-

Sean 'Diddy' Combs: the rap mogul facing life in prison

Sean 'Diddy' Combs: the rap mogul facing life in prison

-

Sean 'Diddy' Combs sex crimes trial to begin Monday

-

Backyard barnyard: rising egg prices prompt hen hires in US

Backyard barnyard: rising egg prices prompt hen hires in US

-

Trinidad leader sworn in, vows fresh start for violence-weary state

-

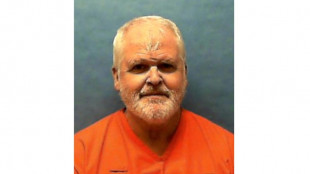

US veteran convicted of quadruple murder executed in Florida

US veteran convicted of quadruple murder executed in Florida

-

UK comedian Russell Brand due in court on rape charges

-

Tokyo's tariff envoy says US talks 'constructive'

Tokyo's tariff envoy says US talks 'constructive'

-

Ledecky out-duels McIntosh in sizzing 400m free

-

Scheffler grabs PGA lead with sizzling 61 at CJ Cup Byron Nelson

Scheffler grabs PGA lead with sizzling 61 at CJ Cup Byron Nelson

-

'Divine dreams' and 38 virgins at Trump prayer event

-

Apple expects $900 mn tariff hit, US iPhone supply shifts to India

Apple expects $900 mn tariff hit, US iPhone supply shifts to India

-

Lakers prepare for offseason rebuild after playoff exit

-

'Natural' for stars like Maguire to deliver now: Man Utd's Amorim

'Natural' for stars like Maguire to deliver now: Man Utd's Amorim

-

EU preparing new sanctions on Russia, French minister tells AFP

-

Apple expects $900 mn tariff hit as shifts US iPhone supply to India

Apple expects $900 mn tariff hit as shifts US iPhone supply to India

-

US to end shipping loophole for Chinese goods Friday

-

Forest's Champions League dreams hit by Brentford defeat

Forest's Champions League dreams hit by Brentford defeat

-

Norris and Piastri taking championship battle in their stride

-

Chelsea close in on UEFA Conference League final with win at Djurgarden

Chelsea close in on UEFA Conference League final with win at Djurgarden

-

Spurs take control in Europa semi against Bodo/Glimt

-

Man Utd seize control of Europa League semi against 10-man Bilbao

Man Utd seize control of Europa League semi against 10-man Bilbao

-

With minerals deal, Ukraine finds way to secure Trump support

-

Amazon revenue climbs 9%, but outlook sends shares lower

Amazon revenue climbs 9%, but outlook sends shares lower

-

Trump axes NSA Waltz after chat group scandal

-

Forest Champions League dreams hit after Brentford defeat

Forest Champions League dreams hit after Brentford defeat

-

'Resilient' Warriors aim to close out Rockets in bruising NBA playoff series

-

US expects Iran talks but Trump presses sanctions

US expects Iran talks but Trump presses sanctions

-

Baffert returns to Kentucky Derby, Journalism clear favorite

-

Top Trump security official replaced after chat group scandal

Top Trump security official replaced after chat group scandal

-

Masked protesters attack Socialists at France May Day rally

-

Mumbai eliminate Rajasthan from IPL playoff race with bruising win

Mumbai eliminate Rajasthan from IPL playoff race with bruising win

-

McDonald's profits hit by weakness in US market

-

Rio goes Gaga for US singer ahead of free concert

Rio goes Gaga for US singer ahead of free concert

-

New research reveals where N. American bird populations are crashing

-

Verstappen late to Miami GP as awaits birth of child

Verstappen late to Miami GP as awaits birth of child

-

Zelensky says minerals deal with US 'truly equal'

-

Weinstein lawyer says accuser sought payday from complaint

Weinstein lawyer says accuser sought payday from complaint

-

Police arrest more than 400 in Istanbul May Day showdown

-

Herbert named head coach of Canada men's basketball team

Herbert named head coach of Canada men's basketball team

-

'Boss Baby' Suryavanshi falls to second-ball duck in IPL

-

Shibutani siblings return to ice dance after seven years

Shibutani siblings return to ice dance after seven years

-

300,000 rally across France for May 1, union says

-

US-Ukraine minerals deal: what we know

US-Ukraine minerals deal: what we know

-

Top Trump official ousted after chat group scandal: reports

-

Schueller hat-trick sends Bayern women to first double

Schueller hat-trick sends Bayern women to first double

-

Baudin in yellow on Tour de Romandie as Fortunato takes 2nd stage

-

UK records hottest ever May Day

UK records hottest ever May Day

-

GM cuts 2025 outlook, projects up to $5 bn hit from tariffs

-

Thousands of UK children write to WWII veterans ahead of VE Day

Thousands of UK children write to WWII veterans ahead of VE Day

-

Top Trump official exiting after chat group scandal: reports

Gold hits record, stocks diverge as Trump fuels Fed fears

Gold reached $3,500 an ounce for the first time Tuesday as US President Donald Trump's tariffs and verbal assault on the Federal Reserve prompted investors to snap up the safe-haven asset.

Wall Street rebounded from sharp losses the previous day at the start of trading, while Europe's main stock markets diverged in afternoon deals as the region's trading resumed after a long weekend break for Easter.

Asian indexes closed mixed, while the dollar diverged against major rivals and oil prices firmed.

"The move across global stock indices appears more reflective of consolidation than panic, but markets remain on edge," said Trade Nation analyst David Morrison.

Sentiment wasn't helped by the International Monetary Fund saying Trump's new tariff policies would take a big bite out of global growth.

The IMF now sees the global economy growing by 2.8 percent this year, 0.5 percentage points lower than its previous forecast in January.

"Lack of certainty is sending investors right into the arms of traditional safe haven assets, with gold and the Japanese yen both cashing in on the drama," noted Matt Britzman, senior equity analyst at Hargreaves Lansdown.

With the US tariff blitz still causing ructions on global trading floors, investors are now dealing with the added worry that Trump will try to remove the country's top banker.

The president last week took a swipe at Fed chief Jerome Powell over the latter's warning that the sweeping levies would likely reignite inflation.

While that raised eyebrows, Trump sent shivers through markets Monday by again calling on Powell to make pre-emptive cuts to US interest rates and calling him a "major loser" and "Mr Too Late".

The Republican tycoon said on his Truth Social platform that there was "virtually" no inflation, claiming energy and food costs were well down and pointed to the several interest rate reductions by the European Central Bank.

The outbursts have fanned concern that Trump is preparing to oust Powell, with top economic adviser Kevin Hassett saying Friday that the president was looking at whether he could do so.

Panicked Wall Street investors dumped US assets again on Monday, with all three main indexes ending down around 2.5 percent.

Analysts warned of another rout should Trump try to fire the Fed boss, which many said could cause a crisis of confidence in the US economy.

"Were Powell to be fired, the initial reaction would be a huge injection of volatility into financial markets, and the most dramatic rush to the exit from US assets that it is possible to imagine," said Pepperstone strategist Michael Brown.

"Lower, much lower, equities; Treasuries sold across the board; and, the dollar falling off a cliff."

Briefing.com analyst Patrick O'Hare put part of Wall Street's Tuesday rebound down to thinking that Trump won't fire Powell and "that he is simply setting him up now to take the blame in the event of an economic downturn".

- Key figures at 1330 GMT -

New York - Dow: UP 1.0 percent at 38,566.69 points

New York - S&P 500: UP 1.0 percent at 5,210.70

New York - Nasdaq Composite: UP 1.2 percent at 16,062.15

London - FTSE 100: UP 0.2 percent at 8,292.34

Paris - CAC 40: DOWN 0.3 percent at 7,264.83

Frankfurt - DAX: DOWN 0.4 percent at 21,114.10

Tokyo - Nikkei 225: DOWN 0.2 percent at 34,220.60 (close)

Hong Kong - Hang Seng Index: UP 0.8 percent at 21,562.32 (close)

Shanghai - Composite: UP 0.3 percent at 3,299.76 (close)

Euro/dollar: DOWN at $1.1467 from $1.1510 on Monday

Pound/dollar: DOWN $1.3371 at $1.3377

Dollar/yen: DOWN at 140.63 yen from 140.89 yen

Euro/pound: DOWN at 85.76 pence from 86.03 pence

Brent North Sea Crude: UP 0.9 percent at $63.09 per barrel

West Texas Intermediate: UP 1.1 percent at $63.85 per barrel

burs-rl/rmb

Y.Kobayashi--AMWN