-

Howe urges Newcastle to be ruthless in transfer market

Howe urges Newcastle to be ruthless in transfer market

-

England defender Dier to leave Bayern at end of season - club official

-

UK comedian Russell Brand appears in court on rape charges

UK comedian Russell Brand appears in court on rape charges

-

Trump signs executive order to cut NPR, PBS public funding

-

'No dumping ground': Tunisia activist wins award over waste scandal

'No dumping ground': Tunisia activist wins award over waste scandal

-

French prison attacks linked to drug traffickers, say prosecutors

-

Hong Kong posts 3.1% growth, warns of trade war 'risk'

Hong Kong posts 3.1% growth, warns of trade war 'risk'

-

Fresh turmoil ahead of South Korean election

-

German chemical giant BASF keeps outlook, warns on tariffs

German chemical giant BASF keeps outlook, warns on tariffs

-

80 years on, Dutch WWII musical still 'incredibly relevant'

-

Slot says Liverpool Premier League win was one of 'best days of my life'

Slot says Liverpool Premier League win was one of 'best days of my life'

-

UK comedian Russell Brand arrives at court to face rape charges

-

Bangladesh's influential Islamists promise sharia as they ready for polls

Bangladesh's influential Islamists promise sharia as they ready for polls

-

Shell net profit sinks 35% in first-quarter as oil prices fall

-

Fearing Indian police, Kashmiris scrub 'resistance' tattoos

Fearing Indian police, Kashmiris scrub 'resistance' tattoos

-

Australian PM says battle ahead to win election

-

In show stretched over 50 years, Slovenian director shoots for space

In show stretched over 50 years, Slovenian director shoots for space

-

Hard right wins local UK election in blow to PM Starmer

-

Australian triple-murder suspect never asked after poisoned guests: husband

Australian triple-murder suspect never asked after poisoned guests: husband

-

Brunson brilliance as Knicks clinch series, Clippers sink Nuggets

-

UK court to rule on Prince Harry security appeal

UK court to rule on Prince Harry security appeal

-

'Alarming deterioration' of US press freedom under Trump, says RSF

-

Hard right makes early gains as local polls test UK's main parties

Hard right makes early gains as local polls test UK's main parties

-

China says open to US trade talks offer but wants tariffs scrapped

-

Climate change takes spice from Indonesia clove farms

Climate change takes spice from Indonesia clove farms

-

Bruised Real Madrid must stay in title fight against Celta

-

Top-five race heats up as Saints try to avoid unwanted history

Top-five race heats up as Saints try to avoid unwanted history

-

Asian stocks gain after China teases US tariff talks

-

South Korea former PM launches presidential bid

South Korea former PM launches presidential bid

-

Mueller eyes one final title as Bayern exit draws near

-

Canelo aims to land knockout blow against Scull in Saudi debut

Canelo aims to land knockout blow against Scull in Saudi debut

-

Lions hopefuls get one last chance to shine with Champions Cup semis

-

Trump vs Toyota? Why US cars are a rare sight in Japan

Trump vs Toyota? Why US cars are a rare sight in Japan

-

Ryu, Ariya shake off major letdowns to start strong in Utah

-

Sean 'Diddy' Combs: the rap mogul facing life in prison

Sean 'Diddy' Combs: the rap mogul facing life in prison

-

Sean 'Diddy' Combs sex crimes trial to begin Monday

-

Backyard barnyard: rising egg prices prompt hen hires in US

Backyard barnyard: rising egg prices prompt hen hires in US

-

Trinidad leader sworn in, vows fresh start for violence-weary state

-

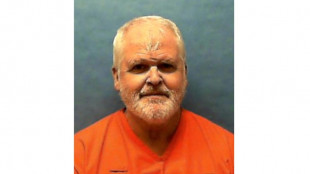

US veteran convicted of quadruple murder executed in Florida

US veteran convicted of quadruple murder executed in Florida

-

UK comedian Russell Brand due in court on rape charges

-

Tokyo's tariff envoy says US talks 'constructive'

Tokyo's tariff envoy says US talks 'constructive'

-

Ledecky out-duels McIntosh in sizzing 400m free

-

Scheffler grabs PGA lead with sizzling 61 at CJ Cup Byron Nelson

Scheffler grabs PGA lead with sizzling 61 at CJ Cup Byron Nelson

-

'Divine dreams' and 38 virgins at Trump prayer event

-

Apple expects $900 mn tariff hit, US iPhone supply shifts to India

Apple expects $900 mn tariff hit, US iPhone supply shifts to India

-

Lakers prepare for offseason rebuild after playoff exit

-

Hemogenyx Pharmaceuticals PLC Announces Second Patient Treated with HG-CT-1 CAR-T Therapy

Hemogenyx Pharmaceuticals PLC Announces Second Patient Treated with HG-CT-1 CAR-T Therapy

-

Nikki Langman to Present at Yale on LEGO(R)-Based Therapy for Mental Health and Substance Misuse Prevention

-

Dr. Moirar Leveille to Speak at Yale’s Women’s Mental Health Conference on Integrative, Cross-Cultural Healing

Dr. Moirar Leveille to Speak at Yale’s Women’s Mental Health Conference on Integrative, Cross-Cultural Healing

-

RYDE Files Annual Report on Form 20-F for Fiscal Year 2024

| RBGPF | 100% | 67.21 | $ | |

| SCS | -0.51% | 9.87 | $ | |

| VOD | -0.31% | 9.73 | $ | |

| NGG | -1.88% | 71.65 | $ | |

| RYCEF | -0.99% | 10.12 | $ | |

| CMSC | 0.09% | 22.03 | $ | |

| RIO | -1.45% | 58.55 | $ | |

| BTI | -0.58% | 43.3 | $ | |

| GSK | -2.84% | 38.75 | $ | |

| RELX | -1.02% | 54.08 | $ | |

| BCC | -0.61% | 92.71 | $ | |

| BCE | -3.78% | 21.44 | $ | |

| JRI | 0.77% | 13.01 | $ | |

| CMSD | -0.18% | 22.26 | $ | |

| BP | 1.51% | 27.88 | $ | |

| AZN | -1.82% | 70.51 | $ |

D. Boral Capital Acted as Exclusive Placement Agent to Safe & Green Holdings Corp. (Nasdaq: SGBX) in Connection with Its Approximately $8.0 Million Private Placement

NEW YORK CITY, NY / ACCESS Newswire / April 22, 2025 / On April. 14, 2025, Safe & Green Holdings Corp. (NASDAQ:SGBX) ("Safe & Green Holdings" or the "Company"), a leading developer, designer, and fabricator of modular structures, announced the pricing of a Private Placement with gross proceeds to the Company expected to be approximately $8.0 million.

The offering consists of 20,408,160 Common Units (or Pre-Funded Units), each consisting of (i) one (1) share of Common Stock or one (1) Pre-Funded Warrant, (ii) one (1) Series A Registered Common Warrant to purchase one (1) share of Common Stock per warrant at an exercise price of $0.784 (the "Series A Warrants") and (iii) one (1) Series B Registered Common Warrant to purchase one (1) share of Common Stock per warrant at an exercise price of $0.98 (the "Series B Warrants" and together with the Series A Warrants, the "Warrants"). The public offering price per Common Unit is $0.392 (or $0.3919 for each Pre-Funded Unit, which is equal to the public offering price per Common Unit to be sold in the offering minus an exercise price of $0.0001 per Pre-Funded Warrant). The Pre-Funded Warrants will be immediately exercisable and may be exercised at any time until exercised in full. For each Pre-Funded Unit sold in the offering, the number of Common Units in the offering will be decreased on a one-for-one basis. The initial exercise price of each Series A Warrant is $0.784 per share of Common Stock. The Series A Warrants are exercisable following stockholder approval and expire sixty (60) months thereafter. The number of securities issuable under the Series A Warrants is subject to adjustment as described in more detail in the report on the Company's Current Report on Form 8-K to be filed with the SEC in connection with the offering (the "8-K"). The initial exercise price of each Series B Warrant is $0.98 per share of Common Stock or pursuant to an alternative cashless exercise option. The Series B Common Warrants are exercisable following stockholder approval and expire thirty (30) months thereafter. The number of securities issuable under the Series B Warrants is subject to adjustment as described in more detail in the 8-K.

The aggregate gross proceeds to the Company are approximately $8.0 million, before deducting placement agent discounts and expenses. The transaction closed on April 14, 2025. The Company expects to use the net proceeds from the offering, together with its existing cash, for working capital, general corporate purposes and equipment for expansion.

D. Boral Capital LLC acted as the Exclusive Placement Agent for the offering.

Sichenzia Ross Ference Carmel LLP, New York, NY, acted as counsel to the Company, and Lucosky Brookman LLP, Woodbridge, NJ, acted as counsel to the placement agent in connection with the offering.

The securities described above were sold in a private placement transaction not involving a public offering and were not registered under the Securities Act of 1933, as amended (the "Securities Act"), or applicable state securities laws. Accordingly, the securities may not be reoffered or resold in the United States except pursuant to an effective registration statement or an applicable exemption from the registration requirements of the Securities Act and such applicable state securities laws. The securities were offered only to accredited investors. Pursuant to a registration rights agreement with the investors, the Company has agreed to file one or more registration statements with the SEC covering the resale of the Common Stock and the Shares issuable upon exercise of the Pre-Funded Warrants and Warrants.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Safe & Green Holdings Corp.

Safe & Green Holdings Corp., a leading modular solutions company, operates under core capabilities which include the development, design, and fabrication of modular structures, meeting the demand for safe and green solutions across various industries. The firm supports third-party and in-house developers, architects, builders, and owners in achieving faster execution, greener construction, and buildings of higher value. For more information, visit https://www.safeandgreenholdings.com/ and follow the Company at @SGHcorp on Twitter.

About D. Boral Capital

D. Boral Capital LLC is a premier, relationship-driven global investment bank headquartered in New York. The firm is dedicated to delivering exceptional strategic advisory and tailored financial solutions to middle-market and emerging growth companies. With a proven track record, D. Boral Capital provides expert guidance to clients across diverse sectors worldwide, leveraging access to capital from key markets, including the United States, Asia, Europe, the Middle East, and Latin America.

A recognized leader on Wall Street, D. Boral Capital has successfully aggregated over $25 billion in capital since its inception in 2020, executing approximately 350 transactions across a broad range of investment banking products.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains statements that may be deemed "forward-looking statements" within the meaning of U.S. securities laws, including statements regarding clinical trials, expected operations and upcoming developments. All statements in this press release other than statements of historical fact are forward-looking statements. These forward-looking statements may be identified by future verbs, as well as terms such as "expect" "potential," "anticipating," "planning" and similar expressions or the negatives thereof. Such statements are based upon certain assumptions and assessments made by management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate.

For more information, please contact:

D. Boral Capital LLC

Email: [email protected]

Telephone: +1(212)-970-5150

SOURCE: D. Boral Capital

View the original press release on ACCESS Newswire

H.E.Young--AMWN