-

India, Pakistan ceasefire holds after early violations

India, Pakistan ceasefire holds after early violations

-

Herbert seals Asian Tour win with final-hole heroics

-

Catholics gather to catch glimpse of Pope Leo XIV at St Peter's prayer

Catholics gather to catch glimpse of Pope Leo XIV at St Peter's prayer

-

US-China talks resume as Trump hails 'total reset' in trade relations

-

Ukraine ready for Russia truce talks, Zelensky says

Ukraine ready for Russia truce talks, Zelensky says

-

Jubilant Peruvians celebrate new pope at mass in adoptive city

-

Scottish refinery closure spells trouble for green transition

Scottish refinery closure spells trouble for green transition

-

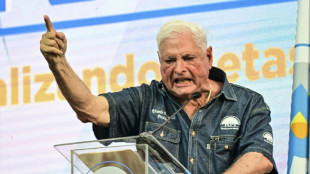

Convicted ex-Panama president Martinelli granted asylum in Colombia

-

IPL chiefs in talks about restart following ceasefire: reports

IPL chiefs in talks about restart following ceasefire: reports

-

Navarrete beats Suarez on technical decision to keep title

-

Scans clear Wallabies fly-half Lolesio of serious back injury

Scans clear Wallabies fly-half Lolesio of serious back injury

-

Leo XIV to address faithful with St Peter's prayer

-

T-Wolves grab 2-1 NBA playoff series lead as Celtics get key win

T-Wolves grab 2-1 NBA playoff series lead as Celtics get key win

-

Gaza war casts shadow over Cannes film festival

-

'Treasure hunt': tourists boost sales at Japan's Don Quijote stores

'Treasure hunt': tourists boost sales at Japan's Don Quijote stores

-

Cannes Festival: the films in competition

-

Cannes film festival: what to look out for

Cannes film festival: what to look out for

-

Jordan hospital treats war casualties from across Middle East

-

As Trump family's Gulf empire grows, rulers seek influence, arms, tech

As Trump family's Gulf empire grows, rulers seek influence, arms, tech

-

S. Korea conservatives choose presidential candidate after last-minute chaos

-

Trump hails 'total reset' in US-China trade relations as talks continue

Trump hails 'total reset' in US-China trade relations as talks continue

-

Film claims to name killer of slain journalist Shireen Abu Akleh

-

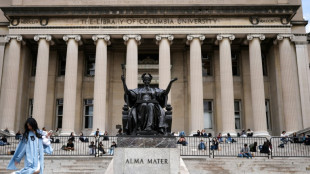

Under Trump pressure, Columbia University ends semester in turmoil

Under Trump pressure, Columbia University ends semester in turmoil

-

Putin proposes direct Ukraine talks but quiet on 30-day ceasefire

-

Trump hails US-China trade 'reset' after first day of talks

Trump hails US-China trade 'reset' after first day of talks

-

Jeeno leads Boutier by one at LPGA Americas Open

-

Lowry, Straka share lead at windy Truist

Lowry, Straka share lead at windy Truist

-

Messi suffers worst defeat in MLS as Miami fall again

-

Celtics overwhelm Knicks to pull within 2-1 in NBA playoff series

Celtics overwhelm Knicks to pull within 2-1 in NBA playoff series

-

Toulouse crush Toulon to reach Top 14 semis as Castres pay tribute to Raisuqe

-

Marseille, Monaco clinch Champions League qualification from Ligue 1

Marseille, Monaco clinch Champions League qualification from Ligue 1

-

'One of those days': Atletico record-breaker Sorloth hits four

-

Toulouse's Ntamack suffers concussion in Top 14, Willemse nears exit

Toulouse's Ntamack suffers concussion in Top 14, Willemse nears exit

-

Record-breaker Sorloth hits four as Atletico smash Real Sociedad

-

'Weight off my shoulders': Bayern's Kane toasts breakthrough title

'Weight off my shoulders': Bayern's Kane toasts breakthrough title

-

Sinner grateful for 'amazing' support on Italian Open return from doping ban

-

Hamburg return to Bundesliga after seven-year absence

Hamburg return to Bundesliga after seven-year absence

-

Toulouse's Ntamack suffers concussion in Top 14 clash

-

India, Pakistan reach ceasefire -- but trade claims of violations

India, Pakistan reach ceasefire -- but trade claims of violations

-

'Long time coming': Bayern's Kane toasts breakthrough title

-

US, China conclude first day of trade talks in Geneva

US, China conclude first day of trade talks in Geneva

-

Kane tastes first title as champions Bayern bid farewell to Mueller

-

Benfica deny Sporting to take Portuguese title race to wire

Benfica deny Sporting to take Portuguese title race to wire

-

Sinner makes triumphant return from doping ban at Italian Open

-

Sinner wins at Italian Open in first match since doping ban

Sinner wins at Italian Open in first match since doping ban

-

Leo XIV, new pope and 'humble servant of God', visits Francis's tomb

-

India claims Pakistan violated truce, says it is retaliating

India claims Pakistan violated truce, says it is retaliating

-

Champions League race hots up as Man City held, Villa win

-

Kane tastes first title as champions Bayern see off Mueller

Kane tastes first title as champions Bayern see off Mueller

-

US envoy calls enrichment 'red line' ahead of new Iran talks

Stocks wilt as investors brace for US Fed tightening

US and European stocks retreated Thursday after minutes from central banks showed US policymakers ready to aggressively wind back easy-money policies while their eurozone counterparts disagreed over their own way forward.

Meanwhile, oil prices continued to slide following heavy losses on Wednesday that had been triggered by concerns about weaker demand because of economic slowdown, with Brent crude falling below $100 per barrel.

A surge of Covid cases in major consumer China has raised concerns about demand, as has the surge in prices following the Russian invasion of Ukraine and Western sanctions.

On Wall Street all three major stock indices were lower in late morning trading, with Dow dropping 0.7 percent.

In Europe, London and Frankfurt ended the day down 0.5 percent, while Paris shed 0.6 percent.

Minutes showed the Fed in March opted to raise US borrowing costs rates by a quarter percentage point, mindful of "greater near-term uncertainty associated with Russia's invasion of Ukraine".

But some policymakers had favoured lifting rates even higher, by half a percentage point, to rein in decades-high inflation which is threatening to derail the economic recovery.

"Last night’s Fed minutes have recommitted the central bank to its path of tightening policy, leaving equities vulnerable in the short term after the bounce from the March lows," said Chris Beauchamp, chief market analyst at online trading platform IG.

- Inflation fight -

At their own meeting last month, European Central Bank policymakers disagreed on how to respond to runaway inflation and economic uncertainty caused by Russia's invasion of Ukraine, minutes indicated Thursday.

"A large number of members held the view that the current high level of inflation and its persistence called for immediate further steps towards monetary policy normalisation," the minutes read.

The ECB's governing council played it safe at the March meeting, agreeing to wind down monthly bond purchases at an accelerated pace in the second quarter, while keeping the end date of the stimulus scheme flexible.

An interest rate hike would follow "some time" after the end of the bond-buying scheme, it said.

But the minutes revealed that some governors wanted to go further to combat inflation, as the war in Ukraine further pushes up prices for energy, food and raw materials.

The prospect of rates rising at a quicker pace over the coming months has added to a wave of uncertainty across trading floors.

Central banks across the world are under fierce pressure to tackle runaway inflation, which has soared further on a Ukraine-driven spike in commodities like gas, oil and wheat.

March was the first Fed hike since it slashed US rates to zero when the Covid-19 pandemic broke out two years ago.

Although current US data points to a healthy economy, commentators warn of possible hard times ahead.

"While the economy continues to grow, there is a clear lack of bullish momentum in this market at the moment," said IG's Beauchamp.

- Key figures around 1530 GMT -

New York - Dow: DOWN 0.7 percent at 34,240.39 points

EURO STOXX 50: DOWN 0.6 percent at 3,802.10

London - FTSE 100: DOWN 0.5 percent at 7,551.81 (close)

Frankfurt - DAX: UP DOWN 0.5 percent at 14,078.15 (close)

Paris - CAC 40: DOWN 0.6 percent at 6,461.68 (close)

Tokyo - Nikkei 225: DOWN 1.7 percent at 26,888.57 (close)

Hong Kong - Hang Seng Index: DOWN 1.2 percent at 21,808.98 (close)

Shanghai - Composite: DOWN 1.4 percent at 3,236.70 (close)

Brent North Sea crude: DOWN 2.3 percent at $98.73 per barrel

West Texas Intermediate: DOWN 2.1 percent at $94.23 per barrel

Euro/dollar: UP at $1.0903 from $1.0896 late Wednesday

Pound/dollar: DOWN at $1.3063 from $1.3069

Euro/pound: UP at 83.46 pence from 83.37 pence

Dollar/yen: UP at 123.87 yen from 123.80 yen

burs-rl/cdw

O.Norris--AMWN