-

Witness accusing Sean Combs of sexual assault defends online posts of 'great times'

Witness accusing Sean Combs of sexual assault defends online posts of 'great times'

-

Trump says will double steel, aluminum tariffs to 50%

-

Taylor, Griffin share lead at PGA Tour's Memorial Tournament

Taylor, Griffin share lead at PGA Tour's Memorial Tournament

-

Trump says to double steel tariff to 50%

-

Alcaraz fights into French Open last 16 as Swiatek, Sabalenka progress

Alcaraz fights into French Open last 16 as Swiatek, Sabalenka progress

-

Central Nigeria flooding kill more than 115

-

Alcaraz wobbles but reaches French Open last 16

Alcaraz wobbles but reaches French Open last 16

-

Germany qualify, England hit six in Women's Nations League

-

Pelicans ace Williamson accused of rape in LA civil suit

Pelicans ace Williamson accused of rape in LA civil suit

-

Trump says Macrons 'are fine' after plane row video

-

'M*A*S*H' actress Loretta Swit dead: publicist

'M*A*S*H' actress Loretta Swit dead: publicist

-

Stocks mixed after Trump accuses China of violating tariff deal

-

How Switzerland's Birch glacier collapsed

How Switzerland's Birch glacier collapsed

-

Musk vows to stay Trump's 'friend' in bizarre black-eyed farewell

-

Who said what: French Open day 6

Who said what: French Open day 6

-

Hamilton determined to make Ferrari adventure work

-

PSG will handle pressure in Champions League final, says skipper Marquinhos

PSG will handle pressure in Champions League final, says skipper Marquinhos

-

Swiatek and Sabalenka into French Open last 16

-

The world's most unpopular president? Peru's leader clings to power

The world's most unpopular president? Peru's leader clings to power

-

Comedian Russell Brand pleads not guilty to rape, sexual assault charges

-

Frenchman Fils pulls out of Roland Garros with injury

Frenchman Fils pulls out of Roland Garros with injury

-

Whitecaps look to make history in CONCACAF final

-

Rohit stars as Mumbai knock Gujarat out of IPL

Rohit stars as Mumbai knock Gujarat out of IPL

-

US top court lets Trump revoke legal status for 500,000 migrants

-

Farhan and Abrar star as resurgent Pakistan win Bangladesh series

Farhan and Abrar star as resurgent Pakistan win Bangladesh series

-

Trump accuses China of violating tariff de-escalation deal

-

'Nice show': Swiatek says women deserve French Open night matches

'Nice show': Swiatek says women deserve French Open night matches

-

World Boxing introducing gender tests for all boxers, targets Khelif

-

Mexico says 10 Colombian ex-soldiers arrested after deadly blast

Mexico says 10 Colombian ex-soldiers arrested after deadly blast

-

Bolsonaro 'never' discussed coup plot, ally tells Brazil court

-

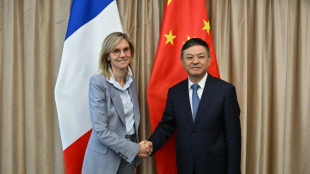

France says it has common ground with China on environment

France says it has common ground with China on environment

-

Navalny widow, media watchdog to launch TV channel

-

'We deserve to be here' - Inzaghi calls on Inter to seize chance in Champions League final

'We deserve to be here' - Inzaghi calls on Inter to seize chance in Champions League final

-

Google makes case for keeping Chrome browser

-

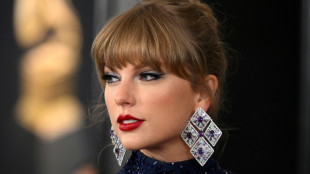

Taylor Swift buys back rights to her old music

Taylor Swift buys back rights to her old music

-

Drug claims overshadow Musk's Oval Office farewell

-

'On song' Zheng dances into French Open last 16

'On song' Zheng dances into French Open last 16

-

Piastri bounces back in second practice at the Spanish Grand Prix

-

Canada growth up but Trump tariffs starting to hurt

Canada growth up but Trump tariffs starting to hurt

-

Death toll in central Nigeria flooding rises to 115

-

Liverpool step up bid to land Leverkusen star Wirtz: reports

Liverpool step up bid to land Leverkusen star Wirtz: reports

-

Stocks dip as Trump raises trade risk with China

-

Prodhomme wins Giro stage as Del Toro holds lead

Prodhomme wins Giro stage as Del Toro holds lead

-

Swiatek, Sabalenka through as Musetti battles into French Open last 16

-

'Really worried': Ukrainian pupils mark end of school as war drags on

'Really worried': Ukrainian pupils mark end of school as war drags on

-

Abortion pill inventor Etienne-Emile Baulieu dies aged 98

-

Oil-rich UAE orders emissions monitoring in new climate law

Oil-rich UAE orders emissions monitoring in new climate law

-

'I think he wants to stay': Amorim hopeful on Fernandes future

-

Real Madrid agree deal to sign Alexander-Arnold early from Liverpool

Real Madrid agree deal to sign Alexander-Arnold early from Liverpool

-

Swiatek secures place in French Open last 16

Birkenstock Announces Pricing of Secondary Offering and Concurrent Share Repurchase

LONDON, GB / ACCESS Newswire / May 29, 2025 / Birkenstock Holding plc ("BIRKENSTOCK") announced today the pricing of an underwritten secondary public offering of 17,927,344 of BIRKENSTOCK's ordinary shares (the "Ordinary Shares") to be sold by BK LC Lux MidCo S.à r.l. ("MidCo"), an entity affiliated with L Catterton (the "Selling Shareholder"), at a price to the public of $52.50 per share. In connection with the offering, the Selling Shareholder has granted the underwriters a 30-day option to purchase up to 2,100,000 additional Ordinary Shares. BIRKENSTOCK is not selling any Ordinary Shares in the offering and will not receive any proceeds from the sale of the Ordinary Shares by the Selling Shareholder.

The closing of the offering is expected to occur on May 30, 2025, subject to customary closing conditions.

Subject to the completion of this offering, BIRKENSTOCK has repurchased, by way of redemption from the underwriters, 3,927,344 Ordinary Shares that are subject to this offering, at a price per share equal to the price paid by the underwriters in the offering, which redeemed Ordinary Shares will be cancelled and no longer outstanding following the completion of the redemption.

Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC are acting as joint lead book-running managers and BofA Securities as joint bookrunner of, and all three banks as representatives of the underwriters for, the proposed offering. Citigroup, Evercore ISI, Jefferies, Morgan Stanley, UBS Investment Bank, Deutsche Bank Securities, BMO Capital Markets, and BNP PARIBAS are acting as bookrunners for the proposed offering, and Baird, BTIG, Piper Sandler, Stifel, Telsey Advisory Group, William Blair, Williams Trading LLC and Academy Securities are acting as co-managers for the proposed offering.

An automatic shelf registration statement on Form F-3ASR (File No. 333-284905) relating to the resale of the Ordinary Shares was previously filed by BIRKENSTOCK with the United States Securities and Exchange Commission (the "SEC") and became effective upon filing on February 13, 2025 (the "Registration Statement"). Before you invest, you should read the prospectus and the documents incorporated by reference in that Registration Statement, as well as the prospectus supplement related to the offering, for more complete information about BIRKENSTOCK and the offering. You may obtain these documents for free by visiting the SEC website at www.sec.gov. Copies of the preliminary prospectus relating to the proposed offering may also be obtained from Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200 West Street, New York, NY 10282, via telephone: (866) 471-2526, or via email: [email protected]; J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717 or via email: [email protected] and [email protected]; and BofA Securities, NC1-022-02-25, 201 North Tryon Street, Charlotte, NC 28255-0001, Attention: Prospectus Department, via email: [email protected].

The offering is being made only by means of a prospectus supplement and the accompanying prospectus. This press release does not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

This press release shall also not be considered an offer of securities in any member state (each, a "Member State") of the European Economic Area ("EEA") or in the United Kingdom. This press release does not constitute a "prospectus" within the meaning of Regulation (EU) 2017/1129 (as amended the "Prospectus Regulation") or the Prospectus Regulation as it forms part of the laws of the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 (as amended, the "UK Prospectus Regulation"). In the EEA and the United Kingdom, any potential offer of securities would only be made pursuant to an exemption under the Prospectus Regulation or the UK Prospectus Regulation (as applicable) from the requirement to publish a prospectus for offers of securities.

This press release is only directed at: (i) in the United Kingdom, persons having professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the "Order"); (ii) high net worth entities falling within Article 49(2)(a) to (d) of the Order; (iii) persons who are outside the United Kingdom; and (iv) any other person to whom it can otherwise be lawfully distributed (all such persons together being referred to as "Relevant Persons"). Any investment or investment activity to which this press release relates is available only to and will be engaged in only with Relevant Persons, and any person who is not a Relevant Person should not rely on it.

ABOUT BIRKENSTOCK

BIRKENSTOCK is a footwear company with a history dating back to 1774, specializing in products designed for foot support. BIRKENSTOCK manufactures and sells footwear, including sandals and shoes, as well as sleep systems and natural cosmetics.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this press release may constitute "forward-looking" statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Such forward-looking statements relate to our current expectations and views of future events, including our current expectations and views with respect to, among other things, the offering of Ordinary Shares. Forward-looking statements include all statements that do not relate to matters of historical fact. In some cases, you can identify these forward-looking statements by the use of words such as "anticipate," "believe," "could," "expect," "should," "plan," "intend," "estimate" and "potential," "aim," "anticipate," "assume," "continue," "could," "expect," "forecast," "guidance," "intend," "may," "ongoing," "plan," "potential," "predict," "project," "seek," "should," "target," "will," "would" or similar words or phrases, or the negatives of those words or phrases. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward- looking statements. Our actual results could differ materially from those expected in our forward-looking statements for many reasons, including the factors described in the sections titled "Cautionary Statement Regarding Forward-Looking Statements" and "Risk Factors" in our Annual Report on Form 20-F filed with the Securities and Exchange Commission on December 18, 2024 as updated by our reports on Form 6-K that update, supplement or supersede such information. Any forward-looking statement made by us in this press release speaks only as of the date of this press release and is expressly qualified in its entirety by the cautionary statements included in this press release. BIRKENSTOCK undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required by law.

INVESTOR & MEDIA CONTACT

Birkenstock Holding plc

[email protected]

SOURCE: Birkenstock Holding plc

View the original press release on ACCESS Newswire

F.Bennett--AMWN