-

France eyes tougher sentences after violence mars PSG celebrations

France eyes tougher sentences after violence mars PSG celebrations

-

Swiatek and Sabalenka set up French Open clash as Alcaraz in hunt for semis

-

Leverkusen sign Brentford goalie Flekken

Leverkusen sign Brentford goalie Flekken

-

Pornhub owner pressures France over age verification law

-

Smoke from Canadian fires reaches Europe: EU climate monitor

Smoke from Canadian fires reaches Europe: EU climate monitor

-

Germany's Merz defends migration crackdown after court setback

-

Stock markets mostly higher as traders eye possible Trump-Xi talks

Stock markets mostly higher as traders eye possible Trump-Xi talks

-

After Madrid penalty furore, football's lawmakers rule for retakes

-

Reigning champion Swiatek beats Svitolina to reach French Open semis

Reigning champion Swiatek beats Svitolina to reach French Open semis

-

Nepal celebrates 75th ascent anniversary of Mount Annapurna

-

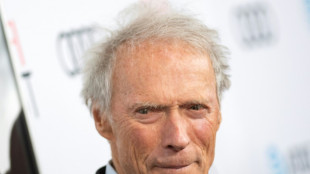

Austrian daily under fire after Clint Eastwood slams 'phony' interview

Austrian daily under fire after Clint Eastwood slams 'phony' interview

-

Ex-England boss Lancaster named Connacht head coach

-

Top seed Sabalenka battles past Zheng to reach French Open semis

Top seed Sabalenka battles past Zheng to reach French Open semis

-

Russia says no quick 'breakthroughs' in 'complex' Ukraine talks

-

Brignone still unsure if she will be fit for Winter Games

Brignone still unsure if she will be fit for Winter Games

-

French policeman to go on trial over 2023 killing of teen that sparked riots

-

UK threatens Abramovich with legal action over Chelsea sale funds

UK threatens Abramovich with legal action over Chelsea sale funds

-

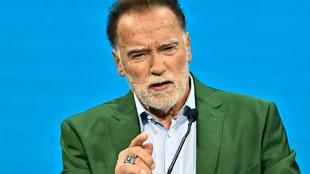

Schwarzenegger surprises Vienna metro users with climate message

-

Top seed Sabalenka beats Zheng to reach French Open semis

Top seed Sabalenka beats Zheng to reach French Open semis

-

Fernandes rejects Saudi move to stay at Man Utd: reports

-

'Aces up the sleeve': Ukraine drone attacks in Russia shake up conflict

'Aces up the sleeve': Ukraine drone attacks in Russia shake up conflict

-

Ruling party-aligned judges set to dominate Mexico Supreme Court

-

Sancho to leave Chelsea after loan spell: reports

Sancho to leave Chelsea after loan spell: reports

-

Stock markets diverge as traders eye possible Trump-Xi talks

-

New rare wild orchid seen in UK for first time in 100 years

New rare wild orchid seen in UK for first time in 100 years

-

Rescuers say Israeli fire kills at least 27 near Gaza aid point

-

Eurozone inflation slows sharply in May

Eurozone inflation slows sharply in May

-

Moscow parties on despite Ukraine drone attacks

-

New police search begins in hunt for missing Madeleine McCann

New police search begins in hunt for missing Madeleine McCann

-

Saudi readies for 'worst case scenario' in sweltering hajj

-

Portuguese police start new search in Madeleine McCann case

Portuguese police start new search in Madeleine McCann case

-

Dutch government falls as far-right leader Wilders quits coalition

-

Wilders: firebrand 'Dutch Trump' gambles for power

Wilders: firebrand 'Dutch Trump' gambles for power

-

Australian woman details fungi interest before deadly meal

-

Most markets rise as traders eye possible Trump-Xi talks

Most markets rise as traders eye possible Trump-Xi talks

-

Rescuers say Israeli fire kills at least 15 near Gaza aid point

-

Trade war cuts global economic growth outlook: OECD

Trade war cuts global economic growth outlook: OECD

-

Year after exodus, silence fills Panama island threatened by sea

-

Former finalist Kyrgios out of Wimbledon with injury

Former finalist Kyrgios out of Wimbledon with injury

-

Time machine: How carbon dating brings the past back to life

-

Nationalist's win dashes hopes for Polish LGBTQ, abortion rights

Nationalist's win dashes hopes for Polish LGBTQ, abortion rights

-

Zico warns Japan players not to follow Brazilians into transfer trap

-

Alcaraz, Swiatek and Sabalenka in French Open semi-final hunt

Alcaraz, Swiatek and Sabalenka in French Open semi-final hunt

-

Mongolia PM resigns after anti-corruption protests

-

In Cairo, the little indie cinema that could

In Cairo, the little indie cinema that could

-

South Korea on cusp, Uzbeks eye historic World Cup spot

-

Contenders eye 'big titles' as Nations League final four kicks off

Contenders eye 'big titles' as Nations League final four kicks off

-

In Canada lake, robot learns to mine without disrupting marine life

-

Asian markets rise as traders eye possible Trump-Xi talks

Asian markets rise as traders eye possible Trump-Xi talks

-

Ancient Myanmar ball game battles for survival in troubled nation

Silicon Valley VCs navigate uncertain AI future

For Silicon Valley venture capitalists, the world has split into two camps: those with deep enough pockets to invest in artificial intelligence behemoths, and everyone else waiting to see where the AI revolution leads.

The generative AI frenzy unleashed by ChatGPT in 2022 has propelled a handful of venture-backed companies to eye-watering valuations.

Leading the pack is OpenAI, which raised $40 billion in its latest funding round at a $300 billion valuation -- unprecedented largesse in Silicon Valley's history.

Other AI giants are following suit. Anthropic now commands a $61.5 billion valuation, while Elon Musk's xAI is reportedly in talks to raise $20 billion at a $120 billion price tag.

The stakes have grown so high that even major venture capital firms -- the same ones that helped birth the internet revolution -- can no longer compete.

Mostly, only the deepest pockets remain in the game: big tech companies, Japan's SoftBank, and Middle Eastern investment funds betting big on a post-fossil fuel future.

"There's a really clear split between the haves and the have-nots," says Emily Zheng, senior analyst at PitchBook, told AFP at the Web Summit in Vancouver.

"Even though the top-line figures are very high, it's not necessarily representative of venture overall, because there's just a few elite startups and a lot of them happen to be AI."

Given Silicon Valley's confidence that AI represents an era-defining shift, venture capitalists face a crucial challenge: finding viable opportunities in an excruciatingly expensive market that is rife with disruption.

Simon Wu of Cathay Innovation sees clear customer demand for AI improvements, even if most spending flows to the biggest players.

"AI across the board, if you're selling a product that makes you more efficient, that's flying off the shelves," Wu explained. "People will find money to spend on OpenAI" and the big players.

The real challenge, according to Andy McLoughlin, managing partner at San Francisco-based Uncork Capital, is determining "where the opportunities are against the mega platforms."

"If you're OpenAI or Anthropic, the amount that you can do is huge. So where are the places that those companies cannot play?"

Finding that answer isn't easy. In an industry where large language models behind ChatGPT, Claude and Google's Gemini seem to have limitless potential, everything moves at breakneck speed.

AI giants including Google, Microsoft, and Amazon are releasing tools and products at a furious pace.

ChatGPT and its rivals now handle search, translation, and coding all within one chatbot -- raising doubts among investors about what new ideas could possibly survive the competition.

Generative AI has also democratized software development, allowing non-professionals to code new applications from simple prompts. This completely disrupts traditional startup organization models.

"Every day I think, what am I going to wake up to today in terms of something that has changed or (was) announced geopolitically or within our world as tech investors," reflected Christine Tsai, founding partner and CEO at 500 Global.

- The 'moat' problem -

In Silicon Valley parlance, companies are struggling to find a "moat" -- that unique feature or breakthrough like Microsoft Windows in the 1990s or Google Search in the 2000s that's so successful it takes competitors years to catch up, if ever.

When it comes to business software, AI is "shaking up the topology of what makes sense and what's investable," noted Brett Gibson, managing partner at Initialized Capital.

The risks seem particularly acute given that generative AI's economics remain unproven. Even the biggest players see a very uncertain path to profitability given the massive sums involved.

The huge valuations for OpenAI and others are causing "a lot of squinting of the eyes, with people wondering 'is this really going to replace labor costs'" at the levels needed to justify the investments, Wu observed.

Despite AI's importance, "I think everyone's starting to see how this might fall short of the magical" even if its early days, he added.

Still, only the rare contrarians believe generative AI isn't here to stay.

In five years, "we won't be talking about AI the same way we're talking about it now, the same way we don't talk about mobile or cloud," predicted McLoughlin.

"It'll become a fabric of how everything gets built."

But who will be building remains an open question.

F.Dubois--AMWN