-

Djokovic closes on 100th ATP title by reaching Geneva final

Djokovic closes on 100th ATP title by reaching Geneva final

-

Stock markets fall as Trump threatens tariffs on EU, Apple

-

Sinner expects 'different atmosphere' at French Open after doping ban

Sinner expects 'different atmosphere' at French Open after doping ban

-

Rivalry with Sinner 'great' for tennis, says Alcaraz

-

Barca the team others look up to now: Bonmati

Barca the team others look up to now: Bonmati

-

Ukraine, Russia begin biggest prisoner swap of war

-

German court says Meta can use user data to train AI

German court says Meta can use user data to train AI

-

Sebastiao Salgado, photojournalism elevated to art

-

Trump fires new 50% tariff threat at EU, drawing stiff response

Trump fires new 50% tariff threat at EU, drawing stiff response

-

Pedersen wins Giro stage 13 as Del Toro extends lead

-

Latest round of US-Iran nuclear talks ends in Rome

Latest round of US-Iran nuclear talks ends in Rome

-

Stokes strikes on England return as Bennett stars for Zimbabwe

-

S.Africa moves to ease black empowerment law under Starlink pressure

S.Africa moves to ease black empowerment law under Starlink pressure

-

Keys back in Grand Slam mode in Paris after 'elusive' major triumph

-

Twenty-year term sought for French surgeon in mass patient abuse trial

Twenty-year term sought for French surgeon in mass patient abuse trial

-

'People don't know me', says defiant Swiatek ahead of French Open defence

-

Trump fires new tariff threats at Apple and the EU

Trump fires new tariff threats at Apple and the EU

-

Stock markets sink as Trump eyes tariffs on EU, Apple

-

Fur-st prize for Icelandic sheepdog at Cannes canine competition

Fur-st prize for Icelandic sheepdog at Cannes canine competition

-

Leningrad Siege survivor, 84, fined over peace placard

-

Leclerc tops first Monaco practice after early collision

Leclerc tops first Monaco practice after early collision

-

Tuchel won't let England stars leave early for Club World Cup

-

Sabalenka feeling 'stronger than ever' on clay before French Open

Sabalenka feeling 'stronger than ever' on clay before French Open

-

Trump fires new tariff threats at Apple and EU

-

Penaud recovers from injury to start Champions Cup final

Penaud recovers from injury to start Champions Cup final

-

France's TotalEnergies to face court in June in 'greenwashing' case

-

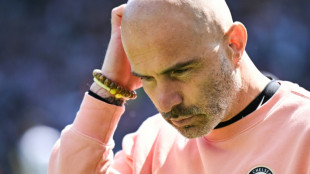

Man City back plea to reduce squad size: Guardiola

Man City back plea to reduce squad size: Guardiola

-

Napoleon's sword sold at auction for 4.7 mn euros

-

European stocks sink as Trump puts EU in tariff crosshairs

European stocks sink as Trump puts EU in tariff crosshairs

-

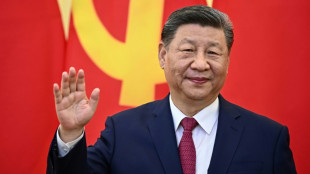

Merz, Xi discuss Ukraine war, trade woes amid global 'chaos'

-

Iran, US hold new round of nuclear talks in Rome

Iran, US hold new round of nuclear talks in Rome

-

Cook strikes on debut after England run riot against Zimbabwe

-

Defendants ask forgiveness ahead of Kardashian robbery verdict

Defendants ask forgiveness ahead of Kardashian robbery verdict

-

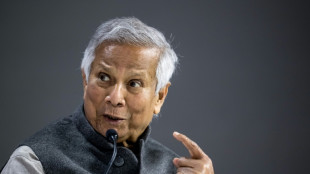

Bangladesh minister says Yunus 'not going to step down'

-

260 miners stuck underground after 'incident' at S.African shaft

260 miners stuck underground after 'incident' at S.African shaft

-

S.Africa minister rejects 'genocide' claim with statistics

-

Lucu's Bordeaux-Begles eye 'neutralising' Pollock in Champions Cup final

Lucu's Bordeaux-Begles eye 'neutralising' Pollock in Champions Cup final

-

Departing Ancelotti wishes Alonso luck as his Real Madrid successor

-

Chelsea can cope with pressure of top-five battle, says Maresca

Chelsea can cope with pressure of top-five battle, says Maresca

-

Brook's quickfire fifty takes England to 565-6 dec against Zimbabwe

-

Alexander-Arnold 'deserves' his part in Liverpool title party: Slot

Alexander-Arnold 'deserves' his part in Liverpool title party: Slot

-

Missing out on Champions League would be huge blow: Newcastle boss Howe

-

Fire walkers defy pain in ancient Greek ritual

Fire walkers defy pain in ancient Greek ritual

-

Stocks firm, dollar drops at end of rocky week

-

Dismayed Chinese students ponder prospects after Trump Harvard ban

Dismayed Chinese students ponder prospects after Trump Harvard ban

-

Slot unsure if Alexander-Arnold will play in Liverpool season finale

-

Helmsman of cargo ship run aground in Norway was likely asleep: reports

Helmsman of cargo ship run aground in Norway was likely asleep: reports

-

Sri Lanka's ex-skipper Mathews to quit Test cricket

-

Ban on ousted ex-ruling party divides Bangladesh voters

Ban on ousted ex-ruling party divides Bangladesh voters

-

UK newspaper The Telegraph set for US ownership

| RBGPF | 4.83% | 66.2 | $ | |

| CMSC | -0.55% | 21.84 | $ | |

| SCS | -1.75% | 9.975 | $ | |

| RELX | 0.85% | 55.45 | $ | |

| GSK | -0.72% | 38.64 | $ | |

| NGG | 0.74% | 74.18 | $ | |

| RIO | 0.65% | 61.52 | $ | |

| BTI | 1.15% | 45.12 | $ | |

| CMSD | -0.2% | 21.687 | $ | |

| RYCEF | -0.98% | 11.2 | $ | |

| AZN | 0.55% | 70.34 | $ | |

| BCE | -0.41% | 21.382 | $ | |

| JRI | -0.61% | 12.563 | $ | |

| VOD | -1.01% | 10.435 | $ | |

| BP | -0.23% | 28.875 | $ | |

| BCC | -1.68% | 85.89 | $ |

Owe the IRS? Clear Start Tax Shares Critical Do's and Don'ts to Avoid Costly Mistakes

From Common Myths to Smart Solutions, Clear Start Tax Explains How to Handle IRS Debt the Right Way

IRVINE, CALIFORNIA / ACCESS Newswire / May 23, 2025 / Owing money to the IRS can feel overwhelming, and confusion about what to do often leads taxpayers to make costly mistakes. According to Clear Start Tax, a trusted tax resolution firm, many people fall victim to common myths or make panic-driven decisions that worsen their situation.

Whether it's ignoring IRS notices, falling for false promises, or assuming there are no options, misunderstanding how IRS debt works can quickly escalate to wage garnishments, levies, or liens. Clear Start Tax is working to educate taxpayers on what's true, what's not, and how to take the right steps toward resolution.

Common Myths About Owing the IRS

Many taxpayers delay action because they believe misinformation or rely on assumptions about how the IRS operates. These myths can lead to inaction-or worse, decisions that trigger enforcement. Clear Start Tax highlights some of the most common misconceptions that often cause taxpayers to miss out on relief opportunities or face avoidable penalties:

"If I ignore it, the IRS will leave me alone."

The IRS never forgets-and ignoring notices accelerates enforcement."I shouldn't file if I can't afford to pay."

Not filing triggers additional penalties, even if you owe nothing upfront."Tax relief is only for people in extreme hardship."

Many taxpayers qualify for relief programs without being in financial crisis."I can negotiate directly with the IRS without risk."

A single error on financial forms can lead to denial, delays, or tougher terms.

"The biggest mistake we see is taxpayers believing they have no options-or believing the wrong ones," said the Head of Client Solutions at Clear Start Tax. "Understanding the facts is the first step to avoiding serious consequences."

Step-by-Step: How to Start Resolving IRS Debt the Right Way

Once taxpayers understand what not to believe, the next challenge is knowing where to begin. The IRS does offer programs to help, but they require proactive effort and accurate information. Clear Start Tax recommends following these essential steps to avoid enforcement and move toward a manageable resolution:

Open Every IRS Letter - Important deadlines and warnings are often missed

File All Outstanding Returns - Staying current is critical, even without payment

Review Your Finances Honestly - Know what you can actually afford

Explore IRS Programs - Options like Offer in Compromise, Installment Agreements, or CNC status can offer real relief

Consult a Licensed Tax Professional - Expert guidance prevents errors and maximizes your chances of approval

"The IRS provides relief options, but navigating them correctly is critical," added the Head of Client Solutions at Clear Start Tax. "We help taxpayers avoid costly mistakes and ensure they get the best possible outcome."

Clear Start Tax: Guiding Taxpayers Away From Mistakes-and Toward Relief

Successfully resolving IRS debt isn't just about knowing what options exist-it's about avoiding missteps and following the right process from start to finish. Many taxpayers lose time, money, or face enforcement simply because they misunderstood IRS procedures or submitted incomplete information. Clear Start Tax provides the expertise and support needed to navigate complex tax issues confidently and efficiently.

IRS notice review and strategic next steps

Application support for relief programs like OIC and CNC

Customized payment solutions based on real financial situations

Direct IRS communication to prevent enforcement actions

About Clear Start Tax

Clear Start Tax is a full-service tax liability resolution firm that serves taxpayers throughout the United States. The company specializes in assisting individuals and businesses with a wide range of IRS and state tax issues, including back taxes, wage garnishment relief, IRS appeals, and offers in compromise. Clear Start Tax helps taxpayers apply for the IRS Fresh Start Program, providing expert guidance in tax resolution. Fully accredited and A+ rated by the Better Business Bureau, the firm's unique approach and commitment to long-term client success distinguish it as a leader in the tax resolution industry.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 535-1627

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

F.Schneider--AMWN