-

Salah on Liverpool bench for Brighton match

Salah on Liverpool bench for Brighton match

-

Meillard leads Swiss sweep in Val d'Isere giant slalom

-

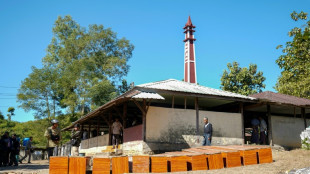

Indonesia flood death toll passes 1,000 as authorities ramp up aid

Indonesia flood death toll passes 1,000 as authorities ramp up aid

-

Cambodia shuts Thailand border crossings over deadly fighting

-

First urban cable car unveiled outside Paris

First urban cable car unveiled outside Paris

-

Vonn second behind Aicher in World Cup downhill at St Moritz

-

Aicher pips Vonn to downhill win at St Moritz

Aicher pips Vonn to downhill win at St Moritz

-

Thailand says 4 soldiers killed in Cambodia conflict, denies Trump truce claim

-

Fans vandalise India stadium after Messi's abrupt exit

Fans vandalise India stadium after Messi's abrupt exit

-

Women sommeliers are cracking male-dominated wine world open

-

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

-

Myanmar junta denies killing civilians in hospital strike

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

Thailand continues Cambodia strikes despite Trump truce calls

-

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

-

North Korea acknowledges its troops cleared mines for Russia

-

US unseals warrant for tanker seized off Venezuelan coast

US unseals warrant for tanker seized off Venezuelan coast

-

Cambodia says Thailand still bombing hours after Trump truce call

-

Machado urges pressure so Maduro understands 'he has to go'

Machado urges pressure so Maduro understands 'he has to go'

-

Best Gold Investment Companies in USA Announced (Augusta Precious Metals, Lear Capital, Robinhood IRA and More Ranked)

-

Leinster stutter before beating Leicester in Champions Cup

Leinster stutter before beating Leicester in Champions Cup

-

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

Union sink second-placed Leipzig to climb in Bundesliga

-

US Treasury lifts sanctions on Brazil Supreme Court justice

US Treasury lifts sanctions on Brazil Supreme Court justice

-

UK king shares 'good news' that cancer treatment will be reduced in 2026

-

Wembanyama expected to return for Spurs in NBA Cup clash with Thunder

Wembanyama expected to return for Spurs in NBA Cup clash with Thunder

-

Five takeaways from Luigi Mangione evidence hearings

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Steelers' Watt undergoes surgery to repair collapsed lung

-

Iran detains Nobel-prize winner in 'brutal' arrest

Iran detains Nobel-prize winner in 'brutal' arrest

-

NBA Cup goes from 'outside the box' idea to smash hit

-

UK health service battles 'super flu' outbreak

UK health service battles 'super flu' outbreak

-

Can Venezuela survive US targeting its oil tankers?

-

Democrats release new cache of Epstein photos

Democrats release new cache of Epstein photos

-

Colombia's ELN guerrillas place communities in lockdown citing Trump 'intervention' threats

-

'Don't use them': Tanning beds triple skin cancer risk, study finds

'Don't use them': Tanning beds triple skin cancer risk, study finds

-

Nancy aims to restore Celtic faith with Scottish League Cup final win

-

Argentina fly-half Albornoz signs for Toulon until 2030

Argentina fly-half Albornoz signs for Toulon until 2030

-

Trump says Thailand, Cambodia have agreed to stop border clashes

-

Salah in Liverpool squad for Brighton after Slot talks - reports

Salah in Liverpool squad for Brighton after Slot talks - reports

-

Marseille coach tips Greenwood as 'potential Ballon d'Or'

-

Draw marks 'starting gun' toward 2026 World Cup, Vancouver says

Draw marks 'starting gun' toward 2026 World Cup, Vancouver says

-

Thai PM says asked Trump to press Cambodia on border truce

-

Salah admired from afar in his Egypt home village as club tensions swirl

Salah admired from afar in his Egypt home village as club tensions swirl

-

World stocks retrench, consolidating Fed-fuelled gains

-

Brazil left calls protests over bid to cut Bolsonaro jail time

Brazil left calls protests over bid to cut Bolsonaro jail time

-

Trump attack on Europe migration 'disaster' masks toughening policies

-

US plan sees Ukraine joining EU in 2027, official tells AFP

US plan sees Ukraine joining EU in 2027, official tells AFP

-

'Chilling effect': Israel reforms raise press freedom fears

Wall Street rebounds, European stocks slump at end of volatile week

European stock markets ended a volatile week in the red of Friday, as investors weighed expectations of economic recovery against soaring inflation, rising interest rates and mixed earnings.

By contrast, Wall Street was in positive territory, and oil prices were steady.

The week has been dominated by investor concern that any possible interest rates by the US Federal Reserve -- as it seeks to rein in high inflation -- could choke off economic recovery following pandemic-induced lockdowns.

The European Central Bank, for its part, appears to be sitting tight for the time being, causing the euro to fall to a 19-month low against the dollar on Friday.

Rising tensions between Russia and the West over the Ukraine crisis have wiped around $7 trillion off stock market valuations across the globe so far this month.

"Downbeat mood rounds up a volatile week for markets," said Victoria Scholar, head of investment at Interactive Investor.

Wall Street was nevertheless in the black, with the tech-heavy NASDAQ rising by 1.4 percent after Apple unveiled record revenues.

Nevertheless, "inflation and tightening concerns exacerbated by surging oil prices and a hawkish Federal Reserve" continued to weigh on sentiment, said ThinkMarkets analyst, Fawad Razaqzada.

In Europe, Frankfurt and Paris ended the day in the red, even though France posted its strongest economist in more than 50 years, while German growth data disappointed.

The German economy shrank by 0.7 percent in the fourth quarter, but expanded by 2.8 percent over the year as a whole, the data showed, while in neighbouring France, economic growth reached seven percent.

In the US, inflation picked up to 4.9 percent in December from 4.7 percent in November.

"The consumer inflation rate is at a near 40-year high, wage pressures are building, supply chains are still tangled, oil prices are at a seven-year high, and more and more companies are talking about ongoing cost pressures," said Patrick O'Hare at Briefing.com.

While stock markets have rallied for the best part of two years, analysts said a hefty pullback can be expected, as investors take profit and central banks roll back massive pandemic-era stimulus.

Crude oil prices remained well-supported after a strong trading week, aided by the Ukraine-Russia crisis, with Brent rising above $91 per barrel.

"Russia's supply of natural gas to Western Europe could further spark volatility across financial markets, and as we turn the corner on the pandemic we now see a possible conflict as one of the biggest threats to markets in 2022," warned Federated Hermes analyst, Lewis Grant.

- Key figures around 1650 GMT -

New York - Dow: UP 0.2 percent at 34,227.14 points

London - FTSE 100: DOWN 1.1 percent at 7,466.07 (close)

Frankfurt - DAX: DOWN 0.5 percent at 15,356.16 (close)

Paris - CAC 40: DOWN 0.8 percent at 6,965.88 (close)

EURO STOXX 50: DOWN 1.1 percent at 4,137.74

Tokyo - Nikkei 225: UP 2.1 percent at 26,717.34 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 23,550.08 (close)

Shanghai - Composite: DOWN 1.0 percent at 3,361.44 (close)

Euro/dollar: UP at $1.1165 from $1.1147

Pound/dollar: UP at $1.3413 from $1.3381

Euro/pound: DOWN at 83.24 pence from 83.27 pence

Dollar/yen: DOWN at 115.19 yen from 115.36 yen

Brent North Sea crude: UP 0.6 percent at $90.61 per barrel

West Texas Intermediate: UP 1.6 percent at $88.02 per barrel

burs-rl/cdw/spm

L.Mason--AMWN