-

Security beefed up for Ashes Test after Bondi shooting

Security beefed up for Ashes Test after Bondi shooting

-

Wembanyama blocking Knicks path in NBA Cup final

-

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

-

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

-

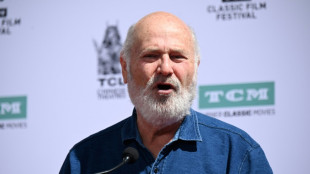

Five Rob Reiner films that rocked, romanced and riveted

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

-

Athletes to stay in pop-up cabins in the woods at Winter Olympics

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

Iran Nobel winner unwell after 'violent' arrest: supporters

-

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

-

'Angry' Louvre workers' strike shuts out thousands of tourists

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

Avant Brands Fully Repays $9.5M Secured Convertible Debenture

KELOWNA, BC / ACCESS Newswire / December 8, 2025 / Avant Brands Inc. (TSX:AVNT)(OTCQX:AVTBF)(FRA:1BU0) ("Avant" or the "Company"), a leading producer of innovative and award-winning cannabis products, today announced the full repayment of its $9.5 million amended and restated convertible debenture (the "A&R Debenture"). The final payment was completed in November 2025, retiring in full the obligation originally issued in connection with the 2023 acquisition of 3PL Ventures Inc.

The successful retirement of the A&R Debenture eliminates Avant's largest monthly recurring debt obligation, strengthens the Company's balance sheet, and releases key operating assets from security. The repayment is part of a consistent focus on deleveraging: Avant has now repaid approximately $4 million in total debt during Fiscal Year 2025, reinforcing its ongoing commitment to disciplined financial management. This follows Avant's eighth consecutive quarter of positive Adjusted EBITDA¹ and a 111% year-over-year increase in year-to-date cash flows from operating activities to $3.7 million².

Key Highlights

Debt Fully Extinguished: The full principal amount of the $9.5 million A&R Debenture was retired in November 2025.

No Conversion: Repayment was completed without any conversion into common shares.

Balance Sheet Strength: Eliminates the Company's largest recurring monthly debt obligation, enhancing liquidity for growth initiatives.

Unencumbered Operating Assets: Key real estate assets-including Grey Bruce Farms and Tumbleweed Farms-are now unencumbered.

Execution and Discipline: Completed 32 consecutive payments since the note's initial issuance in February 2023.

Continued Performance: Reinforces Q3 2025 results-Avant's eighth consecutive quarter of positive Adjusted EBITDA¹, driven by 13% gross revenue growth to $10.8 million2 and a 68% increase in gross profit to $1.7 million2.

Recognized Growth: Named one of The Globe and Mail's Top Growing Companies for the third consecutive year, ranking 138th with 263% three-year revenue growth³.

¹ Adjusted EBITDA is a non-GAAP performance measure. See the Company's Q3 2025 MD&A available on SEDAR+ at www.sedarplus.ca

² As reported in the Q3 2025 financial results.

³ As announced by The Globe and Mail on September 29, 2025.

Norton Singhavon, Founder and CEO of Avant Stated:

"In 2023, we made bold investments at scale-acquiring 3PL and Flowr in parallel, to establish a platform capable of supporting sustained growth. We are pleased to have retired every dollar of this acquisition-related debt. This significant milestone, alongside the $4 million in total debt reduction achieved during Fiscal Year 2025, is a result of the Company's execution, discipline, and long-term commitment to shareholder value. Our balance sheet is significantly stronger, our core assets are unencumbered, and we are well-positioned for the next phase of profitable growth."

This repayment marks the fifth loan the Company has fully retired in its history, bringing total debt repaid to more than $21 million. This record demonstrates Avant's ability to service debt, meet its obligations, and consistently deliver on its commitments while continuing to strengthen its balance sheet.

The A&R Debenture was originally issued in connection with the 2023 acquisition of 3PL Ventures Inc., which-together with the parallel purchase of Flowr Okanagan-expanded Avant's indoor production footprint by approximately 60% to more than 185,000 sq. ft. These acquisitions have positioned Avant as one of Canada's largest indoor cannabis producers and have supported material growth across both domestic and export channels.

Focus on Next Phase of Growth

With the A&R Debenture fully repaid, Avant plans to leverage its improved balance sheet to:

Expand international distribution in high-growth export markets;

Advance high-margin product categories domestically;

Maintain strict cost discipline to maximize operating leverage and free cash flow.

The Company remains committed to driving sustainable, cash-flow-positive growth and enhancing long-term shareholder returns.

About Avant Brands Inc.

Avant Brands Inc. (TSX:AVNT)(OTCQX:AVTBF)(FRA:1BU0) is a leading innovator in premium cannabis products, driven by a commitment to exceptional quality and craftsmanship. As one of Canada's largest indoor producers, the company operates multiple production facilities across the country, cultivating unique and high-quality cannabis strains.

Avant offers a diverse product portfolio catering to recreational, medical, and export markets. Its renowned consumer brands, including blk mkt™, Tenzo™, Cognōscente™, flowr™, and Treehugger™, are available in key recreational markets across Canada. The company's international footprint spans Australia, Israel, and Germany, with its flagship brand blk mkt™ leading the way. Avant also serves qualified medical patients nationwide through its GreenTec™ medical cannabis brand, accessible via the GreenTec Medical portal and trusted partner network.

Avant is a publicly traded company, listed on the Toronto Stock Exchange (TSX) and accessible to international investors through the OTCQX Best Market (OTCQX) and Frankfurt Stock Exchange (FRA). Headquartered in Kelowna, British Columbia, the company operates in strategic locations throughout Canada.

Learn More:

For more information about Avant, including investor presentations and details about its consumer brands, please visit the company website: www.avantbrands.ca

Investor Relations:

For inquiries, please contact:

Avant Brands Investor Relations

1-800-351-6358

[email protected]

Neither TSX Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION:

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation, which reflects the current expectations, estimates, and projections of Avant Brands Inc. ("Avant" or the "Company") regarding future events, performance, or results. Forward-looking information is often, but not always, identified by words such as "expects," "anticipates," "believes," "intends," "plans," "estimates," "may," "could," "would," "should," and similar expressions.

Forward-looking information in this release includes, but is not limited to, statements concerning: the Company's expectations to leverage its improved balance sheet to expand international distribution in high-growth export markets, advance high-margin product categories domestically and maintain strict cost discipline to maximize operating leverage and free cash flow; driving sustainable, cash-flow-positive growth; and enhancing long-term shareholder returns.

Forward-looking information is based on a number of assumptions that management believes to be reasonable as of the date of this news release, including assumptions regarding general business and economic conditions, the Company's ability to maintain and grow market share, regulatory stability, consumer demand for premium cannabis products, and access to capital and key personnel.

Such statements involve known and unknown risks, uncertainties, and other factors that may cause actual results or performance to differ materially from those expressed or implied by the forward-looking information. These risks include, among others, changes in general economic, business, and political conditions; regulatory and licensing risks; evolving cannabis regulations and enforcement practices; shifts in consumer preferences; fluctuations in input costs and supply chains; and the risk factors detailed in the Company's Annual Information Form dated February 28, 2025, and other continuous disclosure filings available on the Company's SEDAR+ profile at www.sedarplus.ca

Readers are cautioned not to place undue reliance on forward-looking information. Avant disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events, or otherwise, except as required by applicable law.

SOURCE: Avant Brands Inc.

View the original press release on ACCESS Newswire

Y.Nakamura--AMWN