-

Trump says 'real chance' of Gaza peace deal

Trump says 'real chance' of Gaza peace deal

-

Macron urged to quit to end France political crisis

-

No.1 Scheffler seeks three-peat at World Challenge

No.1 Scheffler seeks three-peat at World Challenge

-

Canadian PM visits Trump in bid to ease tariffs

-

Stocks falter, gold shines as traders weigh political turmoil

Stocks falter, gold shines as traders weigh political turmoil

-

Senators accuse US attorney general of politicizing justice

-

LeBron's 'decision of all decisions' a PR stunt

LeBron's 'decision of all decisions' a PR stunt

-

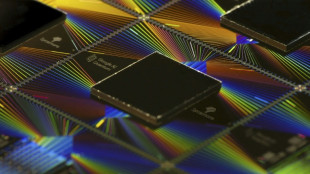

Observing quantum weirdness in our world: Nobel physics explained

-

WTO hikes 2025 trade growth outlook but tariffs to bite in 2026

WTO hikes 2025 trade growth outlook but tariffs to bite in 2026

-

US Supreme Court hears challenge to 'conversion therapy' ban for minors

-

Italy's Gattuso expresses Gaza heartache ahead of World Cup qualifier with Israel

Italy's Gattuso expresses Gaza heartache ahead of World Cup qualifier with Israel

-

EU targets foreign steel to shield struggling sector

-

Djokovic vanquishes exhaustion to push through to Shanghai quarterfinals

Djokovic vanquishes exhaustion to push through to Shanghai quarterfinals

-

Stocks, gold rise as investors weigh AI boom, political turmoil

-

Swiatek coasts through Wuhan debut while heat wilts players

Swiatek coasts through Wuhan debut while heat wilts players

-

Denmark's Rune calls for heat rule at Shanghai Masters

-

Japanese football official sentenced for viewing child sexual abuse images

Japanese football official sentenced for viewing child sexual abuse images

-

Stocks, gold steady amid political upheaval

-

'Veggie burgers' face grilling in EU parliament

'Veggie burgers' face grilling in EU parliament

-

Trio wins physics Nobel for quantum mechanical tunnelling

-

Two years after Hamas attack, Israelis mourn at Nova massacre site

Two years after Hamas attack, Israelis mourn at Nova massacre site

-

German factory orders drop in new blow to Merz

-

Man City star Stones considered retiring after injury woes

Man City star Stones considered retiring after injury woes

-

Kane could extend Bayern stay as interest in Premier League cools

-

Renewables overtake coal but growth slows: reports

Renewables overtake coal but growth slows: reports

-

OpenAI's Fidji Simo says AI investment frenzy 'new normal,' not bubble

-

Extreme rains hit India's premier Darjeeling tea estates

Extreme rains hit India's premier Darjeeling tea estates

-

Raducanu retires from opening match in Wuhan heat with dizziness

-

UK's Starmer condemns pro-Palestinian protests on Oct 7 anniversary

UK's Starmer condemns pro-Palestinian protests on Oct 7 anniversary

-

Tokyo stocks hit new record as markets extend global rally

-

Japan's Takaichi eyes expanding coalition, reports say

Japan's Takaichi eyes expanding coalition, reports say

-

Canadian PM to visit White House to talk tariffs

-

Indonesia school collapse toll hits 67 as search ends

Indonesia school collapse toll hits 67 as search ends

-

Dodgers hold off Phillies, Brewers on the brink

-

Lawrence sparks Jaguars over Chiefs in NFL thriller

Lawrence sparks Jaguars over Chiefs in NFL thriller

-

EU channels Trump with tariffs to shield steel sector

-

Labuschagne out as Renshaw returns to Australia squad for India ODIs

Labuschagne out as Renshaw returns to Australia squad for India ODIs

-

Open AI's Fidji Simo says AI investment frenzy 'new normal,' not bubble

-

Tokyo stocks hit new record as Asian markets extend global rally

Tokyo stocks hit new record as Asian markets extend global rally

-

Computer advances and 'invisibility cloak' vie for physics Nobel

-

Nobel literature buzz tips Swiss postmodernist, Australians for prize

Nobel literature buzz tips Swiss postmodernist, Australians for prize

-

Dodgers hold off Phillies to win MLB playoff thriller

-

China exiles in Thailand lose hope, fearing Beijing's long reach

China exiles in Thailand lose hope, fearing Beijing's long reach

-

Israel marks October 7 anniversary as talks held to end Gaza war

-

Indians lead drop in US university visas

Indians lead drop in US university visas

-

Colombia's armed groups 'expanding,' warns watchdog

-

Shhhh! California bans noisy TV commercials

Shhhh! California bans noisy TV commercials

-

Trump Mineral Price Supports Can Counter Chinese Manipulation of Critical Minerals Markets

-

Alex Honnold to Lead His First-Ever Travel Series, in Partnership With Travel Nevada and Outside

Alex Honnold to Lead His First-Ever Travel Series, in Partnership With Travel Nevada and Outside

-

Clough Global Opportunities Fund Declares Monthly Cash Distributions For October, November, And December 2025 of $0.0501 Per Share

| CMSC | -0.21% | 23.75 | $ | |

| CMSD | -0.31% | 24.365 | $ | |

| RYCEF | -1.03% | 15.54 | $ | |

| RIO | -0.84% | 66.42 | $ | |

| SCS | -0.47% | 16.9 | $ | |

| NGG | 0.64% | 74.375 | $ | |

| RELX | -2.02% | 45.49 | $ | |

| VOD | -0.27% | 11.26 | $ | |

| GSK | 0.13% | 43.505 | $ | |

| BCC | 0.24% | 75.36 | $ | |

| RBGPF | 0% | 78.22 | $ | |

| BTI | 1.51% | 51.965 | $ | |

| AZN | 0.31% | 85.76 | $ | |

| BCE | 0.66% | 23.345 | $ | |

| BP | -0.16% | 34.775 | $ | |

| JRI | -0.39% | 14.125 | $ |

WeTouch Technology Inc. Reports First Quarter Fiscal Year 2025 Financial Results: Net Income Surges Over Fourfold, Cash Reaches $8.9 Per Share

Fiscal Year 2025 First Quarter Revenue Reaches $15.3 Million; Net Income Jumps to $2.6 Million, Up 316.7% Year-over-Year

CHENGDU, CN / ACCESS Newswire / October 7, 2025 / WeTouch Technology Inc. (NASDAQ:WETH) ("WeTouch" or the "Company"), a global leader in touch display solutions, today announced its financial results for the first quarter of fiscal year 2025 ended March 31, 2025.

First Quarter Fiscal Year 2025 Financial Highlights

Total Revenue: Reached $15.3 million, an increase of 2.7% compared to $14.9 million in the first quarter of fiscal 2024.

Gross Profit: Reached $5.6 million, representing a 69.7% increase year-over-year.

Gross Margin: Expanded sharply to 36.9%, compared with 22.4% in the same quarter of 2024.

Net Income: Surged to $2.6 million, compared with $0.6 million in the first quarter of fiscal 2024, an increase of 316.7%.

Cash Reserves: $106.4 million as of March 31, 2025 (equivalent to approximately $8.9 per share), up from $94.8 million as of March 31, 2024.

Overseas Market Revenue: $5.0 million, representing 32.7% of total revenue, compared with $5.5 million, or 36.9% of total revenue, in the first quarter of fiscal 2024.

Total Volume Shipped: 762,545 units, an increase of 11.9% year-over-year.

Shareholders' Equity: Increased to $127.9 million as of March 31, 2025, from $120.5 million a year ago.

Operating Cash Flow: Positive $2.0 million, compared to negative $9.2 million in the same quarter of fiscal 2024.

Management Commentary

"We are highly encouraged by the strong profitability achieved in the first quarter of fiscal 2025," said Zongyi Lian, CEO of WeTouch Technology Inc. "We are pleased to see that our gross margin in fiscal 2025 has already returned to the same level as in 2023, driven by supply chain normalization, increased orders from major international customers, and continued improvements in operational efficiency. Gross margin rose to 36.9% from 22.4% a year ago, demonstrating that the Company has overcome challenges from raw material cost fluctuations, while selling expenses decreased by 80% year-over-year, further underscoring stronger efficiency and profitability. These results clearly reflect the effectiveness of our strategic initiatives and disciplined cost management.

In addition, the Company has completed its Form 10-K filing and is working diligently to remain in full compliance with Nasdaq requirements. We are in discussions with several Fortune Global 500 multinational customers and will disclose key business developments promptly. With shareholder equity steadily rising to $127.9 million, WeTouch's stock continues to trade significantly below its intrinsic value. The Company remains focused on delivering long-term value through disciplined execution and sustained profitability, while management actively explores strategic opportunities to further strengthen competitiveness and enhance shareholder returns."

Market Expansion and Strategic Outlook

WeTouch continues to focus on breakthroughs in curved and ultra-large-size touch display technologies, strengthening its competitive edge in high-end automotive electronics, professional gaming equipment, and commercial display terminals.

The Company is actively expanding collaborations with leading brand customers in Europe, Japan, South Korea, and Taiwan, while solidifying its leadership position in China.

Looking ahead, WeTouch remains committed to:

Driving sustainable growth through innovation in next-generation touch display technologies.

Optimizing its product portfolio toward higher-margin categories such as industrial control computer touchscreens, POS systems, and multifunctional printer displays.

Enhancing financial discipline to support expansion of its new production facility, with mass production expected to commence in the second quarter of 2026.

About WeTouch Technology Inc.

Wetouch Technology Inc. is at the forefront of providing premium touch display solutions, dedicated to reshaping human-machine interaction across diverse industries. With a relentless focus on innovation and customer satisfaction, Wetouch consistently delivers cutting-edge technology and unparalleled performance in touch display solutions globally.

For additional information, please visit: WeTouch Technology Inc. at http://en.usa-wetouch.com/

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will", "expects", "anticipates", "future", "intends", "plans", "believes", "estimates", "target", "going forward", "outlook," "objective" and similar terms. Such statements are based upon management's current expectations and current market and operating conditions, and relate to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and which are beyond Datasea's control, which may cause Datasea's actual results, performance or achievements (including the RMB/USD value of its anticipated benefit to Datasea as described herein) to differ materially and in an adverse manner from anticipated results contained or implied in the forward-looking statements. Further information regarding these and other risks, uncertainties or factors is included in Datasea's filings with the U.S. Securities and Exchange Commission, which are available at www.sec.gov. Datasea does not undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under law.

Investor and Media Contact:

Email: [email protected]

SOURCE: Wetouch Technology Inc.

View the original press release on ACCESS Newswire

X.Karnes--AMWN