-

Hurricane Erin drenches Caribbean islands, threatens US coast

Hurricane Erin drenches Caribbean islands, threatens US coast

-

Europeans arrive for high-stakes Trump and Zelensky talks

-

Trump, Zelensky and Europeans meet in bid to resolve split over Russia

Trump, Zelensky and Europeans meet in bid to resolve split over Russia

-

Hamas accepts new Gaza truce plan: Hamas official

-

Stocks under pressure ahead of Zelensky-Trump talks

Stocks under pressure ahead of Zelensky-Trump talks

-

Russian attacks kill 14 in Ukraine ahead of Trump-Zelensky talks

-

Lassana Diarra seeks 65 mn euros from FIFA and Belgian FA in transfer case

Lassana Diarra seeks 65 mn euros from FIFA and Belgian FA in transfer case

-

Air Canada flight attendants face new pressure to end strike

-

Alonso says 'no excuses' as Real Madrid prepare for La Liga opener

Alonso says 'no excuses' as Real Madrid prepare for La Liga opener

-

Deadly wildfires rage across Spain as record area of land burnt

-

Swedish ex-govt adviser goes on trial over mislaid documents

Swedish ex-govt adviser goes on trial over mislaid documents

-

Injured Springboks captain Kolisi out for four weeks

-

Irish literary star Sally Rooney pledges UK TV fees to banned pro-Palestine group

Irish literary star Sally Rooney pledges UK TV fees to banned pro-Palestine group

-

Stocks mixed ahead of Trump-Zelensky talks

-

Son of Norway princess charged with four rapes

Son of Norway princess charged with four rapes

-

Fresh Pakistan monsoon rains kill 20, halt rescue efforts

-

Forest sign French forward Kalimuendo

Forest sign French forward Kalimuendo

-

Zelensky warns against 'rewarding' Russia after Trump urges concessions

-

FIFA boss condemns racial abuse in German Cup games

FIFA boss condemns racial abuse in German Cup games

-

Stocks diverge ahead of Trump-Zelensky talks

-

Spain and Portugal battle wildfires as death toll mounts

Spain and Portugal battle wildfires as death toll mounts

-

Joao Felix says late Jota 'will forever be part of football history'

-

Javelin star Kitaguchi finds new home in small Czech town

Javelin star Kitaguchi finds new home in small Czech town

-

Rain halts rescue operation after Pakistan floods kill hundreds

-

Zelensky says Russia must end war, after Trump pressures Ukraine

Zelensky says Russia must end war, after Trump pressures Ukraine

-

China slams Germany for 'hyping' regional tensions in Asia

-

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

-

Asia stocks up before Trump-Zelensky talks

-

Fight to save last forests of the Comoros unites farmers, NGOs

Fight to save last forests of the Comoros unites farmers, NGOs

-

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

-

Five killed in Russian drone attack on Ukraine apartment block

Five killed in Russian drone attack on Ukraine apartment block

-

Myanmar junta sets December 28 poll date despite raging civil war

-

German minister says China 'increasingly aggressive'

German minister says China 'increasingly aggressive'

-

Singapore key exports slip in July as US shipments tumble 42.7 pct

-

German great Mueller has goal ruled out on MLS debut for Vancouver

German great Mueller has goal ruled out on MLS debut for Vancouver

-

Zelensky, European leaders head to US for talks on peace deal terms

-

Tourism deal puts one of Egypt's last wild shores at risk

Tourism deal puts one of Egypt's last wild shores at risk

-

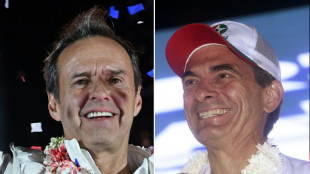

Two right-wing candidates headed to Bolivia presidential run-off

-

Australian court fines Qantas US$59 million for illegal layoffs

Australian court fines Qantas US$59 million for illegal layoffs

-

Games industry in search of new winning combo at Gamescom 2025

-

Rooms of their own: women-only communities thrive in China

Rooms of their own: women-only communities thrive in China

-

Social media hit Ilona Maher takes women's rugby onto new plane

-

Asia stocks up, oil down before Trump-Zelensky talks

Asia stocks up, oil down before Trump-Zelensky talks

-

Zelensky returns to site of stunning Oval Office shouting match

-

Two right-wing candidates headed to Bolivia presidential run-off: projection

Two right-wing candidates headed to Bolivia presidential run-off: projection

-

Land Betterment Celebrates Kim Bryden's Service as Foundational Board Member

-

Newsmax Announces Settlement with Dominion Voting Systems

Newsmax Announces Settlement with Dominion Voting Systems

-

Cubic Awarded U.S. Army Program Executive Officer (PEO), Simulation, Training and Instrumentation (STRI), Synthetic Training Environment (STE) Live Training Systems (LTS) Mortars Rapid Fielding Contract

-

Ambience Healthcare Unveils Chart Chat: The First AI Copilot Built Into the EHR

Ambience Healthcare Unveils Chart Chat: The First AI Copilot Built Into the EHR

-

Fast Finance Pay Corp Reports Second Quarter 2025 Financial Results and Provides a Business Update

| CMSC | 0.11% | 23.145 | $ | |

| BCC | -0.82% | 85.29 | $ | |

| NGG | -1.03% | 70.7 | $ | |

| GSK | -0.31% | 39.24 | $ | |

| AZN | 0.39% | 79.483 | $ | |

| BTI | 1.2% | 57.843 | $ | |

| RIO | -1.42% | 60.385 | $ | |

| BCE | 0.37% | 25.705 | $ | |

| SCS | -0.31% | 16.1 | $ | |

| CMSD | -0.21% | 23.29 | $ | |

| RYCEF | 0.68% | 14.7 | $ | |

| JRI | -0.19% | 13.335 | $ | |

| RBGPF | 3.84% | 76 | $ | |

| VOD | 0.44% | 11.722 | $ | |

| BP | -0.85% | 34.04 | $ | |

| RELX | -0.23% | 47.85 | $ |

Who Really Qualifies for IRS Fresh Start Program? Clear Start Tax Breaks Down the Fine Print in 2025

Clear Start Tax Explains Why Not Everyone Qualifies for IRS Fresh Start, and What It Really Takes to Settle Tax Debt for Less

IRVINE, CA / ACCESS Newswire / June 20, 2025 / The IRS Fresh Start Program has helped many taxpayers resolve overwhelming tax debt, but according to Clear Start Tax, widespread myths continue to mislead the public about who actually qualifies. While many companies advertise Fresh Start as a guaranteed solution, the reality is that eligibility depends on strict financial guidelines that the IRS carefully evaluates.

"Fresh Start can absolutely provide life-changing relief, but not everyone qualifies automatically," said the Head of Client Solutions at Clear Start Tax. "Too often, people are told they're eligible without anyone reviewing their full financial picture."

The Biggest Myth: Everyone Qualifies

Clear Start Tax says the most common misunderstanding is that Fresh Start is an open invitation for anyone who owes back taxes to settle for pennies on the dollar. In truth, Fresh Start is a collection of IRS programs - such as Offer in Compromise, Installment Agreements, and Currently Not Collectible status - each with its own eligibility rules.

"The IRS doesn't approve Fresh Start offers based on how much you owe. They approve based on how much you can actually pay," the Head of Client Solutions at Clear Start Tax explains.

What the IRS Looks at to Determine Eligibility

The IRS reviews every applicant's financial situation in detail. Key factors include:

Income: Wages, self-employment, retirement income, and household earnings

Assets: Equity in real estate, vehicles, bank accounts, retirement funds, and investments

Expenses: Necessary living costs including housing, food, insurance, medical expenses, and dependents

Household Size: How many people rely on the taxpayer's income

Age and Health: Retirement status or medical conditions may impact financial analysis

The IRS calculates a taxpayer's "reasonable collection potential" based on these factors to decide whether full or partial settlement is allowed.

By answering a few simple questions, taxpayers can find out if they're eligible for the IRS Fresh Start Program and take the first step toward resolving their tax debt.

How Clear Start Tax Builds Strong Cases

Because the IRS process is heavily document-driven, Clear Start Tax takes a hands-on approach to preparing each Fresh Start application. Their team:

Conducts full financial reviews to uncover eligibility

Collects and organizes required documentation

Calculates accurate offer amounts based on IRS formulas

Communicates directly with the IRS on the client's behalf

Protects clients from submitting unrealistic or non-compliant offers

"The goal isn't just to submit paperwork, but to submit a proposal the IRS will actually accept," the Head of Client Solutions added. "That's where professional preparation makes all the difference."

Beware of Companies That Overpromise

Clear Start Tax also warns taxpayers to be cautious of companies that promote guaranteed Fresh Start approvals or claim every debt can be settled for next to nothing.

"If someone promises you guaranteed Fresh Start approval before reviewing your full financial profile, that's a red flag," said the Head of Client Solutions at Clear Start Tax. "The IRS does not accept every offer, and submitting weak or incomplete proposals can lead to unnecessary delays and additional financial consequences."

About Clear Start Tax

Clear Start Tax is a full-service tax liability resolution firm that serves taxpayers throughout the United States. The company specializes in assisting individuals and businesses with a wide range of IRS and state tax issues, including back taxes, wage garnishment relief, IRS appeals, and offers in compromise. Clear Start Tax helps taxpayers apply for the IRS Fresh Start Program, providing expert guidance in tax resolution. Fully accredited and A+ rated by the Better Business Bureau, the firm's unique approach and commitment to long-term client success distinguish it as a leader in the tax resolution industry.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

(888) 710-3533

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 535-1627

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

M.Fischer--AMWN