-

Liverpool boss Slot fears replacing Alexander-Arnold will be a tough task

Liverpool boss Slot fears replacing Alexander-Arnold will be a tough task

-

British Airways owner unveils big Boeing, Airbus order

-

IPL suspended for one week over India-Pakistan conflict

IPL suspended for one week over India-Pakistan conflict

-

Slot says all at Liverpool sad to see Alexander-Arnold go

-

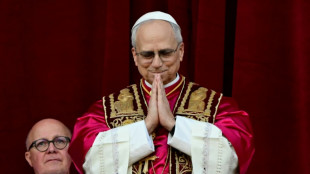

Leo XIV celebrates first mass as pope in Sistine Chapel

Leo XIV celebrates first mass as pope in Sistine Chapel

-

India says repulsed fresh Pakistan attacks as death toll climbs

-

Japan's Panasonic targets 10,000 job cuts worldwide

Japan's Panasonic targets 10,000 job cuts worldwide

-

Putin evokes WWII victory to rally Russia behind Ukraine offensive

-

China exports beat forecasts ahead of US tariff talks

China exports beat forecasts ahead of US tariff talks

-

Leo XIV, the 'Latin Yankee', to celebrate first mass as pope

-

Most stocks lifted by hopes for US-China talks after UK deal

Most stocks lifted by hopes for US-China talks after UK deal

-

IPL suspended indefinitely over India-Pakistan conflict: reports

-

German lender Commerzbank's profits jump as it fends off UniCredit

German lender Commerzbank's profits jump as it fends off UniCredit

-

Rare bone-eroding disease ruining lives in Kenya's poorest county

-

India says repulsed fresh Pakistan attacks as de-escalation efforts grow

India says repulsed fresh Pakistan attacks as de-escalation efforts grow

-

Zhao's historic snooker title sparks talk of China world domination

-

'High expectations': EU looks to Merz for boost in tough times

'High expectations': EU looks to Merz for boost in tough times

-

Poisoned guests rarely invited before deadly mushroom lunch, Australia trial hears

-

China sales to US slump even as exports beat forecasts

China sales to US slump even as exports beat forecasts

-

Indian cricket to make 'final decision' on IPL over Pakistan conflict

-

Dethroned Bundesliga champions Leverkusen face uncertain future

Dethroned Bundesliga champions Leverkusen face uncertain future

-

China can play hardball at looming trade talks with US: analysts

-

French monuments in trouble while PSG prepare for Champions League final

French monuments in trouble while PSG prepare for Champions League final

-

Newcastle face Chelsea in top five showdown, Alexander-Arnold in spotlight

-

Flick's Barca must show 'hunger' in crunch Liga Clasico

Flick's Barca must show 'hunger' in crunch Liga Clasico

-

Clasico the last chance saloon for Ancelotti's Real Madrid

-

Timberwolves overpower Warriors to level series

Timberwolves overpower Warriors to level series

-

Chinese fabric exporters anxious for US trade patch-up

-

Putin gears up to host world leaders at lavish army parade

Putin gears up to host world leaders at lavish army parade

-

Nearing 100, Malaysian ex-PM Mahathir blasts 'old world' Trump

-

Leo XIV, first US pope, to celebrate first mass as pontiff

Leo XIV, first US pope, to celebrate first mass as pontiff

-

Asian stocks lifted by hopes for US-China talks after UK deal

-

Former head of crypto platform Celsius sentenced 12 years

Former head of crypto platform Celsius sentenced 12 years

-

Ex-model testifies in NY court that Weinstein assaulted her at 16

-

Amphastar Pharmaceuticals to Present at the 2025 Bank of America Health Care Conference

Amphastar Pharmaceuticals to Present at the 2025 Bank of America Health Care Conference

-

Ascendant Resources Announces Closing of Second and Final Tranche of Non-Brokered Private Placement

-

Nestlé and OMP Showcase Approach to Future-Ready Supply Chain at Gartner Supply Chain Symposium/Xpo in Barcelona

Nestlé and OMP Showcase Approach to Future-Ready Supply Chain at Gartner Supply Chain Symposium/Xpo in Barcelona

-

Genflow Biosciences PLC Announces Share Subscription, Director's Dealing and Update

-

Argo Blockchain PLC Announces 2024 Annual Results and Restoration of Listing

Argo Blockchain PLC Announces 2024 Annual Results and Restoration of Listing

-

'Great honor': world leaders welcome first US pope

-

Pacquiao to un-retire and fight Barrios for welterweight title: report

Pacquiao to un-retire and fight Barrios for welterweight title: report

-

Trump unveils UK trade deal, first since tariff blitz

-

Man Utd one step away from Europa League glory despite horror season

Man Utd one step away from Europa League glory despite horror season

-

Jeeno shines on greens to grab LPGA lead at Liberty National

-

Mitchell fires PGA career-low 61 to grab Truist lead

Mitchell fires PGA career-low 61 to grab Truist lead

-

AI tool uses selfies to predict biological age and cancer survival

-

Extremely online new pope unafraid to talk politics

Extremely online new pope unafraid to talk politics

-

Postecoglou hits back as Spurs reach Europa League final

-

Chelsea ease into Conference League final against Betis

Chelsea ease into Conference League final against Betis

-

Pope Leo XIV: Soft-spoken American spent decades amid poor in Peru

Oil prices sink as US taps reserves; equities fall

Oil prices tumbled on Thursday as the US announced it would release a record amount of oil from its stockpiles to fight soaring prices over supply fears sparked by the Ukraine war.

President Joe Biden will announce later on Thursday the release of a record million barrels of oil a day for about 180 days from US strategic stockpiles, the White House said.

Reports of the move had already sent London's Brent crude and New York's WTI diving around six percent earlier in the session. Both were still around four percent lower, at prices well above $100 a barrel.

Crude prices have spiked in recent weeks over fears of a major supply shortfall after Russia -- the world's second biggest exporter of oil after Saudi Arabia -- invaded Ukraine on February 24.

The international benchmark contract, Brent North Sea crude, flirted with a record high in early March as it soared to almost $140 per barrel.

Ignoring Western pressure to significantly boost production to ease prices, the OPEC group of oil producing countries and its Russia-led allies agreed another modest oil output increase on Thursday.

The 13 members of the Saudi-led Organization of the Petroleum Exporting Countries and their 10 partners backed an increase of 432,000 barrels per day in May, marginally higher than in previous months.

The group, known as OPEC+, said in a statement following a ministerial meeting that the "continuing oil market fundamentals and the consensus on the outlook pointed to a well-balanced market".

"“Today Opec+ decided against the change in direction that might have helped bring the price of a barrel of Brent Crude back under $100 a barrel, several members steadfastly refusing to engage in global politics instead insisting balancing oil markets must take precedence," AJ Bell analyst Danni Hewson said.

- 'Remains tight' -

However, attention was focused on the US plan -- although analysts downplayed its likely impact on the oil market.

"Sanctions against Russia have distorted supply and though Washington’s move to release stored oil has cooled markets it’s only a stop gap," AJ Bell's Hewson said.

OANDA's Edward Moya said that Biden was "feeling the pressure from Americans as inflation is getting uglier" and stressed that Ukraine peace efforts were the key to oil woes.

"This oil market will remain tight and any coordinated tapping of strategic reserves will only be effective if peace talks in the war in Ukraine are headed in the right direction," he said.

"If it becomes clear that a major de-escalation in the war is not going to happen, then oil could surge back to the recent highs."

Stock markets fell after Russia poured cold water on hopes that ceasefire talks with Ukraine were progressing, leaving the prospect of a protracted war.

Energy majors, like Britain's BP and France's TotalEnergies, saw their share prices drop as lower crude prices bites into revenues and profits.

President Vladimir Putin on Thursday warned "unfriendly" countries, including all EU members, that they would be cut off from Russian gas unless they opened an account in rubles to pay for deliveries.

Wall Street was down in early trading following mixed economic data, including disappointing US spending figures in February as shoppers contended with a 6.4-percent jump in prices compared to February 2021.

The Ukraine war has already sent shockwaves through the world economy, with growth forecasts this year being lowered across the board.

The European development bank, EBRD, forecast gross domestic product in Russia and Ukraine would shrink 10 percent and 20 percent respectively this year.

London stocks dipped on Thursday as data showed that the UK economy rebounded slightly less than initially thought last year and ahead of a far tougher 2022 on fallout from the Ukraine war and rampant inflation.

Asian equities fell after three days of healthy gains.

Adding to selling pressure was data showing signs of a further slowdown in China's manufacturing sector caused by Covid lockdowns.

- Key figures around 1600 GMT -

Brent North Sea crude: DOWN 4.6 percent at $108.24 per barrel

West Texas Intermediate: DOWN 3.8 percent at $103.74 per barrel

New York - DOW: DOWN 0.4 percent at 35,106.26 points

London - FTSE 100: DOWN 0.8 percent at 7,515.68 points (close)

Frankfurt - DAX: DOWN 1.3 percent at 14,414.75 (close)

Paris - CAC 40: DOWN 1.2 percent at 6,659.87 (close)

EURO STOXX 50: DOWN 1.4 percent at 3,902.52

Tokyo - Nikkei 225: DOWN 0.7 percent at 27,821.43 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 21,996.85 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,252.20 (close)

Euro/dollar: DOWN at $1.1088 from $1.1159 late Wednesday

Pound/dollar: UP at $1.3147 from $1.3134

Euro/pound: DOWN at 84.33 pence from 84.96 pence

Dollar/yen: DOWN at 121.54 yen from 121.83 yen

S.F.Warren--AMWN