-

Toulouse handed two-point deduction for salary cap breach

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

-

Athletes to stay in pop-up cabins in the woods at Winter Olympics

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

Iran Nobel winner unwell after 'violent' arrest: supporters

-

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

-

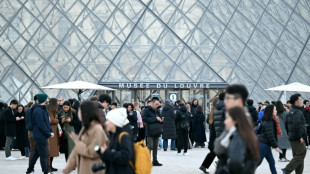

'Angry' Louvre workers' strike shuts out thousands of tourists

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

Flash flood kills dozens in Morocco town

-

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

Australia to toughen gun laws after deadly Bondi shootings

-

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

| SCS | 0.12% | 16.14 | $ | |

| CMSC | 0.04% | 23.31 | $ | |

| RBGPF | -4.49% | 77.68 | $ | |

| RYCEF | 2.01% | 14.9 | $ | |

| GSK | 0.47% | 49.04 | $ | |

| NGG | 0.9% | 75.61 | $ | |

| VOD | 1.15% | 12.736 | $ | |

| CMSD | 0.34% | 23.33 | $ | |

| BTI | 0.44% | 57.35 | $ | |

| RIO | -0.4% | 75.362 | $ | |

| BCE | 1.46% | 23.7403 | $ | |

| BCC | -1.52% | 75.365 | $ | |

| JRI | 0.14% | 13.5856 | $ | |

| RELX | 1.6% | 41.035 | $ | |

| AZN | 1.23% | 90.95 | $ | |

| BP | -0.8% | 34.98 | $ |

Global stocks fall amid worries over interest rate, US-China tensions

Stock markets slid and the dollar firmed Monday after the latest round of robust US economic data fanned expectations of more Federal Reserve interest rate hikes.

Adding to the downbeat mood were geopolitical concerns after the United States shot down a suspected Chinese spy balloon that had floated across the country for days.

China voiced anger on Sunday at the shooting down of the balloon, which it insists was an unmanned weather surveillance aircraft that veered off-course.

This came as equity market rallies enjoyed through January have largely stopped as investors contemplate an extended period of high borrowing costs, aimed at bringing inflation down from multi-decade highs.

And Friday's blowout US jobs report has raised the question of what the Fed is going to do next, said Hugh Johnson of Hugh Johnson Economics.

The worry is that "the Federal Reserve policy is not going to change into anything like a pause or a reduction anytime soon," Johnson said.

Friday's jobs data came two days after Fed Chair Jerome Powell sent less hawkish signals about future interest rate hikes after acknowledging progress in the battle on inflation.

Powell is due for another public appearance on Tuesday.

Wall Street indices spent most of the day in the red, with the S&P 500 ending down 0.6 percent.

London's benchmark FTSE 100 index, which hit an all-time high on Friday, fell 0.8 percent on Monday.

"Having hit a new all-time high..., the FTSE 100 opened the new trading week with a hangover," noted Russ Mould, investment director at AJ Bell.

"Throwing cold water over the party were stronger than expected jobs figures in the US, something closely monitored by the Federal Reserve when making interest rate decisions," he said.

Eurozone stock markets were also down, as were leading indices in Asia.

Oil prices, meanwhile, pushed higher as Iraqi Kurdistan said it was suspending oil exports through Turkey as a precaution after a deadly earthquake rocked its northern neighbor and Syria.

The autonomous Kurdish region of northern Iraq usually exports around 450,000 barrels of oil a day through Turkey.

Dell became the latest tech industry firm to announce job cuts, shedding five percent of its workforce or around 6,650 positions. Its shares closed around three percent lower in New York.

In Asia on Monday, Mumbai stocks slipped again with embattled tycoon Gautam Adani's troubled empire suffering more big losses.

Flagship Adani Enterprises gained more than 1,000 percent in five years before a rout begun last week on allegations of fraud at India's biggest conglomerate.

- Key figures around 2115 GMT -

New York - Dow: DOWN 0.1 percent at 33,891.02 (close)

New York - S&P 500: DOWN 0.6 percent at 4,111.08 (close)

New York - Nasdaq: DOWN 1.0 percent at 11,887.45 (close)

London - FTSE 100: DOWN 0.8 percent at 7,836.71 (close)

Frankfurt - DAX: DOWN 0.8 percent at 15,345.91 (close)

Paris - CAC 40: DOWN 1.3 percent at 7,137.10 (close)

EURO STOXX 50: DOWN 1.2 percent at 4,205.45 (close)

Tokyo - Nikkei 225: UP 0.7 percent at 27,693.65 (close)

Hong Kong - Hang Seng Index: DOWN 2.0 percent at 21,222.16 (close)

Shanghai - Composite: DOWN 0.8 percent at 3,238.70 (close)

Euro/dollar: DOWN at $1.0728 from $1.0795 on Friday

Pound/dollar: DOWN at $1.2020 from $1.2056

Euro/pound: DOWN at 89.22 pence from 89.54 pence

Dollar/yen: UP at 132.65 yen from 131.19 yen

Brent North Sea crude: UP 1.3 percent at $80.99 per barrel

West Texas Intermediate: UP 1.0 percent at $74.11 per barrel

burs-jmb/bys

M.Fischer--AMWN