-

Security beefed up for Ashes Test after Bondi shooting

Security beefed up for Ashes Test after Bondi shooting

-

Wembanyama blocking Knicks path in NBA Cup final

-

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

-

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

-

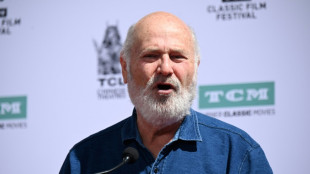

Five Rob Reiner films that rocked, romanced and riveted

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

-

Athletes to stay in pop-up cabins in the woods at Winter Olympics

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

Iran Nobel winner unwell after 'violent' arrest: supporters

-

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

-

'Angry' Louvre workers' strike shuts out thousands of tourists

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

Survey Reveals Cautious Optimism in PIPE Market as Investors Eye Technology, Healthcare, and Cleantech in 2026

NEW YORK, NY / ACCESS Newswire / December 8, 2025 / DealFlow Events today released the results of its PIPE Market Trends & Sentiment Survey, conducted during the 2025 PIPEs Conference. The findings point to measured but growing optimism in the market, with a majority of respondents describing current PIPE conditions as at least "somewhat healthy" and expecting transaction activity to increase over the next year.

According to the survey, 92% of respondents view today's PIPE market as either very or somewhat healthy, while 75% expect PIPE activity to rise in the next 12 months - including 25% who anticipate a significant increase.

"These results reflect what we heard repeatedly at this year's conference: the market is not without its challenges, but confidence in deal activity is clearly building," said Steven Dresner, Founder of DealFlow Events.

Key Findings

Valuation gaps and market volatility remain the primary obstacles.

Respondents identified valuation gaps (67%) and stock price volatility/post-deal performance (67%) as the two greatest challenges facing today's PIPE transactions. Regulatory complexity and limited fundamental investor participation were also frequently cited.

Growth fundamentals and investor quality drive investment decisions.

When evaluating a PIPE, participants placed the highest importance on a company's growth prospects (67%) and quality of the investor group (58%), followed by transaction structure (50%), discount, and incentive features such as warrant coverage.

Deal structures have mostly stabilized.

Half of respondents said terms are "about the same" compared to last year, while the remainder were split on whether structures have become more investor-friendly or issuer-friendly.

Hybrid structures increasingly common.

Nearly 60% of respondents reported seeing somewhat more prevalent use of hybrid financing tools such as convertible PIPEs and structured equity.

Technology dominates investor interest.

When asked which sectors offer the most compelling PIPE opportunities, respondents overwhelmingly pointed to Technology/AI (92%), followed by Healthcare/Life Sciences (67%) and Energy/Cleantech (58%).

Advisors and investors expect to remain active.

More than two-thirds of respondents expect to participate in a PIPE transaction in the next 12 months - as investors, advisors, or issuers. None indicated plans to step away from the market.

PIPEs remain competitive with other financing options.

Half of survey participants view PIPEs as slightly or much more attractive than alternative structures such as ATMs, registered directs, or private credit. Another 42% view them as roughly equivalent.

Regulatory Outlook Mixed but Stable

Respondents described the current SEC and exchange environment as mostly supportive or neutral, though half expect potential future tightening around disclosures or resale processes. Many noted that issuers and investors are adapting to a more structured environment and factoring compliance considerations into transaction planning.

About the Survey

The PIPE Market Trends & Sentiment Survey was conducted during the 2025 PIPEs Conference, gathering insights from sector professionals including investors, bankers, advisors, and corporate executives. The survey aims to capture practitioner sentiment and identify key factors shaping today's PIPE market.

About DealFlow Events

DealFlow Events is a leading producer of independent investment conferences, including The PIPEs Conference, The SPAC Conference, The Private Credit Sourcing Conference, and the DealFlow Discovery Conference. Since 2003, DealFlow Events has been a trusted resource for education, networking, and deal-making across the capital markets landscape.

Media Contact:

Phillip LoFaso

[email protected]

(516) 876-8006

SOURCE: DealFlow Events

View the original press release on ACCESS Newswire

F.Pedersen--AMWN