-

Arsenal rocked by Bournemouth, Villa boost top five bid

Arsenal rocked by Bournemouth, Villa boost top five bid

-

Freeman hat-trick stuns Leinster to take Northampton into Champions Cup final

-

Warren Buffett says will retire from Berkshire Hathaway by year's end

Warren Buffett says will retire from Berkshire Hathaway by year's end

-

Al Ahli beat Kawasaki Frontale to win Asian Champions League

-

Shepherd, Dayal edge Bengaluru past Chennai in IPL thriller

Shepherd, Dayal edge Bengaluru past Chennai in IPL thriller

-

Sabalenka beats Gauff to win third Madrid Open crown

-

Arsenal suffer Bournemouth defeat ahead of PSG showdown

Arsenal suffer Bournemouth defeat ahead of PSG showdown

-

Napoli six clear in Serie A after win at fiery Lecce

-

Van Nistelrooy glad as Leicester end goal drought against sorry Saints

Van Nistelrooy glad as Leicester end goal drought against sorry Saints

-

Meta fighting Nigerian fines, warns could shut Facebook, Instagram

-

Hamas armed wing releases video of apparently injured Israeli hostage

Hamas armed wing releases video of apparently injured Israeli hostage

-

Norris wins wild and wet Miami GP sprint race

-

Gabon ex-junta chief Oligui sworn in after election win

Gabon ex-junta chief Oligui sworn in after election win

-

Singapore ruling party wins election in landslide

-

Eurovision warms up with over-60s disco

Eurovision warms up with over-60s disco

-

Russell helps Bath beat Edinburgh in Challenge Cup semi-final

-

Second-string PSG beaten by Strasbourg before Arsenal return leg

Second-string PSG beaten by Strasbourg before Arsenal return leg

-

Zelensky says won't play Putin 'games' with short truce

-

Norris wins Miami GP sprint race

Norris wins Miami GP sprint race

-

PM of Yemen government announces resignation

-

South Africa bowler Rabada serving ban for positive drug test

South Africa bowler Rabada serving ban for positive drug test

-

Serbian president stable in hospital after cutting short US trip

-

UN envoy urges Israel to halt Syria attacks 'at once'

UN envoy urges Israel to halt Syria attacks 'at once'

-

Villa boost top five bid, Southampton beaten at Leicester

-

Leipzig put Bayern and Kane's title party on ice

Leipzig put Bayern and Kane's title party on ice

-

Serbian president hospitalised after cutting short US trip

-

Buick and Appleby rule again in English 2000 Guineas

Buick and Appleby rule again in English 2000 Guineas

-

Singapore ruling party headed for clear victory in test for new PM

-

Martinez climbs into Tour de Romandie lead with penultimate stage win

Martinez climbs into Tour de Romandie lead with penultimate stage win

-

O'Sullivan backs Zhao Xintong to become snooker 'megastar'

-

Simbine wins 100m in photo finish thriller as Duplantis dominates

Simbine wins 100m in photo finish thriller as Duplantis dominates

-

Atletico held at Alaves in dry Liga draw

-

Cardinals meet ahead of vote for new pope

Cardinals meet ahead of vote for new pope

-

Snooker star Zhao: from ban to cusp of Chinese sporting history

-

Tielemans keeps Villa in chase for Champions League place

Tielemans keeps Villa in chase for Champions League place

-

Anthony Albanese: Australia's dog-loving, Tory fighting PM

-

Trump may have aided Australian PM's election victory: analysts

Trump may have aided Australian PM's election victory: analysts

-

Right-leaning Australian opposition leader loses election, and seat

-

India blocks Pakistani celebrities on social media

India blocks Pakistani celebrities on social media

-

Ancelotti says he will reveal future plans at end of season

-

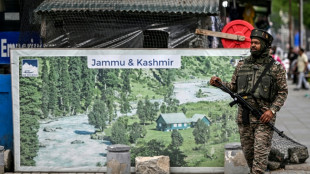

India-Pakistan tensions hit tourism in Kashmiri valley

India-Pakistan tensions hit tourism in Kashmiri valley

-

Bangladesh Islamists rally in show of force

-

Zelensky says won't play Putin's 'games' with short truce

Zelensky says won't play Putin's 'games' with short truce

-

Cardinals meet ahead of papal election

-

Pakistan tests missile weapons system amid India standoff

Pakistan tests missile weapons system amid India standoff

-

France charges 21 prison attack suspects

-

Pakistan military says conducts training launch of missile

Pakistan military says conducts training launch of missile

-

Lives on hold in India's border villages with Pakistan

-

Musk's dreams for Starbase city in Texas hang on vote

Musk's dreams for Starbase city in Texas hang on vote

-

Rockets down Warriors to stay alive in NBA playoffs

Lebanon's 'zombie banks' downsize to weather crisis

Once the economy's crown jewel, Lebanon's banks are shutting branches and laying off employees in droves, resizing to the bleak reality of a crisis they are widely blamed for.

Before the onset in 2019 of a financial collapse deemed one of the world's worst since the 1850s by the World Bank, the small Mediterranean country had an oversized but prosperous banking sector.

The capital Beirut was a booming regional financial hub, attracting savers keen to profit from high interest rates and banking secrecy laws.

But more than two years into the crisis, the reputation of Lebanese lenders has been shredded.

A dizzying currency collapse, coupled with banks imposing strict withdrawal limits and prohibiting transfers abroad, has left ordinary depositors watching on helplessly as their savings evaporate.

And yet bankers stand accused of bypassing those exact same capital controls -- stoking the crisis by helping the political elite squirrel billions of dollars overseas.

Their trust destroyed, citizens now keep new income well away from the banks, which in turn are deprived of money they could lend.

"The whole banking system today is made up of zombie banks," said economic analyst Patrick Mardini.

"They don't work as banks anymore -- they don't give loans, they don't take new deposits."

- 'Abandoned country' -

As a result, the industry has been forced to scale back its operations.

In 2019, Lebanon ranked second in the region for bank branches per 100,000 people, according to the World Bank, and held a total of around $150 billion in deposits.

Deposits by Arab investors and Lebanese expatriates propelled the banking sector to peak at three times the value of national economic output.

But more than 160 branches have closed since the end of 2018, leaving a total of 919 branches operating across the country, according to the Association of Banks in Lebanon (ABL).

The number of employees has dropped by around 5,900, reducing the sector's workforce to roughly 20,000 late last year.

"Lebanon is an abandoned country," ABL chief Salim Sfeir told AFP, referring to negligence by the nation's authorities.

The association claims the sector has been "forced to adapt to the contraction of the economy," even as others blame the banks for overall economic activity plunging by more than half since 2019.

The Lebanese pound, officially pegged at 1,507 to the greenback since 1997, has lost more than 90 percent of its value on the black market.

The slide has prompted banks to adopt a plethora of exchange rates for transactions even though the official rate remains unchanged.

Those who hold dollar accounts have mostly had to withdraw cash in Lebanese pounds and at a fraction of the black market rate.

"If we apply international accounting standards, almost all Lebanese banks are insolvent," investment banker Jean Riachi said.

- 'Exit the market' -

Lebanon's government defaulted on its foreign debt in 2020, stymying the country's hopes of quickly securing new international credit or donor money to stem the crisis.

The ruling elite, beset by internal rifts that have repeatedly left the country without a government, has yet to agree on an economic recovery plan with international creditors.

Disagreements between the government, the central bank and commercial banks over the scale of financial sector losses have dogged talks with the International Monetary Fund that first started nearly two years ago.

In December, the government of Prime Minister Najib Mikati set financial sector losses at around $69 billion in a crucial step towards advancing IMF talks.

But while the global lender said early this month that efforts to agree on a rescue package have progressed, it made clear more work was needed, especially in terms of "restructuring of the financial sector".

The analyst Mardini said bank restructuring proposals have been discussed by several governments.

Central bank chief Riad Salameh has said banks that are unable to lend must "exit the market".

But meaningful progress on restructuring has been impeded by a political elite who maintain large shares in some of the main banks, according to Mardini.

For out-of-pocket depositors, the details of any restructuring arrangements are a secondary concern.

"I just want to recover my savings," said Hicham, a businessman who asked to use his first name only over privacy concerns.

"All the parties concerned must assume their responsibilities."

P.Costa--AMWN