-

France, Germany say to cooperate more closely on defence

France, Germany say to cooperate more closely on defence

-

Merz tells France Mercosur trade deal must be ratified 'quickly'

-

World's richest 10% caused two thirds of global warming: study

World's richest 10% caused two thirds of global warming: study

-

New German finance minister says 'no time to lose'

-

Yemen's Huthis to keep attacking Israeli ships despite US deal

Yemen's Huthis to keep attacking Israeli ships despite US deal

-

Hamas insists on 'comprehensive' deal to end Gaza war

-

Nations urge restraint in India-Pakistan clash

Nations urge restraint in India-Pakistan clash

-

Weight-loss drugmaker Novo Nordisk slims sales forecast

-

Kremlin says taking 'all measures' to protect May 9 parade

Kremlin says taking 'all measures' to protect May 9 parade

-

Stocks mixed before Fed decision, China-US trade talks

-

Danish firm Orsted halts huge UK offshore wind farm project

Danish firm Orsted halts huge UK offshore wind farm project

-

Explosions and fire on the contested India-Pakistan border

-

Distillery layoffs send shudders across remote Scottish island

Distillery layoffs send shudders across remote Scottish island

-

Hong Kong loosens rules for harbour reclamation

-

Israel's Gaza plan 'dangerous moment' for civilians: UN official

Israel's Gaza plan 'dangerous moment' for civilians: UN official

-

Kenya court fines teens for trying to smuggle protected ants

-

Kenya court fines ant smugglers for 'bio-piracy'

Kenya court fines ant smugglers for 'bio-piracy'

-

Young Barca earn respect but crave trophies after Inter heartbreak

-

Palestinians in razed West Bank hamlet vow to stay

Palestinians in razed West Bank hamlet vow to stay

-

Next pope faces 'difficult, complex' point in history, cardinals told

-

J-pop mega-group Arashi to disband after final tour

J-pop mega-group Arashi to disband after final tour

-

Inter seek Champions League final redemption after winning Barca epic

-

Pant under pressure as record IPL buy fails to justify price tag

Pant under pressure as record IPL buy fails to justify price tag

-

BMW upbeat on riding out US tariff chaos

-

Cardinals hold last mass before conclave to elect pope

Cardinals hold last mass before conclave to elect pope

-

Ukraine, Russia trade aerial attacks ahead of WWII victory parade

-

'Prioritise peace': Nations urge restraint in India-Pakistan clash

'Prioritise peace': Nations urge restraint in India-Pakistan clash

-

Asian stocks rise as China-US trade talks boost optimism

-

Toxic mushroom victim said meal was 'delicious', Australian court hears

Toxic mushroom victim said meal was 'delicious', Australian court hears

-

China's Xi heads to Moscow to beef up 'no limits' Putin partnership

-

World energy methane emissions near record high in 2024: IEA

World energy methane emissions near record high in 2024: IEA

-

White smoke: signalling a new pope down the ages

-

What's a cardinal? The 'princes' of the Church electing a new pope

What's a cardinal? The 'princes' of the Church electing a new pope

-

Papal conclave by the numbers

-

The Vatican: a papal powerhouse, world's smallest state

The Vatican: a papal powerhouse, world's smallest state

-

Trump, Ukraine propel EU and UK towards defence pact

-

Syrian leader to meet Macron in first European visit

Syrian leader to meet Macron in first European visit

-

History beckons as cardinals gather to elect new pope

-

China's Xi aims to beef up 'no limits' Putin partnership

China's Xi aims to beef up 'no limits' Putin partnership

-

Hit by Trump cuts, journalists at Dubai-based US channel face uncertain future

-

Roglic gunning for Giro as Pogacar's absence leaves door open

Roglic gunning for Giro as Pogacar's absence leaves door open

-

Trump's White House creates own media universe

-

Sotheby's postpones historical gems auction after India backlash

Sotheby's postpones historical gems auction after India backlash

-

Taiwan bicycle makers in limbo as US tariff threat looms

-

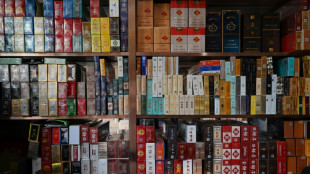

Tobacco town thrives as China struggles to kick the habit

Tobacco town thrives as China struggles to kick the habit

-

Venezuelan opposition figures 'rescued', now in US: Rubio

-

China eases monetary policy to boost ailing economy

China eases monetary policy to boost ailing economy

-

Haliburton stunner sinks Cavs as Pacers take 2-0 series lead

-

No rate cuts expected from US Fed facing 'unfavorable' conditions

No rate cuts expected from US Fed facing 'unfavorable' conditions

-

'No one is illegal': Mormon women stage patchwork protest in Washington

| RIO | 0.52% | 60.11 | $ | |

| BTI | -0.34% | 44.41 | $ | |

| CMSC | 0.18% | 22.06 | $ | |

| NGG | -0.02% | 72.285 | $ | |

| RBGPF | 4.34% | 65.86 | $ | |

| BP | -0.55% | 28.245 | $ | |

| BCC | -5.7% | 87.48 | $ | |

| RELX | -0.53% | 54.64 | $ | |

| RYCEF | 0.38% | 10.43 | $ | |

| GSK | -0.54% | 37.3 | $ | |

| VOD | -2.17% | 9.465 | $ | |

| JRI | -0.31% | 13.01 | $ | |

| CMSD | 0.22% | 22.31 | $ | |

| BCE | -0.14% | 21.56 | $ | |

| SCS | -1.01% | 9.87 | $ | |

| AZN | -0.2% | 70.12 | $ |

Oil prices dive on weaker IMF growth forecast as US stocks rally

Oil prices plunged by more than five percent Tuesday on worries that slowing growth will dent petroleum demand, while US stocks enjoyed a solid rally following a series of weak sessions.

The catalyst for the drop in both Brent and West Texas Intermediate futures was the IMF sharply downgrading its 2022 global growth forecast to 3.6 percent, 0.8 percentage points lower than its previous estimate released in January.

Energy prices are surging, debt levels are rising and shortages remain acute, the IMF noted, as multiple crises including the Ukraine war and coronavirus pandemic fuel an acceleration of inflation.

"The economic effects of the war are spreading far and wide -- like seismic waves that emanate from the epicenter of an earthquake," IMF chief economist Pierre-Olivier Gourinchas said in the report.

The downgrade was sharper for the eurozone, which is now expected to grow by 2.8 percent instead of 3.9 percent.

The report projected US growth would be 3.7 percent, down 0.3 percent from the earlier outlook.

While European bourses pulled back, US stocks enjoyed a buoyant session, rallying after a tepid open.

The broad-based S&P 500 finished up 1.6 percent.

Analysts cited better-than-expected US housing starts data, as well as solid earnings from Johnson & Johnson and other companies.

Much of the strength also stemmed from the positioning of the market.

"It's a nice reflex rally from an oversold position," said Art Hogan, strategist at National Securities, who said the dynamics reflected a "pretty oversold market."

Still, markets remain focused on the shifting monetary policy outlook as the yield on the 10-year US Treasury note climbed above 1.9 percent.

Airline shares were solidly higher after many US carriers lifted mask requirements following a ruling from a federal judge that struck down the nationwide face-covering mandate on transportation. American Airlines, Delta Air Lines and Southwest Airlines all won at least two percent.

But Lockheed Martin lost 1.6 percent after reporting that profits and sales dipped as the defense giant cited the drag from Covid-19 restrictions on its supply chain.

- Key figures around 2050 GMT -

New York - Dow: UP 1.5 percent at 34,911.20 (close)

New York - S&P 500: UP 1.6 percent at 4,462.21 (close)

New York - Nasdaq: UP 2.2 percent at 13,619.66 (close)

London - FTSE 100: DOWN 0.2 percent at 7,601.28 points (close)

Frankfurt - DAX: DOWN 0.1 percent at 14,153.46 (close)

Paris - CAC 40: DOWN 0.8 percent at 6,534.79 (close)

EURO STOXX 50: DOWN 0.5 percent at 3,830.76 (close)

Tokyo - Nikkei 225: UP 0.7 percent at 26,985.09 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,194.03 (close)

Hong Kong - Hang Seng Index: DOWN 2.3 percent at 21,027.76 (close)

Dollar/yen: UP at 128.89 yen from 126.69 yen

Euro/dollar: UP at $1.0796 from $1.0782

Pound/dollar: DOWN at $1.2998 from $1.3019

Euro/pound: UP at 82.98 pence from 82.85 pence

Brent North Sea crude: DOWN 5.2 percent at $107.25 per barrel

West Texas Intermediate: DOWN 5.2 percent at $102.56 per barrel

burs-jmb/cs

Th.Berger--AMWN