-

EU eyes targeting 100 bn euros of US goods with tariffs

EU eyes targeting 100 bn euros of US goods with tariffs

-

Second plane falls off US aircraft carrier in 10 days

-

France, Germany say to cooperate more closely on defence

France, Germany say to cooperate more closely on defence

-

Merz tells France Mercosur trade deal must be ratified 'quickly'

-

World's richest 10% caused two thirds of global warming: study

World's richest 10% caused two thirds of global warming: study

-

New German finance minister says 'no time to lose'

-

Yemen's Huthis to keep attacking Israeli ships despite US deal

Yemen's Huthis to keep attacking Israeli ships despite US deal

-

Hamas insists on 'comprehensive' deal to end Gaza war

-

Nations urge restraint in India-Pakistan clash

Nations urge restraint in India-Pakistan clash

-

Weight-loss drugmaker Novo Nordisk slims sales forecast

-

Kremlin says taking 'all measures' to protect May 9 parade

Kremlin says taking 'all measures' to protect May 9 parade

-

Stocks mixed before Fed decision, China-US trade talks

-

Danish firm Orsted halts huge UK offshore wind farm project

Danish firm Orsted halts huge UK offshore wind farm project

-

Explosions and fire on the contested India-Pakistan border

-

Distillery layoffs send shudders across remote Scottish island

Distillery layoffs send shudders across remote Scottish island

-

Hong Kong loosens rules for harbour reclamation

-

Israel's Gaza plan 'dangerous moment' for civilians: UN official

Israel's Gaza plan 'dangerous moment' for civilians: UN official

-

Kenya court fines teens for trying to smuggle protected ants

-

Kenya court fines ant smugglers for 'bio-piracy'

Kenya court fines ant smugglers for 'bio-piracy'

-

Young Barca earn respect but crave trophies after Inter heartbreak

-

Palestinians in razed West Bank hamlet vow to stay

Palestinians in razed West Bank hamlet vow to stay

-

Next pope faces 'difficult, complex' point in history, cardinals told

-

J-pop mega-group Arashi to disband after final tour

J-pop mega-group Arashi to disband after final tour

-

Inter seek Champions League final redemption after winning Barca epic

-

Pant under pressure as record IPL buy fails to justify price tag

Pant under pressure as record IPL buy fails to justify price tag

-

BMW upbeat on riding out US tariff chaos

-

Cardinals hold last mass before conclave to elect pope

Cardinals hold last mass before conclave to elect pope

-

Ukraine, Russia trade aerial attacks ahead of WWII victory parade

-

'Prioritise peace': Nations urge restraint in India-Pakistan clash

'Prioritise peace': Nations urge restraint in India-Pakistan clash

-

Asian stocks rise as China-US trade talks boost optimism

-

Toxic mushroom victim said meal was 'delicious', Australian court hears

Toxic mushroom victim said meal was 'delicious', Australian court hears

-

China's Xi heads to Moscow to beef up 'no limits' Putin partnership

-

World energy methane emissions near record high in 2024: IEA

World energy methane emissions near record high in 2024: IEA

-

White smoke: signalling a new pope down the ages

-

What's a cardinal? The 'princes' of the Church electing a new pope

What's a cardinal? The 'princes' of the Church electing a new pope

-

Papal conclave by the numbers

-

The Vatican: a papal powerhouse, world's smallest state

The Vatican: a papal powerhouse, world's smallest state

-

Trump, Ukraine propel EU and UK towards defence pact

-

Syrian leader to meet Macron in first European visit

Syrian leader to meet Macron in first European visit

-

History beckons as cardinals gather to elect new pope

-

China's Xi aims to beef up 'no limits' Putin partnership

China's Xi aims to beef up 'no limits' Putin partnership

-

Hit by Trump cuts, journalists at Dubai-based US channel face uncertain future

-

Roglic gunning for Giro as Pogacar's absence leaves door open

Roglic gunning for Giro as Pogacar's absence leaves door open

-

Trump's White House creates own media universe

-

Sotheby's postpones historical gems auction after India backlash

Sotheby's postpones historical gems auction after India backlash

-

Taiwan bicycle makers in limbo as US tariff threat looms

-

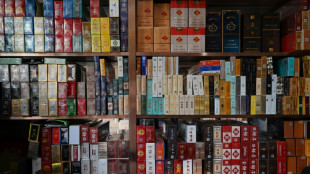

Tobacco town thrives as China struggles to kick the habit

Tobacco town thrives as China struggles to kick the habit

-

Venezuelan opposition figures 'rescued', now in US: Rubio

-

China eases monetary policy to boost ailing economy

China eases monetary policy to boost ailing economy

-

Haliburton stunner sinks Cavs as Pacers take 2-0 series lead

| RYCEF | 0.38% | 10.43 | $ | |

| RBGPF | 4.34% | 65.86 | $ | |

| BTI | -0.27% | 44.44 | $ | |

| VOD | -1.74% | 9.505 | $ | |

| SCS | -0.15% | 9.855 | $ | |

| CMSC | 0.47% | 22.165 | $ | |

| GSK | -0.67% | 37.25 | $ | |

| NGG | 0.1% | 72.37 | $ | |

| AZN | -0.11% | 70.181 | $ | |

| RIO | 0.38% | 60.03 | $ | |

| BP | -0.76% | 28.185 | $ | |

| BCE | 0.3% | 21.655 | $ | |

| JRI | -0.18% | 13.026 | $ | |

| CMSD | 0.1% | 22.332 | $ | |

| BCC | 0.17% | 87.63 | $ | |

| RELX | -0.57% | 54.62 | $ |

Europe stocks shine but US mixed as Netflix plunges

European stocks rose Wednesday as investors tracked corporate earnings and developments in the Ukraine conflict, while US stocks were mixed as Netflix shares tumbled after the streaming giant reported a drop in subscribers.

Oil prices slid further after having slumped the previous day on demand concerns.

"The upbeat market mood which helped Wall Street close firmly higher yesterday has followed through into Europe," City Index senior market analyst Fiona Cincotta told AFP.

Frankfurt won 1.5 percent and Paris rose 1.4 percent, aided by news of a return to growth in eurozone industrial output in February.

London added 0.4 percent, held back by mining shares that were penalised following disappointing performance by Rio Tinto due to the pandemic and production issues.

Europe equities and oil had dropped Tuesday as Moscow launched its eastern offensive in Ukraine and after the International Monetary Fund slashed its global 2022 economic growth forecasts by 0.8 percentage points, largely over inflationary crises linked to the war and the coronavirus pandemic.

"Whilst the Russian war remains a key driver in the markets, the bad news has been priced in for now," Cincotta said.

"Instead, some areas of optimism are arising with banks outperforming after the ECB (European Central Bank) soothed nerves with news that all big banks in the eurozone can withstand Russian write-offs," she added.

- Netflix 'shocker' -

Wall Street was mixed in late morning trading, with the Dow adding 0.7 percent.

But Netflix shares plunged 36 percent after the streaming giant reported its first drop in quarterly subscriptions in a decade, blaming the quarter-over-quarter erosion to suspension of its service in Russia due to Moscow's invasion of Ukraine.

"There is no two ways to look at it, Netflix was a shocker and is likely to take the wind out of the Nasdaq’s recent rally, or at least put it on pause," Cincotta said.

The Nasdaq Composite was down 0.9 percent.

"That said, broadly speaking earnings season has been reasonably solid so far, economic data hasn't revealed any major cracks either, which is helping to keep risk sentiment buoyant," she added.

Michael Hewson at CMC Markets said that the slump in Netflix shares "appears to be prompting a significant de-risking in the more highly valued areas of the US market".

In Asia trading, concerns about China's economy hit trading in Shanghai and Hong Kong.

Shanghai's main stocks index was Asia's biggest faller, losing 1.4 percent as the People's Bank of China (PBoC) kept key lending rates unchanged amid uncertainty over the impact of ongoing Chinese Covid restrictions.

Hong Kong -- which plummeted on Tuesday over concerns about Beijing's ongoing tech-sector crackdown -- also ended down.

"PBoC policymakers realise the futility of cutting rates during a lockdown as policies incentivising lending will have a minimal short-term positive impact on activity so long as mobility restrictions remain in place," noted independent analyst Stephen Innes.

- Key figures around 1530 GMT -

New York - Dow: UP 0.7 percent at 35,170.23 points

EURO STOXX 50: UP 0.7 percent at 3,770.86

London - FTSE 100: UP 0.4 percent at 7,629.22 (close)

Frankfurt - DAX: UP 1.5 percent at 14,362.03 (close)

Paris - CAC 40: UP 1.4 percent at 6,624.91

Tokyo - Nikkei 225: UP 0.86 percent at 27,217.85 (close)

Shanghai - Composite: DOWN 1.4 percent at 3,151.05 (close)

Hong Kong - Hang Seng Index: DOWN 0.4 percent at 20,944.67 (close)

Euro/dollar: UP at $1.0855 from $1.0788 late on Tuesday

Dollar/yen: DOWN at 127.77 yen from 128.91 yen

Pound/dollar: UP at $1.3048 from $1.2998

Euro/pound: UP at 83.21 pence from 82.99 pence

Brent North Sea crude: DOWN 0.5 percent at $106.71 per barrel

West Texas Intermediate: DOWN less than 0.1 percent at $102.48 per barrel

burs-rl/rlp

Th.Berger--AMWN