-

Explosions and fire on the contested India-Pakistan border

Explosions and fire on the contested India-Pakistan border

-

Distillery layoffs send shudders across remote Scottish island

-

Hong Kong loosens rules for harbour reclamation

Hong Kong loosens rules for harbour reclamation

-

Israel's Gaza plan 'dangerous moment' for civilians: UN official

-

Kenya court fines teens for trying to smuggle protected ants

Kenya court fines teens for trying to smuggle protected ants

-

Kenya court fines ant smugglers for 'bio-piracy'

-

Young Barca earn respect but crave trophies after Inter heartbreak

Young Barca earn respect but crave trophies after Inter heartbreak

-

Palestinians in razed West Bank hamlet vow to stay

-

Next pope faces 'difficult, complex' point in history, cardinals told

Next pope faces 'difficult, complex' point in history, cardinals told

-

J-pop mega-group Arashi to disband after final tour

-

Inter seek Champions League final redemption after winning Barca epic

Inter seek Champions League final redemption after winning Barca epic

-

Pant under pressure as record IPL buy fails to justify price tag

-

BMW upbeat on riding out US tariff chaos

BMW upbeat on riding out US tariff chaos

-

Cardinals hold last mass before conclave to elect pope

-

Ukraine, Russia trade aerial attacks ahead of WWII victory parade

Ukraine, Russia trade aerial attacks ahead of WWII victory parade

-

'Prioritise peace': Nations urge restraint in India-Pakistan clash

-

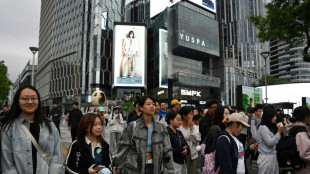

Asian stocks rise as China-US trade talks boost optimism

Asian stocks rise as China-US trade talks boost optimism

-

Toxic mushroom victim said meal was 'delicious', Australian court hears

-

China's Xi heads to Moscow to beef up 'no limits' Putin partnership

China's Xi heads to Moscow to beef up 'no limits' Putin partnership

-

World energy methane emissions near record high in 2024: IEA

-

White smoke: signalling a new pope down the ages

White smoke: signalling a new pope down the ages

-

What's a cardinal? The 'princes' of the Church electing a new pope

-

Papal conclave by the numbers

Papal conclave by the numbers

-

The Vatican: a papal powerhouse, world's smallest state

-

Trump, Ukraine propel EU and UK towards defence pact

Trump, Ukraine propel EU and UK towards defence pact

-

Syrian leader to meet Macron in first European visit

-

History beckons as cardinals gather to elect new pope

History beckons as cardinals gather to elect new pope

-

China's Xi aims to beef up 'no limits' Putin partnership

-

Hit by Trump cuts, journalists at Dubai-based US channel face uncertain future

Hit by Trump cuts, journalists at Dubai-based US channel face uncertain future

-

Roglic gunning for Giro as Pogacar's absence leaves door open

-

Trump's White House creates own media universe

Trump's White House creates own media universe

-

Sotheby's postpones historical gems auction after India backlash

-

Taiwan bicycle makers in limbo as US tariff threat looms

Taiwan bicycle makers in limbo as US tariff threat looms

-

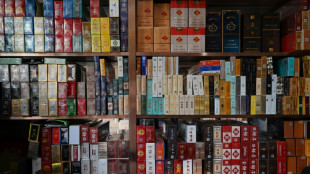

Tobacco town thrives as China struggles to kick the habit

-

Venezuelan opposition figures 'rescued', now in US: Rubio

Venezuelan opposition figures 'rescued', now in US: Rubio

-

China eases monetary policy to boost ailing economy

-

Haliburton stunner sinks Cavs as Pacers take 2-0 series lead

Haliburton stunner sinks Cavs as Pacers take 2-0 series lead

-

No rate cuts expected from US Fed facing 'unfavorable' conditions

-

'No one is illegal': Mormon women stage patchwork protest in Washington

'No one is illegal': Mormon women stage patchwork protest in Washington

-

Indonesia's silvermen beg to make ends meet

-

Toronto festival head says Trump tariffs would hurt film quality

Toronto festival head says Trump tariffs would hurt film quality

-

Trump talks tough on China, but early focus elsewhere

-

China vows to defend 'justice' in looming trade talks with US

China vows to defend 'justice' in looming trade talks with US

-

Man Utd seek to finish off Athletic Bilbao in chase for Europa glory

-

AP to continue crediting 'Napalm Girl' photo to Nick Ut after probe

AP to continue crediting 'Napalm Girl' photo to Nick Ut after probe

-

Phoenix Motor to Discuss 2024 Financial Results During Webinar on June 4

-

Wallace MacDonald Holdings (WMH) Ignites a New Era of American Manufacturing with Revolutionary "Made in America" Technology Complex in Nevada

Wallace MacDonald Holdings (WMH) Ignites a New Era of American Manufacturing with Revolutionary "Made in America" Technology Complex in Nevada

-

HigherKey Studios Set to Redefine Entertainment, Technology, and Human-Centered Innovation

-

Sportstech Provides April 2025 and LTM Business Performance Update Ahead of China Sport Show and TRNR Acquisition Close

Sportstech Provides April 2025 and LTM Business Performance Update Ahead of China Sport Show and TRNR Acquisition Close

-

Tocvan Discovers Another Near Surface High-Grade Corridor at Gran Pilar Gold - Silver Project Drills 6.1 meters of 5.4 g/t Gold and 39 g/t Silver within 41.2 meters of 1.0 g/t Gold and 10 g/t Silver

Turkish central bank raises interest rate to 46 percent

Turkey's central bank hiked its key interest rate to 46 percent on Thursday after a month of protests over the arrest of Istanbul's opposition mayor and economic uncertainty provoked by US President Donald Trump's sweeping tariffs.

That represents the first hike since March 2024, in what economists hail as a "strong signal of commitment" to a tight monetary policy stance.

The rate hike came as Turkey was roiled by street protests against the arrest and jailing last month of Istanbul's popular mayor, Ekrem Imamoglu, on graft charges he denies, which sent the Turkish lira to record lows against the dollar.

It also follows US President Donald Trump's global tariffs that sparked growing economic uncertainty despite the relatively low 10 percent baseline tariff that Washington has applied to Turkey.

The monetary policy committee "has decided to raise the policy rate from 42.5 percent to 46 percent," the central bank said in a statement.

- Risks to inflation -

Nicholas Farr, emerging Europe economist at London-based Capital Economics, said the decision "is a strong signal of commitment to a tight policy stance", in a policy note.

It also "suggests that policymakers have become more concerned about upside risks to inflation," he said.

Turkey's annual inflation that soared to 75 percent in May last year fell to 38.1 percent in March, its lowest level since December 2021, according to official figures released early this month.

But in April, "monthly core goods inflation is expected to rise slightly due to recent developments in financial markets," the bank warned, saying that policymakers would closely monitor capital flows amid the current uncertainty around US trade protectionism.

Turkish authorities are officially targeting 24 percent inflation by the end of 2025.

In addition to calls for boycotts against companies close to the government, the wave of protests has led to a significant decline in the Istanbul Stock Exchange, which has lost more than 13 percent since its close on March 18.

On the day of Imamoglu's arrest, the Turkish lira had plummeted by around 12 percent, reaching its lowest level ever.

This drastic drop was brief, but the lira has still lost more than four percent against the dollar since March 19, despite the $50 billion injection by the central bank to limit the damage.

The bank said Thursday the tight monetary stance would be maintained "until price stability is achieved via a sustained decline in inflation.

"The Committee will adjust the policy rate prudently on a meeting-by-meeting basis with a focus on the inflation outlook," the bank said.

"Monetary policy stance will be tightened in case a significant and persistent deterioration in inflation is foreseen."

T.Ward--AMWN