-

Spurs get Frank off to flier, Sunderland win on Premier League return

Spurs get Frank off to flier, Sunderland win on Premier League return

-

Europeans try to stay on the board after Ukraine summit

-

Richarlison stars as Spurs boss Frank seals first win

Richarlison stars as Spurs boss Frank seals first win

-

Hurricane Erin intensifies to 'catastrophic' category 5 storm in Caribbean

-

Thompson beats Lyles in first 100m head-to-head since Paris Olympics

Thompson beats Lyles in first 100m head-to-head since Paris Olympics

-

Brazil's Bolsonaro leaves house arrest for court-approved medical exams

-

Hodgkinson in sparkling track return one year after Olympic 800m gold

Hodgkinson in sparkling track return one year after Olympic 800m gold

-

Air Canada grounds hundreds of flights over cabin crew strike

-

Hurricane Erin intensifies to category 4 storm as it nears Caribbean

Hurricane Erin intensifies to category 4 storm as it nears Caribbean

-

Championship leader Marc Marquez wins sprint at Austrian MotoGP

-

Newcastle held by 10-man Villa after Konsa sees red

Newcastle held by 10-man Villa after Konsa sees red

-

Semenyo says alleged racist abuse at Liverpool 'will stay with me forever'

-

Pakistan rescuers recover bodies after monsoon rains kill over 340

Pakistan rescuers recover bodies after monsoon rains kill over 340

-

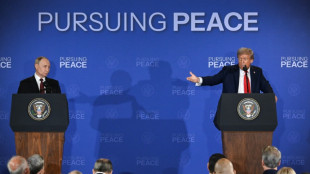

In high-stakes summit, Trump, not Putin, budges

-

Pakistan rescuers recover bodies after monsoon rains kill 340

Pakistan rescuers recover bodies after monsoon rains kill 340

-

Hurricane Erin intensifies to category 3 storm as it nears Caribbean

-

Ukrainians see 'nothing' good from Trump-Putin meeting

Ukrainians see 'nothing' good from Trump-Putin meeting

-

Pakistan rescuers recover bodies after monsoon rains kill 320

-

Bob Simpson: Australian cricket captain and influential coach

Bob Simpson: Australian cricket captain and influential coach

-

Air Canada flight attendants strike over pay, shutting down service

-

Air Canada set to shut down over flight attendants strike

Air Canada set to shut down over flight attendants strike

-

Sabalenka and Gauff crash out in Cincinnati as Alcaraz survives to reach semis

-

Majority of Americans think alcohol bad for health: poll

Majority of Americans think alcohol bad for health: poll

-

Hurricane Erin intensifies in Atlantic, eyes Caribbean

-

Louisiana sues Roblox game platform over child safety

Louisiana sues Roblox game platform over child safety

-

Trump and Putin end summit without Ukraine deal

-

Kildunne confident Women's Rugby World Cup 'heartbreak' can inspire England to glory

Kildunne confident Women's Rugby World Cup 'heartbreak' can inspire England to glory

-

Arsenal 'digging for gold' as title bid starts at new-look Man Utd

-

El Salvador to jail gang suspects without trial until 2027

El Salvador to jail gang suspects without trial until 2027

-

Alcaraz survives to reach Cincy semis as Rybakina topples No. 1 Sabalenka

-

Trump, Putin cite progress but no Ukraine deal at summit

Trump, Putin cite progress but no Ukraine deal at summit

-

Last Chance: Just 7 Days Left to Lock in the LiberNovo Omni Early-Bird Price

-

Trump hails Putin summit but no specifics on Ukraine

Trump hails Putin summit but no specifics on Ukraine

-

Trump, Putin wrap up high-stakes Ukraine talks

-

El Salvador extends detention of suspected gang members

El Salvador extends detention of suspected gang members

-

Scotland's MacIntyre fires 64 to stay atop BMW Championship

-

Colombia's Munoz fires 59 to grab LIV Golf Indy lead

Colombia's Munoz fires 59 to grab LIV Golf Indy lead

-

Alcaraz survives Rublev to reach Cincy semis as Rybakina topples No. 1 Sabalenka

-

Trump offers warm welcome to Putin at high-stakes summit

Trump offers warm welcome to Putin at high-stakes summit

-

Semenyo racist abuse at Liverpool shocks Bournemouth captain Smith

-

After repeated explosions, new test for Musk's megarocket

After repeated explosions, new test for Musk's megarocket

-

Liverpool strike late to beat Bournemouth as Jota remembered in Premier League opener

-

Messi expected to return for Miami against Galaxy

Messi expected to return for Miami against Galaxy

-

Made-for-TV pageantry as Trump brings Putin in from cold

-

Coman bids farewell to Bayern before move to Saudi side Al Nassr

Coman bids farewell to Bayern before move to Saudi side Al Nassr

-

Vietnamese rice grower helps tackle Cuba's food shortage

-

Trump, Putin shake hands at start of Alaska summit

Trump, Putin shake hands at start of Alaska summit

-

Coman bids farewell to Bayern ahead of Saudi transfer

-

Liverpool honour Jota in emotional Premier League curtain-raiser

Liverpool honour Jota in emotional Premier League curtain-raiser

-

Portugal wildfires claim first victim, as Spain on wildfire alert

Capstone Signs LOI to Acquire Southeast Stone Co.

Reaffirms its full-year target of a $100 million revenue run rate

NEW YORK CITY, NEW YORK / ACCESS Newswire / July 1, 2025 / Capstone Holding Corp. (NASDAQ:CAPS), a national building products distribution company, today announced it has signed a non-binding letter of intent ("LOI") to acquire a Southeast-based distributor of thin veneer stone and hardscape materials.

The planned acquisition marks Capstone's entry into the Southeastern U.S. market - a key region in the company's expansion strategy. The target business is known for its strong relationships with residential and commercial builders, and contractors.

"This move extends our national footprint into one of the fastest-growing construction markets in the country," said Matt Lipman, CEO of Capstone Holding Corp. "We're excited by the opportunity to partner with a proven operator and expand our wholesale stone product offerings in this high-growth region. With our platform, we see clear opportunities to reduce freight costs, improve delivery times, and better serve an expanding customer base in the South."

The LOI is non-binding and subject to the negotiation of a definitive stock purchase agreement and other customary conditions. If completed, the acquisition would represent another step in Capstone's strategy to scale through disciplined M&A, targeting strong local operators in growing markets. The purchase price is in line with the formula presented to investors in the Company's investment thesis for tuck-in deals - 4x to 6x EBITDA with 20% to 45% non-cash consideration.

Capstone continues to pursue acquisitions at attractive valuations while reaffirming its full-year targets of a $100 million revenue run rate and $10 million in adjusted EBITDA.

About Capstone Holding Corp.

Capstone Holding Corp. (NASDAQ:CAPS) is a diversified platform of building products businesses focused on distribution, brand ownership, and acquisition. Capstone's Instone subsidiary currently serves 31 U.S. states, with proprietary offerings including stone veneer, landscape stone, and modular masonry systems. Capstone's strategy blends organic growth with disciplined, accretive M&A, supported by a shareholder-aligned capital structure. Learn more at www.capstoneholdingcorp.com.

Investor Contact:

Forward-Looking Statements

This press release contains certain "forward-looking statements". These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company's current expectations and projections about future events. Investors can find many (but not all) of these statements by the use of words such as "may," "will," "expect," "anticipate," "estimate," "intend," "plan," "believe," or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent events or circumstances, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure investors that such expectations will turn out to be correct, and the Company cautions that actual results may differ materially from anticipated results. Additional factors are discussed in the Company's public filings with the Securities and Exchange Commission, available for review at www.sec.gov.

SOURCE: Capstone Holding Corp.

View the original press release on ACCESS Newswire

F.Dubois--AMWN