-

Ex-model testifies in NY court that Weinstein assaulted her at 16

Ex-model testifies in NY court that Weinstein assaulted her at 16

-

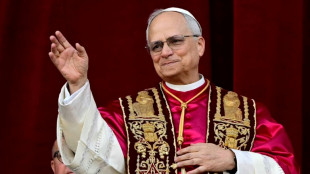

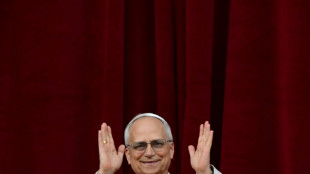

'Great honor': world leaders welcome first US pope

-

Pacquiao to un-retire and fight Barrios for welterweight title: report

Pacquiao to un-retire and fight Barrios for welterweight title: report

-

Trump unveils UK trade deal, first since tariff blitz

-

Man Utd one step away from Europa League glory despite horror season

Man Utd one step away from Europa League glory despite horror season

-

Jeeno shines on greens to grab LPGA lead at Liberty National

-

Mitchell fires PGA career-low 61 to grab Truist lead

Mitchell fires PGA career-low 61 to grab Truist lead

-

AI tool uses selfies to predict biological age and cancer survival

-

Extremely online new pope unafraid to talk politics

Extremely online new pope unafraid to talk politics

-

Postecoglou hits back as Spurs reach Europa League final

-

Chelsea ease into Conference League final against Betis

Chelsea ease into Conference League final against Betis

-

Pope Leo XIV: Soft-spoken American spent decades amid poor in Peru

-

First US pope shared articles critical of Trump, Vance

First US pope shared articles critical of Trump, Vance

-

'Inexcusable' - NBA champs Boston in trouble after letting big leads slip

-

US automakers blast Trump's UK trade deal

US automakers blast Trump's UK trade deal

-

Stocks mostly rise as US-UK unveil trade deal

-

Trump presses Russia for unconditional 30-day Ukraine ceasefire

Trump presses Russia for unconditional 30-day Ukraine ceasefire

-

Anything but Europa League glory 'means nothing' for Man Utd: Amorim

-

'Inexcuseable' - NBA champs Boston in trouble after letting big leads slip

'Inexcuseable' - NBA champs Boston in trouble after letting big leads slip

-

Pope Leo 'fell in love with Peru'and ceviche: Peru bishop

-

Pakistan's T20 cricket league moved to UAE over India conflict

Pakistan's T20 cricket league moved to UAE over India conflict

-

India tells X to block over 8,000 accounts

-

Germany's Merz tells Trump US remains 'indispensable' friend

Germany's Merz tells Trump US remains 'indispensable' friend

-

Ex-model testifies in NY court that Weinstein assaulted her as a minor

-

Chelsea ease past Djurgarden to reach Conference League final

Chelsea ease past Djurgarden to reach Conference League final

-

Man Utd crush Athletic Bilbao to set up Spurs Europa League final

-

Spurs reach Europa League final to keep Postecoglou's trophy boast alive

Spurs reach Europa League final to keep Postecoglou's trophy boast alive

-

US unveils ambitious air traffic control upgrade

-

US climate agency stops tracking costly natural disasters

US climate agency stops tracking costly natural disasters

-

Germany slams Russian 'lies', France warns of war 'spectre' in WWII commemorations

-

'A blessing': US Catholics celebrate first American pope

'A blessing': US Catholics celebrate first American pope

-

Trump hails 'breakthrough' US-UK trade deal

-

Cardinals elect first American pope as Robert Francis Prevost becomes Leo XIV

Cardinals elect first American pope as Robert Francis Prevost becomes Leo XIV

-

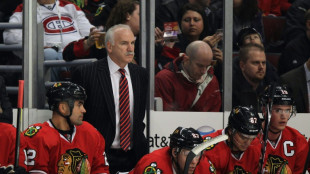

NHL Ducks name Quenneville as coach after probe into sex assault scandal

-

'Great honor': Leaders welcome Leo, first US pope

'Great honor': Leaders welcome Leo, first US pope

-

What is in the new US-UK trade deal?

-

MLB Pirates fire Shelton as manager after 12-16 start

MLB Pirates fire Shelton as manager after 12-16 start

-

Alcaraz '100 percent ready' for return to action in Rome

-

Prevost becomes first US pope as Leo XIV

Prevost becomes first US pope as Leo XIV

-

Andy Farrell holds out hope for son Owen after Lions omission

-

Roglic leads deep field of contenders at tricky Giro d'Italia

Roglic leads deep field of contenders at tricky Giro d'Italia

-

White smoke signals Catholic Church has new pope

-

Bill Gates speeds up giving away fortune, blasts Musk

Bill Gates speeds up giving away fortune, blasts Musk

-

LA Coliseum, SoFi Stadium to share 2028 Olympic opening ceremony

-

Trump unveils 'breakthrough' US-UK trade deal

Trump unveils 'breakthrough' US-UK trade deal

-

Andy Farrell holds out hope for Owen Farrell after Lions omission

-

Trump calls US Fed chair 'fool' after pause in rate cuts

Trump calls US Fed chair 'fool' after pause in rate cuts

-

Stocks rise as US-UK unveil trade deal

-

UN says Israel school closures in east Jerusalem 'assault on children'

UN says Israel school closures in east Jerusalem 'assault on children'

-

Itoje grateful for 'tremendous honour' of leading Lions in Australia

How Ukraine war left China's 'Nickel King' on hook for billions

The play by Xiang Guangda, China's "Nickel King", was to use his influential market position to short the metal, wait for the price to drop, then soak up the rewards when the value bounced back.

But then Russian President Vladimir Putin invaded Ukraine and things got complicated -- fast.

Russia is one of the world's biggest producers of nickel ore, a key component of batteries for electric vehicles.

As concussive Western sanctions over the invasion struck, the price of the silver-white metal rocketed to a record above $100,000 per tonne.

That was too high for Xiang and the entire metals sector, forcing the 145-year-old London Metals Exchange (LME) to suspend trading for a week and leaving nickel-reliant manufacturers struggling to digest the spike in costs.

Stuck in its positions -- reports estimate it was holding at least 100,000 tonnes -- Xiang's company Tsingshan Holdings Group was suddenly on the hook for billions of dollars.

Tsingshan, the world's biggest nickel producer, has been forced to buy back a large number of nickel contracts at higher prices to reduce its exposure.

A Bloomberg News report estimates the buy-back has contributed to a loss of $8 billion, suggesting the firm may need a possible bailout by Chinese authorities.

"Xiang is a shrewd player, but he was caught off guard with the Russian issue," Li Bin, a nickel trader in Shanghai said.

When nickel trading resumed last week prices plunged to about $37,200 a tonne -- still 50 percent higher than in February -- as volatility courses through the market.

"After the historic squeeze, nickel is still struggling to find a price," Susan Zou, senior metals analyst at Rystad Energy said.

- Self-made tycoon -

The market for nickel, essential to make batteries for EVs and a key alloy in stainless steel, is dominated by a handful of players.

Those include Tsingshan, headquartered on China's eastern seaboard.

It was founded by Xiang, a self-made billionaire who is known among Chinese nickel traders as the "Nickel King" and "Big Shot".

Xiang started his career as a mechanic in a state fishery and now owns two sprawling nickel manufacturing hubs in Indonesia.

Those include the Morowali industrial park that spans 2,000 hectares with 44,000 workers and its own airport and is seen as a guarantee a cheap supply of ore for Tsingshan's China-side furnaces.

After his short went wrong, Tsingshan has to either pay off its debts or prove it has sufficient deliverable nickel to repay in kind.

"We are closely watching his next move because it could still roil markets," said Li, the Shanghai nickel trader.

Those rising costs are already being felt by makers of EVs including Tesla and 20 other Chinese rivals such as Xpeng and BYD, which have all hiked vehicle prices over the past two weeks citing a rise in raw material costs.

"The price and supply shocks have pushed major battery makers to look for alternative metals to power electric vehicles," analyst Zou said.

- Beijing to the rescue? –

Beijing could step in to rescue Tsingshan, Chinese media including financial news site Yicai reported, citing sources familiar with the matter.

There are discussions over allowing the company to swap its low-grade nickel products that do not meet LME's quality standards with a purer form of the metal held in state stockpiles to settle its claims, Yicai said.

China is estimated to hold around 100,000 tonnes of nickel in state reserves, according to official data. Tsingshan and China's state reserves administration did not respond to requests for comment.

Xiang has moved markets before, most notably in 2018 when he released large volumes of nickel pig iron, a cheap alternative to pure nickel, that can be used to make stainless steel.

"Xiang has always believed that because he is one of the world's biggest players with ultra-low costs, he could keep the nickel price under his thumb," said a former employee at Tsingshan, who declined to be named.

"He has always bet on nickel prices falling because his production cost in Indonesia is as low as $10,000 per tonne."

Now Xiang has to decide whether to slowly unwind his wager and at what price.

On March 14, Tsingshan said it had reached an agreement with banks to hold on to the company's nickel positions, signalling the billionaire was digging in his heels to ride out the crisis.

That could beat the LME further and lead to more price uncertainty for nickel, trader Li said, and create challenges for battery producers trying to replace petrol cars.

L.Davis--AMWN