-

Lassana Diarra seeks 65 mn euros from FIFA and Belgian FA in transfer case

Lassana Diarra seeks 65 mn euros from FIFA and Belgian FA in transfer case

-

Air Canada flight attendants face new pressure to end strike

-

Alonso says 'no excuses' as Real Madrid prepare for La Liga opener

Alonso says 'no excuses' as Real Madrid prepare for La Liga opener

-

Deadly wildfires rage across Spain as record area of land burnt

-

Swedish ex-govt adviser goes on trial over mislaid documents

Swedish ex-govt adviser goes on trial over mislaid documents

-

Injured Springboks captain Kolisi out for four weeks

-

Irish literary star Sally Rooney pledges UK TV fees to banned pro-Palestine group

Irish literary star Sally Rooney pledges UK TV fees to banned pro-Palestine group

-

Stocks mixed ahead of Trump-Zelensky talks

-

Son of Norway princess charged with four rapes

Son of Norway princess charged with four rapes

-

Fresh Pakistan monsoon rains kill 20, halt rescue efforts

-

Forest sign French forward Kalimuendo

Forest sign French forward Kalimuendo

-

Zelensky warns against 'rewarding' Russia after Trump urges concessions

-

FIFA boss condemns racial abuse in German Cup games

FIFA boss condemns racial abuse in German Cup games

-

Stocks diverge ahead of Trump-Zelensky talks

-

Spain and Portugal battle wildfires as death toll mounts

Spain and Portugal battle wildfires as death toll mounts

-

Joao Felix says late Jota 'will forever be part of football history'

-

Javelin star Kitaguchi finds new home in small Czech town

Javelin star Kitaguchi finds new home in small Czech town

-

Rain halts rescue operation after Pakistan floods kill hundreds

-

Zelensky says Russia must end war, after Trump pressures Ukraine

Zelensky says Russia must end war, after Trump pressures Ukraine

-

China slams Germany for 'hyping' regional tensions in Asia

-

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

-

Asia stocks up before Trump-Zelensky talks

-

Fight to save last forests of the Comoros unites farmers, NGOs

Fight to save last forests of the Comoros unites farmers, NGOs

-

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

-

Five killed in Russian drone attack on Ukraine apartment block

Five killed in Russian drone attack on Ukraine apartment block

-

Myanmar junta sets December 28 poll date despite raging civil war

-

German minister says China 'increasingly aggressive'

German minister says China 'increasingly aggressive'

-

Singapore key exports slip in July as US shipments tumble 42.7 pct

-

German great Mueller has goal ruled out on MLS debut for Vancouver

German great Mueller has goal ruled out on MLS debut for Vancouver

-

Zelensky, European leaders head to US for talks on peace deal terms

-

Tourism deal puts one of Egypt's last wild shores at risk

Tourism deal puts one of Egypt's last wild shores at risk

-

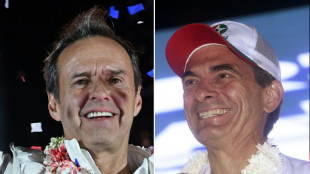

Two right-wing candidates headed to Bolivia presidential run-off

-

Australian court fines Qantas US$59 million for illegal layoffs

Australian court fines Qantas US$59 million for illegal layoffs

-

Games industry in search of new winning combo at Gamescom 2025

-

Rooms of their own: women-only communities thrive in China

Rooms of their own: women-only communities thrive in China

-

Social media hit Ilona Maher takes women's rugby onto new plane

-

Asia stocks up, oil down before Trump-Zelensky talks

Asia stocks up, oil down before Trump-Zelensky talks

-

Zelensky returns to site of stunning Oval Office shouting match

-

Two right-wing candidates headed to Bolivia presidential run-off: projection

Two right-wing candidates headed to Bolivia presidential run-off: projection

-

Cubic Awarded U.S. Army Program Executive Officer (PEO), Simulation, Training and Instrumentation (STRI), Synthetic Training Environment (STE) Live Training Systems (LTS) Mortars Rapid Fielding Contract

-

Ambience Healthcare Unveils Chart Chat: The First AI Copilot Built Into the EHR

Ambience Healthcare Unveils Chart Chat: The First AI Copilot Built Into the EHR

-

Fast Finance Pay Corp Reports Second Quarter 2025 Financial Results and Provides a Business Update

-

SonicStrategy Expands Exposure to 38.8 Million S Tokens Across Staking, Delegation, and DeFi Holdings, Reinforcing Institutional Alignment and Long-Term Yield Strategy

SonicStrategy Expands Exposure to 38.8 Million S Tokens Across Staking, Delegation, and DeFi Holdings, Reinforcing Institutional Alignment and Long-Term Yield Strategy

-

New to The Street's Esteemed Client Synergy CHC Corp. (NASDAQ: SNYR) Announces Nationwide EG America Rollout for FOCUSfactor(R) Focus + Energy EG America, 6th Largest U.S. Convenience Chain, Expands Distribution Across 1,600+ High-Traffic Locations

-

MDCE Subsidiary Infinite Auctions Soars with 2,500% YoY Revenue Growth in Q2 2025

MDCE Subsidiary Infinite Auctions Soars with 2,500% YoY Revenue Growth in Q2 2025

-

Waste Energy Corp Closes Deal to Reduce its Debt by $1 Million

-

Aeluma to Participate in Upcoming Investor Conferences

Aeluma to Participate in Upcoming Investor Conferences

-

Form Bio Appoints Michelle Chen, Ph.D. as President and Chief Executive Officer

-

WidePoint to Participate in the Lytham Partners 2025 Consumer & Technology Investor Summit on August 19, 2025

WidePoint to Participate in the Lytham Partners 2025 Consumer & Technology Investor Summit on August 19, 2025

-

Ondas Enters into Definitive Agreement to Strengthen Multi-Domain Autonomy Leadership with Strategic Acquisition of Robotics Innovator Apeiro Motion

South Korea counts on shipbuilding to ease US tariff woes

Asia's fourth largest economy South Korea is facing gruelling tariffs by US President Donald Trump, but its shipbuilding industry could prove a useful bargaining chip.

Already hit by sector levies on steel and car exports, Seoul is laser-focused on negotiations over a 25 percent country-specific tariff that has been suspended until July 8.

AFP takes a look at what's going on:

- Why shipbuilding? -

In the 1970s, South Korea's military leader president Park Chung-hee accelerated the country's heavy industry, designating sectors such as steel and shipbuilding "strategically important" and rolling out state subsidies.

At the same time, POSCO was founded -- now one of the world's largest steel producers -- and conglomerate Hyundai built its shipyard in southeastern Ulsan, which started to grow rapidly.

European rivals struggled to keep pace.

Sweden's Kockums Shipyard filed for bankruptcy in 1987 -- and in a symbolic shift of global shipbuilding power, Hyundai acquired its 140-metre (460-foot) Goliath crane for one dollar. It now towers over southern Ulsan.

In the 1990s and 2000s, South Korean shipbuilders such as Hyundai Heavy Industries and Samsung Heavy Industries ramped up investment in research and development, backed by generous government subsidies.

The country secured a competitive edge in high-value-added vessels, including LNG carriers, very large crude carriers, and offshore platforms.

Now, South Korea ranks as the world's second-largest shipbuilding nation, trailing only behind China.

- Is it important? -

South Korea's exports hit a record high in 2024, with analysts pointing to shipbuilding as one of the key drivers.

The sector accounted for nearly four percent of total exports and grew by almost 20 percent from the previous year -- reaching $25.6 billion.

Shipbuilding directly employs around 120,000 workers -- roughly one percent of the country's total workforce -- with indirect employment significantly higher in industrial hubs like Ulsan.

Industry data shows so far this year, new orders have exceeded 13 trillion won ($9.4 billion).

In March, Hanwha Ocean secured a landmark $1.6 billion contract to build LNG carriers for Taiwan's Evergreen Marine, one of the largest single orders in the sector this year.

- Why is it a 'bargaining chip'? -

Trump has showed "significant interest in South Korea-US shipbuilding cooperation," said South Korea's trade, industry and energy minister Ahn Duk-geun in April.

Like the Europeans, the US shipbuilding industry has lagged behind South Korea and China, and as a result, the sector is seen as a "highly important bargaining chip in trade negotiations," he added.

At an APEC finance ministers' meeting in South Korea in May, US Trade Representative Jamieson Greer met Chung Ki-sun, vice chairman of HD Hyundai, the country's largest shipbuilder, before he met Seoul's top officials.

"South Korea's shipbuilding and defence industries see a window of opportunity," said Kim Dae-jong, a professor at Sejong University.

- How does it help the US? -

Greer also met with the CEO of Hanwha Ocean, the first non-American company authorised to carry out a dry-dock maintenance of a US Navy vessel.

The move last September was seen as significant as it signalled that Washington sees South Korea, where it already has 28,000 US troops stationed, as a strategic defence hub.

With worries growing about China's expanding naval fleet and potential conflict in the Taiwan Strait, the US has begun seeking reliable overseas shipyards to support its operations in the Asia-Pacific region.

The global market for ship maintenance, repair, and overhaul is projected to exceed $60 billion annually, according to industry estimates.

- Any problems? -

Despite multi-billion-dollar contracts, data suggests South Korea's shipbuilding industry is losing ground in the global race.

China dominates with South Korea's market share dropping, according to industry data.

Demand for eco-friendly vessels is rising, and the government need to overhaul regulations "to support the development of next-generation eco-friendly vessels," Rhee Shin-hyung, a professor at Seoul National University, told AFP.

South Korea's woeful demographics also make staffing hard. In Geoje -– home to Samsung Heavy Industries -– the number of residents in their 20s and 30s has nearly halved in recent years.

Orders are down in 2025 which hints that "the shipbuilding boom may end sooner than the market anticipated," warned Rhee.

Global ship orders between January and April fell by almost half the volume recorded during the same period last year.

Shipbuilders have been enjoying a "supercycle" but unfortunately the "peak is expected to be lower and the boom shorter-lived compared to the past," Nam Chul, vice president at HD Hyundai Heavy Industries, told AFP.

P.Martin--AMWN