-

Louvre heist: five things to know about missing jewellery

Louvre heist: five things to know about missing jewellery

-

Stock markets climb as China-US trade fears ease

-

Colombia recalls ambassador to US as Trump-Petro feud intensifies

Colombia recalls ambassador to US as Trump-Petro feud intensifies

-

Louvre stays closed as France hunts jewel thieves

-

UK lawmakers urge govt to strip Prince Andrew of his titles

UK lawmakers urge govt to strip Prince Andrew of his titles

-

US begins sending nuke workers home as shutdown drags

-

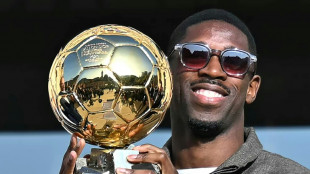

Dembele returns for PSG after six weeks out

Dembele returns for PSG after six weeks out

-

Pope Leo holds first meeting with abuse survivors' group

-

'I probably have to change my behaviour', Flick says after red card

'I probably have to change my behaviour', Flick says after red card

-

US envoys meet Israel's Netanyahu after Gaza violence

-

Three things we learned from the United States Grand Prix

Three things we learned from the United States Grand Prix

-

To beat football violence, Brazilian clubs scan every fan

-

South Africa call up uncapped prop Porthen for November tour

South Africa call up uncapped prop Porthen for November tour

-

Ireland wing Hansen out of All Blacks Test

-

Shares in French bank BNP Paribas plummet after US verdict

Shares in French bank BNP Paribas plummet after US verdict

-

Internet services cut for hours by Amazon cloud outage

-

Pakistan punish sloppy South Africa to reach 259-5 in second Test

Pakistan punish sloppy South Africa to reach 259-5 in second Test

-

Tourists upset as Louvre stays shut after jewel heist

-

Maguire urges Man Utd to build on Liverpool triumph

Maguire urges Man Utd to build on Liverpool triumph

-

Louvre jewel theft: latest in string of museum heists

-

Trial opens in Klarna's $8.3-bn lawsuit against Google

Trial opens in Klarna's $8.3-bn lawsuit against Google

-

Stock markets rise as China-US trade fears ease

-

Slot seeks solutions as Liverpool crisis deepens

Slot seeks solutions as Liverpool crisis deepens

-

Amazon's cloud services hit by hours-long global outage

-

Pakistan ride luck to reach 177-3 in second South Africa Test

Pakistan ride luck to reach 177-3 in second South Africa Test

-

Dembele set for PSG return after six weeks out

-

US envoys in Israel to shore up Gaza plan

US envoys in Israel to shore up Gaza plan

-

Cargo plane skids off Hong Kong runway, kills 2

-

Amazon's cloud services hit by global outage

Amazon's cloud services hit by global outage

-

China posts lacklustre Q3 economic data as key Beijing conclave starts

-

'People can breathe': hope for peace on Afghan-Pakistan border

'People can breathe': hope for peace on Afghan-Pakistan border

-

Louvre closes for second day as France hunts jewel thieves

-

Japan coalition deal paves way for Takaichi to be first woman PM

Japan coalition deal paves way for Takaichi to be first woman PM

-

England hammer New Zealand after Brook and Salt onslaught

-

Five things to know about Gaza's Rafah border crossing

Five things to know about Gaza's Rafah border crossing

-

Thyssenkrupp spins off warship unit to tap defence boom

-

Sweden names ex-Chelsea manager Graham Potter new coach

Sweden names ex-Chelsea manager Graham Potter new coach

-

Kering shares jump on sale of beauty division to L'Oreal

-

10 South Koreans arrested, two rescued in Cambodia scam crackdown

10 South Koreans arrested, two rescued in Cambodia scam crackdown

-

Stock markets bounce back as China-US trade fears ease

-

Pakistan 95-1 at lunch in second South Africa Test

Pakistan 95-1 at lunch in second South Africa Test

-

Bolivia's new president faces worst economic crisis in decades

-

Serious, popular, besties with Trump: Italy's Meloni marks three years

Serious, popular, besties with Trump: Italy's Meloni marks three years

-

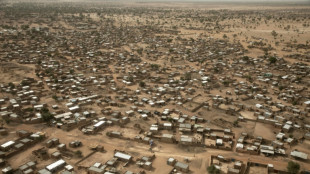

In the Sahel, no reprieve under jihadist blockade

-

One year on, Spain's flood survivors rebuild and remember

One year on, Spain's flood survivors rebuild and remember

-

Cargo plane skids off Hong Kong runway, kills two

-

Myanmar junta says seized 30 Starlink receivers in scam centre raid

Myanmar junta says seized 30 Starlink receivers in scam centre raid

-

Japan set for new coalition and first woman PM

-

Toxic haze chokes Indian capital

Toxic haze chokes Indian capital

-

Flood reckoning for Bali on overdevelopment, waste

Thinking of Moving States to Avoid Tax Debt? Clear Start Tax Explains Why That Won't Work

Tax experts warn that relocating won't stop the IRS from collecting on unpaid taxes - and could even make matters worse.

IRVINE, CALIFORNIA / ACCESS Newswire / October 20, 2025 / Some Americans burdened by tax debt believe that packing up and moving to another state might offer a way out. But according to experts at Clear Start Tax, changing your address does not make your federal tax debt disappear - and in some cases, it can complicate IRS collection efforts.

While state taxes vary, federal tax obligations remain unchanged no matter where a taxpayer resides. The Internal Revenue Service has broad authority to collect outstanding debts nationwide, including garnishing wages, levying bank accounts, or placing federal liens on property.

"Relocating doesn't give you a clean slate with the IRS," said a spokesperson for Clear Start Tax. "Tax debt follows you. The agency has nationwide reach and can enforce collection actions regardless of where you live."

Many taxpayers also overlook that moving can actually extend the collection statute of limitations. Leaving the country or residing in a state with different administrative procedures may pause the clock on how long the IRS can legally pursue collection - giving the agency even more time to act.

"Trying to 'outrun' the IRS is a costly misconception," the spokesperson added. "If anything, it gives the government more time to collect, not less. Taxpayers who relocate without resolving their debt often face bigger problems down the road."

Tax professionals recommend that anyone considering a move should review their IRS Collection Statute Expiration Date (CSED), consult with a qualified tax specialist, and address their balance before relocating to avoid unexpected enforcement actions.

By answering a few simple questions, taxpayers can find out if they're eligible for the IRS Fresh Start Program and take the first step toward resolving their tax debt.

About Clear Start Tax

Clear Start Tax is a trusted national tax resolution firm that helps individuals and businesses navigate complex IRS and state tax issues. With a team of experienced tax professionals, the company provides strategic solutions for back taxes, liens, levies, and tax relief programs. Clear Start Tax has helped thousands of taxpayers regain financial stability and peace of mind.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

(888) 710-3533

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 800-4011

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

M.A.Colin--AMWN