-

Jubilant Peruvians celebrate new pope at mass in adoptive city

Jubilant Peruvians celebrate new pope at mass in adoptive city

-

Scottish refinery closure spells trouble for green transition

-

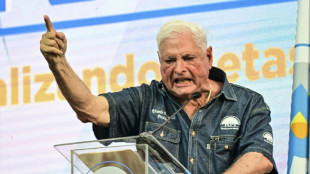

Convicted ex-Panama president Martinelli granted asylum in Colombia

Convicted ex-Panama president Martinelli granted asylum in Colombia

-

IPL chiefs in talks about restart following ceasefire: reports

-

Navarrete beats Suarez on technical decision to keep title

Navarrete beats Suarez on technical decision to keep title

-

Scans clear Wallabies fly-half Lolesio of serious back injury

-

Leo XIV to address faithful with St Peter's prayer

Leo XIV to address faithful with St Peter's prayer

-

T-Wolves grab 2-1 NBA playoff series lead as Celtics get key win

-

Gaza war casts shadow over Cannes film festival

Gaza war casts shadow over Cannes film festival

-

'Treasure hunt': tourists boost sales at Japan's Don Quijote stores

-

Cannes Festival: the films in competition

Cannes Festival: the films in competition

-

Cannes film festival: what to look out for

-

Jordan hospital treats war casualties from across Middle East

Jordan hospital treats war casualties from across Middle East

-

As Trump family's Gulf empire grows, rulers seek influence, arms, tech

-

S. Korea conservatives choose presidential candidate after last-minute chaos

S. Korea conservatives choose presidential candidate after last-minute chaos

-

Trump hails 'total reset' in US-China trade relations as talks continue

-

Film claims to name killer of slain journalist Shireen Abu Akleh

Film claims to name killer of slain journalist Shireen Abu Akleh

-

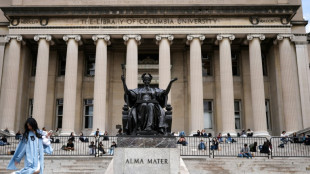

Under Trump pressure, Columbia University ends semester in turmoil

-

Putin proposes direct Ukraine talks but quiet on 30-day ceasefire

Putin proposes direct Ukraine talks but quiet on 30-day ceasefire

-

Trump hails US-China trade 'reset' after first day of talks

-

Jeeno leads Boutier by one at LPGA Americas Open

Jeeno leads Boutier by one at LPGA Americas Open

-

Lowry, Straka share lead at windy Truist

-

Messi suffers worst defeat in MLS as Miami fall again

Messi suffers worst defeat in MLS as Miami fall again

-

Celtics overwhelm Knicks to pull within 2-1 in NBA playoff series

-

Toulouse crush Toulon to reach Top 14 semis as Castres pay tribute to Raisuqe

Toulouse crush Toulon to reach Top 14 semis as Castres pay tribute to Raisuqe

-

Marseille, Monaco clinch Champions League qualification from Ligue 1

-

'One of those days': Atletico record-breaker Sorloth hits four

'One of those days': Atletico record-breaker Sorloth hits four

-

Toulouse's Ntamack suffers concussion in Top 14, Willemse nears exit

-

Record-breaker Sorloth hits four as Atletico smash Real Sociedad

Record-breaker Sorloth hits four as Atletico smash Real Sociedad

-

'Weight off my shoulders': Bayern's Kane toasts breakthrough title

-

Sinner grateful for 'amazing' support on Italian Open return from doping ban

Sinner grateful for 'amazing' support on Italian Open return from doping ban

-

Hamburg return to Bundesliga after seven-year absence

-

Toulouse's Ntamack suffers concussion in Top 14 clash

Toulouse's Ntamack suffers concussion in Top 14 clash

-

India, Pakistan reach ceasefire -- but trade claims of violations

-

'Long time coming': Bayern's Kane toasts breakthrough title

'Long time coming': Bayern's Kane toasts breakthrough title

-

US, China conclude first day of trade talks in Geneva

-

Kane tastes first title as champions Bayern bid farewell to Mueller

Kane tastes first title as champions Bayern bid farewell to Mueller

-

Benfica deny Sporting to take Portuguese title race to wire

-

Sinner makes triumphant return from doping ban at Italian Open

Sinner makes triumphant return from doping ban at Italian Open

-

Sinner wins at Italian Open in first match since doping ban

-

Leo XIV, new pope and 'humble servant of God', visits Francis's tomb

Leo XIV, new pope and 'humble servant of God', visits Francis's tomb

-

India claims Pakistan violated truce, says it is retaliating

-

Champions League race hots up as Man City held, Villa win

Champions League race hots up as Man City held, Villa win

-

Kane tastes first title as champions Bayern see off Mueller

-

US envoy calls enrichment 'red line' ahead of new Iran talks

US envoy calls enrichment 'red line' ahead of new Iran talks

-

Hastoy lifts La Rochelle as Castres pay tribute to Raisuqe

-

Southampton avoid Premier League 'worst-ever' tag with Man City draw

Southampton avoid Premier League 'worst-ever' tag with Man City draw

-

Injury forces Saints quarterback Carr to retire

-

S.Korea conservative party reinstates candidate after day of turmoil

S.Korea conservative party reinstates candidate after day of turmoil

-

Verdict due Tuesday in Depardieu sexual assault trial

Asian markets track Wall St gains, traders wary of hawkish Fed

Asian markets mostly rose Friday after a tough week dominated by the US Federal Reserve's hawkish tone that has set it on an aggressive tightening path, while oil ticked higher after another series of losses.

After a slow start, the region managed to take the lead from Wall Street, which recovered from steep intra-day losses to end on a positive note, having plunged in previous sessions as traders fretted over the prospect of higher interest rates.

While the Fed has made clear it intends to act more decisively to rein in 40-year-high inflation by ramping up borrowing costs and offloading bond holdings, analysts suggested that better clarity on policy was welcome.

The Fed's desire to tighten has sent the dollar rallying against most other major currencies, particularly the euro, which has been weighed by European officials' reticence to move as aggressively on prices. The euro is sitting around a one-month low.

Markets have come under huge pressure this year as the end of ultra-cheap central bank cash, a Covid-fuelled slowdown in China's economic activity, the war in Ukraine and soaring inflation come together in a perfect storm.

Highlighting the difficult task central banks will have in fighting inflation, the UN's Food and Agriculture Organization said Friday that world food prices hit their "highest levels ever" in March as Russia's invasion of Ukraine disrupted wheat and coarse grain exports.

Still, all three indexes on Wall Street ended slightly higher, having bounced back from heavy losses thanks to bargain-buying, while some observers suggested recent selling may have gone too far.

Asia saw a tepid start but most markets enjoyed mild gains towards the end of the day.

Tokyo, Hong Kong, Shanghai, Sydney, Seoul, Taipei, Mumbai, Manila, Jakarta and Bangkok all rose, though Singapore and Wellington were lower.

London, Paris and Frankfurt rallied in the morning, while US futures were also well up.

- Crude concerns -

Still, OANDA's Jeffrey Halley warned traders were "growing warier about China as the Shanghai lockdown drags on" owing to the fast-spreading Omicron virus variant.

"China's Covid-zero policy continues to be its Achilles heel, although there are plenty of other reasons to be a little cautious," he said in a note.

"A serious spread outside of its finance and commercial centre to other large cities will be a big headwind for China's growth, China stocks, and by default eventually, much of Asia."

Crude prices edged up having also endured a downcast week after the United States and allies pledged to release more than 200 million barrels over the coming months to offset the loss of Russian supplies.

The decision comes on top of concerns about demand from China owing to the lockdowns.

Still, there is a feeling that the war in Ukraine, and any possible further sanctions on Russia, could send the oil market higher again.

"I still think... the sentiment-driven sell-off will give way, and fundamentals will reassert themselves, especially as more market participants start fretting about how will the US administration replenish the SPR drawdown," said SPI Asset Management's Stephen Innes.

"Oil prices remain volatile amid concerns over Russian supply against the backdrop of slowing demand in China and a likely depressed US summer driving season due to higher prices at the pump."

He added that "deficits are likely to persist but only moderated by the accelerated strategic stock release from May to November and weaker demand growth".

- Key figures around 0810 GMT -

Tokyo - Nikkei 225: UP 0.4 percent at 26,985.80 (close)

Hong Kong - Hang Seng Index: UP 0.3 percent at 21,872.01 (close)

Shanghai - Composite: UP 0.5 percent at 3,251.85 (close)

London - FTSE 100: UP 1.0 percent at 7,625.18

Brent North Sea crude: UP 0.1 at $100.71 per barrel

West Texas Intermediate: UP 0.2 percent at $96.26 per barrel

Euro/dollar: DOWN at $1.0858 from $1.0880 late Thursday

Pound/dollar: DOWN at $1.3035 from $1.3071

Euro/pound: UP at 83.29 pence from 83.17 pence

Dollar/yen: UP at 124.11 yen from 123.95 yen

New York - Dow: UP 0.3 percent at 34,583.57 (close)

M.Thompson--AMWN