-

Toulouse handed two-point deduction for salary cap breach

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

-

Athletes to stay in pop-up cabins in the woods at Winter Olympics

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

Iran Nobel winner unwell after 'violent' arrest: supporters

-

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

-

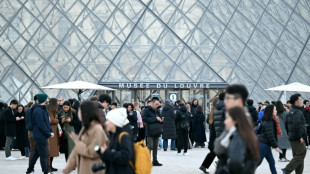

'Angry' Louvre workers' strike shuts out thousands of tourists

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

Flash flood kills dozens in Morocco town

-

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

Australia to toughen gun laws after deadly Bondi shootings

-

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

Stocks slide on US rate-hike expectations

Stock markets mostly fell Tuesday as investors braced for President Joe Biden's State of the Union address and fresh signals from US Federal Reserve chairman Jerome Powell about the direction of interest rates.

Wall Street opened lower while Frankfurt and Paris struggled in afternoon deals, but London was up. Hong Kong and mainland Chinese indices finished higher while Tokyo was flat.

A blockbuster US jobs report last week has undercut hopes that the Fed will put the brakes on its rate-hike campaign, which it launched last year in an effort to tame decades-high inflation

"A strengthening labour market theoretically makes it less likely that the Federal Reserve will halt interest rate rises anytime soon," said Russ Mould, investment director at AJ Bell.

"The Fed needs to see both the jobs market and inflation start to cool before it can justify changing its stance on rates."

Focus was on a speech due later Tuesday from Powell, who "remains a big wild card every time he speaks", said Chris Senyek at Wolfe Research.

"We still believe that the Fed will be 'higher for longer'," Senyek added.

January's rally for equities was halted as investors contemplate an extended period of high borrowing costs aimed at bringing down inflation from multi-decade highs.

While there are signs that price rises are slowing, and the Federal Reserve acknowledged progress in its battle last week, the employment data Friday was seen as a body blow for many.

The reading, which showed more than half a million new posts created in January, led to speculation the Fed could have to unveil even more rate hikes this year, while any chance of a cut before 2024 all but evaporated.

"As the market eagerly awaits Powell's speech, it's worth considering that his words hold the power to move mountains, or in this case, markets," said Matthew Weller, global head of research at Forex.com and City Index.

For his part, Biden is expected to highlight the strong job market and progress in mitigating inflation during his annual address to Congress.

- Bounce for Adani -

London's FTSE 100 was boosted Tuesday by bumper annual profits from British energy giant BP, whose shares rallied more than six percent

Sydney dropped Tuesday as the Australian central bank hiked interest rates to a 10-year high and warned of more to come as it struggles to get a hold on inflation.

Mumbai was also on the back foot, though shares in tycoon Gautam Adani's troubled empire soared following news it had moved to pay back loans of $1.1 billion after allegations of accounting fraud wiped more than $100 billion off the group's market value.

Adani Enterprises jumped as much as 25 percent before trading was suspended. They then pared some of those gains when they restarted.

Observers were also keeping tabs on geopolitical tensions after the United States shot down a suspected Chinese spy balloon that had been floating over the country for several days.

In other markets, oil prices extended gains after Iraqi Kurdistan suspended crude exports through Turkey as a precaution after a deadly earthquake rocked its northern neighbour and Syria.

- Key figures around 1455 GMT -

New York - Dow: DOWN 0.3 percent at 33,796.97 points

London - FTSE 100: UP 0.4 percent at 7,864.45

Frankfurt - DAX: DOWN 0.3 percent at 15,307.12

Paris - CAC 40: DOWN 0.2 at 7,123.09

EURO STOXX 50: FLAT at 4,204.24

Tokyo - Nikkei 225: FLAT at 27,685.47 (close)

Hong Kong - Hang Seng Index: UP 0.4 percent at 21,298.70 (close)

Shanghai - Composite: UP 0.3 percent at 3,248.09 (close)

Euro/dollar: DOWN at $1.0680 from $1.0728 on Monday

Pound/dollar: DOWN at $1.1978 from $1.2020

Euro/pound: DOWN at 89.20 pence from 89.22 pence

Dollar/yen: DOWN at 131.96 yen from 132.65 yen

Brent North Sea crude: UP 1.2 percent at $81.92 per barrel

West Texas Intermediate: UP 1.5 percent at $75.23 per barrel

Y.Aukaiv--AMWN