-

Arsenal rocked by Bournemouth, Villa boost top five bid

Arsenal rocked by Bournemouth, Villa boost top five bid

-

Freeman hat-trick stuns Leinster to take Northampton into Champions Cup final

-

Warren Buffett says will retire from Berkshire Hathaway by year's end

Warren Buffett says will retire from Berkshire Hathaway by year's end

-

Al Ahli beat Kawasaki Frontale to win Asian Champions League

-

Shepherd, Dayal edge Bengaluru past Chennai in IPL thriller

Shepherd, Dayal edge Bengaluru past Chennai in IPL thriller

-

Sabalenka beats Gauff to win third Madrid Open crown

-

Arsenal suffer Bournemouth defeat ahead of PSG showdown

Arsenal suffer Bournemouth defeat ahead of PSG showdown

-

Napoli six clear in Serie A after win at fiery Lecce

-

Van Nistelrooy glad as Leicester end goal drought against sorry Saints

Van Nistelrooy glad as Leicester end goal drought against sorry Saints

-

Meta fighting Nigerian fines, warns could shut Facebook, Instagram

-

Hamas armed wing releases video of apparently injured Israeli hostage

Hamas armed wing releases video of apparently injured Israeli hostage

-

Norris wins wild and wet Miami GP sprint race

-

Gabon ex-junta chief Oligui sworn in after election win

Gabon ex-junta chief Oligui sworn in after election win

-

Singapore ruling party wins election in landslide

-

Eurovision warms up with over-60s disco

Eurovision warms up with over-60s disco

-

Russell helps Bath beat Edinburgh in Challenge Cup semi-final

-

Second-string PSG beaten by Strasbourg before Arsenal return leg

Second-string PSG beaten by Strasbourg before Arsenal return leg

-

Zelensky says won't play Putin 'games' with short truce

-

Norris wins Miami GP sprint race

Norris wins Miami GP sprint race

-

PM of Yemen government announces resignation

-

South Africa bowler Rabada serving ban for positive drug test

South Africa bowler Rabada serving ban for positive drug test

-

Serbian president stable in hospital after cutting short US trip

-

UN envoy urges Israel to halt Syria attacks 'at once'

UN envoy urges Israel to halt Syria attacks 'at once'

-

Villa boost top five bid, Southampton beaten at Leicester

-

Leipzig put Bayern and Kane's title party on ice

Leipzig put Bayern and Kane's title party on ice

-

Serbian president hospitalised after cutting short US trip

-

Buick and Appleby rule again in English 2000 Guineas

Buick and Appleby rule again in English 2000 Guineas

-

Singapore ruling party headed for clear victory in test for new PM

-

Martinez climbs into Tour de Romandie lead with penultimate stage win

Martinez climbs into Tour de Romandie lead with penultimate stage win

-

O'Sullivan backs Zhao Xintong to become snooker 'megastar'

-

Simbine wins 100m in photo finish thriller as Duplantis dominates

Simbine wins 100m in photo finish thriller as Duplantis dominates

-

Atletico held at Alaves in dry Liga draw

-

Cardinals meet ahead of vote for new pope

Cardinals meet ahead of vote for new pope

-

Snooker star Zhao: from ban to cusp of Chinese sporting history

-

Tielemans keeps Villa in chase for Champions League place

Tielemans keeps Villa in chase for Champions League place

-

Anthony Albanese: Australia's dog-loving, Tory fighting PM

-

Trump may have aided Australian PM's election victory: analysts

Trump may have aided Australian PM's election victory: analysts

-

Right-leaning Australian opposition leader loses election, and seat

-

India blocks Pakistani celebrities on social media

India blocks Pakistani celebrities on social media

-

Ancelotti says he will reveal future plans at end of season

-

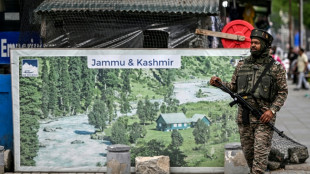

India-Pakistan tensions hit tourism in Kashmiri valley

India-Pakistan tensions hit tourism in Kashmiri valley

-

Bangladesh Islamists rally in show of force

-

Zelensky says won't play Putin's 'games' with short truce

Zelensky says won't play Putin's 'games' with short truce

-

Cardinals meet ahead of papal election

-

Pakistan tests missile weapons system amid India standoff

Pakistan tests missile weapons system amid India standoff

-

France charges 21 prison attack suspects

-

Pakistan military says conducts training launch of missile

Pakistan military says conducts training launch of missile

-

Lives on hold in India's border villages with Pakistan

-

Musk's dreams for Starbase city in Texas hang on vote

Musk's dreams for Starbase city in Texas hang on vote

-

Rockets down Warriors to stay alive in NBA playoffs

Investigation claims Credit Suisse handled dirty money

Credit Suisse handled billions of dollars in dirty money for decades, an international media investigation based on a massive data leak claimed on Sunday, in the latest setback for Switzerland's second-largest bank.

The bank held more than $8 billion (seven billion euros) in accounts of criminals, dictators and human rights abusers, among others, according to the investigation by a group comprising dozens of media organisations.

Credit Suisse rejected the "allegations and insinuations", saying in a statement that many of the issues raised were historical, some dating back more than 70 years.

According to the Organized Crime and Corruption Reporting Project (OCCRP), a non-profit journalism group, the "Suisse Secrets" investigation began when an anonymous source shared bank data with German newspaper Suddeutsche Zeitung more than a year ago.

That information, covering accounts collectively worth $100 billion at their highest point, was trawled through by 48 media outlets worldwide, including The New York Times, Le Monde and The Guardian.

Accounts identified as problematic held over $8 billion in assets, the investigation found.

The accounts included those held by a Yemeni spy chief implicated in torture, the sons of an Azerbaijani strongman, a Serbian drug lord and bureaucrats accused of looting Venezuela's oil wealth.

It was the largest leak ever from a major Swiss bank, OCCRP said.

- 'Tendentious interpretations' -

The leak included information on more than 18,000 bank accounts, many of which "remained open well into the 2010s", said the OCCRP.

In its statement Sunday, the bank said: "Credit Suisse strongly rejects the allegations and insinuations about the bank's purported business practices.

"The matters presented are predominantly historical, in some cases dating back as far as the 1940s, and the accounts of these matters based on partial, inaccurate, or selective information taken out of context, resulting in tendentious interpretations of the bank's business conduct."

About 90 percent of the accounts reviewed were closed -- or were in the process of being closed -- before the press approached the bank, it added. And more than 60 percent of them had been closed before 2015.

The OCCRP, in a statement on its website, said: "We believe the dozens of examples we have cited raise serious questions about Credit Suisse's effectiveness and commitment to meeting its responsibilities."

It said the investigation had found dozens of "dubious characters" in the data, including some linked to government officials.

Among those listed as holding accounts with Credit Suisse were the sons of former Egyptian President Hosni Mubarak and Jordan's King Abdullah II.

When asked why so many of these accounts existed, current and former Credit Suisse employees described a work culture that incentivised taking on risk to maximise profits, according to OCCRP.

"I've too often seen criminals and corrupt politicians who can afford to keep on doing business as usual, no matter what the circumstances, because they have the certainty that their ill-gotten gains will be kept safe and always within their reach," said OCCRP co-founder Paul Radu in a statement.

- A series of setbacks -

The international investigation is the latest in a series of setbacks that Credit Suisse has suffered recently.

In March 2021, the bank was hit by the collapse of Greensill Capital in which it had committed some $10 billion dollars through four funds. The implosion of the US fund Archegos cost it more than $5 billion.

And in Switzerland, a former Credit Suisse employee is among the defendants in a major corruption trial that has just started and involves alleged money laundering and organised crime in Bulgaria. The bank has said it will "defend itself vigorously in court".

Experts say draconian banking secrecy laws in Switzerland effectively silence insiders or journalists who may want to expose wrongdoing within a Swiss bank, according to OCCRP.

A Swiss media group was unable to participate in the investigation due to the risk of criminal prosecution, the organisation said.

O.M.Souza--AMWN