-

'Ref Cam' footage won't show controversial incidents - FIFA

'Ref Cam' footage won't show controversial incidents - FIFA

-

Trump admin announces plan to loosen power plant regulations

-

Rabada rues his luck despite five-wicket haul in WTC final

Rabada rues his luck despite five-wicket haul in WTC final

-

Milei says Argentina to move Israel embassy to Jerusalem in 2026

-

Canada town near Vancouver ready to evacuate as fire nears

Canada town near Vancouver ready to evacuate as fire nears

-

Harvey Weinstein found guilty of sexual assault

-

Brian Wilson's top five Beach Boys songs

Brian Wilson's top five Beach Boys songs

-

USGA says no driver worry despite Scheffler, McIlroy test failures

-

Grealish left out of Man City squad for Club World Cup

Grealish left out of Man City squad for Club World Cup

-

France school stabbing suspect said wanted to kill any campus monitor

-

Starc strikes as Australia fight back in WTC final against South Africa

Starc strikes as Australia fight back in WTC final against South Africa

-

Beach Boy Brian Wilson, surf rock poet, dies at 82

-

Protests spread across US despite Trump threats

Protests spread across US despite Trump threats

-

French antiques expert who duped Versailles sentenced to jail

-

Fizzled out: French winemaker risks prison over champagne fraud

Fizzled out: French winemaker risks prison over champagne fraud

-

Disney, Universal launch first major studio lawsuit against AI company

-

N.Ireland politicians urge end to racially motivated riots

N.Ireland politicians urge end to racially motivated riots

-

Latest GM investments in US in line with slowing EV demand: exec

-

Evenepoel dominates Dauphine time-trial to slip into yellow

Evenepoel dominates Dauphine time-trial to slip into yellow

-

Trump to watch 'Les Miserables', tale of revolt and oppression

-

Wall Street climbs on easing US-China tensions, cool US inflation

Wall Street climbs on easing US-China tensions, cool US inflation

-

UK govt injects health service with 'record' spending boost

-

WTA gives ranking protection for players who freeze eggs

WTA gives ranking protection for players who freeze eggs

-

Waymo leads autonomous taxi race in the US

-

New T-Rex ancestor discovered in drawers of Mongolian institute

New T-Rex ancestor discovered in drawers of Mongolian institute

-

Canada town near Vancouver ready to evacuate as fire approaches

-

Scheffler set for 'hardest' test at Oakmont for US Open

Scheffler set for 'hardest' test at Oakmont for US Open

-

Rabada stars as Australia bundled out for 212 in WTC final

-

South Africa dismiss Australia's Smith in WTC final

South Africa dismiss Australia's Smith in WTC final

-

Brewer Heineken unveils $2.75 bn investment in Mexico

-

US inflation edges up but Trump tariff hit limited for now

US inflation edges up but Trump tariff hit limited for now

-

Steel startup aims to keep Sweden's green industry dream alive

-

Gaza-bound activist convoy reaches Libyan capital

Gaza-bound activist convoy reaches Libyan capital

-

Tuchel wants Bellingham to inspire, not intimidate England team-mates

-

Stocks rise on easing US-China trade tensions, cool US inflation

Stocks rise on easing US-China trade tensions, cool US inflation

-

Trump touts 'done' deal with Beijing on rare earths, Chinese students

-

UK hands health service major spending boost

UK hands health service major spending boost

-

Ingebrigtsen coy on return to competition

-

Austria mourns school shooting victims with minute's silence

Austria mourns school shooting victims with minute's silence

-

US inflation edges up as Trump tariffs flow through economy

-

France makes arrests over cryptocurrency kidnapping

France makes arrests over cryptocurrency kidnapping

-

Charity accuses Israel of deadly strike on Gaza office building

-

Russia sentences in absentia Navalny ally to 18 years

Russia sentences in absentia Navalny ally to 18 years

-

Greenland ice melted much faster than average in May heatwave: scientists

-

Olympic champ O'Callaghan in tears after 200m freestyle win at Australian trials

Olympic champ O'Callaghan in tears after 200m freestyle win at Australian trials

-

South Africa pacemen destroy Australia top order in WTC final

-

Starmer condemns two nights of 'mindless' N.Irish violence

Starmer condemns two nights of 'mindless' N.Irish violence

-

Gisele Pelicot, magazine reach settlement over invasion of privacy

-

Nvidia marks Paris tech fair with Europe AI push

Nvidia marks Paris tech fair with Europe AI push

-

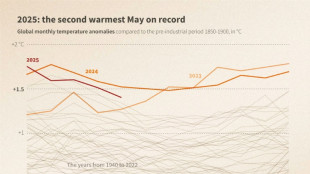

May 2025 second warmest on record: EU climate monitor

Stocks muted as investors track US-China trade talks

Global stock markets diverged on Tuesday as investors waited for the outcome of US-China talks aimed at cementing a fragile trade war truce between the world's two biggest economies.

US indices were muted, while European ones closed in mixed territory, and Asia mostly closed down, with analysts saying much was riding on the talks in London, which were in their second day.

US Commerce Secretary Howard Lutnick told Bloomberg Television that the talks were "going well" and that he expected Tuesday's discussions to last "all day".

With talks dragging on, "the lack of positive headlines weighed on stocks and the dollar," said Kathleen Brooks, research director at XTB trading platform.

Analysts said that any positive sign of agreement would fuel a rise in equities -- but that it could be restrained.

"We wouldn't bank on a big turnaround thanks to any potential trade breakthroughs," said Thomas Mathews, head analyst of Asia Pacific markets for Capital Economics.

"We doubt that the US will back off completely. That's likely to restrain any relief rally," he said.

The talks were expected to be dominated by Chinese exports of rare earth minerals used in a wide range of things including smartphones, electric vehicle batteries and green technology.

Beijing in return was looking for Washington to ease controls on its exports of sensitive electronic components.

New York shares inched a little higher in midday trade.

In Europe, Paris's CAC 40 closed slightly up but Frankfurt's Dax slipped well down.

London's FTSE 100 index closed higher after weak UK unemployment data raised the chances of the Bank of England cutting interest rates into next year, a move which often propels stock prices. It could reach a new record this week if it continues to gain.

Shares in European Union markets, in contrast, could be weakened by the conspicuous lack of any deal between Washington and Brussels before a July 9 deadline for 50-percent US tariffs to take effect. Britain has already sealed an agreement.

Brooks said the upside for the dollar -- which was weaker on Tuesday -- was limited, depending on the scope of any US-China agreement.

"For the dollar to meaningfully retrace some recent losses, we do not think that positive headlines will be enough," she said.

"A trade agreement with an actionable plan to get trade between the US and China flowing freely for the long term is the only way to stop the slide in the buck, in our view."

Investors are also awaiting key US inflation data this week, which could impact the Federal Reserve's monetary policy.

Analysts warn Trump's tariffs will refuel inflation, strengthening the argument to keep interest rates on hold instead of lowering them when the Fed meets next week.

The Fed faces pressure from the president to cut rates.

Oil prices jumped, partly from continued uncertainty about the direction of US-Iran talks on Tehran's nuclear programme.

Iran said a new round of talks was planned for Sunday, in the Omani capital Muscat -- but Trump had earlier said the meeting was expected on Thursday. Each side has drawn up proposals for the other to consider.

- Key figures at around 1545 GMT -

New York - Dow: FLAT at 42,767.94 points

New York - S&P 500: UP 0.1 percent at 6,012.15

New York - Nasdaq Composite: FLAT at 19,584.50

London - FTSE 100: UP 0.2 percent at 8,853.08 (close)

Paris - CAC 40: UP 0.2 percent at 7,804.33 (close)

Frankfurt - DAX: DOWN 0.8 percent at 23,987.56 (close)

Tokyo - Nikkei 225: UP 0.3 percent at 38,211.51 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 24,162.87 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,384.82 (close)

Euro/dollar: UP at $1.1423 from $1.1420 on Monday

Pound/dollar: DOWN at $1.3508 from $1.3552

Dollar/yen: DOWN at 144.90 yen 144.60 yen

Euro/pound: UP 84.57 pence from 84.27 pence

Brent North Sea Crude: UP 1.0 percent at $67.69 per barrel

West Texas Intermediate: UP 1.0 percent at $65.94 per barrel

Ch.Kahalev--AMWN