-

Doctors fight vaccine mistrust as Romania hit by measles outbreak

Doctors fight vaccine mistrust as Romania hit by measles outbreak

-

Fritz fights through to reach ATP Toronto Masters quarters

-

Trump confirms US envoy Witkoff to travel to Russia in coming week

Trump confirms US envoy Witkoff to travel to Russia in coming week

-

Mighty Atom: how the A-bombs shaped Japanese arts

-

'Let's go fly a kite': Capturing wind for clean energy in Ireland

'Let's go fly a kite': Capturing wind for clean energy in Ireland

-

Pakistan beat West Indies by 13 runs to capture T20 series

-

80 years on, Korean survivors of WWII atomic bombs still suffer

80 years on, Korean survivors of WWII atomic bombs still suffer

-

Teenage kicks: McIntosh, 12-year-old Yu set to rule the pool at LA 2028

-

New Zealand former top cop charged over material showing child abuse and bestiality

New Zealand former top cop charged over material showing child abuse and bestiality

-

Bangladesh ex-PM palace becomes revolution museum

-

South Korea begins removing loudspeakers on border with North

South Korea begins removing loudspeakers on border with North

-

Asian markets fluctuate as traders weigh tariffs, US jobs

-

Italy's fast fashion hub becomes Chinese mafia battlefield

Italy's fast fashion hub becomes Chinese mafia battlefield

-

Trump confirms US envoy Witkoff to travel to Russia 'next week'

-

Australia name experienced squad for Women's Rugby World Cup

Australia name experienced squad for Women's Rugby World Cup

-

Netanyahu asks Red Cross for help after 'profound shock' of Gaza hostage videos

-

Dire water shortages compound hunger and displacement in Gaza

Dire water shortages compound hunger and displacement in Gaza

-

Philippine, Indian navies begin first joint South China Sea patrols

-

AI search pushing an already weakened media ecosystem to the brink

AI search pushing an already weakened media ecosystem to the brink

-

New Zealand former top cop charged over child porn, bestiality material

-

Messi out indefinitely with 'minor muscle injury': club

Messi out indefinitely with 'minor muscle injury': club

-

Robertson names one uncapped player in All Blacks squad

-

Swiatek crashes out of WTA Canadian Open, Osaka races through

Swiatek crashes out of WTA Canadian Open, Osaka races through

-

Lyles says best to come after testy trials win

-

UK lenders face $12 bn plus compensation bill despite court ruling: watchdog

UK lenders face $12 bn plus compensation bill despite court ruling: watchdog

-

Man United draws Everton, West Ham blanks Bournemouth in US tour finales

-

Coleman defends 'great person' Richardson after assault controversy

Coleman defends 'great person' Richardson after assault controversy

-

Lyles, Jefferson-Wooden storm to victories at US trials

-

De Minaur survives Tiafoe to reach Toronto quarter-finals

De Minaur survives Tiafoe to reach Toronto quarter-finals

-

Young captures long-awaited first PGA Tour win at Wyndham Championship

-

Osaka roars into WTA Montreal quarter-finals as Keys fights through

Osaka roars into WTA Montreal quarter-finals as Keys fights through

-

West Ham blanks Bournemouth in Premier League US series

-

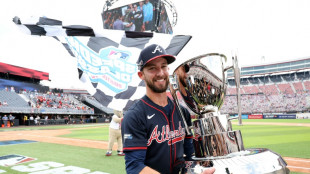

White's two homers drive Braves to 4-2 win over Reds in MLB Speedway Classic

White's two homers drive Braves to 4-2 win over Reds in MLB Speedway Classic

-

Bolsonaro backers rally to praise Trump for Brazil pressure

-

Richardson exits 200m at US trials, Coleman through

Richardson exits 200m at US trials, Coleman through

-

Ferrari boss confident 'frustrated' Hamilton will bounce back after Hungarian GP

-

Chelsea sign Dutch defender Hato from Ajax

Chelsea sign Dutch defender Hato from Ajax

-

'Fantastic Four' stretches lead to 2nd week at N.America box office

-

Japan's Yamashita wins Women's British Open to clinch first major

Japan's Yamashita wins Women's British Open to clinch first major

-

Netanyahu asks ICRC for help after 'profound shock' of Gaza hostage videos

-

French rider Ferrand-Prevot solos to victory in women's Tour de France

French rider Ferrand-Prevot solos to victory in women's Tour de France

-

Oval downpour leaves England-India series on knife edge

-

Despondent Hamilton and Ferrari crash back to earth

Despondent Hamilton and Ferrari crash back to earth

-

Norris relishing combat with McLaren teammate Piastri

-

US trade advisor says Trump tariff rates unlikely to change

US trade advisor says Trump tariff rates unlikely to change

-

Norris wins in Hungary to trim Piastri lead as McLaren reel off another 1-2

-

Norris wins Hungarian Grand Prix in another McLaren 1-2

Norris wins Hungarian Grand Prix in another McLaren 1-2

-

Brook and Root run riot as England eye stunning win in India decider

-

Ukrainian drones spark fire at Sochi oil depot

Ukrainian drones spark fire at Sochi oil depot

-

Lando Norris wins Hungarian Grand Prix in another McLaren 1-2

| RIO | -0.2% | 59.65 | $ | |

| BTI | 1.23% | 54.35 | $ | |

| BP | -1.26% | 31.75 | $ | |

| RBGPF | 0% | 74.94 | $ | |

| CMSC | 0.09% | 22.87 | $ | |

| NGG | 1.99% | 71.82 | $ | |

| SCU | 0% | 12.72 | $ | |

| RELX | -0.58% | 51.59 | $ | |

| CMSD | 0.34% | 23.35 | $ | |

| RYCEF | 0.07% | 14.19 | $ | |

| GSK | 1.09% | 37.56 | $ | |

| VOD | 1.37% | 10.96 | $ | |

| SCS | -1.47% | 10.18 | $ | |

| AZN | 1.16% | 73.95 | $ | |

| BCC | -0.55% | 83.35 | $ | |

| JRI | -0.23% | 13.1 | $ | |

| BCE | 1.02% | 23.57 | $ |

The IRS Is Watching Social Media - Clear Start Tax Warns Creators About the Risks of Monetized Content

Clear Start Tax breaks down how income from platforms like TikTok, YouTube, and Instagram can trigger audits if not reported correctly.

IRVINE, CA / ACCESS Newswire / July 18, 2025 / As more Americans turn to social platforms for income, the IRS is ramping up scrutiny of digital earnings like never before. According to Clear Start Tax, creators who earn money from TikTok, YouTube, Instagram, Twitch, and other platforms may unknowingly trigger IRS scrutiny, especially if they don't report sponsorships, tips, or affiliate income properly.

"Social media income is taxable - no matter how casual the content," said the Head of Client Solutions at Clear Start Tax. "The IRS now receives 1099s from most creator platforms. If your return doesn't match what they see, you could get flagged."

Common Income Streams the IRS Tracks

While some digital entrepreneurs still see their content earnings as a casual side hustle, the IRS treats it as self-employment income. What many don't realize is just how widely their income is reported - and which sources are most commonly flagged. Digital earnings are now more visible due to enhanced IRS data-matching tools and the mandatory tax forms issued by content platforms.

Clear Start Tax explains which revenue streams often get creators into trouble:

Brand deals or sponsorships - Paid collaborations are reportable income, even if compensated in free products.

YouTube, Twitch, or TikTok payouts - often reported via Form 1099-NEC or 1099-K issued by the platform.

Affiliate links or referral bonuses - Whether through Amazon, Linktree, or custom brand deals, all commissions must be reported.

Fan donations and tips - Payments through platforms like Patreon, Ko-fi, or Venmo are still taxable, even if labeled "support."

Merchandise and digital product sales - Sales income is taxable and may trigger additional obligations like self-employment taxes or estimated payments.

IRS Matching & 1099-Ks: Why Reporting Errors Trigger Notices

Starting in 2025, digital platforms must issue 1099-K forms for creators who earn $600 or more - a drastic shift from the old $20,000 threshold. These forms are shared with the IRS and automatically matched against tax returns.

If the IRS sees a discrepancy, it may trigger:

CP2000 notices for underreported income

Penalties and interest for late or missing payments

An audit flag for large or repeated mismatches

"The IRS is using algorithms and AI to flag unreported digital income - and creators are getting caught off guard," said the Head of Client Solutions. "Even small streams of income can add up fast."

How Creators Can Stay Compliant in 2025

With growing IRS oversight of online income, digital creators need to approach their finances like a business. That means keeping thorough records, setting aside money for taxes, and understanding how self-employment rules apply, even for part-time or side-hustle content.

Clear Start Tax recommends content creators take proactive steps to avoid tax trouble:

Track all payments from platforms, sponsors, and affiliate programs

Keep receipts for business expenses like equipment, travel, or software

Use separate accounts for business and personal finances

File accurate self-employment returns, including Schedule C and SE

Make quarterly estimated payments to avoid penalties

Fresh Start Relief for Creators With IRS Debt

Falling behind on taxes can happen quickly, especially when income is irregular and self-managed. Fortunately, even with growing IRS debt, creators still have strong options for resolving what they owe through the Fresh Start Program.

Through the IRS Fresh Start Program, Clear Start Tax helps creators:

Apply for affordable payment plans

Settle for less than owed with an Offer in Compromise

Remove penalties and interest for qualifying hardship cases

By answering a few simple questions, taxpayers can find out if they're eligible for the IRS Fresh Start Program and take the first step toward resolving their tax debt.

"We've seen creators who underestimated how quickly side income adds up - and ended up owing thousands," said the Head of Client Solutions. "Tax debt doesn't mean you've failed - but ignoring it can make recovery harder."

About Clear Start Tax

Clear Start Tax is a full-service tax liability resolution firm that serves taxpayers throughout the United States. The company specializes in assisting individuals and businesses with a wide range of IRS and state tax issues, including back taxes, wage garnishment relief, IRS appeals, and offers in compromise. Clear Start Tax helps taxpayers apply for the IRS Fresh Start Program, providing expert guidance in tax resolution. Fully accredited and A+ rated by the Better Business Bureau, the firm's unique approach and commitment to long-term client success distinguish it as a leader in the tax resolution industry.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

(888) 710-3533

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 535-1627

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

Y.Aukaiv--AMWN