-

Ukraine scrambling for clarity as US downplays halt to arms shipments

Ukraine scrambling for clarity as US downplays halt to arms shipments

-

Peru clinic that leaked Shakira medical record given hefty fine

-

UK's Starmer backs finance minister after tears in parliament

UK's Starmer backs finance minister after tears in parliament

-

Trump tax bill stalled by Republican rebellion in Congress

-

US stocks back at records as oil prices rally

US stocks back at records as oil prices rally

-

Norway battle back to beat Swiss hosts in Euro 2025 opener

-

Netanyahu vows to uproot Hamas as ceasefire proposals are discussed

Netanyahu vows to uproot Hamas as ceasefire proposals are discussed

-

Tarvet won't turn pro yet, despite pushing Alcaraz at Wimbledon

-

Ukraine left scrambling after US says halting some arms shipments

Ukraine left scrambling after US says halting some arms shipments

-

India captain Gill's hundred repels England in second Test

-

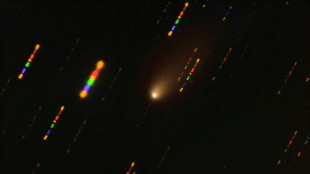

Possible interstellar object spotted zooming through Solar System

Possible interstellar object spotted zooming through Solar System

-

Alcaraz ends Tarvet's Wimbledon adventure, Paolini crashes out

-

Why is there no life on Mars? Rover finds a clue

Why is there no life on Mars? Rover finds a clue

-

Former finalist Paolini stunned as Wimbledon seeds continue to fall

-

Tesla reports lower car sales, extending slump

Tesla reports lower car sales, extending slump

-

Finland open Women's Euro 2025 with win over Iceland

-

India captain Gill hits another hundred against England in 2nd Test

India captain Gill hits another hundred against England in 2nd Test

-

Hamas mulls truce proposals after Trump Gaza ceasefire push

-

Alcaraz ends Tarvet's Wimbledon adventure, Sabalenka advances

Alcaraz ends Tarvet's Wimbledon adventure, Sabalenka advances

-

Tears, prayers, exultation: Diddy radiates relief after partial acquittal

-

Ruthless Alcaraz ends Tarvet's Wimbledon fairytale

Ruthless Alcaraz ends Tarvet's Wimbledon fairytale

-

Bangladesh collapse in ODI series opener to hand Sri Lanka big win

-

Trump says Vietnam to face 20% tariff under 'great' deal

Trump says Vietnam to face 20% tariff under 'great' deal

-

US senator urges bribery probe over Trump-Paramount settlement

-

Nazi-sympathising singer's huge gig to paralyse Zagreb

Nazi-sympathising singer's huge gig to paralyse Zagreb

-

Germany swelters as European heatwave moves eastwards

-

Sabalenka tells troubled Zverev to talk to family about mental health issues

Sabalenka tells troubled Zverev to talk to family about mental health issues

-

Hong Kong govt proposes limited recognition of same-sex couples' rights

-

Wall Street shrugs off drop US private sector jobs

Wall Street shrugs off drop US private sector jobs

-

Spain star Bonmati recovering well from meningitis, says coach Tome

-

Pogacar must 'battle' for Tour de France title says director

Pogacar must 'battle' for Tour de France title says director

-

Tesla reports lower car sales but figures better than feared

-

Alcaraz aims to avoid Wimbledon giant-killing after Sabalenka wins

Alcaraz aims to avoid Wimbledon giant-killing after Sabalenka wins

-

England captain Stokes makes Jaiswal breakthrough in second Test

-

Sean 'Diddy' Combs acquitted of sex trafficking, convicted on lesser charge

Sean 'Diddy' Combs acquitted of sex trafficking, convicted on lesser charge

-

Sabalenka praying for no more Wimbledon upsets after battling win

-

Hamas says discussing proposals after Trump Gaza ceasefire push

Hamas says discussing proposals after Trump Gaza ceasefire push

-

Teen plotting attacks on women charged in France's first 'incel' case

-

Sabalenka overcomes Bouzkova challenge to reach Wimbledon third round

Sabalenka overcomes Bouzkova challenge to reach Wimbledon third round

-

Stocks stuck as US private sector jobs disappoint, UK's Reeves future uncertain

-

Asalanka ton leads Sri Lanka to 244 in first Bangladesh ODI

Asalanka ton leads Sri Lanka to 244 in first Bangladesh ODI

-

UK govt backs finance minister after tears in parliament

-

US private sector shed jobs for first time in recent years: ADP

US private sector shed jobs for first time in recent years: ADP

-

Chelsea sign Brazil striker Joao Pedro from Brighton

-

Farrell says slow-starting Lions still have work to do

Farrell says slow-starting Lions still have work to do

-

French court convicts ex-Ubisoft bosses for workplace harassment

-

Freeman at the double as slick Lions romp past Reds 52-12

Freeman at the double as slick Lions romp past Reds 52-12

-

India's Jaiswal on the attack against England in second Test

-

Liverpool defender Quansah signs for Bayer Leverkusen

Liverpool defender Quansah signs for Bayer Leverkusen

-

Alcaraz aims to avoid giant-killing after Wimbledon seeds tumble

Strawberry Fields REIT Completes Acquisition of Nine Healthcare Facilities Located in Missouri

SOUTH BEND, IN / ACCESS Newswire / July 2, 2025 / (NYSE AMERICAN:STRW) Strawberry Fields REIT, Inc. (the "Company") today announced that it completed the acquisition of nine skilled nursing facilities, comprised of 686 beds, located in Missouri (the "Facilities") for $59,000,000.

The Company completed the acquisition using cash on hand and the issuance of approximately $2.0 million in OP Units of Strawberry Fields REIT LP to the Seller.

Eight of the facilities were leased to the Tide Group ("Tide") led by its founder and CEO Brian Ramos. The eight facilities were added to the master lease the Company entered into in August 2024. The master lease remained materially unchanged other than resetting the lease expiration for a new 10-year period and includes two 5-year tenant options. Additionally, this acquisition increased Tide's annual rents tied to its master lease by $5.5 million and is subject to 3% annual increases.

The ninth facility was leased to an affiliate of Reliant Care Group L.L.C. ("Reliant"). The facility was added to the master lease the Company assumed in December 2024. The master lease remained materially unchanged other than resetting the lease expiration for a 15-year period and includes two 10-year tenant options. Additionally, this acquisition increased Reliant's annual rents by $0.6 million and is subject to 3% annual increases.

Moishe Gubin, the Company's Chairman & CEO, noted: "I am excited that the Company has completed another sizeable acquisition in Missouri. With this acquisition, the Company will have 17 skilled nursing facilities in the State of Missouri and we continue to look for additional opportunities. I am also pleased to continue expanding our master lease relationships with existing tenants, including Brian Ramos and the Tide Group, as well as Rick and Nick DeStefane of Reliant Care Group."

About Strawberry Fields REIT

Strawberry Fields REIT, Inc., is a self-administered real estate investment trust engaged in the ownership, acquisition, development and leasing of skilled nursing and certain other healthcare- related properties. The Company's portfolio includes 141 healthcare facilities with an aggregate of 15,400+ bed, located throughout the states of Arkansas, Illinois, Indiana, Kansas, Kentucky, Michigan, Missouri, Ohio, Oklahoma, Tennessee and Texas. The 141 healthcare facilities comprise 129 skilled nursing facilities, 10 assisted living facilities, and two long-term acute care hospitals.

Safe Harbor Statement

Certain statements in this press release may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Those forward-looking statements include all statements that are not historical statements of fact and those regarding our intent, belief or expectations, including, but not limited to, statements regarding: future financing plans, business strategies, growth prospects and operating and financial performance; expectations regarding the making of distributions and the payment of dividends; and compliance with and changes in governmental regulations.

Words such as "anticipate(s)," "expect(s)," "intend(s)," "plan(s)," "believe(s)," "may," "will," "would," "could," "should," "seek(s)" and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. These statements are based on management's current expectations and beliefs and are subject to a number of risks and uncertainties that could lead to actual results differing materially from those projected, forecasted or expected. Although we believe that the assumptions underlying the forward-looking statements are reasonable, we can give no assurance that our expectations will be attained. Factors which could have a material adverse effect on our operations and future prospects or which could cause actual results to differ materially from our expectations include, but are not limited to: (i) the COVID-19 pandemic and the measures taken to prevent its spread and the related impact on our business or the businesses of our tenants; (ii) the ability and willingness of our tenants to meet and/or perform their obligations under the triple-net leases we have entered into with them, including, without limitation, their respective obligations to indemnify, defend and hold us harmless from and against various claims, litigation and liabilities; (iii) the ability of our tenants to comply with applicable laws, rules and regulations in the operation of the facilities we lease to them; (iv) the ability and willingness of our tenants to renew their leases with us upon their expiration, and the ability to reposition our facilities on the same or better terms in the event of nonrenewal or in the event we replace an existing tenant, as well as any obligations, including indemnification obligations, we may incur in connection with the replacement of an existing tenant; (v) the availability of and the ability to identify (a) tenants who meet our credit and operating standards, and (b) suitable acquisition opportunities, and the ability to acquire and lease the respective facilities to such tenants on favorable terms; (vi) the ability to generate sufficient cash flows to service our outstanding indebtedness; (vii) access to debt and equity capital markets; (viii) fluctuating interest rates; (ix) the ability to retain our key management personnel; (x) the ability to maintain our status as a real estate investment trust ("REIT"); (xi) changes in the U.S. tax law and other state, federal or local laws, whether or not specific to REITs; (xii) other risks inherent in the real estate business, including potential liability relating to environmental matters and illiquidity of real estate investments; and (xiii) any additional factors included under "Risk Factors" in our Annual Report Form 10-K dated March 13, 2025, including in the section entitled "Risk Factors" in Item 1A of Part I of such report, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the SEC.

Forward-looking statements speak only as of the date of this press release. Except in the normal course of our public disclosure obligations, we expressly disclaim any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in our expectations or any change in events, conditions or circumstances on which any statement is based.

Investor Relations:

Strawberry Fields REIT, Inc.

[email protected]

+1 (773) 747-4100 x422

SOURCE: Strawberry Fields REIT Inc.

View the original press release on ACCESS Newswire

P.Silva--AMWN