-

Spurs get Frank off to flier, Sunderland win on Premier League return

Spurs get Frank off to flier, Sunderland win on Premier League return

-

Europeans try to stay on the board after Ukraine summit

-

Richarlison stars as Spurs boss Frank seals first win

Richarlison stars as Spurs boss Frank seals first win

-

Hurricane Erin intensifies to 'catastrophic' category 5 storm in Caribbean

-

Thompson beats Lyles in first 100m head-to-head since Paris Olympics

Thompson beats Lyles in first 100m head-to-head since Paris Olympics

-

Brazil's Bolsonaro leaves house arrest for court-approved medical exams

-

Hodgkinson in sparkling track return one year after Olympic 800m gold

Hodgkinson in sparkling track return one year after Olympic 800m gold

-

Air Canada grounds hundreds of flights over cabin crew strike

-

Hurricane Erin intensifies to category 4 storm as it nears Caribbean

Hurricane Erin intensifies to category 4 storm as it nears Caribbean

-

Championship leader Marc Marquez wins sprint at Austrian MotoGP

-

Newcastle held by 10-man Villa after Konsa sees red

Newcastle held by 10-man Villa after Konsa sees red

-

Semenyo says alleged racist abuse at Liverpool 'will stay with me forever'

-

Pakistan rescuers recover bodies after monsoon rains kill over 340

Pakistan rescuers recover bodies after monsoon rains kill over 340

-

In high-stakes summit, Trump, not Putin, budges

-

Pakistan rescuers recover bodies after monsoon rains kill 340

Pakistan rescuers recover bodies after monsoon rains kill 340

-

Hurricane Erin intensifies to category 3 storm as it nears Caribbean

-

Ukrainians see 'nothing' good from Trump-Putin meeting

Ukrainians see 'nothing' good from Trump-Putin meeting

-

Pakistan rescuers recover bodies after monsoon rains kill 320

-

Bob Simpson: Australian cricket captain and influential coach

Bob Simpson: Australian cricket captain and influential coach

-

Air Canada flight attendants strike over pay, shutting down service

-

Air Canada set to shut down over flight attendants strike

Air Canada set to shut down over flight attendants strike

-

Sabalenka and Gauff crash out in Cincinnati as Alcaraz survives to reach semis

-

Majority of Americans think alcohol bad for health: poll

Majority of Americans think alcohol bad for health: poll

-

Hurricane Erin intensifies in Atlantic, eyes Caribbean

-

Louisiana sues Roblox game platform over child safety

Louisiana sues Roblox game platform over child safety

-

Trump and Putin end summit without Ukraine deal

-

Kildunne confident Women's Rugby World Cup 'heartbreak' can inspire England to glory

Kildunne confident Women's Rugby World Cup 'heartbreak' can inspire England to glory

-

Arsenal 'digging for gold' as title bid starts at new-look Man Utd

-

El Salvador to jail gang suspects without trial until 2027

El Salvador to jail gang suspects without trial until 2027

-

Alcaraz survives to reach Cincy semis as Rybakina topples No. 1 Sabalenka

-

Trump, Putin cite progress but no Ukraine deal at summit

Trump, Putin cite progress but no Ukraine deal at summit

-

Last Chance: Just 7 Days Left to Lock in the LiberNovo Omni Early-Bird Price

-

Trump hails Putin summit but no specifics on Ukraine

Trump hails Putin summit but no specifics on Ukraine

-

Trump, Putin wrap up high-stakes Ukraine talks

-

El Salvador extends detention of suspected gang members

El Salvador extends detention of suspected gang members

-

Scotland's MacIntyre fires 64 to stay atop BMW Championship

-

Colombia's Munoz fires 59 to grab LIV Golf Indy lead

Colombia's Munoz fires 59 to grab LIV Golf Indy lead

-

Alcaraz survives Rublev to reach Cincy semis as Rybakina topples No. 1 Sabalenka

-

Trump offers warm welcome to Putin at high-stakes summit

Trump offers warm welcome to Putin at high-stakes summit

-

Semenyo racist abuse at Liverpool shocks Bournemouth captain Smith

-

After repeated explosions, new test for Musk's megarocket

After repeated explosions, new test for Musk's megarocket

-

Liverpool strike late to beat Bournemouth as Jota remembered in Premier League opener

-

Messi expected to return for Miami against Galaxy

Messi expected to return for Miami against Galaxy

-

Made-for-TV pageantry as Trump brings Putin in from cold

-

Coman bids farewell to Bayern before move to Saudi side Al Nassr

Coman bids farewell to Bayern before move to Saudi side Al Nassr

-

Vietnamese rice grower helps tackle Cuba's food shortage

-

Trump, Putin shake hands at start of Alaska summit

Trump, Putin shake hands at start of Alaska summit

-

Coman bids farewell to Bayern ahead of Saudi transfer

-

Liverpool honour Jota in emotional Premier League curtain-raiser

Liverpool honour Jota in emotional Premier League curtain-raiser

-

Portugal wildfires claim first victim, as Spain on wildfire alert

Record Financing for NeXtWind: €1.4 Billion for the Expansion of Wind Energy in Germany

Record financing for NeXtWind: €1.4 billion for the expansion of wind energy in Germany

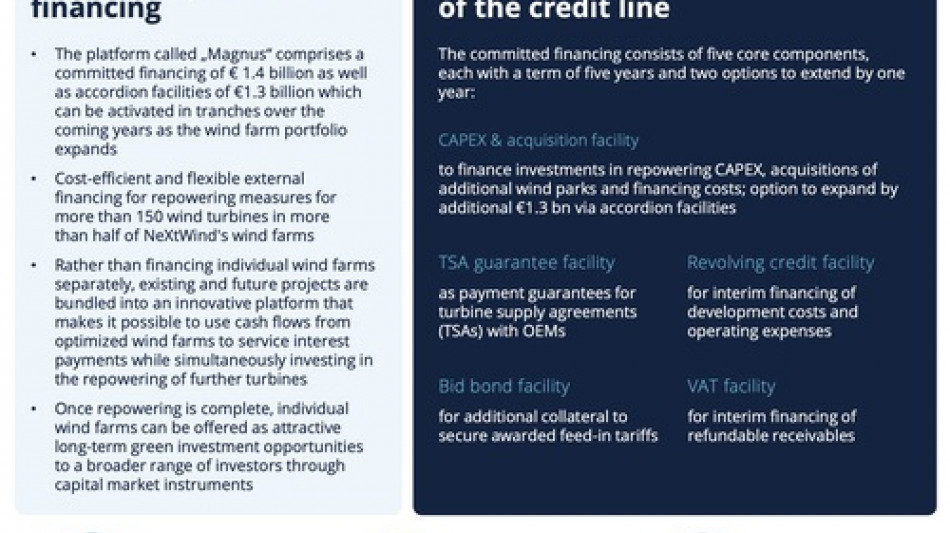

Innovative platform financing enables debt investments in renewable energy on an unprecedented scale

NeXtWind plans to quadruple the capacity of more than half of its 37 wind farms by 2028 as part of an increase of its total generation capacity to 3 GW

Lars B. Meyer, Co-CEO of NeXtWind, said: "Thanks to this novel platform approach, we can optimize our wind farms more quickly and accelerate our growth. In the long term, we aim to transform them into state-of-the-art, integrated clean energy hubs."

BERLIN, GERMANY / ACCESS Newswire / July 1, 2025 / NeXtWind, a leading renewable energy company, has secured €1.4 billion in debt financing. The agreement also includes an additional €1.3 billion in so-called accordion facilities, which can be activated in tranches over the coming years.

This syndicated loan is the largest of its kind for an independent wind energy provider in Germany, and it opens the onshore wind market to debt investments from major financial institutions both domestically and internationally. NeXtWind will use the new financing to modernize more than half of its wind farms, increasing their generation capacity to over 1 GW by 2028. Subsequently, the company plans to further develop these wind farms into sustainable energy infrastructure hubs.

"This financing is a significant milestone for NeXtWind and testament to the confidence in our business model," explains Lars B. Meyer, Co-CEO of NeXtWind. "Thanks to this novel platform approach, we can optimize our wind farms more quickly and accelerate our growth. In the long term, we aim to transform them into state-of-the-art, integrated hubs that can generate, store and distribute energy from various renewable sources in a grid-friendly manner at the right time - all in one place."

A pioneer in renewable energy

Since its founding in 2020, NeXtWind has established itself as a leading independent player in the renewable energy sector. The company acquires and optimizes existing wind farms by installing new turbines alongside state-of-the-art technology ('repowering'). NeXtWind's repowering capacity currently stands at approximately 1.4 GW, with an expected completion date set for 2026. This enables around one million households to be supplied with green electricity every year.

In the medium term, NeXtWind is pursuing an ambitious growth strategy. By 2028, it aims to increase the generation capacity to 3 GW. This will be achieved through a combination of wind farms included in the financing and newly built projects ('greenfield'), among others.

Innovative financing model on an unprecedented scale

This successful debt financing is an important step towards advancing the energy transition. The concept is based on a financing model for onshore wind projects that is unique in Germany to date. Rather than financing individual wind farms separately, existing and future projects are bundled into an innovative platform, leveraging portfolio efficiencies. Once repowering is complete, individual wind farms can be offered as attractive long-term green investment opportunities to a broader range of investors through capital market instruments.

The €1.4 billion loan package consists of five core components tailored to the various financial requirements of repowering, including a term loan for acquisitions and investments as well as flexible guarantee lines. This innovative financing approach opens up institutional debt capital on a new scale and creates the basis for scalable financing of infrastructure solutions in the renewable energy sector.

Lazard structured the financing and accompanied the entire process as exclusive financial advisor to NeXtWind. Deutsche Bank, ING Bank and LBBW act as underwriters, mandated lead arrangers and bookrunners on the transaction. Deutsche Bank also serves as Global Coordinator, while ING Bank further supports as Green Loan Coordinator, Facility and Security Agent. Renowned insurance companies have also joined the transaction upon closing of the loan agreement to provide part of the guarantee line.

Further information on NeXtWind can be found here.

Press contact

FGS Global

Niels Schlesier | +49 162 26 27 473

Rebekka Koch | +49 171 86 01 425

Mail: [email protected]

About NeXtWind:

NeXtWind is a leading renewable energy provider with offices in Berlin and London. Since its founding in 2020, the company has focused on acquiring and optimizing existing wind farms ('repowering'). It currently operates 37 onshore wind farms with a total capacity of 450 MW and has a total repowering capacity of around 1.4 GW. The company aims to increase its total generation capacity to 3 GW by 2028.

In the long term, NeXtWind seeks to build up a sustainable energy infrastructure ('Cleanfrastructure') in Europe. To this end, NeXtWind plans to develop integrated clean energy hubs. With a strong financial backing totaling USD 750 million (investors include Sandbrook Capital, PSP Investments and IMCO), NeXtWind is poised to be a key partner in advancing Germany's energy transition.

SOURCE: NeXtWind Management GmbH

View the original press release on ACCESS Newswire

F.Dubois--AMWN