-

Merz tells France Mercosur trade deal must be ratified 'quickly'

Merz tells France Mercosur trade deal must be ratified 'quickly'

-

World's richest 10% caused two thirds of global warming: study

-

New German finance minister says 'no time to lose'

New German finance minister says 'no time to lose'

-

Yemen's Huthis to keep attacking Israeli ships despite US deal

-

Hamas insists on 'comprehensive' deal to end Gaza war

Hamas insists on 'comprehensive' deal to end Gaza war

-

Nations urge restraint in India-Pakistan clash

-

Weight-loss drugmaker Novo Nordisk slims sales forecast

Weight-loss drugmaker Novo Nordisk slims sales forecast

-

Kremlin says taking 'all measures' to protect May 9 parade

-

Stocks mixed before Fed decision, China-US trade talks

Stocks mixed before Fed decision, China-US trade talks

-

Danish firm Orsted halts huge UK offshore wind farm project

-

Explosions and fire on the contested India-Pakistan border

Explosions and fire on the contested India-Pakistan border

-

Distillery layoffs send shudders across remote Scottish island

-

Hong Kong loosens rules for harbour reclamation

Hong Kong loosens rules for harbour reclamation

-

Israel's Gaza plan 'dangerous moment' for civilians: UN official

-

Kenya court fines teens for trying to smuggle protected ants

Kenya court fines teens for trying to smuggle protected ants

-

Kenya court fines ant smugglers for 'bio-piracy'

-

Young Barca earn respect but crave trophies after Inter heartbreak

Young Barca earn respect but crave trophies after Inter heartbreak

-

Palestinians in razed West Bank hamlet vow to stay

-

Next pope faces 'difficult, complex' point in history, cardinals told

Next pope faces 'difficult, complex' point in history, cardinals told

-

J-pop mega-group Arashi to disband after final tour

-

Inter seek Champions League final redemption after winning Barca epic

Inter seek Champions League final redemption after winning Barca epic

-

Pant under pressure as record IPL buy fails to justify price tag

-

BMW upbeat on riding out US tariff chaos

BMW upbeat on riding out US tariff chaos

-

Cardinals hold last mass before conclave to elect pope

-

Ukraine, Russia trade aerial attacks ahead of WWII victory parade

Ukraine, Russia trade aerial attacks ahead of WWII victory parade

-

'Prioritise peace': Nations urge restraint in India-Pakistan clash

-

Asian stocks rise as China-US trade talks boost optimism

Asian stocks rise as China-US trade talks boost optimism

-

Toxic mushroom victim said meal was 'delicious', Australian court hears

-

China's Xi heads to Moscow to beef up 'no limits' Putin partnership

China's Xi heads to Moscow to beef up 'no limits' Putin partnership

-

World energy methane emissions near record high in 2024: IEA

-

White smoke: signalling a new pope down the ages

White smoke: signalling a new pope down the ages

-

What's a cardinal? The 'princes' of the Church electing a new pope

-

Papal conclave by the numbers

Papal conclave by the numbers

-

The Vatican: a papal powerhouse, world's smallest state

-

Trump, Ukraine propel EU and UK towards defence pact

Trump, Ukraine propel EU and UK towards defence pact

-

Syrian leader to meet Macron in first European visit

-

History beckons as cardinals gather to elect new pope

History beckons as cardinals gather to elect new pope

-

China's Xi aims to beef up 'no limits' Putin partnership

-

Hit by Trump cuts, journalists at Dubai-based US channel face uncertain future

Hit by Trump cuts, journalists at Dubai-based US channel face uncertain future

-

Roglic gunning for Giro as Pogacar's absence leaves door open

-

Trump's White House creates own media universe

Trump's White House creates own media universe

-

Sotheby's postpones historical gems auction after India backlash

-

Taiwan bicycle makers in limbo as US tariff threat looms

Taiwan bicycle makers in limbo as US tariff threat looms

-

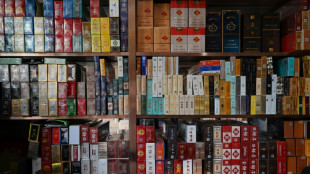

Tobacco town thrives as China struggles to kick the habit

-

Venezuelan opposition figures 'rescued', now in US: Rubio

Venezuelan opposition figures 'rescued', now in US: Rubio

-

China eases monetary policy to boost ailing economy

-

Haliburton stunner sinks Cavs as Pacers take 2-0 series lead

Haliburton stunner sinks Cavs as Pacers take 2-0 series lead

-

No rate cuts expected from US Fed facing 'unfavorable' conditions

-

'No one is illegal': Mormon women stage patchwork protest in Washington

'No one is illegal': Mormon women stage patchwork protest in Washington

-

Indonesia's silvermen beg to make ends meet

| RIO | 0.52% | 60.11 | $ | |

| BTI | -0.34% | 44.41 | $ | |

| CMSC | 0.18% | 22.06 | $ | |

| NGG | -0.02% | 72.285 | $ | |

| RBGPF | 4.34% | 65.86 | $ | |

| BP | -0.55% | 28.245 | $ | |

| BCC | -5.7% | 87.48 | $ | |

| RELX | -0.53% | 54.64 | $ | |

| RYCEF | 0.38% | 10.43 | $ | |

| GSK | -0.54% | 37.3 | $ | |

| VOD | -2.17% | 9.465 | $ | |

| JRI | -0.31% | 13.01 | $ | |

| CMSD | 0.22% | 22.31 | $ | |

| BCE | -0.14% | 21.56 | $ | |

| SCS | -1.01% | 9.87 | $ | |

| AZN | -0.2% | 70.12 | $ |

European stocks slide on return from Easter break

European stock markets slid Tuesday, catching up with losses in Asia and on Wall Street caused by slow growth concerns in China and rising US interest rates.

Trading for the first time since Thursday, London's benchmark FTSE 100 index was down 0.4 percent nearing the half-way stage.

Losses were steeper in the eurozone, with Frankfurt's DAX index and the Paris CAC 40 shedding around one percent, also after an extended weekend.

"Despite the public holiday in most of Europe yesterday, this is shaping up to be another volatile and eventful week for global markets," noted Lukman Otunuga, senior research analyst at FXTM.

"Later today, the International Monetary Fund will release its updated global economic outlook with markets expecting a downgrade for growth this year."

Otunuga said "such a development may hit investor confidence, sweetening appetite for safe-haven assets".

One traditional haven, the yen, struck a fresh 20-year low Tuesday at 128 to the dollar, with the Japanese currency heavily weighed down by diverging monetary policy in Japan and the United States.

High oil prices in Japan -- a major importer of crude -- have also pushed the currency lower, according to analysts.

Japan's Nikkei 225 rebounded from losses Monday -- and led other major Asian stock markets higher.

But Hong Kong plummeted by its largest margin in three weeks -- knocked by concerns around Beijing's tough tech-sector regulations and economic growth concerns in China.

Millions of residents are still cloistered in their homes in China's financial capital Shanghai.

Investors were left weighing whether attempts to lift the economy by Chinese policymakers -- who have held off cutting interest rates -- would offset Beijing's zero-Covid policies.

"The focus in Asia is on mainland policy easing to cushion the impact of lockdowns," said Stephen Innes at SPI Asset Management.

China's economic growth accelerated in the first quarter of the year to 4.8 percent, official data showed Monday, but the government warned of "significant challenges" ahead.

- Key figures around 1030 GMT -

London - FTSE 100: DOWN 0.4 percent at 7,586.79 points

Frankfurt - DAX: DOWN 0.9 percent at 14,036.68

Paris - CAC 40: DOWN 1.0 percent at 6,523.90

EURO STOXX 50: DOWN 1.1 percent at 3,807.47

Tokyo - Nikkei 225: UP 0.69 percent at 26,985.09 (close)

Shanghai - Composite: DOWN 0.05 percent at 3,194.03 (close)

Hong Kong - Hang Seng Index: DOWN 2.28 percent at 21,027.76 (close)

New York - Dow: DOWN 0.1 percent at 34,411.69 (close)

Dollar/yen: UP at 128.21 yen from 126.54 yen

Euro/dollar: DOWN at $1.0793 from $1.0802

Pound/dollar: FLAT at $1.3023

Euro/pound: FLAT at 82.87 pence

Brent North Sea crude: DOWN 1.3 percent at $111.68 per barrel

West Texas Intermediate: DOWN 1.6 percent at $106.49 per barrel

T.Ward--AMWN