-

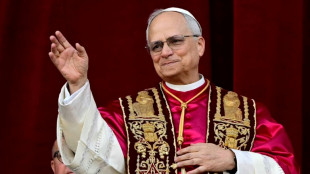

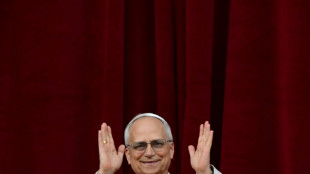

'Great honor': world leaders welcome first US pope

'Great honor': world leaders welcome first US pope

-

Pacquiao to un-retire and fight Barrios for welterweight title: report

-

Trump unveils UK trade deal, first since tariff blitz

Trump unveils UK trade deal, first since tariff blitz

-

Man Utd one step away from Europa League glory despite horror season

-

Jeeno shines on greens to grab LPGA lead at Liberty National

Jeeno shines on greens to grab LPGA lead at Liberty National

-

Mitchell fires PGA career-low 61 to grab Truist lead

-

AI tool uses selfies to predict biological age and cancer survival

AI tool uses selfies to predict biological age and cancer survival

-

Extremely online new pope unafraid to talk politics

-

Postecoglou hits back as Spurs reach Europa League final

Postecoglou hits back as Spurs reach Europa League final

-

Chelsea ease into Conference League final against Betis

-

Pope Leo XIV: Soft-spoken American spent decades amid poor in Peru

Pope Leo XIV: Soft-spoken American spent decades amid poor in Peru

-

First US pope shared articles critical of Trump, Vance

-

'Inexcusable' - NBA champs Boston in trouble after letting big leads slip

'Inexcusable' - NBA champs Boston in trouble after letting big leads slip

-

US automakers blast Trump's UK trade deal

-

Stocks mostly rise as US-UK unveil trade deal

Stocks mostly rise as US-UK unveil trade deal

-

Trump presses Russia for unconditional 30-day Ukraine ceasefire

-

Anything but Europa League glory 'means nothing' for Man Utd: Amorim

Anything but Europa League glory 'means nothing' for Man Utd: Amorim

-

'Inexcuseable' - NBA champs Boston in trouble after letting big leads slip

-

Pope Leo 'fell in love with Peru'and ceviche: Peru bishop

Pope Leo 'fell in love with Peru'and ceviche: Peru bishop

-

Pakistan's T20 cricket league moved to UAE over India conflict

-

India tells X to block over 8,000 accounts

India tells X to block over 8,000 accounts

-

Germany's Merz tells Trump US remains 'indispensable' friend

-

Ex-model testifies in NY court that Weinstein assaulted her as a minor

Ex-model testifies in NY court that Weinstein assaulted her as a minor

-

Chelsea ease past Djurgarden to reach Conference League final

-

Man Utd crush Athletic Bilbao to set up Spurs Europa League final

Man Utd crush Athletic Bilbao to set up Spurs Europa League final

-

Spurs reach Europa League final to keep Postecoglou's trophy boast alive

-

US unveils ambitious air traffic control upgrade

US unveils ambitious air traffic control upgrade

-

US climate agency stops tracking costly natural disasters

-

Germany slams Russian 'lies', France warns of war 'spectre' in WWII commemorations

Germany slams Russian 'lies', France warns of war 'spectre' in WWII commemorations

-

'A blessing': US Catholics celebrate first American pope

-

Trump hails 'breakthrough' US-UK trade deal

Trump hails 'breakthrough' US-UK trade deal

-

Cardinals elect first American pope as Robert Francis Prevost becomes Leo XIV

-

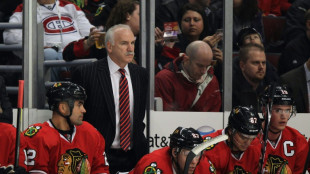

NHL Ducks name Quenneville as coach after probe into sex assault scandal

NHL Ducks name Quenneville as coach after probe into sex assault scandal

-

'Great honor': Leaders welcome Leo, first US pope

-

What is in the new US-UK trade deal?

What is in the new US-UK trade deal?

-

MLB Pirates fire Shelton as manager after 12-16 start

-

Alcaraz '100 percent ready' for return to action in Rome

Alcaraz '100 percent ready' for return to action in Rome

-

Prevost becomes first US pope as Leo XIV

-

Andy Farrell holds out hope for son Owen after Lions omission

Andy Farrell holds out hope for son Owen after Lions omission

-

Roglic leads deep field of contenders at tricky Giro d'Italia

-

White smoke signals Catholic Church has new pope

White smoke signals Catholic Church has new pope

-

Bill Gates speeds up giving away fortune, blasts Musk

-

LA Coliseum, SoFi Stadium to share 2028 Olympic opening ceremony

LA Coliseum, SoFi Stadium to share 2028 Olympic opening ceremony

-

Trump unveils 'breakthrough' US-UK trade deal

-

Andy Farrell holds out hope for Owen Farrell after Lions omission

Andy Farrell holds out hope for Owen Farrell after Lions omission

-

Trump calls US Fed chair 'fool' after pause in rate cuts

-

Stocks rise as US-UK unveil trade deal

Stocks rise as US-UK unveil trade deal

-

UN says Israel school closures in east Jerusalem 'assault on children'

-

Itoje grateful for 'tremendous honour' of leading Lions in Australia

Itoje grateful for 'tremendous honour' of leading Lions in Australia

-

Cardinals to vote anew for pope after second black smoke

Venezuela's risky currency stabilization to tackle inflation

Venezuela has been in recession for eight years, suffered four years of hyperinflation and endured a currency in free fall.

But the beleaguered bolivar has, against all odds, managed to stabilize since October.

It is thanks to a $2.2 billion investment by the state in a bid to slow down inflation in the South American nation.

Last year ended with inflation at 686 percent -- the highest in the world.

But that was a significant improvement on the 130,000 percent in 2018, 9,585 percent in 2019 and 3,000 percent in 2020.

According to consultancy Aristimuno Herrera & Associates, Venezuela's central bank has injected $2.2 billion into the internal market over the last five months.

Banned for 15 years by the government, the US dollar was once scarce and highly prized, exchanging hands on the black market for signficantly more than the official exchange rate.

Suffering a cashflow crisis, the government was forced to lift the ban in 2019.

- 'Can it be sustained?' -

"Offering more dollars than there is demand generates stability in the exchange rate," Cesar Aristimuno, director at Aristimuno Herrera & Associates, told AFP.

The bank has acknowledged 29 "interventions" since October 2021, although without giving details of the amounts.

Last October, the bank slashed six zeros off the bolivar -- making one new bolivar worth a million old ones -- with the government saying this would improve faith in the local currency.

At the same time, authorities imposed a three percent tax on foreign currency transactions and cryptocurrencies.

"The legal tender is and will continue to be the bolivar," Vice President Delcy Rodriguez, who is also the economy and finance minister, told parliament.

Since October, the exchange rate against the dollar has moved from 4.18 to 4.32 bolivars, a depreciation of just 3.24 percent.

That compares favorably to the depreciation of 76 percent in 2021 and more than 95 percent in each of the previous three years.

After shrinking by more than 80 percent during eight years of recession, Venezuelan GDP grew by four percent in 2021, the government claims.

"Our economy is so small that such a policy can be applied. The issue is how long will they sustain it," said Henkel Garcia, director at Econometrica.

Some experts fear that the government is "burning" international reserves but Aristimuno and Garcia both say the dollars have come from an increase in revenues from Venezuelan oil due to rising crude prices and a limited increase in production.

State oil company PDVSA produced more than three million barrels a day in 2014 but that fell to 400,000 six years later.

It has now risen to 680,000 according to OPEC, the Organization of the Petroleum Exporting Countries.

The central bank says it has $10.8 billion in reserves, half the amount of 2014 and a third of the 2007 figure.

However, the bank is including $5 billion provided by the International Monetary Fund to help mitigate effects of the coronavirus pandemic, but which has been withheld due to questions over the 2018 re-election of President Nicolas Maduro in a poll widely dismissed as a fraud.

- 'Collateral damage' -

While the injection of dollars has beneficial effects, there is "collateral damage," said Aristimuno.

Since inflation is high and the exchange rate is stable, the dollar's buying power is falling.

Likewise, "exports are losing their attractiveness" compared to imports.

Carlos Fernandez Gallardo, president of the FEDECAMARAS employers federation, said he is worried.

"There is an increase in dollar costs for producers, with a pernicious effect on the consumer," he told AFP.

"What will happen if these dollars disappear?"

In 2018, the government attempted to tackle inflation by obliging banks to keep 85 percent of their reserves in the central bank in an attempt to limit the printing of money.

That served to reduce credit, which was already in free fall with the depreciating bolivar.

Venezuela is a credit minnow with less than $140 million in 2021, compared to $14 billion in neighboring Colombia.

Aware that credit, investments and growth are intimately related, Caracas partially changed tack in February, allowing loans indexed against the dollar under certain conditions and reducing the obligatory reserves to 73 percent.

But the challenge remains, how to promote growth while keeping inflation under control.

S.F.Warren--AMWN