-

Kenya court fines teens for trying to smuggle protected ants

Kenya court fines teens for trying to smuggle protected ants

-

Kenya court fines ant smugglers for 'bio-piracy'

-

Young Barca earn respect but crave trophies after Inter heartbreak

Young Barca earn respect but crave trophies after Inter heartbreak

-

Palestinians in razed West Bank hamlet vow to stay

-

Next pope faces 'difficult, complex' point in history, cardinals told

Next pope faces 'difficult, complex' point in history, cardinals told

-

J-pop mega-group Arashi to disband after final tour

-

Inter seek Champions League final redemption after winning Barca epic

Inter seek Champions League final redemption after winning Barca epic

-

Pant under pressure as record IPL buy fails to justify price tag

-

BMW upbeat on riding out US tariff chaos

BMW upbeat on riding out US tariff chaos

-

Cardinals hold last mass before conclave to elect pope

-

Ukraine, Russia trade aerial attacks ahead of WWII victory parade

Ukraine, Russia trade aerial attacks ahead of WWII victory parade

-

'Prioritise peace': Nations urge restraint in India-Pakistan clash

-

Asian stocks rise as China-US trade talks boost optimism

Asian stocks rise as China-US trade talks boost optimism

-

Toxic mushroom victim said meal was 'delicious', Australian court hears

-

China's Xi heads to Moscow to beef up 'no limits' Putin partnership

China's Xi heads to Moscow to beef up 'no limits' Putin partnership

-

World energy methane emissions near record high in 2024: IEA

-

White smoke: signalling a new pope down the ages

White smoke: signalling a new pope down the ages

-

What's a cardinal? The 'princes' of the Church electing a new pope

-

Papal conclave by the numbers

Papal conclave by the numbers

-

The Vatican: a papal powerhouse, world's smallest state

-

Trump, Ukraine propel EU and UK towards defence pact

Trump, Ukraine propel EU and UK towards defence pact

-

Syrian leader to meet Macron in first European visit

-

History beckons as cardinals gather to elect new pope

History beckons as cardinals gather to elect new pope

-

China's Xi aims to beef up 'no limits' Putin partnership

-

Hit by Trump cuts, journalists at Dubai-based US channel face uncertain future

Hit by Trump cuts, journalists at Dubai-based US channel face uncertain future

-

Roglic gunning for Giro as Pogacar's absence leaves door open

-

Trump's White House creates own media universe

Trump's White House creates own media universe

-

Sotheby's postpones historical gems auction after India backlash

-

Taiwan bicycle makers in limbo as US tariff threat looms

Taiwan bicycle makers in limbo as US tariff threat looms

-

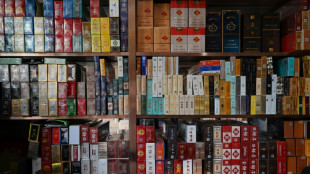

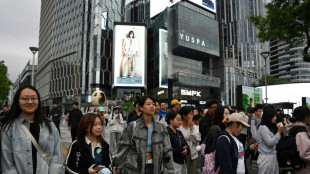

Tobacco town thrives as China struggles to kick the habit

-

Venezuelan opposition figures 'rescued', now in US: Rubio

Venezuelan opposition figures 'rescued', now in US: Rubio

-

China eases monetary policy to boost ailing economy

-

Haliburton stunner sinks Cavs as Pacers take 2-0 series lead

Haliburton stunner sinks Cavs as Pacers take 2-0 series lead

-

No rate cuts expected from US Fed facing 'unfavorable' conditions

-

'No one is illegal': Mormon women stage patchwork protest in Washington

'No one is illegal': Mormon women stage patchwork protest in Washington

-

Indonesia's silvermen beg to make ends meet

-

Toronto festival head says Trump tariffs would hurt film quality

Toronto festival head says Trump tariffs would hurt film quality

-

Trump talks tough on China, but early focus elsewhere

-

China vows to defend 'justice' in looming trade talks with US

China vows to defend 'justice' in looming trade talks with US

-

Man Utd seek to finish off Athletic Bilbao in chase for Europa glory

-

AP to continue crediting 'Napalm Girl' photo to Nick Ut after probe

AP to continue crediting 'Napalm Girl' photo to Nick Ut after probe

-

Wallace MacDonald Holdings (WMH) Ignites a New Era of American Manufacturing with Revolutionary "Made in America" Technology Complex in Nevada

-

HigherKey Studios Set to Redefine Entertainment, Technology, and Human-Centered Innovation

HigherKey Studios Set to Redefine Entertainment, Technology, and Human-Centered Innovation

-

Sportstech Provides April 2025 and LTM Business Performance Update Ahead of China Sport Show and TRNR Acquisition Close

-

Tocvan Discovers Another Near Surface High-Grade Corridor at Gran Pilar Gold - Silver Project Drills 6.1 meters of 5.4 g/t Gold and 39 g/t Silver within 41.2 meters of 1.0 g/t Gold and 10 g/t Silver

Tocvan Discovers Another Near Surface High-Grade Corridor at Gran Pilar Gold - Silver Project Drills 6.1 meters of 5.4 g/t Gold and 39 g/t Silver within 41.2 meters of 1.0 g/t Gold and 10 g/t Silver

-

Evotec Receives $ 2.5 m Grant to Generate Next Generation Tuberculosis Treatments

-

Colombia moves to join China's Belt and Road

Colombia moves to join China's Belt and Road

-

Martinez cried 'for two days' after nearly missing Barca triumph with injury

-

US, Chinese officials to hold trade talks in Switzerland

US, Chinese officials to hold trade talks in Switzerland

-

Barca 'will be back' after painful Champions League exit to Inter, says Flick

Trump's tariff storm a threat to dollar's dominance?

As President Donald Trump's tariffs threaten the US economy, questions are being asked about how long the dollar can maintain its status as the world's key trading and reserve currency.

AFP examines the greenback's current situation and outook:

- Is the dollar still all-powerful? -

The dollar, whose strength is based on the economic and political power of the United States, is traditionally considered a preferred safe haven in times of crisis or conflict.

Almost 58 percent of foreign exchange reserves together held by the world's central banks were denominated in dollars as of the final quarter last year, according to the International Monetary Fund.

That compares with 71 percent in 1999, with the drop attributed to rising competition from smaller currencies.

Roughly half of all global transactions by value are currently in dollars, compared with around 22 percent for the euro, seven percent for the pound sterling, and four percent for the Chinese yuan, according February data from international payments facilitator Swift.

Many strategic commodities, such as oil, are quoted in the greenback, reinforcing its central role across global trade.

However, the recent decline in the dollar's value suggests its safe haven status "has at least temporarily disappeared" in favour of the Swiss franc, yen and gold, Ryan Chahrour, a professor of economics at Cornell University, told AFP.

- 'Exorbitant privilege'? -

Before the dollar took charge, sterling dominated international trade, driven by the UK's status as an industrial powerhouse beginning in the 19th century.

However, following the Second World War, a ruined Europe desperately needed liquidity, while the United States found itself in a position of strength.

The dollar emerged as the new reference currency under the Bretton Woods accords of 1944, which laid the foundations for the current international monetary system.

Many countries have since chosen to peg their currency to the US unit, while demand for dollars has allowed the world's biggest economy to borrow freely, theoretically without limits, with its debt largely owed to foreign investors.

Former French finance minister Valery Giscard d'Estaing described this economic advantage enjoyed by the United States as an "exorbitant privilege", ahead of becoming French president in the 1970s.

On the other hand, the relative strength of the greenback despite recent turmoil makes American exports more expensive.

To counter this, Trump advisor Stephen Miran is considering major global reform aimed at devaluing the US currency.

At the same time, several central banks have begun a process of "de-dollarising" their reserves.

By using the dollar extensively, countries and companies expose themselves to US sanctions -- as illustrated by the freezing of Russia's foreign exchange reserves abroad following its invasion of Ukraine in early 2022.

- Why is Trump shaking the dollar? -

The dollar initially gained on news of Trump's tariffs owing to concerns the levies will push up inflation.

However, that has given way to rising fears that global growth will be impacted, causing recent heavy falls for oil prices that in turn have reduced inflationary pressures.

Expectations that the US Federal Reserve could cut interest rates to prop up the economy are also weighing on the dollar.

Another fear is that the Fed is no longer fulfilling its role as lender of last resort, as it limits the availability of dollars to other central banks.

Trump is contributing to "undermining the foundations of dollar dominance", tarnishing the reputation of the United States, believes Mark Sobel, a former senior US Treasury official.

He argues that in addition to weakening the country's economic strength through his trade policy, Trump is challenging the rule of law.

"The United States is not acting like a reliable partner or trusted ally," he told AFP.

- What alternatives? -

Sobel said it is "premature to say dollar dominance is going away or the dollar has lost its kind of global status because there aren't alternatives".

Stefan Lewellen, assistant professor of finance at Pennsylvania State University, said it is not yet time to write the currency's "obituary".

Looking at why the euro is not ready to take the helm, he added that the European single currency is "fundamentally still governed by individual nations that have mixed incentives to cooperate".

Among other units, he said the Canadian and Australian dollars, as well as the Swiss franc, are limited by the modest size of their markets.

As for the yuan, it remains under Beijing's strict control, owing to the lack of free convertibility and restrictions on capital movements.

G.Stevens--AMWN