-

Lassana Diarra seeks 65 mn euros from FIFA and Belgian FA in transfer case

Lassana Diarra seeks 65 mn euros from FIFA and Belgian FA in transfer case

-

Air Canada flight attendants face new pressure to end strike

-

Alonso says 'no excuses' as Real Madrid prepare for La Liga opener

Alonso says 'no excuses' as Real Madrid prepare for La Liga opener

-

Deadly wildfires rage across Spain as record area of land burnt

-

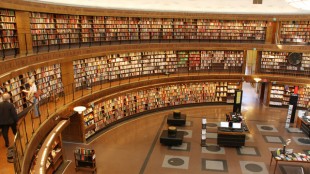

Swedish ex-govt adviser goes on trial over mislaid documents

Swedish ex-govt adviser goes on trial over mislaid documents

-

Injured Springboks captain Kolisi out for four weeks

-

Irish literary star Sally Rooney pledges UK TV fees to banned pro-Palestine group

Irish literary star Sally Rooney pledges UK TV fees to banned pro-Palestine group

-

Stocks mixed ahead of Trump-Zelensky talks

-

Son of Norway princess charged with four rapes

Son of Norway princess charged with four rapes

-

Fresh Pakistan monsoon rains kill 20, halt rescue efforts

-

Forest sign French forward Kalimuendo

Forest sign French forward Kalimuendo

-

Zelensky warns against 'rewarding' Russia after Trump urges concessions

-

FIFA boss condemns racial abuse in German Cup games

FIFA boss condemns racial abuse in German Cup games

-

Stocks diverge ahead of Trump-Zelensky talks

-

Spain and Portugal battle wildfires as death toll mounts

Spain and Portugal battle wildfires as death toll mounts

-

Joao Felix says late Jota 'will forever be part of football history'

-

Javelin star Kitaguchi finds new home in small Czech town

Javelin star Kitaguchi finds new home in small Czech town

-

Rain halts rescue operation after Pakistan floods kill hundreds

-

Zelensky says Russia must end war, after Trump pressures Ukraine

Zelensky says Russia must end war, after Trump pressures Ukraine

-

China slams Germany for 'hyping' regional tensions in Asia

-

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

-

Asia stocks up before Trump-Zelensky talks

-

Fight to save last forests of the Comoros unites farmers, NGOs

Fight to save last forests of the Comoros unites farmers, NGOs

-

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

-

Five killed in Russian drone attack on Ukraine apartment block

Five killed in Russian drone attack on Ukraine apartment block

-

Myanmar junta sets December 28 poll date despite raging civil war

-

German minister says China 'increasingly aggressive'

German minister says China 'increasingly aggressive'

-

Singapore key exports slip in July as US shipments tumble 42.7 pct

-

German great Mueller has goal ruled out on MLS debut for Vancouver

German great Mueller has goal ruled out on MLS debut for Vancouver

-

Zelensky, European leaders head to US for talks on peace deal terms

-

Tourism deal puts one of Egypt's last wild shores at risk

Tourism deal puts one of Egypt's last wild shores at risk

-

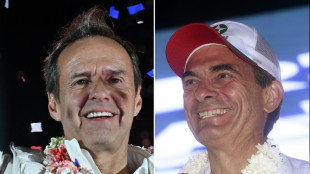

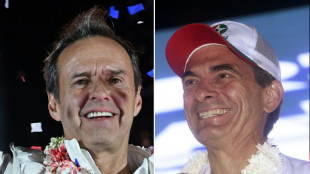

Two right-wing candidates headed to Bolivia presidential run-off

-

Australian court fines Qantas US$59 million for illegal layoffs

Australian court fines Qantas US$59 million for illegal layoffs

-

Games industry in search of new winning combo at Gamescom 2025

-

Rooms of their own: women-only communities thrive in China

Rooms of their own: women-only communities thrive in China

-

Social media hit Ilona Maher takes women's rugby onto new plane

-

Asia stocks up, oil down before Trump-Zelensky talks

Asia stocks up, oil down before Trump-Zelensky talks

-

Zelensky returns to site of stunning Oval Office shouting match

-

Two right-wing candidates headed to Bolivia presidential run-off: projection

Two right-wing candidates headed to Bolivia presidential run-off: projection

-

Cubic Awarded U.S. Army Program Executive Officer (PEO), Simulation, Training and Instrumentation (STRI), Synthetic Training Environment (STE) Live Training Systems (LTS) Mortars Rapid Fielding Contract

-

Ambience Healthcare Unveils Chart Chat: The First AI Copilot Built Into the EHR

Ambience Healthcare Unveils Chart Chat: The First AI Copilot Built Into the EHR

-

Fast Finance Pay Corp Reports Second Quarter 2025 Financial Results and Provides a Business Update

-

SonicStrategy Expands Exposure to 38.8 Million S Tokens Across Staking, Delegation, and DeFi Holdings, Reinforcing Institutional Alignment and Long-Term Yield Strategy

SonicStrategy Expands Exposure to 38.8 Million S Tokens Across Staking, Delegation, and DeFi Holdings, Reinforcing Institutional Alignment and Long-Term Yield Strategy

-

New to The Street's Esteemed Client Synergy CHC Corp. (NASDAQ: SNYR) Announces Nationwide EG America Rollout for FOCUSfactor(R) Focus + Energy EG America, 6th Largest U.S. Convenience Chain, Expands Distribution Across 1,600+ High-Traffic Locations

-

MDCE Subsidiary Infinite Auctions Soars with 2,500% YoY Revenue Growth in Q2 2025

MDCE Subsidiary Infinite Auctions Soars with 2,500% YoY Revenue Growth in Q2 2025

-

Waste Energy Corp Closes Deal to Reduce its Debt by $1 Million

-

Aeluma to Participate in Upcoming Investor Conferences

Aeluma to Participate in Upcoming Investor Conferences

-

Form Bio Appoints Michelle Chen, Ph.D. as President and Chief Executive Officer

-

WidePoint to Participate in the Lytham Partners 2025 Consumer & Technology Investor Summit on August 19, 2025

WidePoint to Participate in the Lytham Partners 2025 Consumer & Technology Investor Summit on August 19, 2025

-

Ondas Enters into Definitive Agreement to Strengthen Multi-Domain Autonomy Leadership with Strategic Acquisition of Robotics Innovator Apeiro Motion

Reaves Utility Income Fund Increases its Monthly Distribution 5.26% to $0.20 Per Share

DENVER, CO / ACCESS Newswire / June 23, 2025 / Reaves Utility Income Fund (NYSE American:UTG) is pleased to announce today a 5.26% increase in its annual distribution to $2.40, to be paid monthly at the rate of $0.20 per common share. This is the thirteenth increase of the distribution since the Fund's inception in February 2004. The increased dividend rate represents an annualized distribution rate of 6.92% based on the current market price. As of June 18, 2025, the Fund's market price was $34.66 per share and its net asset value was $35.13 per share.

Tim Porter, the Fund's co-portfolio manager and Chief Investment Officer of Reaves Asset Management, the Fund's investment adviser, commented, "We are pleased to raise the Fund's distribution rate and remain confident that our portfolio of utility and infrastructure companies will continue to support the Fund's monthly distribution to shareholders."

The Fund has formally implemented the 19b-1 exemption received from the Securities and Exchange Commission in 2009. A portion of each distribution may be treated as paid from sources other than net income, including but not limited to short-term capital gain, long-term capital gain and return of capital. The final determination of the source of these distributions, including the percentage of qualified dividend income, will be made after the Fund's year end.

Not less than eighty percent of the Fund's assets will continue to be invested in the securities of domestic and foreign companies involved to a significant extent in providing products, services, or equipment for (i) the generation or distribution of electricity, gas or water, (ii) telecommunications activities or (iii) infrastructure operations, such as airports, toll roads and municipal services ("Utilities" or the "Utility Industry"). As a policy, the Fund continues to strive to provide a high level of after-tax income and total return consisting primarily of tax-advantaged distributions and capital appreciation.

The following dates apply to the upcoming distributions that have been declared:

Ex-Date: July 18, 2025

Record Date: July 18, 2025

Payable Date: July 31, 2025

Ex-Date: August 18, 2025

Record Date: August 18, 2025

Payable Date: August 29, 2025

Ex-Date: September 17, 2025

Record Date: September 17, 2025

Payable Date: September 30, 2025

Reaves Utility Income Fund

The investment objective of the Fund is to provide a high level of income and total return consisting primarily of tax-advantaged distributions and capital appreciation. There were approximately $3.87 billion of total assets under management and 89.52 million common shares outstanding as of June 18, 2025.

An investor should consider investment objectives, risks, charges and expenses carefully before investing. To obtain an annual report or semi-annual report which contains this and other information visit www.utilityincomefund.com or call 1-800-644-5571. Read them carefully before investing.

There is no guarantee that distributions will be paid or that the rate will remain the same.

Paralel Distributors LLC, FINRA Member Firm.

SOURCE: Reaves Utility Income Fund

View the original press release on ACCESS Newswire

D.Moore--AMWN