-

Belgian region grapples with forever chemical scandal

Belgian region grapples with forever chemical scandal

-

New-look Australia focused on LA 2028 at swimming worlds

-

China urges global consensus on balancing AI development, security

China urges global consensus on balancing AI development, security

-

David's century sparks Aussies to T20I clincher over WIndies

-

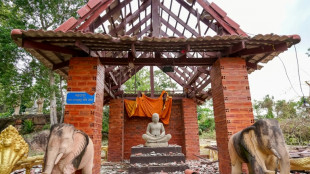

Death toll rises in Thai-Cambodian clashes despite ceasefire call

Death toll rises in Thai-Cambodian clashes despite ceasefire call

-

Taiwan votes in high-stakes recall election

-

China prodigy takes on swimming world aged 12

China prodigy takes on swimming world aged 12

-

UN gathering eyes solution to deadlocked Palestinian question

-

Polls open in Taiwan's high-stakes recall election

Polls open in Taiwan's high-stakes recall election

-

'Alien' lands at Comic-Con

-

Top footballers afraid to speak out against playing too many games: FIFPro chief

Top footballers afraid to speak out against playing too many games: FIFPro chief

-

Cambodia calls for ceasefire with Thailand after deadly clashes

-

Top US Justice official questions Epstein accomplice for 2nd day

Top US Justice official questions Epstein accomplice for 2nd day

-

Cambodia calls for ceasefire with Thailand: envoy to UN

-

Raducanu and Fernandez beat the heat to reach DC Open semis

Raducanu and Fernandez beat the heat to reach DC Open semis

-

US stocks end at records as markets eye tariff deadline

-

Trump, EU chief to meet Sunday in push for trade deal

Trump, EU chief to meet Sunday in push for trade deal

-

Fake AI photos of Trump with Epstein flood internet

-

'Upset' Messi suspended over MLS All-Star no-show: league

'Upset' Messi suspended over MLS All-Star no-show: league

-

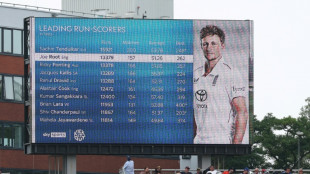

Ponting says 'no reason' why Root cannot top Tendulkar's run record

-

NFL players, employees fined for selling Super Bowl tickets: reports

NFL players, employees fined for selling Super Bowl tickets: reports

-

World's smallest snake makes big comeback

-

Trade on agenda as Trump lands in Scotland for diplomacy and golf

Trade on agenda as Trump lands in Scotland for diplomacy and golf

-

UN chief blasts 'lack of compassion' for Palestinians in Gaza

-

Trump administration expected to say greenhouse gases aren't harmful

Trump administration expected to say greenhouse gases aren't harmful

-

Hamilton suffers unprecedented spinning knockout in Belgian GP sprint qualifying

-

European powers urge end to Gaza 'humanitarian catastrophe'

European powers urge end to Gaza 'humanitarian catastrophe'

-

Messi, Alba suspended over MLS All-Star no-show: league

-

RB's Permane returns as team boss at Belgian GP two years after sacking

RB's Permane returns as team boss at Belgian GP two years after sacking

-

Trump says '50/50 chance' of US-EU trade deal

-

Top US Justice official meets with Epstein accomplice for 2nd day

Top US Justice official meets with Epstein accomplice for 2nd day

-

Mekies makes retaining Verstappen his Red Bull priority

-

Pogacar exits Alps with Tour stranglehold as Arensman edges white-knuckle win

Pogacar exits Alps with Tour stranglehold as Arensman edges white-knuckle win

-

Piastri takes pole for Belgian GP sprint race ahead of Verstappen

-

UK, France, Germany say Gaza 'humanitarian catastrophe must end now'

UK, France, Germany say Gaza 'humanitarian catastrophe must end now'

-

Stock markets mark time as Trump puts EU-US trade deal at 50/50

-

Pogacar exits Alps with Tour stranglehold as Arensman takes stage

Pogacar exits Alps with Tour stranglehold as Arensman takes stage

-

France defends move to recognise Palestinian state

-

Trade on agenda as Trump heads to Scotland for diplomacy and golf

Trade on agenda as Trump heads to Scotland for diplomacy and golf

-

France's top court annuls arrest warrant against Syria's Assad

-

How might Trump's tariffs hurt Brazil?

How might Trump's tariffs hurt Brazil?

-

Rubiales forced kiss could drive Spain on in Euro 2025 final: England's Toone

-

Trump says Hamas 'didn't want' Gaza deal as talks break down

Trump says Hamas 'didn't want' Gaza deal as talks break down

-

Tour de France prankster gets eight-month suspended term for crossing finish line

-

Root climbs to second on all-time Test list as England dominate India

Root climbs to second on all-time Test list as England dominate India

-

Stock markets stall as Trump puts EU-US trade deal at 50/50

-

Iran says it held 'frank' nuclear talks with European powers

Iran says it held 'frank' nuclear talks with European powers

-

UK starts online checks to stop children accessing harmful content

-

Root up to third on all-time Test list as England dominate India

Root up to third on all-time Test list as England dominate India

-

Piastri outpaces Verstappen in opening practice at Belgian GP

| RBGPF | -1.52% | 73.88 | $ | |

| SCU | 0% | 12.72 | $ | |

| JRI | -0.46% | 13.09 | $ | |

| SCS | 0.66% | 10.58 | $ | |

| CMSD | 0.17% | 22.89 | $ | |

| RYCEF | -0.3% | 13.2 | $ | |

| NGG | -0.11% | 72.15 | $ | |

| RELX | -1.86% | 52.73 | $ | |

| BCC | 1.94% | 88.14 | $ | |

| RIO | -1.16% | 63.1 | $ | |

| GSK | -0.68% | 37.97 | $ | |

| CMSC | 0.24% | 22.485 | $ | |

| VOD | -0.79% | 11.43 | $ | |

| BCE | -0.95% | 24.2 | $ | |

| BP | 0.22% | 32.2 | $ | |

| AZN | -1.4% | 72.66 | $ | |

| BTI | -0.71% | 52.25 | $ |

IRS Zeroes In on Rental Income - Clear Start Tax Warns Landlords About 2025 Enforcement Surge

Clear Start Tax Alerts Landlords to Increased IRS Scrutiny of Rental Income, Short-Term Rentals, and 1099 Reporting Requirements

IRVINE, CA / ACCESS Newswire / July 25, 2025 / With IRS enforcement on the rise in 2025, rental income is now under the microscope - and many landlords may not even realize they're at risk. According to Clear Start Tax, a nationally recognized tax resolution firm, the IRS is using new tools and funding to flag unreported rental income, misclassified deductions, and missing 1099s. From Airbnb hosts to multi-property investors, property owners are facing a surge in IRS notices and audits.

"Rental income used to fly under the radar, but not anymore," said the Head of Client Solutions at Clear Start Tax. "If you've received rent payments through apps, failed to issue 1099s, or deducted personal expenses as rental costs, the IRS likely has a way to find it-and take action."

Why Rental Income Is Now a Top IRS Target

With expanded digital reporting and increased third-party data sharing, the IRS now has unprecedented visibility into rental transactions. Platforms like Airbnb, Vrbo, and property management services are required to submit 1099-K or 1099-MISC forms directly to the IRS, leaving even casual or short-term landlords more exposed than ever.

Clear Start Tax notes that the most common red flags include:

Unreported rental income from short-term or vacation rentals

Overstated deductions, such as repairs, utilities, or travel

Missing 1099 forms for contractors, cleaners, or management staff

Failing to classify a property correctly (e.g., personal vs. rental use)

When discrepancies are detected, the IRS may issue an audit notice, demand payment, or begin enforced collection actions like bank levies or wage garnishment.

How Clear Start Tax Helps Landlords Resolve IRS Issues the Right Way

Clear Start Tax offers expert guidance to help property owners respond to IRS notices, correct filings, and avoid escalating penalties. Whether the issue stems from unfiled tax returns or improperly documented deductions, the firm provides a full review of the taxpayer's rental income and expenses-and builds a path to resolution.

Their services include:

Reviewing and amending past returns

Organizing proof of legitimate deductions

Requesting penalty abatement

Negotiating IRS payment plans or settlement programs

"We've worked with clients who had no idea their part-time rental could lead to tens of thousands in tax liability," said the Head of Client Solutions. "Once the IRS gets involved, you need expert support fast."

Common Solutions for Landlords With IRS Debt

When landlords owe back taxes related to rental income, Clear Start Tax evaluates every available IRS program to identify the most strategic option. These may include:

Offer in Compromise (OIC): Settle for less than you owe based on financial hardship

Installment Agreement: Pay off the debt in monthly installments

Penalty Abatement: Remove late fees if you meet IRS criteria

Currently Not Collectible (CNC): Pause IRS collections temporarily due to inability to pay

Each program has specific qualifications, and Clear Start Tax ensures all supporting documentation is gathered, submitted, and followed through properly.

By answering a few simple questions, taxpayers can find out if they're eligible for the IRS Fresh Start Program and take the first step toward resolving their tax debt.

Why Landlords Can't Afford to Ignore IRS Rental Rules

Clear Start Tax emphasizes that landlords should not ignore IRS letters, assume small rental activity doesn't count, or rely on platforms like Airbnb to handle tax reporting. The responsibility remains with the taxpayer, and the consequences for mistakes can be severe.

"Even just a couple thousand in unreported income can snowball into major penalties and interest," said the Head of Client Solutions. "The key is acting early and working with someone who understands how to resolve it before it gets worse."

About Clear Start Tax

Clear Start Tax is a full-service tax liability resolution firm that serves taxpayers throughout the United States. The company specializes in assisting individuals and businesses with a wide range of IRS and state tax issues, including back taxes, wage garnishment relief, IRS appeals, and offers in compromise. Clear Start Tax helps taxpayers apply for the IRS Fresh Start Program, providing expert guidance in tax resolution. Fully accredited and A+ rated by the Better Business Bureau, the firm's unique approach and commitment to long-term client success distinguish it as a leader in the tax resolution industry.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

(888) 710-3533

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 535-1627

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

L.Harper--AMWN