-

Resilient US economy spurs on stock markets

Resilient US economy spurs on stock markets

-

Trump administration seeks to release some of Epstein probe material

-

Man Utd agree deal to sign Brentford winger Mbeumo: reports

Man Utd agree deal to sign Brentford winger Mbeumo: reports

-

New clashes rock Syria's Druze heartland as tribal fighters reinforce Bedouin

-

Germany presses ahead with deportations to Afghanistan

Germany presses ahead with deportations to Afghanistan

-

Crews rescue 18 miners trapped in Colombia

-

McIlroy five back as Harman leads British Open

McIlroy five back as Harman leads British Open

-

Lyles the showman ready to deliver 100m entertainment

-

EU targets Russian oil in tough new Ukraine war sanctions

EU targets Russian oil in tough new Ukraine war sanctions

-

Liverpool line up swoop for Frankfurt striker Ekitike: reports

-

Stocks up, dollar down tracking Trump moves and earnings

Stocks up, dollar down tracking Trump moves and earnings

-

Three Sri Lankan elephants killed in blow to conservation efforts

-

Indie game studios battle for piece of Switch 2 success

Indie game studios battle for piece of Switch 2 success

-

Former Liverpool and Man Utd star Ince banned for drink-driving

-

Spain taming fire that belched smoke cloud over Madrid

Spain taming fire that belched smoke cloud over Madrid

-

Top Holy Land clerics visit Gaza after deadly church strike

-

Scotland end tour with seven-try thrashing of Samoa

Scotland end tour with seven-try thrashing of Samoa

-

Sharaa's pullout from Syria Druze heartland exposes shaky leadership

-

Trump team to seek release of Epstein documents

Trump team to seek release of Epstein documents

-

Wrexham chief wants playoff push after promotion to Championship

-

Snoop Dogg becomes co-owner of Championship club Swansea

Snoop Dogg becomes co-owner of Championship club Swansea

-

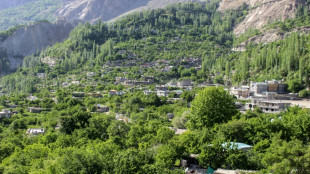

Pakistan bans new hotel construction around tourist lakes

-

Trump's budget hacksaw leaves public broadcasting on precipice

Trump's budget hacksaw leaves public broadcasting on precipice

-

New deep sea mining rules lack consensus despite US pressure

-

Stocks head for positive end to week, Tokyo struggles ahead of vote

Stocks head for positive end to week, Tokyo struggles ahead of vote

-

North Korea bars foreign tourists from new seaside resort

-

Lions ignoring the noise ahead of Wallabies Test

Lions ignoring the noise ahead of Wallabies Test

-

CBS says Stephen Colbert's 'The Late Show' to end in May 2026

-

Lions block Wallabies flanker Samu from Pasifika team

Lions block Wallabies flanker Samu from Pasifika team

-

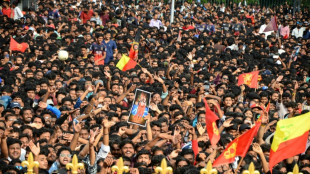

Indian state blames cricket team for deadly stampede

-

Trump threatens to sue WSJ, Murdoch over story on alleged 2003 letter to Epstein

Trump threatens to sue WSJ, Murdoch over story on alleged 2003 letter to Epstein

-

Serbian youth pumps up protest at last EXIT festival

-

US Congress approves $9 bn in Trump cuts to foreign aid, public media

US Congress approves $9 bn in Trump cuts to foreign aid, public media

-

Misbehaving monks: Sex scandal shakes Thai Buddhist faithful

-

Injury rules All Blacks wing Ioane out of third France Test

Injury rules All Blacks wing Ioane out of third France Test

-

China mulls economy-boosting measures to counter 'severe situation'

-

Wallabies skipper Wilson concedes losing Valetini a massive blow

Wallabies skipper Wilson concedes losing Valetini a massive blow

-

Asian markets on course to end week on a positive note

-

UK 'princes in the tower' murder probe clears Richard III

UK 'princes in the tower' murder probe clears Richard III

-

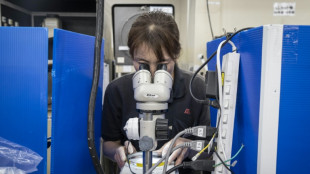

From Antarctica to Brussels, hunting climate clues in old ice

-

Springboks pick dynamic half-backs for final Championship warm-up

Springboks pick dynamic half-backs for final Championship warm-up

-

Jorge Martin returns to MotoGP racing at revamped Brno

-

Olympic champion Lyles to make 100m season debut at London Diamond League

Olympic champion Lyles to make 100m season debut at London Diamond League

-

Japan's SMEs ready to adapt to Trump tariffs

-

South Korea to end private adoptions after landmark probe

South Korea to end private adoptions after landmark probe

-

California to sue Trump govt over axed high-speed rail funds

-

Brazil's Lula calls Trump's tariff threat 'unacceptable blackmail'

Brazil's Lula calls Trump's tariff threat 'unacceptable blackmail'

-

In rural Canadian town, new risk of measles deepens vaccine tensions

-

What to know about Trump's effort to oust Fed Chair Powell

What to know about Trump's effort to oust Fed Chair Powell

-

Trump threatens to sue WSJ over story on alleged 2003 letter to Epstein

Amazing AI PLC Announces Results of ABB, Director Dealings and RPT

Results of Accelerated Bookbuild, Director Dealings, Related Party Transactions and Issue of Equity

LONDON, GB / ACCESS Newswire / July 18, 2025 / Amazing AI plc (AQSE:AAI) - AAI, a global fintech group specialising in online consumer loans, announces the results of an accelerated bookbuild to raise up to £200,000, including participation of two Directors and related party transactions.

Results of Accelerated Bookbuild

The Company announces that, via an accelerated bookbuild, it has raised £150,365 in cash through the issue of 30,073,000 new Ordinary Shares in the Company ("ABB Shares") of £0.005 each in the Company at a price of £0.005 per share (the "ABB") from five UK institutional investors, in addition to the participation of Paul Mathieson, Chief Executive Officer of the Company, Neil Patrick, Non-executive Chairman of the Company and two existing major shareholders in the Company.

The funds raised through the ABB will be used in support of the Company's Bitcoin Treasury Policy, details of which were set out in the announcements of 24 June, 27 June and 1 July 2025, and for general working capital purposes.

Further Conversion of Debt

As announced on 17 July 2025, the Company entered into an agreement with Paul Mathieson, Chief Executive Officer of the Company, to convert £50,000 of debt owed to him by the Company, via the issue of 10,000,000 new ordinary shares in the Company at £0.005 per share (the "Conversion Shares").

Paul Mathieson, CEO of Amazing AI plc said,"We are very excited by the investor response to our accelerated bookbuild and to welcome five UK institutional investors as new shareholders of AAI. We believe this institutional investment combined with further investment by both the CEO and the Chairman of AAI is a strong endorsement of the Company's strategy and business prospects and establishes a solid foundation for future capital raising."

Related Party Transactions

The participation in the ABB by Paul Mathieson and Neil Patrick and, as noted in the announcement on 17 July 2025, the Further Debt Conversion by Paul Mathieson, Chief Executive Officer of the Company, are all related party transactions pursuant to Rule 4.6 of the AQSE Growth Market Access Rulebook. The Director of AAI independent of the related party transactions, being Glendys Aguilera, confirms that, having exercised reasonable care, skill and diligence, the terms of the related party transactions are fair and reasonable, insofar as the shareholders of AAI are concerned.

Admission andTotal Voting Rights

The ABB Shares and Conversion Shares (together the "Admission Shares") will rank pari passu in all respects with the existing ordinary shares of the Company. Application has been made for the Admission Shares to be admitted to trading on AQSE Growth Market ("Admission") and it is expected that Admission will take place on, or around, 24 July 2025.

Following Admission of the 40,073,000 Admission Shares, the Company's enlarged issued share capital will comprise 219,303,759 ordinary shares. The Company does not hold any shares in treasury. The figure of 219,303,759 ordinary shares may be used by shareholders in the Company as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change in their interest in, the share capital of the Company under the Financial Conduct Authority's Disclosure and Transparency Rules.

This announcement contains inside information for the purposes of the UK Market Abuse Regulation and the Directors of the Company accept responsibility for the contents of this announcement.

Enquiries:

Amazing AI plc | |

Paul Mathieson - Chief Executive Officer |

Cairn Financial Advisers LLP (AAI Corporate Adviser) | |

Ludovico Lazzaretti | +44 (0) 20 7213 0880 |

Jo Turner |

Oberon Capital (AAI Corporate Broker) | |

Adam Pollock | +44 (0) 203 179 5300 |

Professional/institutional investors can contact Oberon Capital on [email protected]

About Amazing AI plc

Amazing AI plc (AAI) is an AI driven, consumer finance fintech innovator that leverages its regulated licensed lending and collections operations, experience and network to distribute best-of-breed AI finance related services globally, specifically focused on lending, collections and debt financing services. AAI operates under the consumer brand Mr. Amazing Loans in the United States with state consumer lending licenses/certificates of authority and an established track-record of lending, collections and regulatory compliance for over 14 years. AAI intends to investigate further utilisation of AI in its own US consumer lending operational processes and seek additional strategic collaborations, joint ventures and acquisitions in the AI sector globally, including in AI deception detection services to increase underwriting and collections performance. AAI also plans to investigate the potential to conduct its own enhanced product/service development, territory customisation and new service initiatives.

For more information please visit:www.investmentevolution.com/investors

Important Notices

Amazing AI plc (the "Company") intends to hold treasury reserves and surplus cash in bitcoin. Bitcoin is a type of cryptocurrency or crypto asset. Whilst the Board of Directors of the Company considers holding bitcoin to be in the best interests of the Company, the Board remains aware that the financial regulator in the UK (the "Financial Conduct Authority" or "FCA") considers investment in bitcoin to be high risk. At the outset, it is important to note that an investment in the Company is not an investment in bitcoin, either directly or by proxy. However, the Board of Directors of the Company consider bitcoin to be an appropriate store of value and growth for the Company's reserves and, accordingly, the Company is materially exposed to bitcoin. Such an approach is innovative, and the Board of Directors of the Company wish to be clear and transparent with prospective and actual investors in the Company on the Company's position in this regard.

The Company is neither authorised nor regulated by the FCA and cryptocurrencies (such as bitcoin) are unregulated in the UK. As with most other investments, the value of bitcoin can go down as well as up, and therefore the value of bitcoin holdings can fluctuate. The Company may not be able to realise any future bitcoin exposure for the same as it paid in the first place or even for the value the Company ascribes to bitcoin positions due to these market movements. As bitcoin is unregulated, the Company is not protected by the UK's Financial Ombudsman Service or the Financial Services Compensation Scheme.

Nevertheless, the Board of Directors of the Company has taken the decision to invest in bitcoin, and in doing so is mindful of the special risks bitcoin presents to the Company's financial position. These risks include (but are not limited to): (i) the value of bitcoin can be highly volatile, with value dropping as quickly as it can rise. Investors in bitcoin must be prepared to lose all money invested in bitcoin; (ii) the bitcoin market is largely unregulated. There is a risk of losing money due to risks such as cyber-attacks, financial crime and counterparty failure; (iii) the Company may not be able to sell bitcoin at will. The ability to sell bitcoin depends on various factors, including the supply and demand in the market at the relevant time. Operational failings such as technology outages, cyber-attacks and comingling of funds could cause unwanted delay; and (iv) crypto assets are characterised in some quarters by high degrees of fraud, money laundering and financial crime. In addition, there is a perception in some quarters that cyber-attacks are prominent which can lead to theft of holdings or ransom demands. The Board of Directors of the Company does not subscribe to such a negative view, especially in relation to bitcoin. However, prospective investors in the Company are encouraged to do their own research before investing.

Caution Regarding Forward Looking Statements

Certain statements made in this announcement are forward-looking statements. These forward-looking statements are not historical facts but rather are based on the Company's current expectations, estimates, and projections about its industry; its beliefs; and assumptions. Words such as 'anticipates,' 'expects,' 'intends,' 'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions are intended to identify forward-looking statements. These statements are not a guarantee of future performance and are subject to known and unknown risks, uncertainties, and other factors, some of which are beyond the Company's control, are difficult to predict, and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. The Company cautions security holders and prospective security holders not to place undue reliance on these forward-looking statements, which reflect the view of the Company only as of the date of this announcement. The forward-looking statements made in this announcement relate only to events as of the date on which the statements are made. The Company will not undertake any obligation to release publicly any revisions or updates to these forward-looking statements to reflect events, circumstances, or unanticipated events occurring after the date of this announcement except as required by law or by any appropriate regulatory authority.

Notification of a Transaction pursuant to Article 19(1) of Regulation (EU) No. 596/2014 | |||||

1 | Details of the person discharging managerial responsibilities/person closely associated | ||||

a. | Name | Paul Mathieson | |||

2 | Reason for notification | ||||

a. | Position/Status | Chief Executive Officer | |||

b. | Initial notification/Amendment | Initial Notification | |||

3 | Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor | ||||

a. | Name | Amazing AI plc | |||

b. | LEI | 984500ARA55ED7411Y77 | |||

4 | Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted | ||||

a. | Description of the financial instrument, type of instrument | Ordinary SharesISIN: GB00BPQC9525 | |||

b. | Nature of the transaction | Conversion of debt and Subscription for new Ordinary Shares | |||

Price(s) per share (p) | Volume(s) | ||||

0.5 | 20,000,000 | ||||

d. | Aggregated information - Volume - Price | N/A | |||

e. | Date of the transaction | 18 July 2025 | |||

f. | Place of the transaction | AQSE, London | |||

Notification of a Transaction pursuant to Article 19(1) of Regulation (EU) No. 596/2014 | |||||

1 | Details of the person discharging managerial responsibilities/person closely associated | ||||

a. | Name | Neil Patrick | |||

2 | Reason for notification | ||||

a. | Position/Status | Non-Executive Chairman | |||

b. | Initial notification/Amendment | Initial Notification | |||

3 | Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor | ||||

a. | Name | Amazing AI plc | |||

b. | LEI | 984500ARA55ED7411Y77 | |||

4 | Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted | ||||

a. | Description of the financial instrument, type of instrument | Ordinary SharesISIN: GB00BPQC9525 | |||

b. | Nature of the transaction | Subscription for Ordinary Shares | |||

Price(s) per share (p) | Volume(s) | ||||

0.5 | 400,000 | ||||

d. | Aggregated information - Volume - Price | N/A | |||

e. | Date of the transaction | 18 July 2025 | |||

f. | Place of the transaction | AQSE, London | |||

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

SOURCE: Amazing AI PLC

View the original press release on ACCESS Newswire

O.Johnson--AMWN