-

Belgian region grapples with forever chemical scandal

Belgian region grapples with forever chemical scandal

-

New-look Australia focused on LA 2028 at swimming worlds

-

China urges global consensus on balancing AI development, security

China urges global consensus on balancing AI development, security

-

David's century sparks Aussies to T20I clincher over WIndies

-

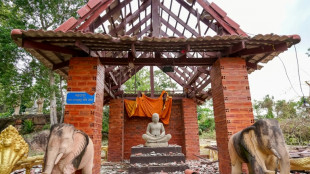

Death toll rises in Thai-Cambodian clashes despite ceasefire call

Death toll rises in Thai-Cambodian clashes despite ceasefire call

-

Taiwan votes in high-stakes recall election

-

China prodigy takes on swimming world aged 12

China prodigy takes on swimming world aged 12

-

UN gathering eyes solution to deadlocked Palestinian question

-

Polls open in Taiwan's high-stakes recall election

Polls open in Taiwan's high-stakes recall election

-

'Alien' lands at Comic-Con

-

Top footballers afraid to speak out against playing too many games: FIFPro chief

Top footballers afraid to speak out against playing too many games: FIFPro chief

-

Cambodia calls for ceasefire with Thailand after deadly clashes

-

Top US Justice official questions Epstein accomplice for 2nd day

Top US Justice official questions Epstein accomplice for 2nd day

-

Cambodia calls for ceasefire with Thailand: envoy to UN

-

Raducanu and Fernandez beat the heat to reach DC Open semis

Raducanu and Fernandez beat the heat to reach DC Open semis

-

US stocks end at records as markets eye tariff deadline

-

Trump, EU chief to meet Sunday in push for trade deal

Trump, EU chief to meet Sunday in push for trade deal

-

Fake AI photos of Trump with Epstein flood internet

-

'Upset' Messi suspended over MLS All-Star no-show: league

'Upset' Messi suspended over MLS All-Star no-show: league

-

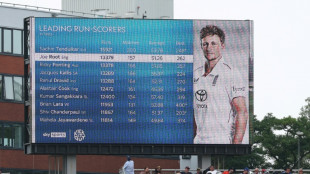

Ponting says 'no reason' why Root cannot top Tendulkar's run record

-

NFL players, employees fined for selling Super Bowl tickets: reports

NFL players, employees fined for selling Super Bowl tickets: reports

-

World's smallest snake makes big comeback

-

Trade on agenda as Trump lands in Scotland for diplomacy and golf

Trade on agenda as Trump lands in Scotland for diplomacy and golf

-

UN chief blasts 'lack of compassion' for Palestinians in Gaza

-

Trump administration expected to say greenhouse gases aren't harmful

Trump administration expected to say greenhouse gases aren't harmful

-

Hamilton suffers unprecedented spinning knockout in Belgian GP sprint qualifying

-

European powers urge end to Gaza 'humanitarian catastrophe'

European powers urge end to Gaza 'humanitarian catastrophe'

-

Messi, Alba suspended over MLS All-Star no-show: league

-

RB's Permane returns as team boss at Belgian GP two years after sacking

RB's Permane returns as team boss at Belgian GP two years after sacking

-

Trump says '50/50 chance' of US-EU trade deal

-

Top US Justice official meets with Epstein accomplice for 2nd day

Top US Justice official meets with Epstein accomplice for 2nd day

-

Mekies makes retaining Verstappen his Red Bull priority

-

Pogacar exits Alps with Tour stranglehold as Arensman edges white-knuckle win

Pogacar exits Alps with Tour stranglehold as Arensman edges white-knuckle win

-

Piastri takes pole for Belgian GP sprint race ahead of Verstappen

-

UK, France, Germany say Gaza 'humanitarian catastrophe must end now'

UK, France, Germany say Gaza 'humanitarian catastrophe must end now'

-

Stock markets mark time as Trump puts EU-US trade deal at 50/50

-

Pogacar exits Alps with Tour stranglehold as Arensman takes stage

Pogacar exits Alps with Tour stranglehold as Arensman takes stage

-

France defends move to recognise Palestinian state

-

Trade on agenda as Trump heads to Scotland for diplomacy and golf

Trade on agenda as Trump heads to Scotland for diplomacy and golf

-

France's top court annuls arrest warrant against Syria's Assad

-

How might Trump's tariffs hurt Brazil?

How might Trump's tariffs hurt Brazil?

-

Rubiales forced kiss could drive Spain on in Euro 2025 final: England's Toone

-

Trump says Hamas 'didn't want' Gaza deal as talks break down

Trump says Hamas 'didn't want' Gaza deal as talks break down

-

Tour de France prankster gets eight-month suspended term for crossing finish line

-

Root climbs to second on all-time Test list as England dominate India

Root climbs to second on all-time Test list as England dominate India

-

Stock markets stall as Trump puts EU-US trade deal at 50/50

-

Iran says it held 'frank' nuclear talks with European powers

Iran says it held 'frank' nuclear talks with European powers

-

UK starts online checks to stop children accessing harmful content

-

Root up to third on all-time Test list as England dominate India

Root up to third on all-time Test list as England dominate India

-

Piastri outpaces Verstappen in opening practice at Belgian GP

| RBGPF | -1.52% | 73.88 | $ | |

| SCU | 0% | 12.72 | $ | |

| JRI | -0.46% | 13.09 | $ | |

| SCS | 0.66% | 10.58 | $ | |

| CMSD | 0.17% | 22.89 | $ | |

| RYCEF | -0.3% | 13.2 | $ | |

| NGG | -0.11% | 72.15 | $ | |

| RELX | -1.86% | 52.73 | $ | |

| BCC | 1.94% | 88.14 | $ | |

| RIO | -1.16% | 63.1 | $ | |

| GSK | -0.68% | 37.97 | $ | |

| CMSC | 0.24% | 22.485 | $ | |

| VOD | -0.79% | 11.43 | $ | |

| BCE | -0.95% | 24.2 | $ | |

| BP | 0.22% | 32.2 | $ | |

| AZN | -1.4% | 72.66 | $ | |

| BTI | -0.71% | 52.25 | $ |

Solera National Bancorp Announces Second Quarter 2025 Financial Results

Net income of $5.9 million ($1.38 per share), a NEW RECORD!

Q2 2025 pre-tax and pre-provision income of $8.6 million. Another new record!

American Banker has recognized Solera National as part of the 2025 Top-Performing Banks with under $2B of assets, #3.

LAKEWOOD, CO / ACCESS Newswire / July 25, 2025 / Solera National Bancorp, Inc. (OTC:SLRK) ("Company"), the holding company for Solera National Bank ("Bank"), a business-focused bank located in the Denver metropolitan area, today reported financial results for the three months ended June 30, 2025. See highlights below.

2Q25 Financial Highlights

Net income of $5.9 million ($1.38 per share), a $1.7 million or 40% increase from Q2 2024.

Net interest income increased $726 thousand or 11% from Q2 2024.

Solera had a pre-tax and pre-provision income of $8.6 million. 48% or $2.8 million increase from Q2 2024.

Non-interest income of $3.7 million or $2.5 million, or a 205% increase from Q2 2024.

Return on assets was 2.02%, a 66 bps improvement from Q2 2024.

Return on equity was 25.92%, a 549 bps improvement from Q2 2024.

Mike Quagliano, Executive Chairman of the Board, commented: "We exist for the benefit of the shareholders, and our relentless focus on customer excellence has led to 11 years of stellar earnings, with this latest quarter being the best yet."

Steve Snailum, COO, commented: "The agility of Solera is propelling us forward in the banking landscape. The commitment of the company and the board to advancing Solera's tech stack and streamlining the operations empowers us to swiftly overcome obstacles, streamline processes, and foster client relationships in a very unique way. We are committed to quicker advancement than the competition and maintaining stronger customer bonds. This record-breaking quarter truly showcases the dedication, skill, and effort that is on display daily at Solera National Bank."

Avram Shabanyan, EVP, commented: "Strong partnerships and a disciplined focus on client success fuel Solera Bank's continued growth in the self-directed space. Our continued commitment to customer-first solutions empowers individuals to utilize their retirement funds in alternative investment opportunities confidently."

Jay Hansen, Chief Financial Officer, commented: "Our performance this quarter reflects the strength of our diversified portfolio and disciplined risk management. Our ratios continue to improve, and our team members are in a great position for long-term success."

About Solera National Bancorp, Inc.

Solera National Bancorp, Inc. was incorporated in 2006 to organize and serve as the holding company for Solera National Bank, which opened for business in September 2007. Solera National Bank is a community bank serving the needs of emerging businesses and real estate investors. At the core of Solera National Bank is welcoming, attentive, and respectful customer service, a focus on supporting a growing and diverse economy, and a passion to serve our community through service, education, and volunteerism. For more information, please visit http://www.SoleraBank.com.

This press release contains statements that may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The statements contained in this release, which are not historical facts and that relate to future plans or projected results of Solera National Bancorp, Inc. and its wholly-owned subsidiary, Solera National Bank, are forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated, or implied. We undertake no obligation to update or revise any forward-looking statement. Readers of this release are cautioned not to put undue reliance on forward-looking statements.

Source: Solera National Bank

Contacts: Jay Hansen, CFO (303) 209-8600

FINANCIAL TABLES FOLLOW

SOLERA NATIONAL BANCORP, INC.

CONSOLIDATED BALANCE SHEET

(unaudited)

($000s) | 6/30/25 | 3/31/25 | 12/31/24 | 9/30/24 | 6/30/24 | |||||

ASSETS | ||||||||||

Cash and due from banks | $ | 1,969 | $ | 2,401 | $ | 1,576 | $ | 2,193 | $ | 2,241 |

Federal funds sold | - | - | 800 | 400 | - | |||||

Interest-bearing deposits with banks | 2,963 | 1,033 | 148 | 595 | 844 | |||||

Investment securities, available-for-sale | 422,112 | 290,397 | 322,375 | 317,180 | 183,311 | |||||

Investment securities, held-to-maturity | - | - | - | - | 200,457 | |||||

FHLB and Federal Reserve Bank stocks, at cost | 5,004 | 5,525 | 7,457 | 3,204 | 10,959 | |||||

Paycheck Protection Program (PPP) loans, gross | - | 5 | 20 | 35 | 50 | |||||

Traditional loans, gross | 754,518 | 766,687 | 792,753 | 797,516 | 792,739 | |||||

Allowance for loan and lease losses | (11,219 | ) | (10,914 | ) | (10,913 | ) | (10,912 | ) | (10,810 | ) |

Net traditional loans | 743,299 | 755,773 | 781,840 | 786,604 | 781,929 | |||||

Premises and equipment, net | 35,128 | 33,236 | 33,476 | 32,289 | 30,625 | |||||

Accrued interest receivable | 10,244 | 7,153 | 7,750 | 6,940 | 7,808 | |||||

Bank-owned life insurance | 5,190 | 5,159 | 5,127 | 5,095 | 5,063 | |||||

Other assets | 13,433 | 11,103 | 8,820 | 8,734 | 8,325 | |||||

TOTAL ASSETS | $ | 1,239,342 | $ | 1,111,785 | $ | 1,169,389 | $ | 1,163,269 | $ | 1,231,612 |

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||||

Noninterest-bearing demand deposits | $ | 463,861 | $ | 466,455 | $ | 484,604 | $ | 497,661 | $ | 503,819 |

Interest-bearing demand deposits | 65,761 | 60,507 | 54,734 | 64,606 | 62,905 | |||||

Savings and money market deposits | 138,964 | 104,560 | 100,987 | 103,118 | 102,892 | |||||

Time deposits | 436,547 | 287,378 | 294,338 | 353,405 | 272,744 | |||||

Total deposits | 1,105,133 | 918,900 | 934,663 | 1,018,790 | 942,360 | |||||

Accrued interest payable | 2,528 | 1,808 | 2,587 | 2,618 | 2,104 | |||||

Short-term borrowings | (1 | ) | 60,191 | 104,607 | 13,300 | 164,613 | ||||

Long-term FHLB borrowings | 34,000 | 34,000 | 34,000 | 34,000 | 34,000 | |||||

Accounts payable and other liabilities | 5,337 | 6,087 | 4,576 | 5,395 | 3,961 | |||||

TOTAL LIABILITIES | 1,146,997 | 1,020,987 | 1,080,434 | 1,074,104 | 1,147,038 | |||||

Common stock | 43 | 43 | 43 | 43 | 43 | |||||

Additional paid-in capital | 38,778 | 38,763 | 38,748 | 38,748 | 38,778 | |||||

Retained earnings | 83,008 | 77,076 | 72,455 | 67,163 | 61,667 | |||||

Accumulated other comprehensive (loss) gain | (29,484 | ) | (25,084 | ) | (22,291 | ) | (16,789 | ) | (15,914 | ) |

TOTAL STOCKHOLDERS' EQUITY | 92,345 | 90,798 | 88,955 | 89,165 | 84,574 | |||||

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 1,239,342 | $ | 1,111,785 | $ | 1,169,389 | $ | 1,163,269 | $ | 1,231,612 |

SOLERA NATIONAL BANCORP, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

Three Months Ended | |||||||||||||||||||

($000s, except per share data) | 6/30/25 | 3/31/25 | 12/31/24 | 9/30/24 | 6/30/24 | ||||||||||||||

Interest and dividend income | |||||||||||||||||||

Interest and fees on traditional loans | $ | 12,791 | $ | 13,101 | $ | 13,615 | $ | 13,854 | $ | 13,270 | |||||||||

Investment securities | 4,831 | 3,490 | 3,297 | 3,544 | 3,721 | ||||||||||||||

Dividends on bank stocks | 180 | 175 | 131 | 160 | 249 | ||||||||||||||

Other | 21 | 49 | 13 | 19 | 22 | ||||||||||||||

Total interest income | $ | 17,823 | $ | 16,815 | $ | 17,056 | $ | 17,577 | $ | 17,262 | |||||||||

Interest expense | |||||||||||||||||||

Deposits | 6,235 | 4,959 | 5,564 | 6,312 | 5,285 | ||||||||||||||

FHLB & Fed borrowings | 1,410 | 1,550 | 1,223 | 1,332 | 2,831 | ||||||||||||||

Total interest expense | 7,645 | 6,509 | 6,787 | 7,644 | 8,116 | ||||||||||||||

Net interest income | 10,178 | 10,306 | 10,269 | 9,933 | 9,146 | ||||||||||||||

Provision for loan and lease losses | 310 | 7 | 6 | 105 | 4 | ||||||||||||||

Net interest income after provision for loan and lease losses | 9,868 | 10,299 | 10,263 | 9,828 | 9,142 | ||||||||||||||

Noninterest income | |||||||||||||||||||

Customer service and other fees | 291 | 300 | 470 | 389 | 468 | ||||||||||||||

Other income | 677 | 807 | 954 | 1,138 | 738 | ||||||||||||||

Gain on sale of securities | 2,709 | - | - | 858 | - | ||||||||||||||

Total noninterest income | 3,677 | 1,107 | 1,424 | 2,385 | 1,206 | ||||||||||||||

Noninterest expense | |||||||||||||||||||

Employee compensation and benefits | 2,827 | 2,656 | 2,611 | 2,472 | 2,514 | ||||||||||||||

Occupancy | 553 | 448 | 492 | 393 | 387 | ||||||||||||||

Professional fees | 330 | 259 | 309 | 122 | 75 | ||||||||||||||

Other general and administrative | 1,593 | 1,694 | 1,437 | 1,423 | 1,582 | ||||||||||||||

Total noninterest expense | 5,303 | 5,057 | 4,849 | 4,410 | 4,558 | ||||||||||||||

Net Income Before Taxes | $ | 8,242 | $ | 6,349 | $ | 6,838 | $ | 7,803 | $ | 5,790 | |||||||||

Income Tax Expense | 2,309 | 1,711 | 1,526 | 2,294 | 1,564 | ||||||||||||||

Net Income | $ | 5,933 | $ | 4,638 | $ | 5,312 | $ | 5,509 | $ | 4,226 | |||||||||

Income Per Share | $ | 1.38 | $ | 1.08 | $ | 1.24 | $ | 1.28 | $ | 0.98 | |||||||||

Tangible Book Value Per Share | $ | 21.48 | $ | 21.12 | $ | 20.69 | $ | 20.74 | $ | 19.67 | |||||||||

WA Shares outstanding | 4,299,953 | 4,299,953 | 4,299,953 | 4,299,953 | 4,299,953 | ||||||||||||||

Pre-Tax Pre-Provision Income | $ | 8,552 | $ | 6,356 | $ | 6,844 | $ | 7,908 | $ | 5,794 | |||||||||

Net Interest Margin | 3.56 | % | 3.93 | % | 3.81 | % | 3.67 | % | 3.39 | % | |||||||||

Cost of Funds | 2.66 | % | 2.49 | % | 2.51 | % | 2.72 | % | 2.80 | % | |||||||||

Efficiency Ratio | 47.58 | % | 44.31 | % | 41.47 | % | 38.48 | % | 44.03 | % | |||||||||

Return on Average Assets | 2.02 | % | 1.63 | % | 1.82 | % | 1.84 | % | 1.36 | % | |||||||||

Return on Average Equity | 25.92 | % | 20.64 | % | 23.86 | % | 25.37 | % | 20.42 | % | |||||||||

Leverage Ratio | 9.8 | % | 10.4 | % | 9.5 | % | 9.1 | % | 8.2 | % | |||||||||

Asset Quality: | |||||||||||||||||||

Non-performing loans to gross loans | 0.60 | % | 0.42 | % | 0.52 | % | 0.65 | % | 0.48 | % | |||||||||

Non-performing assets to total assets | 0.37 | % | 0.29 | % | 0.35 | % | 0.45 | % | 0.31 | % | |||||||||

Allowance for loan losses to gross traditional loans | 1.49 | % | 1.42 | % | 1.38 | % | 1.37 | % | 1.36 | % | |||||||||

* Not meaningful due to the insignificant amount of non-performing loans. | |||||||||||||||||||

Criticized loans/assets: | |||||||||||||||||||

Special mention | $ | 2,842 | $ | 11,103 | $ | 10,730 | $ | 29,145 | $ | 25,244 | |||||||||

Substandard: Accruing | 39,971 | 19,641 | 14,911 | 22,410 | 23,030 | ||||||||||||||

Substandard: Nonaccrual | 4,526 | 3,251 | 4,142 | 5,180 | 3,784 | ||||||||||||||

Doubtful | - | - | - | - | - | ||||||||||||||

Total criticized loans | $ | 47,339 | $ | 33,995 | $ | 29,782 | $ | 56,735 | $ | 52,058 | |||||||||

Other real estate owned | - | - | - | - | - | ||||||||||||||

Investment securities | - | - | - | - | - | ||||||||||||||

Total criticized assets | $ | 47,339 | $ | 33,995 | $ | 29,782 | $ | 56,735 | $ | 52,058 | |||||||||

Criticized assets to total assets | 3.82 | % | 3.06 | % | 2.55 | % | 4.88 | % | 4.23 | % | |||||||||

SOURCE: Solera National Bancorp, Inc.

View the original press release on ACCESS Newswire

F.Bennett--AMWN