-

Departing Alonso says announcement on next move 'not far' away

Departing Alonso says announcement on next move 'not far' away

-

Arsenal hit back to rescue valuable draw at Liverpool

-

Pakistan's Kashmiris return to homes, but keep bunkers stocked

Pakistan's Kashmiris return to homes, but keep bunkers stocked

-

Postecoglou hopeful over Kulusevski injury ahead of Spurs' Europa final

-

Washington hails 'substantive progress' after trade talks with China

Washington hails 'substantive progress' after trade talks with China

-

Barca edge Real Madrid in thriller to move to brink of Liga title

-

Albanians vote in election seen as key test of EU path

Albanians vote in election seen as key test of EU path

-

Forest owner Marinakis confronts Nuno after draw deals Champions League blow

-

Dortmund thump Leverkusen to spoil Alonso's home farewell

Dortmund thump Leverkusen to spoil Alonso's home farewell

-

Pedersen sprints back into Giro pink after mountain goat incident

-

Zverev cruises into Rome last 16, Sabalenka battles past Kenin

Zverev cruises into Rome last 16, Sabalenka battles past Kenin

-

Newcastle win top-five showdown with Chelsea, Forest held to damaging draw

-

Iran says nuclear talks 'difficult but useful', US 'encouraged'

Iran says nuclear talks 'difficult but useful', US 'encouraged'

-

Zarco first home winner of French MotoGP since 1954

-

Taliban govt suspends chess in Afghanistan over gambling

Taliban govt suspends chess in Afghanistan over gambling

-

Eduan, Simbine shine at world relays

-

Washington 'optimistic' amid trade talks with China

Washington 'optimistic' amid trade talks with China

-

Tonali sinks 10-man Chelsea as Newcastle win top five showdown

-

Ukraine says will meet Russia for talks if it agrees to ceasefire

Ukraine says will meet Russia for talks if it agrees to ceasefire

-

India's worst-hit border town sees people return after ceasefire

-

Pope Leo XIV warns of spectre of global war in first Sunday address

Pope Leo XIV warns of spectre of global war in first Sunday address

-

Ukraine says will meet Russia for talks if Moscow agrees to ceasefire

-

Sabalenka battles past Kenin and into Rome last 16

Sabalenka battles past Kenin and into Rome last 16

-

Erdogan says efforts to end Ukraine war at 'turning point'

-

Pope Leo XIV calls for peace at St Peter's prayer

Pope Leo XIV calls for peace at St Peter's prayer

-

Ukraine will meet Russia for talks if Moscow agrees to ceasefire

-

India, Pakistan ceasefire holds after early violations

India, Pakistan ceasefire holds after early violations

-

Herbert seals Asian Tour win with final-hole heroics

-

Catholics gather to catch glimpse of Pope Leo XIV at St Peter's prayer

Catholics gather to catch glimpse of Pope Leo XIV at St Peter's prayer

-

US-China talks resume as Trump hails 'total reset' in trade relations

-

Ukraine ready for Russia truce talks, Zelensky says

Ukraine ready for Russia truce talks, Zelensky says

-

Jubilant Peruvians celebrate new pope at mass in adoptive city

-

Scottish refinery closure spells trouble for green transition

Scottish refinery closure spells trouble for green transition

-

Convicted ex-Panama president Martinelli granted asylum in Colombia

-

IPL chiefs in talks about restart following ceasefire: reports

IPL chiefs in talks about restart following ceasefire: reports

-

Navarrete beats Suarez on technical decision to keep title

-

Scans clear Wallabies fly-half Lolesio of serious back injury

Scans clear Wallabies fly-half Lolesio of serious back injury

-

Leo XIV to address faithful with St Peter's prayer

-

T-Wolves grab 2-1 NBA playoff series lead as Celtics get key win

T-Wolves grab 2-1 NBA playoff series lead as Celtics get key win

-

Gaza war casts shadow over Cannes film festival

-

'Treasure hunt': tourists boost sales at Japan's Don Quijote stores

'Treasure hunt': tourists boost sales at Japan's Don Quijote stores

-

Cannes Festival: the films in competition

-

Cannes film festival: what to look out for

Cannes film festival: what to look out for

-

Jordan hospital treats war casualties from across Middle East

-

As Trump family's Gulf empire grows, rulers seek influence, arms, tech

As Trump family's Gulf empire grows, rulers seek influence, arms, tech

-

S. Korea conservatives choose presidential candidate after last-minute chaos

-

Trump hails 'total reset' in US-China trade relations as talks continue

Trump hails 'total reset' in US-China trade relations as talks continue

-

Film claims to name killer of slain journalist Shireen Abu Akleh

-

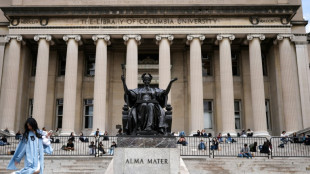

Under Trump pressure, Columbia University ends semester in turmoil

Under Trump pressure, Columbia University ends semester in turmoil

-

Putin proposes direct Ukraine talks but quiet on 30-day ceasefire

China worries weigh on global stocks

Stock markets mostly fell Tuesday as investors worried about the impact of the Covid outbreak in China and rising interest rates in the United States.

Wall Street failed to get any momentum from Monday's gains and a relief rally in Europe faded as the day wore on.

The European single currency hit a two-year low against the dollar, which was boosted by its haven status amid Ukraine turmoil.

But world oil prices rebounded from heavy losses in recent days on fears over weaker Chinese demand.

"The inability of equity markets to hold on to today’s initial gains doesn’t bode particularly well and speaks to a general lack of confidence more broadly about the economic outlook, and the ability of central banks to engineer a 'soft landing' as they look to tackle inflation," said market analyst Michael Hewson at CMC Markets.

Patrick J. O'Hare pointed out that even data showing a rebound in March of orders of US durable goods was not enough to turn around sentiment.

It is "another indication that market participants have their doubts about stronger economic activity persisting in the face of clear growth obstacles like hawkish-minded central banks and ongoing supply chain pressures that have been felt with China's lockdowns."

The tech-heavy Nasdaq Composite was down 3.0 percent ahead of earnings reports from Google-parent Alphabet and Microsoft, with were also down sharply.

The Omicron flare-up across China has led authorities to impose strict containment measures in its biggest cities, shutting off millions of people and threatening to deal a hammer blow to the world's number two economy.

Hong Kong stocks edged up but made only a small dent in the massive losses suffered the day before, while Shanghai extended the previous day's losses of more than five percent.

Sentiment was soothed somewhat after the People's Bank of China vowed to boost growth and consumption.

China's Covid measures have dealt a severe blow to its economy, leading to concerns about knock-on effects for the rest of the world -- given its reliance on Chinese-made goods.

The China crisis comes as traders grapple with a hawkish Fed, which is struggling to control inflation that sits at a more than 40-year high.

US central bank policymakers have said they are keen to lift rates several times this year to get a grip on prices, with boss Jerome Powell indicating a half-point rise next month followed by more before January.

Added to the picture, the Ukraine war has sparked additional markets turmoil owing to the impact on commodity prices and inflation.

Oil prices recovered somewhat from sharp losses in recent days.

"Oil prices have rebounded modestly after yesterday’s sharp sell-off as investors look to balance how much of an effect a sharp slowdown in demand from China will have when set against the resilience of demand elsewhere, in relation to global inventories," said CMC Markets' Hewson.

- Key figures at 1530 GMT -

New York - Dow: DOWN 1.4 percent at 33,557.65 points

EURO STOXX 50: DOWN 1.0 percent at 3,721.36

London - FTSE 100: UP less than 0.1 percent at 7,386.19 (close)

Paris - CAC 40: DOWN 0.5 percent at 6,414.57 (close)

Frankfurt - DAX: DOWN 1.2 percent at 13,756.40 (close)

Tokyo - Nikkei 225: UP 0.4 percent at 26,700.11 (close)

Hong Kong - Hang Seng Index: UP 0.3 percent at 19,934.71 (close)

Shanghai - Composite: DOWN 1.4 percent at 2,886.43 (close)

Brent North Sea crude: UP 1.6 percent at $103.91 per barrel

West Texas Intermediate: UP 1.7 percent at $100.17 per barrel

Euro/dollar: DOWN at $1.0659 from $1.0713 late on Monday

Pound/dollar: DOWN at $1.2626 from $1.2741

Euro/pound: UP at 84.44 pence from 84.08 pence

Dollar/yen: DOWN at 127.37 yen from 128.14 yen

burs-rl/ach

C.Garcia--AMWN