-

Doctors fight vaccine mistrust as Romania hit by measles outbreak

Doctors fight vaccine mistrust as Romania hit by measles outbreak

-

Fritz fights through to reach ATP Toronto Masters quarters

-

Trump confirms US envoy Witkoff to travel to Russia in coming week

Trump confirms US envoy Witkoff to travel to Russia in coming week

-

Mighty Atom: how the A-bombs shaped Japanese arts

-

'Let's go fly a kite': Capturing wind for clean energy in Ireland

'Let's go fly a kite': Capturing wind for clean energy in Ireland

-

Pakistan beat West Indies by 13 runs to capture T20 series

-

80 years on, Korean survivors of WWII atomic bombs still suffer

80 years on, Korean survivors of WWII atomic bombs still suffer

-

Teenage kicks: McIntosh, 12-year-old Yu set to rule the pool at LA 2028

-

New Zealand former top cop charged over material showing child abuse and bestiality

New Zealand former top cop charged over material showing child abuse and bestiality

-

Bangladesh ex-PM palace becomes revolution museum

-

South Korea begins removing loudspeakers on border with North

South Korea begins removing loudspeakers on border with North

-

Asian markets fluctuate as traders weigh tariffs, US jobs

-

Italy's fast fashion hub becomes Chinese mafia battlefield

Italy's fast fashion hub becomes Chinese mafia battlefield

-

Trump confirms US envoy Witkoff to travel to Russia 'next week'

-

Australia name experienced squad for Women's Rugby World Cup

Australia name experienced squad for Women's Rugby World Cup

-

Netanyahu asks Red Cross for help after 'profound shock' of Gaza hostage videos

-

Dire water shortages compound hunger and displacement in Gaza

Dire water shortages compound hunger and displacement in Gaza

-

Philippine, Indian navies begin first joint South China Sea patrols

-

AI search pushing an already weakened media ecosystem to the brink

AI search pushing an already weakened media ecosystem to the brink

-

New Zealand former top cop charged over child porn, bestiality material

-

Messi out indefinitely with 'minor muscle injury': club

Messi out indefinitely with 'minor muscle injury': club

-

Robertson names one uncapped player in All Blacks squad

-

Swiatek crashes out of WTA Canadian Open, Osaka races through

Swiatek crashes out of WTA Canadian Open, Osaka races through

-

Lyles says best to come after testy trials win

-

UK lenders face $12 bn plus compensation bill despite court ruling: watchdog

UK lenders face $12 bn plus compensation bill despite court ruling: watchdog

-

Man United draws Everton, West Ham blanks Bournemouth in US tour finales

-

Coleman defends 'great person' Richardson after assault controversy

Coleman defends 'great person' Richardson after assault controversy

-

Lyles, Jefferson-Wooden storm to victories at US trials

-

De Minaur survives Tiafoe to reach Toronto quarter-finals

De Minaur survives Tiafoe to reach Toronto quarter-finals

-

Young captures long-awaited first PGA Tour win at Wyndham Championship

-

Osaka roars into WTA Montreal quarter-finals as Keys fights through

Osaka roars into WTA Montreal quarter-finals as Keys fights through

-

West Ham blanks Bournemouth in Premier League US series

-

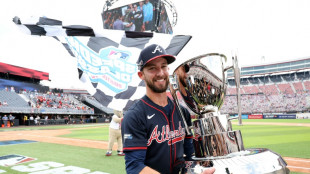

White's two homers drive Braves to 4-2 win over Reds in MLB Speedway Classic

White's two homers drive Braves to 4-2 win over Reds in MLB Speedway Classic

-

Bolsonaro backers rally to praise Trump for Brazil pressure

-

Richardson exits 200m at US trials, Coleman through

Richardson exits 200m at US trials, Coleman through

-

Ferrari boss confident 'frustrated' Hamilton will bounce back after Hungarian GP

-

Chelsea sign Dutch defender Hato from Ajax

Chelsea sign Dutch defender Hato from Ajax

-

'Fantastic Four' stretches lead to 2nd week at N.America box office

-

Japan's Yamashita wins Women's British Open to clinch first major

Japan's Yamashita wins Women's British Open to clinch first major

-

Netanyahu asks ICRC for help after 'profound shock' of Gaza hostage videos

-

French rider Ferrand-Prevot solos to victory in women's Tour de France

French rider Ferrand-Prevot solos to victory in women's Tour de France

-

Oval downpour leaves England-India series on knife edge

-

Despondent Hamilton and Ferrari crash back to earth

Despondent Hamilton and Ferrari crash back to earth

-

Norris relishing combat with McLaren teammate Piastri

-

US trade advisor says Trump tariff rates unlikely to change

US trade advisor says Trump tariff rates unlikely to change

-

Norris wins in Hungary to trim Piastri lead as McLaren reel off another 1-2

-

Norris wins Hungarian Grand Prix in another McLaren 1-2

Norris wins Hungarian Grand Prix in another McLaren 1-2

-

Brook and Root run riot as England eye stunning win in India decider

-

Ukrainian drones spark fire at Sochi oil depot

Ukrainian drones spark fire at Sochi oil depot

-

Lando Norris wins Hungarian Grand Prix in another McLaren 1-2

| JRI | -0.23% | 13.1 | $ | |

| RBGPF | 0% | 74.94 | $ | |

| CMSD | 0.34% | 23.35 | $ | |

| SCS | -1.47% | 10.18 | $ | |

| VOD | 1.37% | 10.96 | $ | |

| BCC | -0.55% | 83.35 | $ | |

| RYCEF | 0.07% | 14.19 | $ | |

| CMSC | 0.09% | 22.87 | $ | |

| NGG | 1.99% | 71.82 | $ | |

| SCU | 0% | 12.72 | $ | |

| RIO | -0.2% | 59.65 | $ | |

| GSK | 1.09% | 37.56 | $ | |

| AZN | 1.16% | 73.95 | $ | |

| BTI | 1.23% | 54.35 | $ | |

| RELX | -0.58% | 51.59 | $ | |

| BP | -1.26% | 31.75 | $ | |

| BCE | 1.02% | 23.57 | $ |

Coeur d'Alene Bancorp Announces Its Second Quarter 2025 Results

Coeur d'Alene Bancorp (OTC Pink:CDAB), the parent company of bankcda, is pleased to announce its results for the second quarter 2025.

COEUR D'ALENE, ID / ACCESS Newswire / July 18, 2025 / Coeur d'Alene Bancorp today reported net income of $372,894 or $0.20 per share for the second quarter 2025, compared to $383,459 or $0.20 per share for the second quarter 2024. Net income of $622,653 or $0.33 per share for the six months ended June 30, 2025, was also reported, compared to $768,893 or $0.41 per share for the six months ended 2024. All results are unaudited.

As of June 30, 2025, total consolidated assets were $227.0 million, a decrease of $12.7 million or 5.3% compared to June 30, 2024. Gross loans ended the period at $137.6 million compared to $120.6 million as of June 30, 2024, an increase of $17.0 million or 14.1%. Total deposits were $195.4 million as of June 30, 2025, compared to $196.8 million as of June 30, 2024, a 0.7% decrease.

"Our balance sheet remains strong with continued loan growth and stable deposits. Our net interest margin continues to improve as deposit pricing pressure eases and cashflow from our bond portfolio allows for higher reinvestment rates. Net income remains below historic levels due to increased overhead as we continue our branch expansion. We will be opening our second branch in Washington state in Richland during the third quarter. Management and the Board believe strategic branch additions, coupled with technology, will allow us to meet our future growth objectives." said Wes Veach, President, and Chief Executive Officer.

Financial Highlights:

Diluted earnings per share were $0.32 for six months ended 2025 versus $0.40 per share for six months ended 2025.

Net book value per share ended the quarter at $12.86 compared to $11.44 from one year ago.

Annualized return on average asset (ROAA) was 0.54% and annualized return on average equity (ROAE) was 5.25% for six months ended 2025, compared to 0.65% and 7.39% for six months ended 2024, respectively.

Total assets ended the period at $227.0 million compared to $239.8 million as of June 30, 2024, a decrease of 5.3%.

Gross loans were $137.6 million at quarter end, versus $120.6 million on June 30, 2024.

Total deposits were $195.4 million, compared to $196.8 million as of June 30, 2024, a decrease of 0.7%.

For the six months ended June 30, 2025, net interest margin was 3.86%, compared to 3.17% for six months ended June 30, 2024.

Asset quality remains strong with nonperforming assets to Tier 1 capital of 0.61% as of June 30, 2025.

We continue to be FIVE Star-rated from Bauer Financial, which is their highest rating.

We continue to far exceed the minimum community bank leverage ratio.

Coeur d'Alene Bancorp, parent company of bankcda, is headquartered in Coeur d'Alene, Idaho with branches in Coeur d'Alene, Hayden, Post Falls, Kellogg, Spokane, and a loan production office in Spokane Valley.

For more information, visit www.bankcda.bank or contact Wes Veach at 208-415-5006.

Forward-Looking Statements

This press release contains, among other things, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements preceded by, followed by, or that include the words "may," "could," "should," "would," "believe," "anticipate," "estimate," "expect," "intend," "plan," "projects," "outlook" or similar expressions. These statements are based upon the current belief and expectations of the Coeur d'Alene Bancorp's management team and are subject to significant risks and uncertainties that are subject to change based on various factors (many of which are beyond Coeur d'Alene Bancorp's control). Although Coeur d'Alene Bancorp believes that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. Therefore, Coeur d'Alene Bancorp can give no assurance that the results contemplated in the forward-looking statements will be realized. The inclusion of this forward-looking information should not be construed as a representation by Coeur d'Alene Bancorp or any other person that the future events, plans, or expectations contemplated by Coeur d'Alene Bancorp will be achieved.

All subsequent written and oral forward-looking statements attributable to Coeur d'Alene Bancorp or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Coeur d'Alene Bancorp does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law.

Balance Sheet Overview

(Unaudited)

Jun 30, 2025 | Jun 30, 2024 | Mar 31, 2025 | ||||

Assets: | ||||||

Cash and due from banks | $ | 11,533,346 | $ | 10,902,275 | $ | 6,523,357 |

Securities available for sale, at fair value | 68,167,726 | 100,236,264 | 77,684,462 | |||

Net loans | 134,990,764 | 118,419,948 | 134,049,508 | |||

Other assets | 12,356,101 | 10,229,007 | 12,821,221 | |||

Total assets | $ | 227,047,937 | $ | 239,787,495 | $ | 231,078,548 |

Liabilities and Shareholders' Equity: | ||||||

Total deposits | $ | 195,438,280 | $ | 196,809,232 | $ | 193,995,705 |

Borrowings | - | 15,500,000 | 6,000,000 | |||

Capital lease liability | 1,418,758 | 371,979 | 1,436,798 | |||

Other liabilities | 5,773,133 | 5,478,268 | 5,784,565 | |||

Shareholders' equity | 24,417,766 | 21,628,016 | 23,861,479 | |||

Total liabilities and shareholders' equity | $ | 227,047,937 | $ | 239,787,495 | $ | 231,078,548 |

Ratios: | ||||||

Return on average assets | 0.54 | % | 0.65 | % | 0.42 | % |

Return on average equity | 5.25 | % | 7.39 | % | 4.26 | % |

Community bank leverage ratio | 11.42 | % | 10.47 | % | 10.74 | % |

Net interest margin (YTD) | 3.86 | % | 3.17 | % | 3.62 | % |

Efficiency Ratio (YTD) | 76.57 | % | 75.31 | % | 79.20 | % |

Nonperforming assets to total assets | 0.07 | % | 0.00 | % | 0.00 | % |

Nonperforming assets to tier 1 capital | 0.61 | % | 0.00 | % | 0.00 | % |

Income Statement Overview

(unaudited)

For the three months ended | For the six months ended | ||||||||||

Jun 30, 2025 | Jun 30, 2024 | Jun 30, 2025 | Jun 30, 2024 | ||||||||

Interest income | $ | 2,888,832 | $ | 2,660,862 | $ | 5,744,976 | $ | 5,305,414 | |||

Interest expense | 667,901 | 845,539 | 1,469,231 | 1,626,484 | |||||||

Net interest income | 2,220,931 | 1,815,324 | 4,275,745 | 3,678,930 | |||||||

Loan loss provision | 106,500 | 2,812 | 213,000 | 2,812 | |||||||

Noninterest income | 240,986 | 238,065 | 457,065 | 452,977 | |||||||

Salaries and employee benefits | 1,048,313 | 875,877 | 2,048,429 | 1,779,658 | |||||||

Occupancy expense | 219,222 | 165,459 | 455,818 | 337,726 | |||||||

Loss on sale, net of gains | - | - | - | 23,005 | |||||||

Other noninterest expense | 557,823 | 510,658 | 1,119,701 | 994,271 | |||||||

Income before income taxes | 530,057 | 498,582 | 895,863 | 994,435 | |||||||

Income tax expense | 157,164 | 115,123 | 273,210 | 225,542 | |||||||

Net income | $ | 372,894 | $ | 383,459 | $ | 622,653 | $ | 768,893 | |||

SOURCE: Coeur d'Alene Bancorp

View the original press release on ACCESS Newswire

L.Durand--AMWN