-

Doctors fight vaccine mistrust as Romania hit by measles outbreak

Doctors fight vaccine mistrust as Romania hit by measles outbreak

-

Fritz fights through to reach ATP Toronto Masters quarters

-

Trump confirms US envoy Witkoff to travel to Russia in coming week

Trump confirms US envoy Witkoff to travel to Russia in coming week

-

Mighty Atom: how the A-bombs shaped Japanese arts

-

'Let's go fly a kite': Capturing wind for clean energy in Ireland

'Let's go fly a kite': Capturing wind for clean energy in Ireland

-

Pakistan beat West Indies by 13 runs to capture T20 series

-

80 years on, Korean survivors of WWII atomic bombs still suffer

80 years on, Korean survivors of WWII atomic bombs still suffer

-

Teenage kicks: McIntosh, 12-year-old Yu set to rule the pool at LA 2028

-

New Zealand former top cop charged over material showing child abuse and bestiality

New Zealand former top cop charged over material showing child abuse and bestiality

-

Bangladesh ex-PM palace becomes revolution museum

-

South Korea begins removing loudspeakers on border with North

South Korea begins removing loudspeakers on border with North

-

Asian markets fluctuate as traders weigh tariffs, US jobs

-

Italy's fast fashion hub becomes Chinese mafia battlefield

Italy's fast fashion hub becomes Chinese mafia battlefield

-

Trump confirms US envoy Witkoff to travel to Russia 'next week'

-

Australia name experienced squad for Women's Rugby World Cup

Australia name experienced squad for Women's Rugby World Cup

-

Netanyahu asks Red Cross for help after 'profound shock' of Gaza hostage videos

-

Dire water shortages compound hunger and displacement in Gaza

Dire water shortages compound hunger and displacement in Gaza

-

Philippine, Indian navies begin first joint South China Sea patrols

-

AI search pushing an already weakened media ecosystem to the brink

AI search pushing an already weakened media ecosystem to the brink

-

New Zealand former top cop charged over child porn, bestiality material

-

Messi out indefinitely with 'minor muscle injury': club

Messi out indefinitely with 'minor muscle injury': club

-

Robertson names one uncapped player in All Blacks squad

-

Swiatek crashes out of WTA Canadian Open, Osaka races through

Swiatek crashes out of WTA Canadian Open, Osaka races through

-

Lyles says best to come after testy trials win

-

UK lenders face $12 bn plus compensation bill despite court ruling: watchdog

UK lenders face $12 bn plus compensation bill despite court ruling: watchdog

-

Man United draws Everton, West Ham blanks Bournemouth in US tour finales

-

Coleman defends 'great person' Richardson after assault controversy

Coleman defends 'great person' Richardson after assault controversy

-

Lyles, Jefferson-Wooden storm to victories at US trials

-

De Minaur survives Tiafoe to reach Toronto quarter-finals

De Minaur survives Tiafoe to reach Toronto quarter-finals

-

Young captures long-awaited first PGA Tour win at Wyndham Championship

-

Osaka roars into WTA Montreal quarter-finals as Keys fights through

Osaka roars into WTA Montreal quarter-finals as Keys fights through

-

West Ham blanks Bournemouth in Premier League US series

-

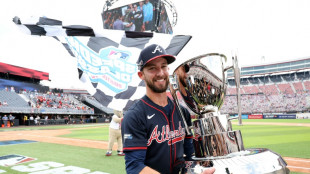

White's two homers drive Braves to 4-2 win over Reds in MLB Speedway Classic

White's two homers drive Braves to 4-2 win over Reds in MLB Speedway Classic

-

Bolsonaro backers rally to praise Trump for Brazil pressure

-

Richardson exits 200m at US trials, Coleman through

Richardson exits 200m at US trials, Coleman through

-

Ferrari boss confident 'frustrated' Hamilton will bounce back after Hungarian GP

-

Chelsea sign Dutch defender Hato from Ajax

Chelsea sign Dutch defender Hato from Ajax

-

'Fantastic Four' stretches lead to 2nd week at N.America box office

-

Japan's Yamashita wins Women's British Open to clinch first major

Japan's Yamashita wins Women's British Open to clinch first major

-

Netanyahu asks ICRC for help after 'profound shock' of Gaza hostage videos

-

French rider Ferrand-Prevot solos to victory in women's Tour de France

French rider Ferrand-Prevot solos to victory in women's Tour de France

-

Oval downpour leaves England-India series on knife edge

-

Despondent Hamilton and Ferrari crash back to earth

Despondent Hamilton and Ferrari crash back to earth

-

Norris relishing combat with McLaren teammate Piastri

-

US trade advisor says Trump tariff rates unlikely to change

US trade advisor says Trump tariff rates unlikely to change

-

Norris wins in Hungary to trim Piastri lead as McLaren reel off another 1-2

-

Norris wins Hungarian Grand Prix in another McLaren 1-2

Norris wins Hungarian Grand Prix in another McLaren 1-2

-

Brook and Root run riot as England eye stunning win in India decider

-

Ukrainian drones spark fire at Sochi oil depot

Ukrainian drones spark fire at Sochi oil depot

-

Lando Norris wins Hungarian Grand Prix in another McLaren 1-2

| JRI | -0.23% | 13.1 | $ | |

| RBGPF | 0% | 74.94 | $ | |

| CMSD | 0.34% | 23.35 | $ | |

| SCS | -1.47% | 10.18 | $ | |

| VOD | 1.37% | 10.96 | $ | |

| BCC | -0.55% | 83.35 | $ | |

| RYCEF | 0.07% | 14.19 | $ | |

| CMSC | 0.09% | 22.87 | $ | |

| NGG | 1.99% | 71.82 | $ | |

| SCU | 0% | 12.72 | $ | |

| RIO | -0.2% | 59.65 | $ | |

| GSK | 1.09% | 37.56 | $ | |

| AZN | 1.16% | 73.95 | $ | |

| BTI | 1.23% | 54.35 | $ | |

| RELX | -0.58% | 51.59 | $ | |

| BP | -1.26% | 31.75 | $ | |

| BCE | 1.02% | 23.57 | $ |

Gladstone Commercial Corporation Provides a Semiannual Business Update

MCLEAN, VA / ACCESS Newswire / July 18, 2025 / Gladstone Commercial Corporation (Nasdaq:GOOD) ("Gladstone Commercial") is a real estate investment trust ("REIT") focused on acquiring, owning, and operating net leased industrial properties across the United States. We are providing the following semiannual business update regarding our portfolio performance through June 30, 2025.

We collected 100% of cash base rents from our tenants.

We invested $152.2 million in four acquisitions of industrial properties totaling 874,871 square feet with a weighted average lease term of approximately 14.3 years and annualized GAAP rents of $13.2 million.

We renewed leases on 67,709 square feet of industrial space and 55,308 square feet of office space across the portfolio.

We increased same store lease revenue by 6.4% compared to the same time period in 2024.

We sold 60,000 square feet of non-core office property and completed the sale of 676,031 square feet of non-core industrial property.

As of June 30, 2025, our portfolio had industrial concentration as a percentage of annualized straight-line rent of 67% compared with 62% as of the same time in 2024.

As of June 30, 2025, our portfolio consisted of 17.0 million square feet across 143 properties in 27 states, with occupancy of 98.7% compared with 98.5% as of the same time in 2024.

Buzz Cooper, President of Gladstone Commercial commented, "The team has continued to work hard in 2025 as we press forward with our growth initiatives, focusing on increasing our industrial concentration and improving the overall quality of our portfolio. We are pleased with the results through the first half of 2025 and will continue our strategy of growing our overall industrial concentration through acquisitions and strategic selling of non-core assets."

Gary Gerson, Chief Financial Officer of Gladstone Commercial commented, "We continue to grow the industrial portfolio with accretive real estate while recycling non-core assets and renewing leases in a volatile environment and at the same time, maintaining a strong balance sheet. This is shaping up to be an outstanding year for the company and its shareholders."

About Gladstone Commercial (Nasdaq: GOOD)

Gladstone Commercial is a real estate investment trust focused on acquiring, owning and operating net leased industrial and office properties across the United States. As of June 30, 2025, Gladstone Commercial's real estate portfolio consisted of 143 properties located in 27 states, totaling approximately 17.0 million square feet. For additional information, please visit www.gladstonecommercial.com.

For Broker Submittals:

Midwest/West | South Central |

Ryan Carter | Todd Alan McDonald |

Executive Vice President | Senior Vice President |

(571) 451-0019 | (703) 287-5895 |

Southeast/Northeast | |

Nick Lindsay | |

Vice President | |

(703) 966-3864 | |

Investor or Media Inquiries:

Buzz Cooper | Catherine Gerkis |

President | Director of Investor Relations/ESG |

(703) 287-5815 | (703) 287-5846 |

All statements contained in this press release, other than historical facts, may constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Forward-looking statements involve inherent risks and uncertainties as they relate to expectations, beliefs, projections, future plans and strategies, anticipated events, or trends concerning matters that are not historical facts and may ultimately prove to be incorrect or false. Forward-looking statements include information about possible or assumed future events, including, without limitation, those relating to the discussion and analysis of Gladstone Commercial's business, financial condition, results of operations, and our strategic plans and objectives. Words such as "may," "might," "believe," "will," "anticipate," "future," "could," "growth," "plan," "intend," "expect," "should," "would," "if," "seek," "possible," "potential," "likely" and variations of these words and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements contain these words. Forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those included within or contemplated by such statements, including, but not limited to, the description of risks and uncertainties in "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" of the company's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, as filed with the SEC on February 18, 2025, and certain other filings made with the SEC. Gladstone Commercial cautions readers not to place undue reliance on any such forward-looking statements which speak only as of the date made. The company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

For further information: Gladstone Commercial Corporation, (703) 287-5893

For Investor Relations inquiries related to any of the monthly dividend paying Gladstone funds, please visit www.gladstonecompanies.com.

SOURCE: Gladstone Commercial Corporation

View the original press release on ACCESS Newswire

M.Fischer--AMWN