-

Hurricane Erin drenches Caribbean islands, threatens US coast

Hurricane Erin drenches Caribbean islands, threatens US coast

-

Europeans arrive for high-stakes Trump and Zelensky talks

-

Trump, Zelensky and Europeans meet in bid to resolve split over Russia

Trump, Zelensky and Europeans meet in bid to resolve split over Russia

-

Hamas accepts new Gaza truce plan: Hamas official

-

Stocks under pressure ahead of Zelensky-Trump talks

Stocks under pressure ahead of Zelensky-Trump talks

-

Russian attacks kill 14 in Ukraine ahead of Trump-Zelensky talks

-

Lassana Diarra seeks 65 mn euros from FIFA and Belgian FA in transfer case

Lassana Diarra seeks 65 mn euros from FIFA and Belgian FA in transfer case

-

Air Canada flight attendants face new pressure to end strike

-

Alonso says 'no excuses' as Real Madrid prepare for La Liga opener

Alonso says 'no excuses' as Real Madrid prepare for La Liga opener

-

Deadly wildfires rage across Spain as record area of land burnt

-

Swedish ex-govt adviser goes on trial over mislaid documents

Swedish ex-govt adviser goes on trial over mislaid documents

-

Injured Springboks captain Kolisi out for four weeks

-

Irish literary star Sally Rooney pledges UK TV fees to banned pro-Palestine group

Irish literary star Sally Rooney pledges UK TV fees to banned pro-Palestine group

-

Stocks mixed ahead of Trump-Zelensky talks

-

Son of Norway princess charged with four rapes

Son of Norway princess charged with four rapes

-

Fresh Pakistan monsoon rains kill 20, halt rescue efforts

-

Forest sign French forward Kalimuendo

Forest sign French forward Kalimuendo

-

Zelensky warns against 'rewarding' Russia after Trump urges concessions

-

FIFA boss condemns racial abuse in German Cup games

FIFA boss condemns racial abuse in German Cup games

-

Stocks diverge ahead of Trump-Zelensky talks

-

Spain and Portugal battle wildfires as death toll mounts

Spain and Portugal battle wildfires as death toll mounts

-

Joao Felix says late Jota 'will forever be part of football history'

-

Javelin star Kitaguchi finds new home in small Czech town

Javelin star Kitaguchi finds new home in small Czech town

-

Rain halts rescue operation after Pakistan floods kill hundreds

-

Zelensky says Russia must end war, after Trump pressures Ukraine

Zelensky says Russia must end war, after Trump pressures Ukraine

-

China slams Germany for 'hyping' regional tensions in Asia

-

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

-

Asia stocks up before Trump-Zelensky talks

-

Fight to save last forests of the Comoros unites farmers, NGOs

Fight to save last forests of the Comoros unites farmers, NGOs

-

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

-

Five killed in Russian drone attack on Ukraine apartment block

Five killed in Russian drone attack on Ukraine apartment block

-

Myanmar junta sets December 28 poll date despite raging civil war

-

German minister says China 'increasingly aggressive'

German minister says China 'increasingly aggressive'

-

Singapore key exports slip in July as US shipments tumble 42.7 pct

-

German great Mueller has goal ruled out on MLS debut for Vancouver

German great Mueller has goal ruled out on MLS debut for Vancouver

-

Zelensky, European leaders head to US for talks on peace deal terms

-

Tourism deal puts one of Egypt's last wild shores at risk

Tourism deal puts one of Egypt's last wild shores at risk

-

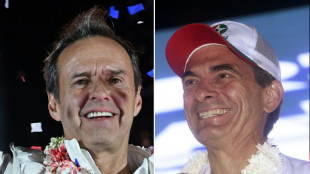

Two right-wing candidates headed to Bolivia presidential run-off

-

Australian court fines Qantas US$59 million for illegal layoffs

Australian court fines Qantas US$59 million for illegal layoffs

-

Games industry in search of new winning combo at Gamescom 2025

-

Rooms of their own: women-only communities thrive in China

Rooms of their own: women-only communities thrive in China

-

Social media hit Ilona Maher takes women's rugby onto new plane

-

Asia stocks up, oil down before Trump-Zelensky talks

Asia stocks up, oil down before Trump-Zelensky talks

-

Zelensky returns to site of stunning Oval Office shouting match

-

Two right-wing candidates headed to Bolivia presidential run-off: projection

Two right-wing candidates headed to Bolivia presidential run-off: projection

-

Land Betterment Celebrates Kim Bryden's Service as Foundational Board Member

-

Newsmax Announces Settlement with Dominion Voting Systems

Newsmax Announces Settlement with Dominion Voting Systems

-

Cubic Awarded U.S. Army Program Executive Officer (PEO), Simulation, Training and Instrumentation (STRI), Synthetic Training Environment (STE) Live Training Systems (LTS) Mortars Rapid Fielding Contract

-

Ambience Healthcare Unveils Chart Chat: The First AI Copilot Built Into the EHR

Ambience Healthcare Unveils Chart Chat: The First AI Copilot Built Into the EHR

-

Fast Finance Pay Corp Reports Second Quarter 2025 Financial Results and Provides a Business Update

| CMSC | 0.11% | 23.145 | $ | |

| BCC | -0.82% | 85.29 | $ | |

| NGG | -1.03% | 70.7 | $ | |

| GSK | -0.31% | 39.24 | $ | |

| AZN | 0.39% | 79.483 | $ | |

| BTI | 1.2% | 57.843 | $ | |

| RIO | -1.42% | 60.385 | $ | |

| BCE | 0.37% | 25.705 | $ | |

| SCS | -0.31% | 16.1 | $ | |

| CMSD | -0.21% | 23.29 | $ | |

| RYCEF | 0.68% | 14.7 | $ | |

| JRI | -0.19% | 13.335 | $ | |

| RBGPF | 3.84% | 76 | $ | |

| VOD | 0.44% | 11.722 | $ | |

| BP | -0.85% | 34.04 | $ | |

| RELX | -0.23% | 47.85 | $ |

Swiss central bank cuts interest rates to zero percent

The Swiss National Bank cut interest rates to zero percent on Thursday as inflation cools and the franc strengthens, while the economic outlook has deteriorated.

The SNB, however, held off a decision to return to its era of negative rates -- a policy that helped to curb the Swiss franc's rise but was unpopular among pension funds and other investors.

The franc's movement is also under scrutiny in the United States, as the US Treasury Department added Switzerland to its watch list of countries likely to manipulate their currencies earlier this month.

The SNB says its interventions in the foreign exchange market aim to ensure price stability, not unduly increase the Swiss economy's competitiveness.

The Swiss currency is a safe haven investment that has climbed against the dollar since US President Donald Trump launched his tariff blitz in April.

In Thursday's statement, the SNB -- which has denied manipulating the franc -- said it "remains willing to be active in the foreign exchange market as necessary".

The SNB cited easing inflationary pressure in its decision to cut rates by a quarter point, but it also pointed to a gloomy economic forecast.

"The global economic outlook for the coming quarters has deteriorated due to the increase in trade tensions," the central bank said, adding that the outlook for Switzerland remained uncertain.

"Developments abroad continue to represent the main risk," it said, expecting growth in the global economy to weaken over the coming quarters.

- Cooling inflation -

The SNB said Swiss gross domestic product growth was strong in the first quarter of the year -- largely due to exports to the United States being brought forward ahead of Trump's tariff manoeuvres.

But stripping that factor out, growth was more moderate, and is likely to slow again and remain subdued for the rest of the year, the SNB said.

The SNB expects GDP growth of one percent to 1.5 percent for 2025, and for 2026 too.

It said Swiss unemployment was likely to continue to rise slightly.

The bank lowered its inflation forecast for 2025 from 0.4 percent to 0.2 percent, and for 2026 from 0.8 percent to 0.5 percent.

The consumer price index even fell into negative territory in May, at minus 0.1 percent.

- Negative rates -

Between 2015 and 2022, the SNB's monetary policy was based on a negative interest rate of minus 0.75 percent -- which increased the cost of deposits held by banks and financial institutions relative to the amounts they were required to entrust to the central bank.

Those seven years left a bitter memory for major savers, who bore the brunt in fees, while pension funds were forced into riskier investments.

Negative rates make the Swiss franc less attractive to investors as it reduces returns on investments.

Thursday's decision was widely expected by analysts.

Adrian Prettejohn, Europe economist at the London-based research group Capital Economics, said the SNB is expected to move rates to negative 0.25 percent at its September meeting due to deflation.

"There are also significant downside risks to inflation from trade tensions as well as heightened geopolitical uncertainty, which could push up the value of the franc further," he said.

He said the central bank's language on currency interventions "supports our view that the SNB is not planning to use foreign exchange interventions as its main tool for loosening monetary policy anytime soon".

O.Norris--AMWN