizing Under Local Anesthesia With No Sedation for Eligible Patients

Awake Breast Augmentation: Gruber Plastic Surgery Highlights Live Implant Sizing Under Local Anesthesia With No Sedation for Eligible Patients

-

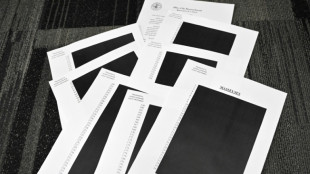

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

Integrated BioPharma Reports Results for its Quarter and Fiscal Year Ended June 30, 2025

HILLSIDE, NJ / ACCESS Newswire / September 23, 2025 / Integrated BioPharma, Inc. (OTCQX:INBP) (the "Company" or "INBP") reports its financial results for the quarter and fiscal year ended June 30, 2025.

Revenue for the quarter ended June 30, 2025 was $14.2 million compared to $12.7 million for the quarter ended June 30, 2024, an increase of $1.5 million or 11.8%. The Company had operating income of approximately $589,000 and $402,000 in the quarters ended June 30, 2025 and 2024, respectively.

Revenues for the fiscal year ended June 30, 2025 were $54.3 million compared to $50.3 million for the fiscal year ended June 30, 2024, an increase of $4.0 million or 8.0%. The Company had operating income for the fiscal year ended June 30, 2025 of approximately $0.6 million compared to operating income of $0.3 million for the fiscal year ended June 30, 2024.

For the quarter ended June 30, 2025, the Company had a net loss of approximately $0.2 million or $0.01 per share of common stock, compared with net income of $0.3 million or $0.01 per share of common stock for the quarter ended June 30, 2024. The Company's diluted net (loss) income per share of common stock for the quarters ended June 30, 2025 and 2024 were $(0.01) and $0.01 per share of common stock, respectively.

For the fiscal year ended June 30, 2025, the Company had net income of approximately $808,000 or $0.03 per share of common stock, compared with a net income of $112,000 or $0.00 per share of common stock for the fiscal year ended June 30, 2024. The Company's diluted net income per share of common stock for the fiscal years ended June 30, 2025 and 2024 were $0.03 and $0.00 per share of common stock, respectively.

"Our revenues increased by 8.0% in the fiscal year ended June 30, 2025 compared to the comparable period a year ago. Our revenue from our two largest customers in our Contract Manufacturing Segment represented approximately 84% and 90% of total revenue in the fiscal year ended June 30, 2025 and 2024, respectively," stated the Co-Chief Executive Officers of the Company, Riva Sheppard and Christina Kay. "We are happy to report that while focusing on our core business we were able to expand our customer base over the past year and increase our revenue," the Co-CEOs further stated.

A summary of our financial results for the three months and fiscal years ended June 30, 2025 and 2024 follows:

INTEGRATED BIOPHARMA, INC. AND SUBSIDIARIES | ||||||||||||

CONSOLIDATED STATEMENTS OF INCOME | ||||||||||||

(In thousands, except share and per share amounts) | ||||||||||||

(unaudited) | ||||||||||||

Three Months Ended | Fiscal Year Ended | |||||||||||

June 30, | June 30, | |||||||||||

2025 | 2024 | 2025 | 2024 | |||||||||

Total revenue | $ | 14,175 | $ | 12,746 | $ | 54,353 | $ | 50,317 | ||||

Cost of sales | 12,706 | 11,462 | 48,791 | 46,433 | ||||||||

Gross profit | 1,469 | 1,284 | 5,562 | 3,884 | ||||||||

Selling and administrative expenses | 880 | 882 | 3,542 | 3,633 | ||||||||

Operating income | 589 | 402 | 2,020 | 251 | ||||||||

Other income, net | 6 | 12 | 42 | 17 | ||||||||

Income before income taxes | 595 | 414 | 2,062 | 268 | ||||||||

Income tax expense, net | 773 | 146 | 1,254 | 156 | ||||||||

Net (loss) income | $ | (178 | ) | $ | 268 | $ | 808 | $ | 112 | |||

Net (loss) income per common share: | ||||||||||||

Basic | $ | (0.01 | ) | $ | 0.01 | $ | 0.03 | $ | 0.00 | |||

Diluted | $ | (0.01 | ) | $ | 0.01 | $ | 0.03 | $ | 0.00 | |||

Weighted average common shares outstanding: | ||||||||||||

Basic | 30,622,045 | 30,099,610 | 30,295,655 | 30,066,003 | ||||||||

Diluted | 30,622,045 | 30,702,683 | 31,168,372 | 30,873,681 | ||||||||

About Integrated BioPharma Inc. (INBP)

Integrated BioPharma, Inc. ("INBP") is engaged primarily in the business of manufacturing, distributing, marketing and sales of vitamins, nutritional supplements and herbal products. Further information is available at ir.ibiopharma.com.

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, as well as assumptions, that, if they never materialize or prove incorrect, could cause the results of INBP to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements generally are identified by the words "expects," "anticipates," believes," intends," "estimates," "should," "would," "strategy," "plan" and similar expressions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements and are not guarantees of future performance. Such statements speak only as of the date hereof, are subject to change and should not be relied upon for investment purposes. INBP undertakes no obligation to revise or update any statements for any reasons. The risks, uncertainties and assumptions include, among others, changes in general economic and business conditions; loss of market share through competition; introduction of competing products by other companies; the timing of regulatory approval and the introduction of new products by INBP; changes in industry capacity; pressure on prices from competition or from purchasers of INBP's products; regulatory changes in the pharmaceutical manufacturing industry and nutraceutical industry; regulatory obstacles to the introduction of new technologies or products that are important to INBP; availability of qualified personnel; the loss of any significant customers or suppliers; inflation, including inflationary pressures from any tariffs, and tightened labor markets; our ability to expand our customer base and other risks and uncertainties described in the section entitled "Risk Factors" in INBP's most recent Annual Report on Form 10-K and its subsequent Quarterly Reports on Form 10-Q. Accordingly, INBP cannot give assurance that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of INBP.

Contact: Dina Masi, CFO

Integrated BioPharma, Inc.

[email protected]

888.319.6962

SOURCE: Integrated BioPharma, Inc.

View the original press release on ACCESS Newswire

A.Jones--AMWN