-

France eyes tougher sentences after violence mars PSG celebrations

France eyes tougher sentences after violence mars PSG celebrations

-

Swiatek and Sabalenka set up French Open clash as Alcaraz in hunt for semis

-

Leverkusen sign Brentford goalie Flekken

Leverkusen sign Brentford goalie Flekken

-

Pornhub owner pressures France over age verification law

-

Smoke from Canadian fires reaches Europe: EU climate monitor

Smoke from Canadian fires reaches Europe: EU climate monitor

-

Germany's Merz defends migration crackdown after court setback

-

Stock markets mostly higher as traders eye possible Trump-Xi talks

Stock markets mostly higher as traders eye possible Trump-Xi talks

-

After Madrid penalty furore, football's lawmakers rule for retakes

-

Reigning champion Swiatek beats Svitolina to reach French Open semis

Reigning champion Swiatek beats Svitolina to reach French Open semis

-

Nepal celebrates 75th ascent anniversary of Mount Annapurna

-

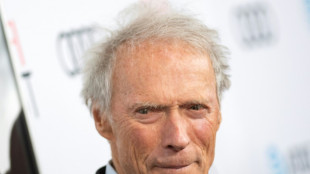

Austrian daily under fire after Clint Eastwood slams 'phony' interview

Austrian daily under fire after Clint Eastwood slams 'phony' interview

-

Ex-England boss Lancaster named Connacht head coach

-

Top seed Sabalenka battles past Zheng to reach French Open semis

Top seed Sabalenka battles past Zheng to reach French Open semis

-

Russia says no quick 'breakthroughs' in 'complex' Ukraine talks

-

Brignone still unsure if she will be fit for Winter Games

Brignone still unsure if she will be fit for Winter Games

-

French policeman to go on trial over 2023 killing of teen that sparked riots

-

UK threatens Abramovich with legal action over Chelsea sale funds

UK threatens Abramovich with legal action over Chelsea sale funds

-

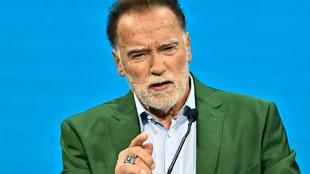

Schwarzenegger surprises Vienna metro users with climate message

-

Top seed Sabalenka beats Zheng to reach French Open semis

Top seed Sabalenka beats Zheng to reach French Open semis

-

Fernandes rejects Saudi move to stay at Man Utd: reports

-

'Aces up the sleeve': Ukraine drone attacks in Russia shake up conflict

'Aces up the sleeve': Ukraine drone attacks in Russia shake up conflict

-

Ruling party-aligned judges set to dominate Mexico Supreme Court

-

Sancho to leave Chelsea after loan spell: reports

Sancho to leave Chelsea after loan spell: reports

-

Stock markets diverge as traders eye possible Trump-Xi talks

-

New rare wild orchid seen in UK for first time in 100 years

New rare wild orchid seen in UK for first time in 100 years

-

Rescuers say Israeli fire kills at least 27 near Gaza aid point

-

Eurozone inflation slows sharply in May

Eurozone inflation slows sharply in May

-

Moscow parties on despite Ukraine drone attacks

-

New police search begins in hunt for missing Madeleine McCann

New police search begins in hunt for missing Madeleine McCann

-

Saudi readies for 'worst case scenario' in sweltering hajj

-

Portuguese police start new search in Madeleine McCann case

Portuguese police start new search in Madeleine McCann case

-

Dutch government falls as far-right leader Wilders quits coalition

-

Wilders: firebrand 'Dutch Trump' gambles for power

Wilders: firebrand 'Dutch Trump' gambles for power

-

Australian woman details fungi interest before deadly meal

-

Most markets rise as traders eye possible Trump-Xi talks

Most markets rise as traders eye possible Trump-Xi talks

-

Rescuers say Israeli fire kills at least 15 near Gaza aid point

-

Trade war cuts global economic growth outlook: OECD

Trade war cuts global economic growth outlook: OECD

-

Year after exodus, silence fills Panama island threatened by sea

-

Former finalist Kyrgios out of Wimbledon with injury

Former finalist Kyrgios out of Wimbledon with injury

-

Time machine: How carbon dating brings the past back to life

-

Nationalist's win dashes hopes for Polish LGBTQ, abortion rights

Nationalist's win dashes hopes for Polish LGBTQ, abortion rights

-

Zico warns Japan players not to follow Brazilians into transfer trap

-

Alcaraz, Swiatek and Sabalenka in French Open semi-final hunt

Alcaraz, Swiatek and Sabalenka in French Open semi-final hunt

-

Mongolia PM resigns after anti-corruption protests

-

In Cairo, the little indie cinema that could

In Cairo, the little indie cinema that could

-

South Korea on cusp, Uzbeks eye historic World Cup spot

-

Contenders eye 'big titles' as Nations League final four kicks off

Contenders eye 'big titles' as Nations League final four kicks off

-

In Canada lake, robot learns to mine without disrupting marine life

-

Asian markets rise as traders eye possible Trump-Xi talks

Asian markets rise as traders eye possible Trump-Xi talks

-

Ancient Myanmar ball game battles for survival in troubled nation

Oil under $65 a boon for consumers, but a burden on producers

US President Donald Trump's tariffs, his call to "drill baby drill" and especially a decision by OPEC+ to hike crude output quotas have oil prices trading at lows not seen since the Covid pandemic.

That is good news for consumers but not so much for producers, analysts say.

A barrel of Brent North Sea crude, the international benchmark, stands below $65, a far cry from the more than the $120 reached in 2022 following the invasion of Ukraine by major oil producer Russia.

- Lower inflation -

The fall in oil prices has contributed to a global slowdown for inflation, while also boosting growth in countries reliant on importing crude, such as much of Europe.

The US consumer price index, for example, was down 11.8 percent year-on-year in April.

Cheaper crude "increases the level of disposable income" consumers have to be spending on "discretionary items" such as leisure and tourism, said Pushpin Singh, an economist at British research group Cebr.

The price of Brent has fallen by more than $10 compared with a year ago, reducing the cost of various fuel types derived directly from oil.

This is helping to push down transportation and manufacturing costs that may, in the medium term, help further cut prices of consumer goods, Singh told AFP.

But he noted that while the drop in crude prices is partly a consequence of Trump's trade policies, the net effect on inflation remains difficult to predict amid threatened surges to other input costs, such as metals.

At the same time, "cheaper oil can make renewable energy sources less competitive, potentially slowing investment in green technologies", Singh added.

- Oil producers -

As prices retreat however the undisputed losers are oil-producing countries, "especially high-cost producers who at current and lower prices are forced to scale back production in the coming months", said Ole Hansen, head of commodity strategy at Saxo Bank.

Oil trading close to or below $60 "will obviously not be great for shale producers" either, said Rystad Energy analyst Jorge Leon.

"Having lower oil prices is going to be the detriment to their development," he told AFP.

Some companies extracting oil and natural gas from shale rock have already announced reduced investment in the Permian Basin, located between Texas and New Mexico.

For the OPEC+ oil alliance, led by Saudi Arabia and Russia, tolerance for low prices varies greatly.

Saudi Arabia, the United Arab Emirates and Kuwait have monetary reserves allowing them to easily borrow to finance diversified economic projects, Leon said.

Hansen forecast that "the long-term winners are likely to be major OPEC+ producers, especially in the Middle East, as they reclaim market shares that were lost since 2022 when they embarked on voluntary production cuts".

The 22-nation group began a series of cuts in 2022 to prop up crude prices, but Saudi Arabia, Russia and six other members surprised markets recently by sharply raising output.

On Saturday, the countries announced a huge increase in crude production for July with an additional 411,000 barrels a day.

Analysts say the hikes have likely been aimed at punishing OPEC members that have failed to meet their quotas, but it also follows pressure from Trump to lower prices.

That is directly impacting the likes of Iran and Venezuela, whose economies depend heavily on oil revenues.

A lower-price environment also hurts Nigeria, which like other OPEC+ members possesses a more limited ability to borrow funds, according to experts.

Bit non-OPEC member Guyana, whose GDP growth has surged in recent years thanks to the discovery of oil, risks seeing its economy slow.

M.A.Colin--AMWN