-

Lassana Diarra seeks 65 mn euros from FIFA and Belgian FA in transfer case

Lassana Diarra seeks 65 mn euros from FIFA and Belgian FA in transfer case

-

Air Canada flight attendants face new pressure to end strike

-

Alonso says 'no excuses' as Real Madrid prepare for La Liga opener

Alonso says 'no excuses' as Real Madrid prepare for La Liga opener

-

Deadly wildfires rage across Spain as record area of land burnt

-

Swedish ex-govt adviser goes on trial over mislaid documents

Swedish ex-govt adviser goes on trial over mislaid documents

-

Injured Springboks captain Kolisi out for four weeks

-

Irish literary star Sally Rooney pledges UK TV fees to banned pro-Palestine group

Irish literary star Sally Rooney pledges UK TV fees to banned pro-Palestine group

-

Stocks mixed ahead of Trump-Zelensky talks

-

Son of Norway princess charged with four rapes

Son of Norway princess charged with four rapes

-

Fresh Pakistan monsoon rains kill 20, halt rescue efforts

-

Forest sign French forward Kalimuendo

Forest sign French forward Kalimuendo

-

Zelensky warns against 'rewarding' Russia after Trump urges concessions

-

FIFA boss condemns racial abuse in German Cup games

FIFA boss condemns racial abuse in German Cup games

-

Stocks diverge ahead of Trump-Zelensky talks

-

Spain and Portugal battle wildfires as death toll mounts

Spain and Portugal battle wildfires as death toll mounts

-

Joao Felix says late Jota 'will forever be part of football history'

-

Javelin star Kitaguchi finds new home in small Czech town

Javelin star Kitaguchi finds new home in small Czech town

-

Rain halts rescue operation after Pakistan floods kill hundreds

-

Zelensky says Russia must end war, after Trump pressures Ukraine

Zelensky says Russia must end war, after Trump pressures Ukraine

-

China slams Germany for 'hyping' regional tensions in Asia

-

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

-

Asia stocks up before Trump-Zelensky talks

-

Fight to save last forests of the Comoros unites farmers, NGOs

Fight to save last forests of the Comoros unites farmers, NGOs

-

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

-

Five killed in Russian drone attack on Ukraine apartment block

Five killed in Russian drone attack on Ukraine apartment block

-

Myanmar junta sets December 28 poll date despite raging civil war

-

German minister says China 'increasingly aggressive'

German minister says China 'increasingly aggressive'

-

Singapore key exports slip in July as US shipments tumble 42.7 pct

-

German great Mueller has goal ruled out on MLS debut for Vancouver

German great Mueller has goal ruled out on MLS debut for Vancouver

-

Zelensky, European leaders head to US for talks on peace deal terms

-

Tourism deal puts one of Egypt's last wild shores at risk

Tourism deal puts one of Egypt's last wild shores at risk

-

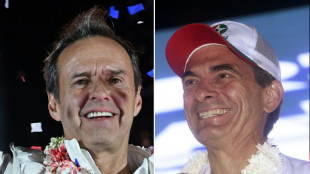

Two right-wing candidates headed to Bolivia presidential run-off

-

Australian court fines Qantas US$59 million for illegal layoffs

Australian court fines Qantas US$59 million for illegal layoffs

-

Games industry in search of new winning combo at Gamescom 2025

-

Rooms of their own: women-only communities thrive in China

Rooms of their own: women-only communities thrive in China

-

Social media hit Ilona Maher takes women's rugby onto new plane

-

Asia stocks up, oil down before Trump-Zelensky talks

Asia stocks up, oil down before Trump-Zelensky talks

-

Zelensky returns to site of stunning Oval Office shouting match

-

Two right-wing candidates headed to Bolivia presidential run-off: projection

Two right-wing candidates headed to Bolivia presidential run-off: projection

-

Cubic Awarded U.S. Army Program Executive Officer (PEO), Simulation, Training and Instrumentation (STRI), Synthetic Training Environment (STE) Live Training Systems (LTS) Mortars Rapid Fielding Contract

-

Ambience Healthcare Unveils Chart Chat: The First AI Copilot Built Into the EHR

Ambience Healthcare Unveils Chart Chat: The First AI Copilot Built Into the EHR

-

Fast Finance Pay Corp Reports Second Quarter 2025 Financial Results and Provides a Business Update

-

SonicStrategy Expands Exposure to 38.8 Million S Tokens Across Staking, Delegation, and DeFi Holdings, Reinforcing Institutional Alignment and Long-Term Yield Strategy

SonicStrategy Expands Exposure to 38.8 Million S Tokens Across Staking, Delegation, and DeFi Holdings, Reinforcing Institutional Alignment and Long-Term Yield Strategy

-

New to The Street's Esteemed Client Synergy CHC Corp. (NASDAQ: SNYR) Announces Nationwide EG America Rollout for FOCUSfactor(R) Focus + Energy EG America, 6th Largest U.S. Convenience Chain, Expands Distribution Across 1,600+ High-Traffic Locations

-

MDCE Subsidiary Infinite Auctions Soars with 2,500% YoY Revenue Growth in Q2 2025

MDCE Subsidiary Infinite Auctions Soars with 2,500% YoY Revenue Growth in Q2 2025

-

Waste Energy Corp Closes Deal to Reduce its Debt by $1 Million

-

Aeluma to Participate in Upcoming Investor Conferences

Aeluma to Participate in Upcoming Investor Conferences

-

Form Bio Appoints Michelle Chen, Ph.D. as President and Chief Executive Officer

-

WidePoint to Participate in the Lytham Partners 2025 Consumer & Technology Investor Summit on August 19, 2025

WidePoint to Participate in the Lytham Partners 2025 Consumer & Technology Investor Summit on August 19, 2025

-

Ondas Enters into Definitive Agreement to Strengthen Multi-Domain Autonomy Leadership with Strategic Acquisition of Robotics Innovator Apeiro Motion

Does Hospital Indemnity Insurance Help Cover Recurring Stays?

NEW YORK, NY / ACCESS Newswire / June 21, 2025 / A three-day stay in the hospital costs an average of $30,000 in the United States.1 While health insurance can help reduce your out-of-pocket costs if you have to be admitted to the hospital, there are contingent costs that may not be covered by your insurer. The cost of hospital stays, and other expenses like childcare could have a significant impact while you are unable to work. A hospital indemnity insurance policy can help with these costs. Here, we explore what health insurance helps cover and how the cash benefits of hospital indemnity insurance can help fill coverage gaps relating to recurring hospital stays.

What does health insurance help cover?

Many people receive health insurance through their employer, which can help with the cost of a hospital stay. Employer-sponsored health insurance plans cost an average of $111 per month, while Marketplace plans cost an average of $456 per month.2 So, if you're wondering, "How much is health insurance?," the answer depends on your specific circumstances and plan options.

Marketplace health insurance plans typically cover a range of essential health benefits, including:3

Outpatient services

Emergency services

Hospitalization for surgery or overnight stays

Pregnancy, maternity and newborn care

Mental health and behavioral health treatment

Prescription drugs

Rehabilitative and habilitative services and devices

Laboratory services

Preventive and wellness services

Chronic disease management

Pediatric services

Hospital costs are usually covered at least in part by primary health insurance plans, but you'll still have to pay copays and deductibles, and your health insurance plan may be subject to coverage limits.

What is hospital indemnity insurance?

Hospital indemnity insurance is a supplemental plan that can help fill gaps in your primary health insurance. It's not a replacement for health insurance but can help you with unexpected expenses and provide additional support if you've had multiple hospital stays that forced you to reach a coverage limit.

Hospital indemnity insurance works similarly to health insurance in that you pay premiums to an insurance provider in exchange for coverage. You may have access to a plan through your employer, or you can purchase an individual plan directly from an insurance company. Unlike health insurance, however, hospital indemnity insurance plans typically pay eligible cash benefits based on the policy option you choose. You can use the benefits in any way you see fit, such as:

Out-of-pocket medical expenses

Childcare

Living expenses like groceries, rent and utilities

Plans may function differently between providers, but typically, you can file a claim for care provided while in the hospital, and your insurance provider pays eligible claims to help you with the costs of your hospital stay.

Why is hospital indemnity insurance worth it?

There are a number of reasons why you might consider a hospital indemnity insurance plan. These may include:

Added financial assistance: Hospital stays can be expensive, especially if you have to go multiple times in the same year. Hospital indemnity insurance helps provide added financial support for recurring visits.

Flexibility: Health insurance plans typically pay the hospital directly for treatment. But hospital indemnity insurance pays cash benefits direct to the policyholder, unless otherwise assigned, so you can use it for both medical and non-medical costs.

Surpassing coverage limits: If you've reached a health insurance coverage limit after being admitted to the hospital several times, you could still use the hospital indemnity insurance.

Ultimately, if you think you or a family member will have multiple stays at the hospital in a given year, hospital indemnity insurance could help provide some added peace of mind.

The bottom line

Hospital indemnity insurance provides coverage options that can help with recurring hospital stays. This supplemental policy pays cash benefits direct to the policyholder, unless otherwise assigned, so you can use your benefits to help fill gaps in your health insurance coverage or help pay living expenses. Consider applying for a hospital indemnity insurance policy for added peace of mind.

Sources:

1 Healthcare.gov - Why health insurance is important. https://www.healthcare.gov/why-coverage-is-important/protection-from-high-medical-costs/. Accessed May 12, 2025.

2 Ramsey Solutions - How Much Does Health Insurance Cost? Updated May 12, 2025. https://www.ramseysolutions.com/insurance/how-much-does-health-insurance-cost. Accessed May 12, 2025.

3 Healthcare.gov - Health benefits & coverage. https://www.healthcare.gov/coverage/what-marketplace-plans-cover/. Accessed May 12, 2025.

Content within this article is provided for general informational purposes and is not provided as tax, legal, health, or financial advice for any person or for any specific situation. Employers, employees, and other individuals should contact their own advisers about their situations. For complete details, including availability and costs of Aflac insurance, please contact your local Aflac agent.

Aflac coverage is underwritten by American Family Life Assurance Company of Columbus. In New York, Aflac coverage is underwritten by American Family Life Assurance Company of New York.

Hospital, B40000 series: In Delaware, Policies B40100DE & B4010HDE. In Idaho, Policies B40100ID & B4010HID. In Oklahoma, Policies B40100OK & B4010HOK. In Pennsylvania, Policies B40100PA & B4010HPA. In Virginia, Policies B40100VA & B4010HVA.

Coverage may not be available in all states, including but not limited to DE, ID, NJ, NM, NY, VA or VT. Benefits/premium rates may vary based on state and plan levels. Optional riders may be available at an additional cost. Policies and riders may also contain a waiting period. Refer to the exact policy and rider forms for benefit details, definitions, limitations, and exclusions.

Aflac WWHQ | 1932 Wynnton Road | Columbus, GA 31999

CONTACT:

Senior PR & Corporate Communications

Contact: Angie Blackmar, 706-392-2097 or [email protected]

SOURCE: Aflac

View the original press release on ACCESS Newswire

M.A.Colin--AMWN