-

Ex-model testifies in NY court that Weinstein assaulted her at 16

Ex-model testifies in NY court that Weinstein assaulted her at 16

-

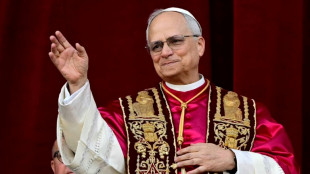

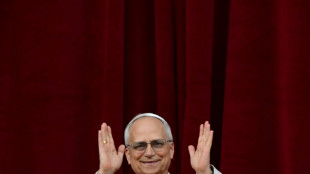

'Great honor': world leaders welcome first US pope

-

Pacquiao to un-retire and fight Barrios for welterweight title: report

Pacquiao to un-retire and fight Barrios for welterweight title: report

-

Trump unveils UK trade deal, first since tariff blitz

-

Man Utd one step away from Europa League glory despite horror season

Man Utd one step away from Europa League glory despite horror season

-

Jeeno shines on greens to grab LPGA lead at Liberty National

-

Mitchell fires PGA career-low 61 to grab Truist lead

Mitchell fires PGA career-low 61 to grab Truist lead

-

AI tool uses selfies to predict biological age and cancer survival

-

Extremely online new pope unafraid to talk politics

Extremely online new pope unafraid to talk politics

-

Postecoglou hits back as Spurs reach Europa League final

-

Chelsea ease into Conference League final against Betis

Chelsea ease into Conference League final against Betis

-

Pope Leo XIV: Soft-spoken American spent decades amid poor in Peru

-

First US pope shared articles critical of Trump, Vance

First US pope shared articles critical of Trump, Vance

-

'Inexcusable' - NBA champs Boston in trouble after letting big leads slip

-

US automakers blast Trump's UK trade deal

US automakers blast Trump's UK trade deal

-

Stocks mostly rise as US-UK unveil trade deal

-

Trump presses Russia for unconditional 30-day Ukraine ceasefire

Trump presses Russia for unconditional 30-day Ukraine ceasefire

-

Anything but Europa League glory 'means nothing' for Man Utd: Amorim

-

'Inexcuseable' - NBA champs Boston in trouble after letting big leads slip

'Inexcuseable' - NBA champs Boston in trouble after letting big leads slip

-

Pope Leo 'fell in love with Peru'and ceviche: Peru bishop

-

Pakistan's T20 cricket league moved to UAE over India conflict

Pakistan's T20 cricket league moved to UAE over India conflict

-

India tells X to block over 8,000 accounts

-

Germany's Merz tells Trump US remains 'indispensable' friend

Germany's Merz tells Trump US remains 'indispensable' friend

-

Ex-model testifies in NY court that Weinstein assaulted her as a minor

-

Chelsea ease past Djurgarden to reach Conference League final

Chelsea ease past Djurgarden to reach Conference League final

-

Man Utd crush Athletic Bilbao to set up Spurs Europa League final

-

Spurs reach Europa League final to keep Postecoglou's trophy boast alive

Spurs reach Europa League final to keep Postecoglou's trophy boast alive

-

US unveils ambitious air traffic control upgrade

-

US climate agency stops tracking costly natural disasters

US climate agency stops tracking costly natural disasters

-

Germany slams Russian 'lies', France warns of war 'spectre' in WWII commemorations

-

'A blessing': US Catholics celebrate first American pope

'A blessing': US Catholics celebrate first American pope

-

Trump hails 'breakthrough' US-UK trade deal

-

Cardinals elect first American pope as Robert Francis Prevost becomes Leo XIV

Cardinals elect first American pope as Robert Francis Prevost becomes Leo XIV

-

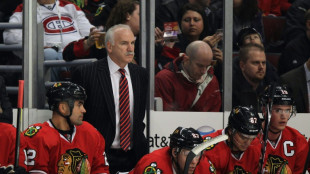

NHL Ducks name Quenneville as coach after probe into sex assault scandal

-

'Great honor': Leaders welcome Leo, first US pope

'Great honor': Leaders welcome Leo, first US pope

-

What is in the new US-UK trade deal?

-

MLB Pirates fire Shelton as manager after 12-16 start

MLB Pirates fire Shelton as manager after 12-16 start

-

Alcaraz '100 percent ready' for return to action in Rome

-

Prevost becomes first US pope as Leo XIV

Prevost becomes first US pope as Leo XIV

-

Andy Farrell holds out hope for son Owen after Lions omission

-

Roglic leads deep field of contenders at tricky Giro d'Italia

Roglic leads deep field of contenders at tricky Giro d'Italia

-

White smoke signals Catholic Church has new pope

-

Bill Gates speeds up giving away fortune, blasts Musk

Bill Gates speeds up giving away fortune, blasts Musk

-

LA Coliseum, SoFi Stadium to share 2028 Olympic opening ceremony

-

Trump unveils 'breakthrough' US-UK trade deal

Trump unveils 'breakthrough' US-UK trade deal

-

Andy Farrell holds out hope for Owen Farrell after Lions omission

-

Trump calls US Fed chair 'fool' after pause in rate cuts

Trump calls US Fed chair 'fool' after pause in rate cuts

-

Stocks rise as US-UK unveil trade deal

-

UN says Israel school closures in east Jerusalem 'assault on children'

UN says Israel school closures in east Jerusalem 'assault on children'

-

Itoje grateful for 'tremendous honour' of leading Lions in Australia

Britain cedes control of bailed-out NatWest bank

Britain announced Monday that it has ceded control of bailed-out bank giant NatWest, cutting its stake to below 50 percent for the first time since the global financial crisis.

The government has sold off another tranche of shares for more than £1.2 billion ($1.6 billion, 1.4 billion euros), taking its holding from 50.6 percent to 48.1 percent.

The group was rescued with £45.5 billion of taxpayers' cash in the world's biggest banking bailout at the height of the 2008 meltdown.

"This is a landmark in the government's plan to return to private ownership the institutions brought into public ownership as a result of the 2007-2008 financial crisis," the Treasury said in a statement.

The UK had already returned state-rescued Lloyds Banking Group to full private ownership five years ago.

- 'Important milestone' -

NatWest Chief Executive Alison Rose described Monday's news as an "important milestone".

Britain has sold about 550 million shares at 220.5 pence per share to NatWest, which was formerly known as Royal Bank of Scotland (RBS).

"This sale means that the government is no longer the majority owner of NatWest Group and is therefore an important landmark in our plan to return the bank to the private sector," added Economic Secretary to the Treasury John Glen.

"We will continue to prioritise delivering value for money for the taxpayer as we take forward this plan."

At its peak, the government owned 84 percent of the financial services giant but this has been gradually reduced.

The Edinburgh-based bank was ravaged by its badly-timed consortium takeover of Dutch bank ABN Amro at the top of the market in 2007, just before the financial crisis struck.

RBS has since undertaken a massive restructuring to sell assets, slash its balance sheet and axe thousands of jobs worldwide.

The bank returned to net profit in 2017 after nine straight annual losses.

The group's performance has been blighted, however, by litigation and conduct costs, including compensation for a mis-selling credit insurance scandal.

Rose, the first female CEO of a major UK lender, renamed the bank NatWest in a bid to move on from its troubled past.

In the wake of the pandemic, RBS sank into the red in 2020 after setting aside billions to cover potential Covid fallout.

But NatWest rebounded back into profit last year as the British economy recovered from Covid.

Since 2008, the group has axed its total workforce from almost 200,000 staff to 56,200 in 2021.

And it has dramatically slashed its balance sheet from £2.2 trillion to just £782 billion.

The bank exited 35 nations and currently operates in 19 countries.

- 'Champagne on ice' -

NatWest shares rose 1.9 percent to 224.70 pence in late Monday morning trade on London's rising FTSE 100 index.

However, analysts cautioned about adverse fallout from soaring living costs in home market Britain.

"Natwest is finally free of state control after well over a decade," said AJ Bell investment director Russ Mould.

"Any champagne might have to be put on ice given the challenges facing the bank from the cost-of-living crisis and the risks of mounting bad debts."

J.Williams--AMWN