-

Pakistan's Kashmiris return to homes, but keep bunkers stocked

Pakistan's Kashmiris return to homes, but keep bunkers stocked

-

Postecoglou hopeful over Kulusevski injury ahead of Spurs' Europa final

-

Washington hails 'substantive progress' after trade talks with China

Washington hails 'substantive progress' after trade talks with China

-

Barca edge Real Madrid in thriller to move to brink of Liga title

-

Albanians vote in election seen as key test of EU path

Albanians vote in election seen as key test of EU path

-

Forest owner Marinakis confronts Nuno after draw deals Champions League blow

-

Dortmund thump Leverkusen to spoil Alonso's home farewell

Dortmund thump Leverkusen to spoil Alonso's home farewell

-

Pedersen sprints back into Giro pink after mountain goat incident

-

Zverev cruises into Rome last 16, Sabalenka battles past Kenin

Zverev cruises into Rome last 16, Sabalenka battles past Kenin

-

Newcastle win top-five showdown with Chelsea, Forest held to damaging draw

-

Iran says nuclear talks 'difficult but useful', US 'encouraged'

Iran says nuclear talks 'difficult but useful', US 'encouraged'

-

Zarco first home winner of French MotoGP since 1954

-

Taliban govt suspends chess in Afghanistan over gambling

Taliban govt suspends chess in Afghanistan over gambling

-

Eduan, Simbine shine at world relays

-

Washington 'optimistic' amid trade talks with China

Washington 'optimistic' amid trade talks with China

-

Tonali sinks 10-man Chelsea as Newcastle win top five showdown

-

Ukraine says will meet Russia for talks if it agrees to ceasefire

Ukraine says will meet Russia for talks if it agrees to ceasefire

-

India's worst-hit border town sees people return after ceasefire

-

Pope Leo XIV warns of spectre of global war in first Sunday address

Pope Leo XIV warns of spectre of global war in first Sunday address

-

Ukraine says will meet Russia for talks if Moscow agrees to ceasefire

-

Sabalenka battles past Kenin and into Rome last 16

Sabalenka battles past Kenin and into Rome last 16

-

Erdogan says efforts to end Ukraine war at 'turning point'

-

Pope Leo XIV calls for peace at St Peter's prayer

Pope Leo XIV calls for peace at St Peter's prayer

-

Ukraine will meet Russia for talks if Moscow agrees to ceasefire

-

India, Pakistan ceasefire holds after early violations

India, Pakistan ceasefire holds after early violations

-

Herbert seals Asian Tour win with final-hole heroics

-

Catholics gather to catch glimpse of Pope Leo XIV at St Peter's prayer

Catholics gather to catch glimpse of Pope Leo XIV at St Peter's prayer

-

US-China talks resume as Trump hails 'total reset' in trade relations

-

Ukraine ready for Russia truce talks, Zelensky says

Ukraine ready for Russia truce talks, Zelensky says

-

Jubilant Peruvians celebrate new pope at mass in adoptive city

-

Scottish refinery closure spells trouble for green transition

Scottish refinery closure spells trouble for green transition

-

Convicted ex-Panama president Martinelli granted asylum in Colombia

-

IPL chiefs in talks about restart following ceasefire: reports

IPL chiefs in talks about restart following ceasefire: reports

-

Navarrete beats Suarez on technical decision to keep title

-

Scans clear Wallabies fly-half Lolesio of serious back injury

Scans clear Wallabies fly-half Lolesio of serious back injury

-

Leo XIV to address faithful with St Peter's prayer

-

T-Wolves grab 2-1 NBA playoff series lead as Celtics get key win

T-Wolves grab 2-1 NBA playoff series lead as Celtics get key win

-

Gaza war casts shadow over Cannes film festival

-

'Treasure hunt': tourists boost sales at Japan's Don Quijote stores

'Treasure hunt': tourists boost sales at Japan's Don Quijote stores

-

Cannes Festival: the films in competition

-

Cannes film festival: what to look out for

Cannes film festival: what to look out for

-

Jordan hospital treats war casualties from across Middle East

-

As Trump family's Gulf empire grows, rulers seek influence, arms, tech

As Trump family's Gulf empire grows, rulers seek influence, arms, tech

-

S. Korea conservatives choose presidential candidate after last-minute chaos

-

Trump hails 'total reset' in US-China trade relations as talks continue

Trump hails 'total reset' in US-China trade relations as talks continue

-

Film claims to name killer of slain journalist Shireen Abu Akleh

-

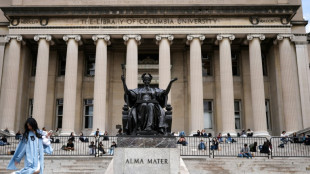

Under Trump pressure, Columbia University ends semester in turmoil

Under Trump pressure, Columbia University ends semester in turmoil

-

Putin proposes direct Ukraine talks but quiet on 30-day ceasefire

-

Trump hails US-China trade 'reset' after first day of talks

Trump hails US-China trade 'reset' after first day of talks

-

Jeeno leads Boutier by one at LPGA Americas Open

US indicts Archegos founder Hwang for fraud, market manipulation

US authorities on Wednesday arrested Archegos founder Bill Hwang and charged him with securities fraud and market manipulation following the fund's spectacular implosion last year that cost large banks billions of dollars.

The family-owned hedge fund run by Hwang had taken huge bets on a few stocks with money borrowed from banks, and when several of those bets turned sour, the fund was unable to meet "margin calls" to cover the losses.

The 2021 collapse of the fund sent shockwaves through financial markets and caused $10 billion in losses for Credit Suisse, Nomura, Morgan Stanley and other leading financial institutions.

Hwang and Patrick Halligan, chief financial officer of Archegos, were both arrested by the FBI early Wednesday.

"Their alleged crimes jeopardized not only their own company but also innocent investors and financial institutions around the world," Deputy Attorney General Lisa Monaco told reporters.

Both men were expected to make court appearances later Wednesday at federal court in New York, Justice Department officials said at a news conference.

A searing 59-page indictment said Hwang and Halligan used the firm "as an instrument of market manipulation and fraud, with far-reaching consequences for other participants in the United States securities markets," according to the indictment.

Hwang and other conspirators, including head trader William Tomita, sought to defraud investors by convincing them that shares in the fund's portfolio were on the rise when in fact the stock price increases "were the artificial product of Hwang's manipulative trading and deceptive conduct that caused others to trade," the indictment said.

They also repeatedly made "false and misleading statements" to convince others to trade with and extend credit to the firm.

- Inflating share prices -

The fund used derivatives to take large stakes in top Chinese names such as Baidu Inc, Tencent Music Entertainment Group and Vipshop Holding, plus US giants such as ViacomCBS and Discovery.

The plan initially worked and the fund tripled in size in just a year, while Hwang's personal fortune soared to $35 billion from just $1.5 billion and turned him and the firm into "significant economic forces in the United States securities markets," the filing said.

The US financial markets regulator, the Securities and Exchange Commission (SEC), also charged Hwang, Halligan, Tomita and Chief Risk Officer Scott Becker for their roles in the scheme.

The move to inflate share prices caused the firm to expand rapidly, "increasing in value from approximately $1.5 billion with $10 billion in exposure in March 2020 to a value of more than $36 billion with $160 billion in exposure at its peak in March 2021," the SEC said in a statement.

The South Korean-born businessman studied in the United States and went to work for Tiger Management, rising to form his own Tiger Asia Management. In 2012, Hwang paid $44 million to settle with the SEC over an insider trading case and shuttered the firm.

O.Norris--AMWN