-

Howe urges Newcastle to be ruthless in transfer market

Howe urges Newcastle to be ruthless in transfer market

-

England defender Dier to leave Bayern at end of season - club official

-

UK comedian Russell Brand appears in court on rape charges

UK comedian Russell Brand appears in court on rape charges

-

Trump signs executive order to cut NPR, PBS public funding

-

'No dumping ground': Tunisia activist wins award over waste scandal

'No dumping ground': Tunisia activist wins award over waste scandal

-

French prison attacks linked to drug traffickers, say prosecutors

-

Hong Kong posts 3.1% growth, warns of trade war 'risk'

Hong Kong posts 3.1% growth, warns of trade war 'risk'

-

Fresh turmoil ahead of South Korean election

-

German chemical giant BASF keeps outlook, warns on tariffs

German chemical giant BASF keeps outlook, warns on tariffs

-

80 years on, Dutch WWII musical still 'incredibly relevant'

-

Slot says Liverpool Premier League win was one of 'best days of my life'

Slot says Liverpool Premier League win was one of 'best days of my life'

-

UK comedian Russell Brand arrives at court to face rape charges

-

Bangladesh's influential Islamists promise sharia as they ready for polls

Bangladesh's influential Islamists promise sharia as they ready for polls

-

Shell net profit sinks 35% in first-quarter as oil prices fall

-

Fearing Indian police, Kashmiris scrub 'resistance' tattoos

Fearing Indian police, Kashmiris scrub 'resistance' tattoos

-

Australian PM says battle ahead to win election

-

In show stretched over 50 years, Slovenian director shoots for space

In show stretched over 50 years, Slovenian director shoots for space

-

Hard right wins local UK election in blow to PM Starmer

-

Australian triple-murder suspect never asked after poisoned guests: husband

Australian triple-murder suspect never asked after poisoned guests: husband

-

Brunson brilliance as Knicks clinch series, Clippers sink Nuggets

-

UK court to rule on Prince Harry security appeal

UK court to rule on Prince Harry security appeal

-

'Alarming deterioration' of US press freedom under Trump, says RSF

-

Hard right makes early gains as local polls test UK's main parties

Hard right makes early gains as local polls test UK's main parties

-

China says open to US trade talks offer but wants tariffs scrapped

-

Climate change takes spice from Indonesia clove farms

Climate change takes spice from Indonesia clove farms

-

Bruised Real Madrid must stay in title fight against Celta

-

Top-five race heats up as Saints try to avoid unwanted history

Top-five race heats up as Saints try to avoid unwanted history

-

Asian stocks gain after China teases US tariff talks

-

South Korea former PM launches presidential bid

South Korea former PM launches presidential bid

-

Mueller eyes one final title as Bayern exit draws near

-

Canelo aims to land knockout blow against Scull in Saudi debut

Canelo aims to land knockout blow against Scull in Saudi debut

-

Lions hopefuls get one last chance to shine with Champions Cup semis

-

Trump vs Toyota? Why US cars are a rare sight in Japan

Trump vs Toyota? Why US cars are a rare sight in Japan

-

Ryu, Ariya shake off major letdowns to start strong in Utah

-

Sean 'Diddy' Combs: the rap mogul facing life in prison

Sean 'Diddy' Combs: the rap mogul facing life in prison

-

Sean 'Diddy' Combs sex crimes trial to begin Monday

-

Backyard barnyard: rising egg prices prompt hen hires in US

Backyard barnyard: rising egg prices prompt hen hires in US

-

Trinidad leader sworn in, vows fresh start for violence-weary state

-

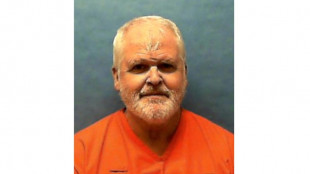

US veteran convicted of quadruple murder executed in Florida

US veteran convicted of quadruple murder executed in Florida

-

UK comedian Russell Brand due in court on rape charges

-

Tokyo's tariff envoy says US talks 'constructive'

Tokyo's tariff envoy says US talks 'constructive'

-

Ledecky out-duels McIntosh in sizzing 400m free

-

Scheffler grabs PGA lead with sizzling 61 at CJ Cup Byron Nelson

Scheffler grabs PGA lead with sizzling 61 at CJ Cup Byron Nelson

-

'Divine dreams' and 38 virgins at Trump prayer event

-

Apple expects $900 mn tariff hit, US iPhone supply shifts to India

Apple expects $900 mn tariff hit, US iPhone supply shifts to India

-

Lakers prepare for offseason rebuild after playoff exit

-

Hemogenyx Pharmaceuticals PLC Announces Second Patient Treated with HG-CT-1 CAR-T Therapy

Hemogenyx Pharmaceuticals PLC Announces Second Patient Treated with HG-CT-1 CAR-T Therapy

-

Nikki Langman to Present at Yale on LEGO(R)-Based Therapy for Mental Health and Substance Misuse Prevention

-

Dr. Moirar Leveille to Speak at Yale’s Women’s Mental Health Conference on Integrative, Cross-Cultural Healing

Dr. Moirar Leveille to Speak at Yale’s Women’s Mental Health Conference on Integrative, Cross-Cultural Healing

-

RYDE Files Annual Report on Form 20-F for Fiscal Year 2024

| RBGPF | 100% | 67.21 | $ | |

| SCS | -0.51% | 9.87 | $ | |

| VOD | -0.31% | 9.73 | $ | |

| NGG | -1.88% | 71.65 | $ | |

| RYCEF | -0.99% | 10.12 | $ | |

| CMSC | 0.09% | 22.03 | $ | |

| RIO | -1.45% | 58.55 | $ | |

| BTI | -0.58% | 43.3 | $ | |

| GSK | -2.84% | 38.75 | $ | |

| RELX | -1.02% | 54.08 | $ | |

| BCC | -0.61% | 92.71 | $ | |

| BCE | -3.78% | 21.44 | $ | |

| JRI | 0.77% | 13.01 | $ | |

| CMSD | -0.18% | 22.26 | $ | |

| BP | 1.51% | 27.88 | $ | |

| AZN | -1.82% | 70.51 | $ |

Don't Miss the April 30 Deadline: Prepare Q1 2025 Form 941 Filing with Tax1099

Stay ahead of the curve! Tax1099, a leading IRS-authorized e-filing platform, reminds businesses to prepare and file Form 941 before the due date to ensure compliance and avoid costly IRS penalties.

FAYETTEVILLE, AR and DALLAS, TX / ACCESS Newswire / April 22, 2025 / With the form 941 due date of April 30, 2025, fast approaching, Tax1099 encourages businesses to start preparing now to streamline their federal employment tax reporting. Form 941, the Employer's Quarterly Federal Tax Return, is critical for reporting withheld income taxes, Social Security, and Medicare taxes, and must be filed by the last day of the month following each quarter.

Form 941 eFile through Tax1099 simplifies the process, offering speed, accuracy, and security. Whether you're managing a single return or multiple filings, Tax1099's intuitive platform makes compliance effortless for businesses of all sizes.

Don't Forget Schedule B!

For businesses with semiweekly tax liabilities, Form 941 Schedule B is required to report daily tax liabilities. E-file it alongside Form 941 to ensure full compliance. Tax1099 seamlessly handles both, so you're covered without the hassle.

Form 941 Due Dates for 2025 Tax Year

Q1 (January-March): 941 Due Date April 30, 2025

Q2 (April-June): 941 Due Date July 31, 2025

Q3 (July-September): 941 Due Date October 31, 2025

Q4 (October-December): 941 Due Date January 31, 2026

Businesses need to report federal withholdings from employees, including:

Wages paid to employees.

All federal income tax withholdings.

All reported employee tips.

Employer and employee shares of Social Security and Medicare taxes in addition to any additional Medicare tax withholdings.

Any quarterly adjustments to Social Security or Medicare taxes for things like sick pay or tips.

Don't Risk Penalties-Act Now!

Miss the Form 941 due date, and the IRS could hit you with fines starting at 5% of unpaid taxes per month, up to 25%, plus interest. Tax1099's all-in-one platform automates prep, validates data, and delivers flawless submissions. Trusted by over 1 million businesses, it's your ticket to fast, error-free filings by every Quarterly Form 941 due dates.

Benefits of E-Filing with Tax1099

Seamless Integration: Syncs with accounting software like QuickBooks and Xero to import payroll data effortlessly.

Bulk Filing: Efficiently handle multiple Form 941 submissions for businesses with complex payroll needs.

Step-by-Step Guidance: Clear prompts and instructions ensure accurate filings, even for first-time users.

Team Collaboration: Invite team members, assign roles, and manage permissions for a streamlined workflow.

Top-Tier Security: Protects sensitive data with 256-bit encryption, TIN masking, and two-factor authentication.

Beat the Clock-File Today! Don't let penalties sneak up. With Tax1099, you can file your Form 941 now and keep your business in the clear. Get started at Tax1099.com!

About Zenwork Tax1099

Tax1099, an IRS-authorized e-filing service, simplifies tax compliance for over 750,000 businesses nationwide. Supporting 40+ federal and state-compliant forms, including Form 941, Tax1099 offers robust features like bulk filing, TIN matching, API integration, and 24/7 support. Learn more at www.tax1099.com.

About Zenwork Inc.

Zenwork Inc., the parent company of Tax1099, is a leader in digital tax compliance. With a decade of experience, Zenwork Inc. has assisted over 750,000 businesses and 70,000 CPA firms in simplifying compliance. Learn more about Zenwork and its products at www.zenwork.com, www.tax1099.com, and www.compliancely.com

Contact:

Ed Pratt

Zenwork Inc.

[email protected]

SOURCE: ZENWORK INC

View the original press release on ACCESS Newswire

M.A.Colin--AMWN