-

Toulouse handed two-point deduction for salary cap breach

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

-

Athletes to stay in pop-up cabins in the woods at Winter Olympics

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

Iran Nobel winner unwell after 'violent' arrest: supporters

-

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

-

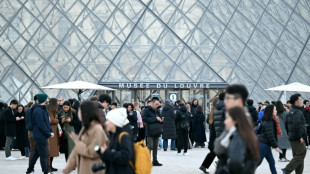

'Angry' Louvre workers' strike shuts out thousands of tourists

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

Flash flood kills dozens in Morocco town

-

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

Australia to toughen gun laws after deadly Bondi shootings

-

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

SoftBank Group reports $5.9 bn third-quarter loss on tech slump

Japan's SoftBank Group on Tuesday reported a surprise $5.9 billion net loss in the third quarter, as a slump in the tech sector continued to hit the investment behemoth's bottom line.

The loss compared with the net profit of 29.0 billion yen ($219 million) the firm reported in the same three-month period last year.

Its two Vision Fund investment vehicles alone lost 660 billion yen ($5 billion) in October-December, "reflecting declines in the share prices of a wide range of portfolio companies", SoftBank said.

The firm has made huge bets to find and grow hot new tech ventures around the world, but that has left its earnings vulnerable to fickle market forces, and its Vision Funds have reported losses for four straight quarters.

Interest rate hikes by the US Federal Reserve and other central banks to tackle inflation have weighed on global tech shares, putting pressure on SoftBank.

Its results have lurched between dizzying highs and lows in recent years, with China's crackdown on its tech sector taking a toll on the company.

Second-quarter earnings were boosted by the sale of some shares in Alibaba as it reduced its stake to around 15 percent from 24 percent.

But it reported a record quarterly net loss for the first quarter, as tech shares tanked on interest rate hikes, a trend analysts said was likely to continue.

"Weakness in global equity markets remains the main risk to the SoftBank story," said Kirk Boodry, an analyst at Redex Research who publishes on SmartKarma.

SoftBank CEO Masayoshi Son has regularly defended his strategy of making major bets on high-tech firms and start-ups, insisting that the approach will lead to a handful of significant wins that outweigh losses.

But his tactics have come under increasing scrutiny given the firm's successive losses, and Son will no longer deliver the company's results presentation.

- 'Very tough' -

His unusual presentation style, complete with images of unicorns riding over troughs, have been a staple of SoftBank's quarterly results.

On Tuesday, however, his chief financial officer Yoshimitsu Goto is expected to do the talking instead, and faces explaining losses in firms like DoorDash.

Last quarter, he warned "we are very pessimistic".

"We could make a lot of money if we knew when (share prices) will recover, but honestly, we don't know," Goto said.

Analysts said there was good reason to be cautious.

"The overall investment environment is very tough including on US shares," Hideki Yasuda, an analyst at Toyo Securities, told AFP before the results.

But he and other observers think the firm could start to see the benefits of an improving situation in China.

"We are generally somewhat negative on Softbank's positioning heading into 2023 with concerns on tech valuation at the forefront," wrote Redex's Broody.

"But a recovery in China... provides some support," he added, noting that Beijing's crackdown on tech firms and its anti-Covid policies "both appear to be leveling out".

F.Dubois--AMWN